Just_Super

Funding Thesis

I give CrowdStrike (NASDAQ:CRWD) a purchase score primarily as a consequence of its nice retention metrics, doubling software program’s longstanding “Rule of 40,” and the truth that it is at the moment buying and selling at a major low cost in comparison with its all-time excessive.

Firm Overview

CrowdStrike, based in 2011, is a cybersecurity firm that focuses on offering cloud-based endpoint safety, menace intelligence, and incident response companies.

On the core of CrowdStrike’s choices is the Falcon platform, their flagship product. This cloud-native platform ensures safety throughout all endpoints, together with laptops, desktops, servers, and cell units. Utilizing AI and behavioral evaluation, CrowdStrike’s platform can detect and stop even probably the most subtle cyber-attacks. In contrast to conventional antivirus options, Falcon goes past identified threats and gives complete safety towards each identified and unknown threats.

CrowdStrike caters to a various vary of shoppers, together with massive enterprises, authorities companies, and small to medium-sized companies. Their companies lengthen past mere safety, encompassing menace searching, incident response, and menace intelligence. By proactive menace searching, CrowdStrike’s consultants actively seek for indicators of malicious actions to cease assaults earlier than they trigger harm. Within the occasion of a safety incident, their incident response companies present speedy and efficient mitigation methods to reduce the impression.

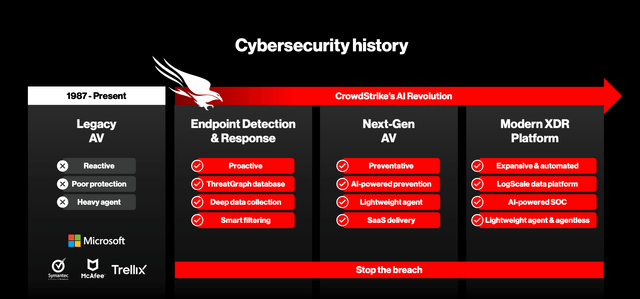

Cybersecurity Business Historical past (CrowdStrike April 2023 Investor Presentation)

CrowdStrike positions themselves as a “fashionable” answer to the ever-increasing drawback of cybersecurity threats. They play towards cybersecurity opponents together with Microsoft’s Defender platform, in addition to different firms similar to Symantec (GEN), McAfee, and Trellix.

Thesis Explainer

As talked about above, there are three key explanation why I see CrowdStrike to be a sexy purchase in the meanwhile.

1. Retention

CrowdStrike advantages from offering a particularly “sticky” service. It is not on daily basis that an organization goes round trying to commerce out its present cybersecurity software program. Such software program is a kind of forms of companies the place you are most completely satisfied when you do not hear something from it, but you are completely satisfied to pay for it due to its important worth from a safety standpoint.

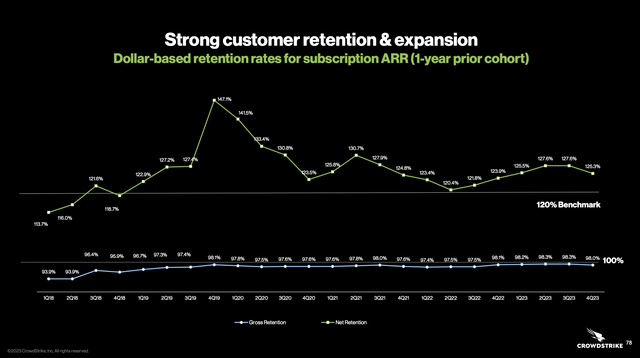

These business traits, together with offering an ideal service, have helped CrowdStrike to take pleasure in extremely excessive retention charges. Gross retention has exceeded 97% ever because the Q2 of 2019. Web retention has exceeded 120% each quarter since Q1 of 2019.

CrowdStrike’s gross and web retention over time. (April 2023 Investor Presentation)

These metrics illustrate simply how sticky CrowdStrike’s income is. At such excessive retention charges, every new buyer that’s added is basically stacking cash on high of the ARR.

2. Doubling the “Rule of 40”

The Rule of 40 is a broadly used monetary guideline within the software program business that helps assess the general well being and development potential of an organization. It combines two key metrics: income development charge and profitability. Based on the Rule of 40, an organization’s mixed income development charge and profitability needs to be equal to or larger than 40%. Free money movement margin is often used because the profitability metric.

The idea behind this rule is that an organization can prioritize both excessive development or profitability, so long as the mixed end result stays above the brink. For instance, an organization with a 20% development charge and 20% free money movement margin would meet the Rule of 40.

Corporations that exceed the excessive 40% bar are usually thought of to be beneficiaries of nice companies economics whereas concurrently placing collectively speedy development. This rule is especially related for SaaS firms, the place excessive development is usually prioritized to seize market share and acquire a aggressive edge.

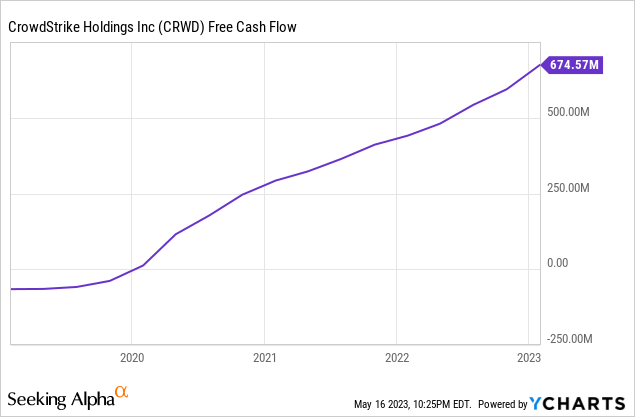

With this in thoughts, CrowdStrike’s Rule of 40 rating is available in at a whopping 85%. Sure, it’s greater than double the hurdle charge for what usually can be thought of an ideal software program enterprise. Administration touched on this of their newest convention name and investor presentation. The 85% rating helps put in perspective simply how wholesome CrowdStrike’s margins are, whereas concurrently rising at a whirlwind tempo.

3. Low cost from All-Time Excessive

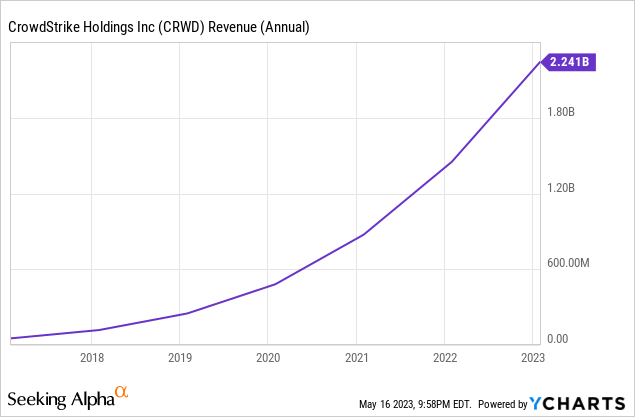

CrowdStrike’s inventory value peaked at $280+ again in November of 2021. At the moment, the inventory is buying and selling for ~$137, which represents a 50%+ low cost from its all-time excessive. For context, CrowdStrike produced $874 million of income in all of 2021. In the meantime, they’re on observe to do $2.2 billion of income in 2023. Moreover, that they had 2021 free money movement totals of $293 million, however are on observe to do $677 million in 2023.

Primarily, markets have created the chance to purchase into CrowdStrike for 50% of its value from a 12 months and a half in the past, however with nearly triple the income and greater than double the free money movement.

Financials

CrowdStrike’s financials are fairly sturdy and spectacular. They’ve been capable of gas substantial quantities of development in a comparatively brief time frame, all whereas trending in direction of profitability. There have been a pair issues particularly that stood out from CrowdStrike’s financials.

High-Line Progress

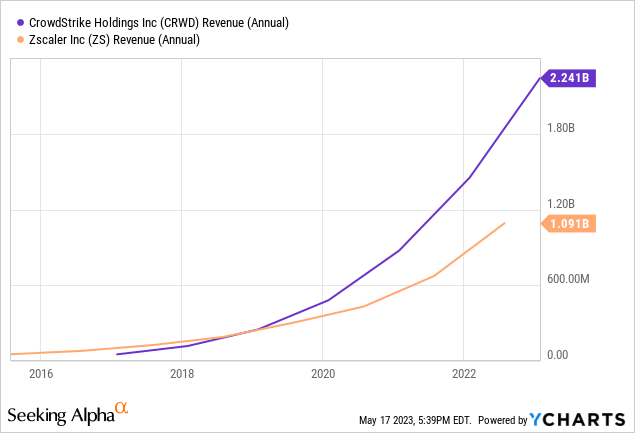

CrowdStrike has skilled speedy top-line development ever since they IPO’d again in 2019. The corporate’s top-line income has grown at a blistering 80% CAGR, relationship again to 2018.

CrowdStrike additionally believes that there’s ample room left for development. The corporate estimates a TAM of $20 billion for the endpoint safety market, which is CrowdStrike’s core service. Moreover, when accounting for the remainder of the corporate’s adjoining companies, they estimate a cumulative TAM of $98 billion. Even when these estimates are optimistically over-inflated by administration, they nonetheless stand for instance that there’s loads of room to achieve market share.

Wholesome Free Money Stream Margin

CrowdStrike’s free money movement margin exceeded 30% in each 2021 and 2022, and administration expects it to stay above the 30% threshold for 2023. The corporate even anticipates the margin increasing above 30% over the following few years. Free money movement for 2022 got here in at a complete of $442 million. Increasing free money movement margins, coupled concurrently with sturdy income development, may assist create important worth for traders.

The wholesome margins will probably be key in serving to CrowdStrike sustain the breakneck development. Moreover, I would not be shocked to see CrowdStrike use among the money movement to put money into acquisitions to assist gas much more development within the close to future.

Valuation

Valuation is among the few hesitations related to CrowdStrike’s inventory. By nearly all conventional valuation multiples, CrowdStrike is significantly overvalued, no less than when in comparison with the broader info know-how sector. This contains multiples similar to Value/Earnings (GAAP and Non-GAAP in addition to TTM and FWD), Value/Gross sales, Value/Guide, and many others. Just about the one widespread a number of that means CrowdStrike to be undervalued is the Non-GAAP Ahead Value/Earnings Progress, which should not come as a shock as CrowdStrike’s speedy development is critical sufficient to offset an in any other case costly value.

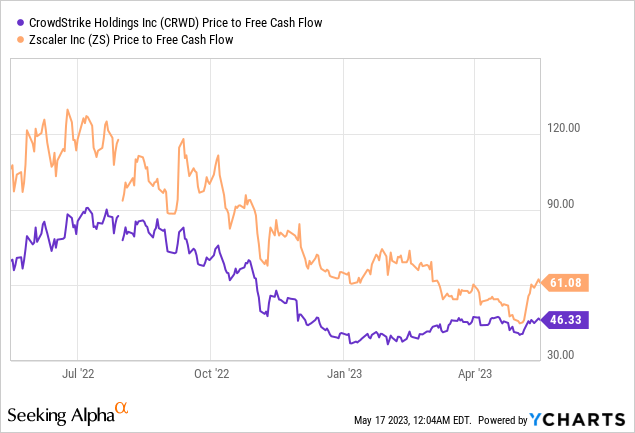

Though CrowdStrike could seem overvalued when in comparison with the IT sector as a complete, they do not look fairly as overvalued when in comparison with direct opponents. Probably the greatest comparables for CrowdStrike can be Zscaler (ZS), one other firm specializing in cloud safety. CrowdStrike at the moment has a market cap of ~$32 billion, whereas Zscaler’s is ~$17 billion.

As you’ll be able to see from the graph above, revenues for the 2 firms have been roughly equal again in 2018 and 2019. Nonetheless, as soon as CrowdStrike IPO’d in 2019, they began to tug away. Not solely has CrowdStrike reached a bigger scale than that of Zscaler, additionally they have been rising top-line at a quicker charge. Couple these two components collectively, and it may be troublesome for a corporation like Zscaler to catch again as much as CrowdStrike.

With CrowdStrike’s current observe document in thoughts, it is fascinating to see them at the moment priced cheaper than Zscaler in a number of multiples, such because the Value to Free Money Stream a number of that’s illustrated above. It is price noting as properly that Zscaler additionally has a notably bigger brief curiosity at 9.5%, in comparison with CrowdStrike’s 3.4%.

General, CrowdStrike’s inventory could initially seem costly when in comparison with the broad IT sector. However upon additional digging, and when in comparison with its direct opponents, the valuation seems to be way more manageable.

Catalysts

Warren Buffett as soon as famously beneficial that “in the event you aren’t prepared to personal a inventory for ten years, do not even take into consideration proudly owning it for ten minutes.”

CrowdStrike is a inventory that I’d be comfy shopping for now, even when the market have been to close down and open again up in 10 years. It is troublesome to foretell the place the value will go within the close to future, though Searching for Alpha’s momentum indicators counsel that it might be poised for a value bump, however it’s onerous to think about CrowdStrike not being extremely beneficial 10 years down the road. With the discharge of every quarter’s earnings, the standard of CrowdStrike’s enterprise will turn out to be an increasing number of obvious.

On the very least, I may see CrowdStrike’s inventory experiencing a wholesome leap once they start producing constructive web earnings by GAAP requirements. The precise timeline for that is unknown, however some tentative projections counsel it could occur in 2025 or 2026.

Dangers

Maybe the best threat for CrowdStrike’s inventory is that every one of those positives that collectively make the corporate so enticing could already be totally priced in to the present value. There’s undoubtedly an opportunity that this might be right.

Nonetheless, the markets are usually relatively erratic and short-sighted, particularly for know-how shares similar to CrowdStrike. By approaching the funding with a long-term horizon, traders may gain advantage significantly from the expansion of the corporate over the following 5 or 10 years, and far of the short-term uncertainty will probably be ironed-out over time.

Conclusion

General, CrowdStrike stands out as a sexy funding alternative. With distinctive retention metrics, doubling the “Rule of 40,” and a major low cost from its all-time excessive, CrowdStrike is well-positioned for the longer term. Though valuation comparisons to the broader IT sector could counsel overvaluation, when in comparison with direct opponents, CrowdStrike’s valuation seems extra affordable. The corporate’s long-term prospects and potential catalysts, coupled with its strong enterprise fundamentals, make it an interesting long-term funding choice, regardless of short-term market fluctuations and uncertainties.