A Newbie’s information on methods to do elementary evaluation on shares: Basic evaluation of a inventory is used to find out the monetary and enterprise well being of an organization. It’s all the time really useful to carry out an entire elementary evaluation of the inventory earlier than investing in case you are planning for a long-term funding.

When you’re concerned available in the market, you may also have concerning the time period ‘Technical Evaluation’. Properly, technical evaluation is an efficient strategy to seek out the entry and exit time inventory for intraday buying and selling or quick time period. Right here, we glance into charts, traits, and patterns. You may make good earnings utilizing totally different technical indicators effectively. Nonetheless, if you wish to discover a multi-bagger inventory to put money into, which can provide you good returns yr after yr, then the elemental evaluation is the precise instrument that it’s important to make the most of.

It is because to get a number of instances returns (say 5x or 10x), it is advisable stay invested in a inventory for the long run. Whereas the technical indicators will present you exit indicators within the quick time period at any time when there’s a downtrend or small setbacks, nonetheless, it’s important to stay invested in that inventory if the corporate is basically sturdy. In such instances, it’s important to be assured that the inventory will develop and provides good returns sooner or later and keep away from short-term underperformance. Brief-term market fluctuations, unavoidable elements, or mishappenings gained’t have an effect on the basics of the sturdy firm in the long run.

On this submit, we’re going to focus on methods to do elementary evaluation on shares (methods to test fundamentals of an organization). Right here, we are going to elaborate on a number of tips that in the event you observe with self-discipline, you’ll be able to simply be capable of choose basically sturdy corporations.

Methods to do elementary evaluation on shares?

Listed below are the six important steps that it is advisable carry out to investigate the basics of an organization within the Indian inventory market. They’re actually easy, but efficient to seek out basically wholesome corporations. Right here it goes:

Step 1: Use the monetary ratios for the Preliminary Screening

There are over 5,500 shares listed on the Indian inventory trade. When you begin studying the financials of all these corporations (i.e. stability sheet, profit-loss assertion, and so forth.), then it would take years. The annual experiences of most corporations are round 200-300 pages lengthy. And it’s not price your time to learn every firm’s report.

A greater strategy is first to shortlist a number of good corporations based mostly on a number of standards. After which to check these screened corporations one after the other to choose the one which fits you the most effective.

Enroll for the ‘Basic Evaluation For Rookies’ course in Hindi on FinGrad Academy.

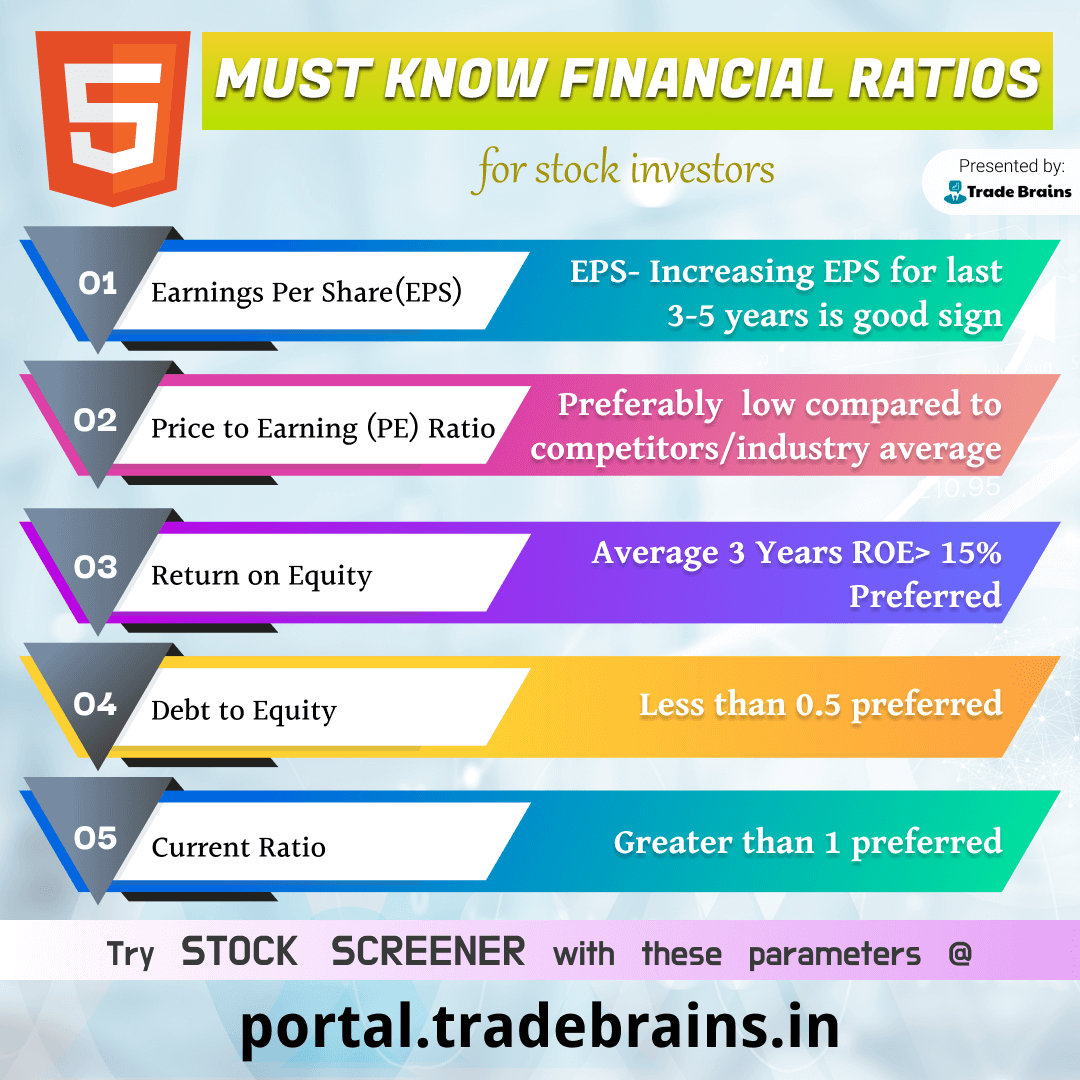

For the preliminary screening of the shares, you should utilize varied monetary ratios like Worth to Earnings (PE) ratio, Worth to Ebook Worth (PBV) ratio, ROE, CAGR, Present ratio, Dividend yield, and so forth. If you wish to know extra about the most effective monetary ratios for screening, right here’s an article on 8 Monetary Ratio Evaluation that Each Inventory Investor Ought to Know. Briefly, it is advisable use totally different monetary ratios for preliminary screening.

Subsequent, for performing the inventory screening utilizing monetary ratios, you should utilize Commerce Brains Screener. Let me provide you with an instance of methods to display shares utilizing Commerce Brains Screener.

Methods to do a screening of shares utilizing Commerce Brains Screener?

Step 1: Go to Commerce Brains Portal.

Step 2: From the highest menu, choose Screener. Else, right here’s the direct hyperlink.

Step 3: Add Standards (monetary ratios) to display shares

Step 4: Run the Filter to get the listing of shares

For instance, if you wish to filter corporations with a PE ratio between 8 to twenty and dividend yield % between 1 to three%, and Avg ROE for the final three years larger than 12%, you’ll be able to choose the next standards. Commerce Brains Screener will shortlist the shares in line with the factors talked about and provide the listing of corporations.

(Supply: Commerce Brains Portal)

Additional, you can too add plenty of monetary ratios in your standards like ROCE, Present Ratio, ROA, P/Ebook worth, and so forth. Apart from, you can too use every other monetary ratio that you simply want to display shares that fits your requirement.

Step 2: Perceive the corporate

When you’ve screened the businesses based mostly on the above standards, the subsequent step is to analyze them. It will be significant that you simply perceive the corporate wherein you’re investing. As a result of in the event you don’t, you gained’t be capable of determine whether or not the corporate is performing good or dangerous, whether or not the corporate is making the fitting selections in the direction of its future aim or not; whether or not its opponents are doing good or dangerous in comparison with them and most significantly whether or not you need to maintain or promote the inventory.

Due to this fact, it’s important that you simply perceive the corporate. Questions like what are its merchandise/companies, who’re main the corporate (founders/promoters), administration effectivity, opponents, and so forth ought to be identified to you.

A easy technique to perceive the corporate is to go to its web site. Go to the corporate’s web site and test it’s ‘ABOUT’, ‘PRODUCTS’, ‘PROMOTERS/BOARD OF DIRECTORS’ web page, and so forth. Learn the mission and imaginative and prescient assertion of that firm. Additional, if you’ll find the annual report of the corporate, obtain and skim it. This report will give the in-depth information of the corporate.

Additional, if you’ll be able to perceive the merchandise, companies & imaginative and prescient of the corporate and discover it engaging, then transfer additional to the subsequent step. Else, ignore that firm.

ALSO READ

Methods to Choose Shares to Purchase in India? Inventory Selecting Information for Rookies!

Step 3: Research the monetary outcomes of the corporate

Upon getting understood the corporate and located it interesting, subsequent it is advisable test the financials of the corporate like Steadiness sheet, Revenue loss statements, and money circulate statements.

As a thumb rule, Income/Gross sales, internet revenue, and margin growing for the final 5 years could be thought of a wholesome signal for the corporate. After that, you additionally have to test the opposite financials like Working value, bills, belongings, liabilities, and so forth.

Now, the place can you discover the financials of an organization that you simply’re to speculate? Among the finest web sites to test the monetary statements of an organization that I might positively advocate you to test is Commerce Brains Portal. Listed below are the steps to test the monetary outcomes of an organization on the Commerce Brains portal:

Step 1: Go to Commerce Brains Portal

Step 2: Enter the corporate’s identify within the search field. The corporate’s particulars will open like key ratios, revenue and loss assertion, stability sheet, money circulate assertion, quarterly statements, peer competitors, and so forth.

Step 3: Research the corporate’s monetary outcomes for the final 5 years.

(Fig: Reliance Industries Financials)

It’s required that you simply research the financials of the corporate fastidiously with a view to choose a very good inventory for long-term funding. When you have no idea methods to learn the financials of an organization, you’ll be able to take a look at this monetary assertion and ratio evaluation course for rookies.

Step 4: Verify the Debt and Crimson Flags

The whole debt in an organization is without doubt one of the greatest elements to test earlier than investing in a inventory. An organization can’t carry out properly and reward its shareholders if it has an enormous debt. They should repay the debt and in addition pay curiosity on the borrowed cash earlier than the rest. Briefly, keep away from corporations with big money owed.

As a thumb rule, all the time put money into corporations with a debt/fairness ratio of lower than one. You should use this ratio within the preliminary screening of shares or else test it whereas studying the financials of an organization.

As well as, additionally different crimson flags within the firm could be repeatedly declining revenue/ margin, low liquidity, and pledging of shares.

Step 5. Discover the corporate’s opponents

It’s all the time good to check the friends of an organization earlier than investing. Decide what this firm is doing that its opponents aren’t.

Additional, you need to be capable of reply the query that why you’re investing on this firm and never any of its opponents. The reply ought to be convincing one like Distinctive promoting level (USP), Aggressive benefit, Low-cost merchandise, Model Worth, future prospects (upcoming tasks, new plant), and so forth.

You will discover the listing of the opponents of the corporate on the Commerce Brains Portal itself. Simply enter the inventory identify within the search field and navigate down. You’ll discover a peer comparability there. Else, you are able to do a google search to seek out the opponents of the corporate. Research the opponents intimately earlier than investing.

(Fig: Friends Comparability | Commerce Brains Portal)

Step 6: Analyze future prospects

Most good investments are based mostly on the long run facets/potential of the corporate and hardly on their present state of affairs. Traders are fascinated with how a lot returns they will get from their investments sooner or later. Due to this fact, all the time put money into an organization with sturdy lengthy future prospects. Choose solely these corporations to speculate whose product or companies will nonetheless be used twenty years from now.

Furthermore, there isn’t any level in investing in a CD or pen-drive making firm with no long run (say 10 years from now) prospects. With cloud drives evolving so quick, these merchandise will develop into out of date with time.

In case you are planning to speculate for the long run, then the lengthy lifetime of the corporate’s product is a should criterion to test. Additional, test future prospects, enlargement prospects, potential sources of income sooner or later, and so forth.

ALSO READ

What’s Qualitative Evaluation of Shares? And Methods to Carry out it?

Abstract

Basic evaluation is an previous and confirmed technique to seek out sturdy corporations for long run funding. On this submit, we mentioned methods to test the basics of an organization.

The six steps to carry out elementary evaluation on shares defined on this article are: 1) Use the monetary ratios for preliminary screening, 2)Perceive the corporate, 3) Research the monetary experiences of the corporate, 4) Verify the debt and crimson indicators, 5) Discover the corporate’s opponents 6) Analyse the long run prospects.

Additionally learn: How To Make investments Rs 10,000 In India for Excessive Returns?

That’s all for at this time. I hope this submit on ‘Methods to do elementary evaluation on shares’ or ‘Methods to test fundamentals of an organization‘ is helpful to the readers. Additional, When you discover this submit useful and need me to put in writing extra contents on any related matter, please remark beneath. Apart from, in the event you’ve any doubts/queries, you can too ask within the remark part. I’ll be comfortable to assist. Take care and Completely satisfied Investing.

Incessantly Requested Questions (FAQs)

1. How do you research the basics of an organization?

To review the basics of an organization,

Use monetary ratios just like the PE Ratio, PBV Ratio, Return on Fairness, Compounded annual development price, present ratio, dividend yield and extra to do the preliminary screening.

Then, perceive extra concerning the firm, the services and products that it affords, its future targets, its opponents, its administration, its mission and imaginative and prescient.

Verify if its monetary outcomes are sturdy. Are the revenues and earnings steadily growing? What are its belongings and liabilities, its working value, and extra?

Then test for crimson flags like declining revenue, a debt-equity ratio larger than 1, low liquidity, and pledging of shares and so forth

Research the opponents and perceive why you’re investing on this firm and never its opponents.

Analyse its future prospects and determine whether it is actually price investing within the firm.

2. What are the 5 steps of elementary evaluation?

The 5 steps for elementary evaluation are:

Use monetary ratios for screening

Perceive the corporate, its enterprise, and future prospects.

Research the monetary experiences of the corporate.

Verify for crimson flags.

Evaluate the corporate with its opponents.

3. How do you analyse shares for rookies?

There are two methods of analyzing shares. One is key evaluation and the opposite is technical evaluation. Basic evaluation is mostly used whenever you need to put money into an organization for the long run. It entails an in depth research of the corporate, its opponents, its future prospects, and its monetary experiences. Technical evaluation is finished for intraday or short-term buying and selling. It entails learning charts, traits, patterns and understanding how information can impression the share costs of corporations.

4. How do you analyse inventory earlier than investing?

Listed below are a number of duties that ought to be in your guidelines for analyzing shares:

Assessment its monetary statements like Steadiness sheet, Revenue assertion, Money circulate assertion Notes to accounts, and so forth.

Trade evaluation: Research its opponents.

Valuation: Discover out if its valuation is honest and whether it is price investing in.

Arrive at a worth goal to find out your entry and exit.

5. What are the three layers of elementary evaluation?

The three layers of economic evaluation are Financial Evaluation, Trade Evaluation, and Firm Evaluation. These elements could be studied with a top-down or bottom-up strategy whereas performing the elemental evaluation.

Kritesh (Tweet right here) is the Founder & CEO of Commerce Brains & FinGrad. He’s an NSE Licensed Fairness Basic Analyst with +7 Years of Expertise in Share Market Investing. Kritesh often writes about Share Market Investing and IPOs and publishes his private insights in the marketplace.

Begin Your Inventory Market Journey Right this moment!

Need to be taught Inventory Market buying and selling and Investing? Ensure that to take a look at unique Inventory Market programs by FinGrad, the educational initiative by Commerce Brains. You may enroll in FREE programs and webinars out there on FinGrad at this time and get forward in your buying and selling profession. Be a part of now!!