Basic Evaluation of Laxmi Natural Industries: After itemizing at a premium of 20% in March 2021, the inventory of Laxmi Natural Industries rallied additional by 200% in one other 7 months. Nevertheless, the inventory has corrected 50% since then. Does this fall make it a horny firm? What can the buyers of the corporate count on within the coming quarters? We’ll attempt to reply these and plenty of different questions in our elementary evaluation of Laxmi Natural Industries Ltd.

Basic Evaluation of Laxmi Natural Industries

We’ll begin our research by getting ourselves accustomed to the enterprise and merchandise of the corporate. Subsequent, we’ll take a look at the market measurement and alternatives. After this, we’ll race by means of the financials of the inventory. A spotlight of the longer term plans and a abstract conclude the article on the finish.

Firm Overview

Laxmi Natural Industries Ltd. was arrange three a long time in the past by Vasudeo Goenka as a producer of alcohol-based chemical substances. It’s presently led by his eldest son Ravi Goenka who serves as chairman and managing director of the corporate.

Over time, the corporate has emerged as a number one producer of acetyl intermediates (AI) in India. Along with this, it additionally produces specialty intermediates (SI) equivalent to ketene and diketene derivatives as a part of its different section. Lastly, fluoro specialty intermediates are the third division of the corporate.

As a feather in its cap, with a capability of over 2,32,00 TPA, Laxmi Natural is without doubt one of the largest producers of Ethyl Acetate in India commanding a 33% market share. Moreover, it additionally has home management in Diketene derivatives with a 55% market share.

Companies from numerous industries together with prescription drugs, inks & coatings, printing & packaging, agrochemicals, adhesives, dyes & pigments, digital, automotive, and paints make use of the merchandise of Laxmi Natural Industries.

Supply: Laxmi Natural Industries Ltd. FY 2021-22 Annual Report

It owns three manufacturing services and two distilleries for Ethanol manufacturing which serves as a uncooked materials for acetyl intermediates. Together with this, the chemical maker additionally has captive energy technology capabilities.

Product-wise Segments

The high-value SI section accounted for 35% of the highest line and 65% of the earnings within the nine-month interval ending December 2022. Whereas the stability was led by the AI division contributing to 65% and 35% of the gross sales and earnings respectively.

Geography-wise Segments

It is without doubt one of the largest producers of Ethyl Acetate worldwide with its merchandise being exported to over 43 nations throughout 6 continents. Abroad gross sales accounted for 30% of the overall gross sales in FY22.

We bought a very good understanding of the corporate and its merchandise. Allow us to equip ourselves with the chemical substances trade panorama for our elementary evaluation of Laxmi Natural Industries.

Trade Overview

Acetyl Intermediates (the important thing income section of Laxmi Natural Industries) are commodity chemical substances with huge utilization functions. It’s a massive market will a number of small and huge shoppers and suppliers. The worldwide commodity chemical substances demand is pegged at $ 3,745 billion and is projected to extend at a charge of 5-6% over the subsequent few years.

Speaking about specialty chemical substances, the worldwide market was valued at $ 847 billion in 2020 and is anticipated to develop at a CAGR of 5.2% to $ 1,090 billion by 2025. In recent times, India’s specialty chemical substances trade boomed due to the Chinese language-government decarbonization crackdown and the Covid-19 pandemic outbreak.

Supply: Laxmi Natural Industries Ltd. FY 2021-22 Annual Report

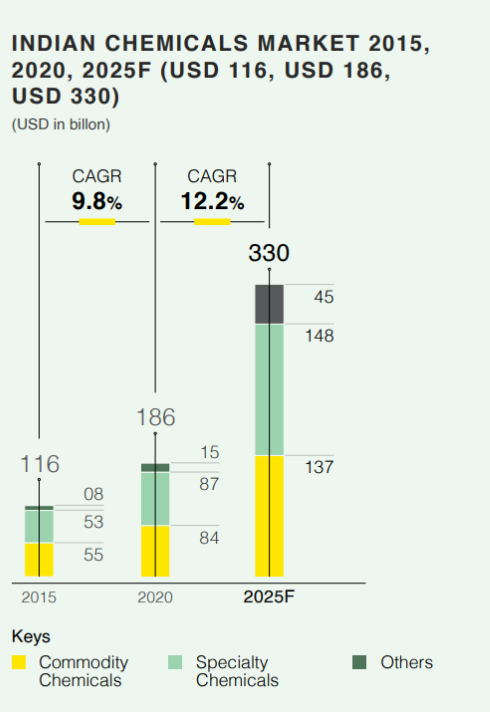

The structural shift is anticipated to profit the nation immensely and enhance its share within the world specialty chemical substances trade to six% by 2026 from 4%. Thus, India’s commodity chemical substances trade is anticipated to the touch $137 billion in worth by 2025 whereas the specialty chemical substances sector is anticipated to hit the $148 billion mark.

Supply: Laxmi Natural Industries Ltd. FY 2021-22 Annual Report

Going ahead, a wide range of components equivalent to a slowdown in China, low-cost Indian producers, higher analysis & improvement capabilities, and economies of scale will probably drive the expansion of the chemical substances sector in India.

Laxmi Natural Industries – Financials

Income and Internet Revenue Development

We’ll now take a look at the financials of the corporate for our elementary evaluation of Laxmi Natural Industries.

The working income grew at a CAGR of 17.23% from Rs 1,393 crore in FY18 to Rs 3,084 crore in FY22. Throughout the identical interval, the revenue after tax grew at a a lot sharper charge of 27.64% to Rs 256 crore.

The desk under exhibits the working income and internet revenue development of Laxmi Natural Industries over the previous couple of years.

Income can rise quicker than gross sales both due to working leverage or margin enchancment. With Laxmi Natural, each components performed their respective roles. Allow us to perceive this by performing a fast margin evaluation.

Margin Evaluation

From 2018-19, chemical firms began seeing quantity and margin growth due to the slowdown in China. That’s the very first thing. Secondly, the share of the high-margin specialty chemical substances division within the earnings of Laxmi Natural elevated in recent times.

Thus, each these occasions resulted within the widening of the working revenue margin and internet revenue margin of Laxmi Natural Industries. The desk under showcases the advance in margins of the chemical firm over the previous couple of years.

Return Ratios: RoE and RoCE

Greater profitability straight aided return ratios: RoE and RoCE of the corporate. An off-the-cuff observer could level out that FY22 return ratios are nonetheless under FY18. Nevertheless, the info doesn’t current the whole image.

Greater earnings led to growth within the fairness base and discount of debt. Moreover, the corporate has been investing closely in capability growth these days. The outcomes of this CAPEX will accrue within the coming quarters. Thus, we will say that the return ratios of the corporate have significantly improved.

The desk under presents the return on capital employed (RoCE) and return on fairness (RoE) of Laxmi Natural Industries for the earlier 5 fiscals.

Debt / Fairness Ratio

We’ll hold our debt evaluation temporary as Laxmi Natural Industries is a debt-free inventory with an virtually negligible debt-to-equity ratio of 0.07.

Future Plans Of Laxmi Natural Industries

To this point we checked out earlier years’ information for our elementary evaluation of Laxmi Natural Industries. On this part, we’ll attempt to perceive what lies forward for the corporate and its buyers.

Final yr the corporate made a big capital expenditure of Rs 200 crore to extend the capability of its specialty chemical substances division. The administration is bullish on this high-margin section to proceed to drive important bottom-line development.

Just lately, the corporate entered the Fluoro Speciality Intermediates market by buying an organization’s property in Italy. Subsequent, it dismantled & relocated the plant to Maharashtra whereas establishing an R&D facility in Italy. This step will de-risk and diversify the corporate’s operations whereas aiding it to faucet the progressive pharma, agro, and specialty chemical substances markets.

Moreover, it has acquired a big ground area of 30,000 sq. ft. for establishing a brand new analysis and improvement facility.

Key Metrics

We’re virtually on the finish of our elementary evaluation of Laxmi Natural Industries. Allow us to take a fast take a look at the important thing metrics of the inventory.

In Conclusion

As we conclude our elementary evaluation of Laxmi Natural Industries, we will positively say that the corporate has loads of alternatives within the close to future. Nevertheless, to maintain its excessive P/E, the inventory must ship on gross sales development constantly and keep margins. Thus, chemical trade buyers can hold an in depth watch on uncooked materials costs and quarterly gross sales development of Laxmi Natural.

In your opinion, what different components ought to buyers take into account whereas investing in chemical firms? How about you tell us within the feedback under?

By using the inventory screener, inventory heatmap, portfolio backtesting, and inventory examine device on the Commerce Brains portal, buyers acquire entry to complete instruments that allow them to establish the perfect shares additionally get up to date with inventory market information, and make well-informed funding selections.

Vikalp Mishra is a commerce graduate from the College of Delhi. He likes to jot down on finance, cash and enterprise. He’s a voracious reader with a real curiosity in investing. Drop him a mail at [email protected].

Begin Your Inventory Market Journey In the present day!

Need to study Inventory Market buying and selling and Investing? Ensure to take a look at unique Inventory Market programs by FinGrad, the educational initiative by Commerce Brains. You’ll be able to enroll in FREE programs and webinars obtainable on FinGrad at this time and get forward in your buying and selling profession. Be a part of now!!