Full story: Britain’s vitality worth cap falls to £2,074 however households will see little aid

Jillian Ambrose

Nice Britain’s vitality worth cap has fallen to £2,074 a yr, however the common family will nonetheless pay nearly double the speed for his or her fuel and electrical energy than earlier than prices began to soar, our vitality correspondent Jillian Ambrose experiences.

Round 27m households can anticipate a modest drop in vitality payments this summer time after the regulator Ofgem lowered the cap on the everyday annual dual-fuel tariff to mirror a steep drop in international vitality costs over latest months.

From July, when the change takes impact, households will see their common fuel and electrical energy invoice fall from the £2,500 a yr degree set by the federal government’s vitality worth assure.

However households who struggled to pay their payments over the winter will really feel little aid, as a result of authorities top-ups value £400 between October to March have come to an finish.

The typical vitality invoice will stay nearly double the extent seen in October 2021 – when Russia started limiting provides of fuel to Europe in a transfer that despatched wholesale costs hovering. Earlier than the vitality disaster, the everyday family paid £1,271 a yr for fuel and electrical energy.

Households may nonetheless face dual-fuel payments above £2,074 in the event that they use greater than the everyday quantity of vitality as a result of Ofgem’s cap limits the speed vitality suppliers can cost for every unit of fuel and electrical energy – not the full invoice.

Extra right here:

Key occasions

Germany in winter recession: what the consultants say

Weak non-public and public consumption dragged the German financial system into recession final winter, says Carsten Brzeski, international head of macro at ING.

Brzeski explains:

It’s not the worst-case situation of a extreme recession however a drop of virtually 1% from final summer time. The nice and cozy winter climate, a rebound in industrial exercise, helped by the Chinese language reopening and an easing of provide chain frictions, weren’t sufficient to get the financial system out of the recessionary hazard zone. Non-public consumption continued to endure from still-high retail vitality costs.

Trying past the primary quarter, the optimism at the beginning of the yr appears to have given approach to extra of a way of actuality. A drop in buying energy, thinned-out industrial order books in addition to the affect of essentially the most aggressive financial coverage tightening in a long time, and the anticipated slowdown of the US financial system all argue in favour of weak financial exercise.

On prime of those cyclical components, the continuing conflict in Ukraine, demographic change and the present vitality transition will structurally weigh on the German financial system within the coming years.

Javier Blas says Germany’s fall into recession reveals the affect of Europe’s vitality disaster – the nation scrambled to chop fuel use after the Ukraine conflict started.

The affect of the European vitality disaster: after early knowledge was revised, Germany fell into recession in 1Q 2023, after financial exercise already contracted in 4Q 2022 #EnergyCrisis

— Javier Blas (@JavierBlas) Might 25, 2023

Claus Vistesen, chief euro zone economist at Pantheon Macroeconomics, informed shoppers:

“Germany did fall into recession on the finish of final yr, in spite of everything, because the shock in vitality costs weighed on shoppers’ spending,”

He added that it’s unlikely that the German GDP will proceed to fall within the coming quarters, “however we see no robust restoration both.”

And it is a recession in Germany … as predicted by the IFO survey, for a while.

— Claus Vistesen (@ClausVistesen) Might 25, 2023

Germany falls into recession

Europe’s largest financial system has fallen into recession, because the financial disruption attributable to Russia’s invasion of Ukraine hit development.

New knowledge launched this morning reveals that Germany’s financial system has shrunk during the last two quarters – the technical definion of a recession.

German GDP shrank by 0.3% within the January-March quarter, revised figures present, moderately than stagnating as first estimated.

That follows a 0.5% contraction in October-December.

Ruth Model, president of the Federal Statistical Workplace, says:

“After GDP development entered detrimental territory on the finish of 2022, the German financial system has now recorded two consecutive detrimental quarters.”

Statistics physique Destatis experiences that family spending fell.

It says:

The reluctance of households to purchase was obvious in a wide range of areas: households spent much less on meals and drinks, clothes and footwear, and on furnishings within the first quarter of 2023 than within the earlier quarter.

There was additionally a fall in authorities expenditure, whereas funding was up and building output additionally rose.

Earlier this week, the IMF ditched its prediction that the UK would fall into recession this yr.

Up to date at 03.21 EDT

Martin Lewis, founding father of MoneySavingExpert, has welcomed the information that the Ofgem worth cap will drop in July.

He says:

From 1 July, vitality payments will now not be subsidised by the state, as Ofgem is fortunately dropping the Worth Cap beneath the Authorities’s Power Worth Assure for the primary time because it was launched. Payments will drop by a median 17%, that means for each £100/mth individuals pay immediately, they are going to sometimes be paying £83/mth from July.“This will likely be a aid for a lot of, but most will nonetheless be paying extra for his or her vitality than in the course of the winter. It is because, aside from for these with excessive use, the drop within the charges doesn’t make up for the £66 per 30 days state assist individuals obtained till April – and most are on month-to-month direct debit, which suggests they pay the identical in summer time as winter.

General, this nonetheless leaves individuals paying double or extra what they did earlier than the vitality disaster hit in October 2021.

Lewis argues that the federal government may present focused assist to assist struggling households within the coming winter:

“The very fact the state is paying far lower than deliberate to assist individuals’s payments means there may be some wriggle room right here for focused assist for one more onerous winter coming for many who are simply above the advantages threshold. Although I’m not holding out a lot hope that it’ll occur.“The ethical hazard of excessive standing expenses continues too. The discount is all off the unit price. It can nonetheless price roughly £300/yr only for the power of getting fuel and electrical energy.

This perversely means the much less you employ, the much less you save. I and plenty of others have pushed Ofgem on this, to little avail, although it’s launching a session on working prices which affect this and will assist a bit sooner or later.”

Up to date at 03.09 EDT

6.6m households face gasoline poverty below new worth cap

Nationwide Power Motion have calculated that there’ll nonetheless be 6.6 million households in gasoline povert as soon as the worth of vitality falls in July, below the brand new worth cap, down from round 7.5m.

The charity factors out that vitality payments are nonetheless roughly nearly double the extent of October 2021.

And crucially, payments from July will likely be corresponding to final winter because the Authorities has withdrawn assist value £400 to every family.

Nationwide Power Motion’s chief govt Adam Scorer says:

“Popping out of winter, most individuals will welcome any respite from file excessive costs, but it surely nonetheless leaves costs greater than two-thirds larger than the beginning of the vitality disaster and two million extra households trapped in gasoline poverty.

Greater than two and half million low earnings and susceptible households are now not receiving any authorities assist for unaffordable payments. For them, the vitality disaster is way from over.”

NEA additionally present recommendation and assist for these struggling – click on right here for extra particulars.

Full story: Britain’s vitality worth cap falls to £2,074 however households will see little aid

Jillian Ambrose

Nice Britain’s vitality worth cap has fallen to £2,074 a yr, however the common family will nonetheless pay nearly double the speed for his or her fuel and electrical energy than earlier than prices began to soar, our vitality correspondent Jillian Ambrose experiences.

Round 27m households can anticipate a modest drop in vitality payments this summer time after the regulator Ofgem lowered the cap on the everyday annual dual-fuel tariff to mirror a steep drop in international vitality costs over latest months.

From July, when the change takes impact, households will see their common fuel and electrical energy invoice fall from the £2,500 a yr degree set by the federal government’s vitality worth assure.

However households who struggled to pay their payments over the winter will really feel little aid, as a result of authorities top-ups value £400 between October to March have come to an finish.

The typical vitality invoice will stay nearly double the extent seen in October 2021 – when Russia started limiting provides of fuel to Europe in a transfer that despatched wholesale costs hovering. Earlier than the vitality disaster, the everyday family paid £1,271 a yr for fuel and electrical energy.

Households may nonetheless face dual-fuel payments above £2,074 in the event that they use greater than the everyday quantity of vitality as a result of Ofgem’s cap limits the speed vitality suppliers can cost for every unit of fuel and electrical energy – not the full invoice.

Extra right here:

Ofgem’s Brearley: Now we have confronted the largest vitality shock in our historical past.

Q: Yesterday, vitality agency SSE reported its earnings have nearly doubled within the final yr (to an adjusted pre-tax revenue of £2.18bn). Does that counsel the market may be rigged?

Ofgem CEO Jonathan Brearley factors out that SSE don’t have a home retail enterprise within the UK, so that they don’t have the enterprise that we’re regulating via the worth cap.

He says there was large turbulence available in the market with the price of commodities internationally going up dramatically.

That got here as Russia began withdrawing their fuel from the market, and the entire of Europe planning to maneuver away from Russian fuel.

Which means the market is tighter and that does imply that costs are larger.

Brearley provides that the state of affairs is beginning to stabilise, and repeats that he hopes to see “aggressive fastened worth offers reenter the market”.

He concludes:

Now we have confronted the largest vitality shock in our historical past. However issues are enhancing.

Q: Wholesale fuel costs have been falling for months – why is that profit solely being applied from July?

Brearley explains that vitality corporations are shopping for vitality ‘ahead available in the market’..

So proper now they’re not shopping for our energy and vitality for July. They’re shopping for it for in a while within the yr. Which means this does take time to feed via.

This chart reveals how the month-ahead price of UK fuel has certainly plummeted – from over 600p per therm final August to 64p per therm immediately.

Brearley provides that we’re not in the identical world as in 2015 or 2016, earlier than the worth cap was launched.

Then, individuals talked about costs “going up like a rock after which costs coming down like a feather”.

Right this moment, the components Ofgem makes use of when costs go up is broadly the identical because the components for when costs come down. So the advantages of the present low costs must be felt for longer.

Q: However thousands and thousands of persons are struggling – shouldn’t Ofgem be reducing the cap additional?

Brearley tells the BBC’s Right this moment programme that Ofgem’s job is to make sure that prices are pretty mirrored within the worth paid by prospects. That’s what its doing.

Ofgem just lately moved to a quarterly worth cap change – moderately than each six months.

Brearley says that change means price reductions are being handed via way more rapidly than they in any other case would.

He says there may be “a lot greater societal debate” about the way to assist households who’re battling many househoold payments, not merely vitality prices.

Ofgem CEO Jonathan Brearley is now explaining immediately’s worth cap announcement on Radio 4’s Right this moment Programme.

Q: Nationwide Power Motion assume 6.5 million individuals will nonetheless dwell in gasoline poverty below the brand new worth cap – why is it so excessive?

Brearley says there was a dramatic fall in the price of vitality, resulting in this morning’s discount of round £420 per yer (for a typical annual invoice).

He says:

The rationale why is it nonetheless excessive is, finally, though that drop is dramatic, it’s not as dramatic because the rises we noticed between 2021 and 2022.

Brearley provides that the vitality market is stabilising, and Ofgem is seeing indicators that prospects may begin transferring to extra aggressive vitality provides (which dried up when wholesale vitality costs started surging, and plenty of smaller suppliers collapsed].

He says:

The market is stabilising and we’re seeing indicators that for instance, switching could return, so we may even see higher provides even than the worth cap.

However finally, costs are larger than they have been earlier than. and also you’re proper, many households will wrestle.

Brearley provides that Ofgem, the trade and the federal government must work collectively to assist these susceptible prospects.

Q: If one in all your key jobs is to face up for shoppers, and 6.5m will likely be in gasoline poverty, are you doing all of your job correctly?

Brearley says Ofgem’s job is to control the vitality worth, to control the market and to control the businesses concerned. However it could’t provide monetary assist to prospects.

He says that six or 9 months in the past, individuals although the worth cap could possibly be £3,000, £4,000 or evern £5,000 immediately.

The market is transferring a step in the best course. however sure, there may be nonetheless extra to do.

Ofgem’s Brearley: Payments will nonetheless be troubling for many individuals

Ofgem CEO Jonathan Brearley has warned that vitality costs are unlikely to fall to their pre-crisis ranges [in 2019, the cap was £1,254 per year].

Brearley says:

“After a tough winter for shoppers it’s encouraging to see indicators that the market is stabilising and costs are transferring in the best course. Individuals ought to begin seeing cheaper vitality payments from the beginning of July, and that may be a welcome step in direction of decrease prices.

“Nevertheless, we all know persons are nonetheless discovering it onerous, the cost-of-living disaster continues and these payments will nonetheless be troubling many individuals up and down the nation. The place persons are struggling, we urge them to contact their provider who will have the ability to provide a spread of assist, reminiscent of fee plans or entry to hardship funds.

“Within the medium time period, we’re unlikely to see costs return to the degrees we noticed earlier than the vitality disaster, and subsequently we consider that it’s crucial that authorities, Ofgem, client teams and the broader trade work collectively to assist susceptible teams. Particularly, we’ll proceed to work with authorities to have a look at all choices.”

Up to date at 02.13 EDT

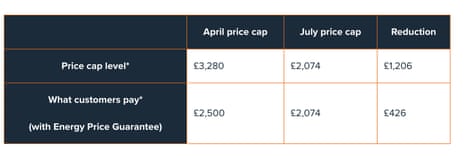

This chart, from Ofgem, reveals how typical vitality payments will drop when the worth cap is subsequent adjusted in July:

As you possibly can see, Ofgem’s cap on vitality payments will come down from £3,280 per yr to £2,074 per yr for a typical consumer.

However, the federal government’s personal vitality worth assure limits a typical invoice at £2,500/yr, so the efficient discount is smaller.

Up to date at 02.13 EDT

Right this moment’s replace signifies that, for the primary time for the reason that international fuel disaster took maintain greater than 18 months in the past, costs are falling for patrons on default tariffs.

Ofgem says:

The financial savings can now be handed on to prospects extra rapidly, because of Ofgem now updating the worth cap quarterly moderately than each six months.

At its peak, the worth cap reached £4,279 and, while immediately’s degree is decrease than final quarter, it’s nonetheless above the degrees it was earlier than the vitality disaster took maintain, that means many households may nonetheless wrestle to pay payments.

Ofgem cuts worth cap to £2,074 from July

Newsflash: Common vitality payments will fall this summer time.

Regulator Ofgem has simply introduced that Nice Britain’s vitality worth cap will fall from July, to £2,074 a yr for a typical family – a saving of over £400 per yr.

The transfer means round 27m households can anticipate a modest drop in vitality payments this summer time. Ofgem is reducing the cap on the everyday annual dual-fuel tariff to mirror a steep drop in international vitality costs over latest months.

From July, when the change takes impact, households will see their common fuel and electrical energy invoice fall from the £2,500 a yr degree set by the federal government’s vitality worth assure.

However the common family will nonetheless pay nearly double the speed for his or her fuel and electrical energy than earlier than prices began to soar.

And as this can be a cap on vitality prices, there’s no restrict on the payments a family may run up.

Up to date at 03.40 EDT

Full story: Thousands and thousands will face gasoline poverty regardless of Ofgem transfer to chop vitality worth cap

Jillian Ambrose

Round 6.5m households will nonetheless be in gasoline poverty, analysts estimate, even as soon as payments fall in July.

At greater than £2,000, typical vitality payments will stay nearly double the extent they have been at earlier than Russia started limiting fuel provides to Europe because it ready to invade Ukraine. In October 2021, the everyday family paid £1,271 a yr for fuel and electrical energy, my colleague Jillian Ambrose explains.

In a forecast that can alarm hard-pressed households, Cornwall’s analysts have warned they don’t anticipate payments to return to pre-2020 ranges “earlier than the tip of the last decade on the earliest”.

Peter Smith, a director of Nationwide Power Motion, a gasoline poverty charity, stated:

“It’s excellent news vitality costs are now not spiralling however the vitality disaster is way from over.”

Extra right here:

Sharon Graham, the chief of the Unite union, has accused Ofgem of being the “regulator that received’t regulate”, saying it’s “now not match for function”.

Even earlier than the brand new worth cap announcement hits the wires at 7am, Graham says:

“The value cap could also be down however vitality payments for thousands and thousands of households will nonetheless be crippling.

“On this second of disaster we wanted a robust vitality regulator which might be on the entrance foot combating the profiteering of the UK’s vitality corporations. As a substitute we’ve got a regulator that received’t regulate, rampant Massive Power plundering the financial system and a authorities that’s completely trying the opposite manner.

Unite has beforehand referred to as for a clamp down on “extreme” earnings generated by regional electrical energy distribution community operators, who deliver electrical energy to UK properties

Graham additionally cites the scandal of debt collectors breaking into properties to suit vitality meters for susceptible prospects, saying:

“The pre-payment meter scandal demonstrates for all those that haven’t realised that Ofgem is now not match for function. No marvel half the board have been despatched on their manner. It’s time to face information.

Time to deliver the vitality profiteers into public possession. That might create an actual Ofgem.”

Introduction: Ofgem to announce vitality worth cap immediately

Good morning.

The vitality regulator is poised to pronounces a minimize to family payments this summer time, however UK households may little aid within the ongoing price of dwelling disaster.

Ofgem is predicted to decrease the vitality worth cap by a number of hundred kilos a yr, when it’s subsequent adjusted in July. The announcement is due at 7am.

Analysts at consultancy Cornwall Perception predicts the worth cap will fall to £2,054 a yr for a typical family, following the drop in wholesale vitality costs in latest months.

The cap, which was meant to guard shoppers throughout Nice Britain from rising costs, soared final yr after the Ukraine invasion drove up oil and fuel costs. This prompted the federal government to step in with its personal vitality worth assure, successfully a decrease cap than Ofgem’s.

Since April, the Ofgem cap has been set at an annual degree of £3,280 for the common family on a dual-fuel tariff, which might be painfully excessive. However the authorities’s vitality assure means common payments are decrease, at £2,500 a yr for a typical buyer.

That EPG will rise to £3,000 from July – that means the Ofgem cap (assuming it does fall immediately) will decide payments.

Importantly, the cap is on the unit cost of vitality – NOT the utmost a family could be billed (which remains to be decided by how a lot vitality they use).

And if the Ofgem cap does drop to round £2,000 per yr, as anticipated, households will nonetheless be paying way more for vitality than earlier than the Ukraine conflict – although European wholesale fuel costs have hit 22-month lows in Might.

Households which struggled to pay their payments over the winter will proceed to be squeezed as authorities funds value a complete of £400 between October to March this yr have come to an finish.

Campaigners from the Finish Gas Poverty Coalition have warned that households hoping for a pointy drop of their payments could discover little distinction in contrast with the charges they paid over winter.

Simon Francis, a coordinator on the coalition, stated final week:

“Individuals now face many extra months with payments remaining stubbornly excessive. This can see them proceed to make use of up their financial savings for on a regular basis gadgets, run up bank card payments, fall into debt with vitality companies or flip to meals banks as the price of dwelling disaster deepens.”

Though inflation did fall yesterday, costs proceed to rise sooner than economists anticipated, pushed by necessities reminiscent of meals.

The agenda

7am BST: Ofgem announcement on UK vitality worth cap

9.30am BST: Newest realtime UK financial knowledge from the Workplace for Nationwide Statistics

11am BST: CBI distributive trades survey of UK retail sector

1.30pm BST: US weekly jobless claims figures

1.30pm BST: Chicago Fed nationwide exercise index

Up to date at 01.55 EDT