Robert Method

Funding Thesis

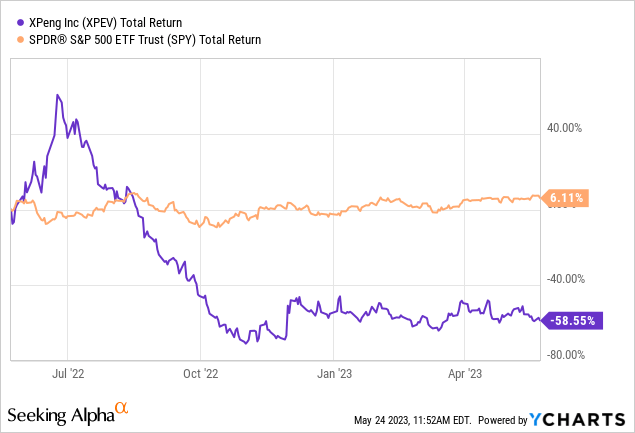

Chinese language automaker XPeng (NYSE:XPEV) simply introduced its earnings outcomes, which have been gentle throughout the board for each revenues and earnings, whereas it additionally introduced a weak second quarter with deliveries anticipated to fall 36.1% to 39.0% year-on-year.

Though XPEV inventory has already fallen considerably, we expect it’s poised to achieve decrease ranges as powerful competitors from bigger rivals BYD (OTCPK:BYDDF) and Tesla (TSLA) will proceed, whereas China faces very tough macroeconomic instances. We downgrade XPeng’s ranking from “Purchase” to “Promote” as we additionally imagine there are a lot better Chinese language equities, in deep worth territory, to achieve publicity to Chinese language innovation.

Demand Issues

Sure figures launched in the course of the first quarter and the final quarters make us surprise if XPeng was primarily affected by a requirement downside, slightly than the Chinese language economic system that was locked down for a lot of final 12 months and 2021.

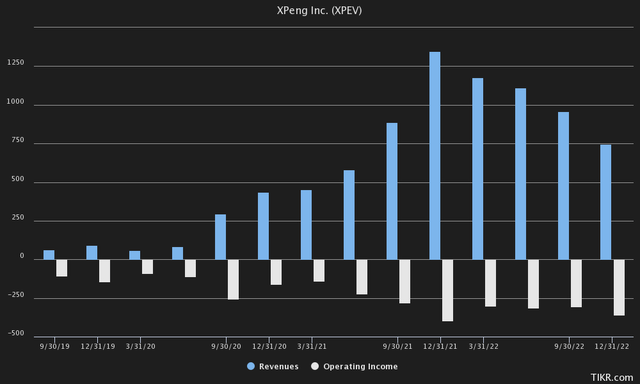

Revenues got here in a lot decrease than anticipated, at $587.31 million versus the anticipated $712.67 million, inflicting revenues to fall even additional and now stand at -45.9% year-on-year, regardless of a rebounding economic system. Automotive gross margins turned detrimental for the primary time because the second quarter of 2020. By way of working earnings, the corporate additionally appears to proceed to bleed cash, with -$376.46M for the primary quarter.

TIKR Terminal

One of many causes XPeng skilled a weaker-than-usual Q1 than This fall would be the expiration of some subsidiaries that expired on the finish of the 12 months in 2022, thus boosting year-end gross sales in This fall. Nonetheless, a ten% buy tax exemption reportedly nonetheless runs via the top of 2023, which might additional harm gross sales when it expires on the finish of the 12 months.

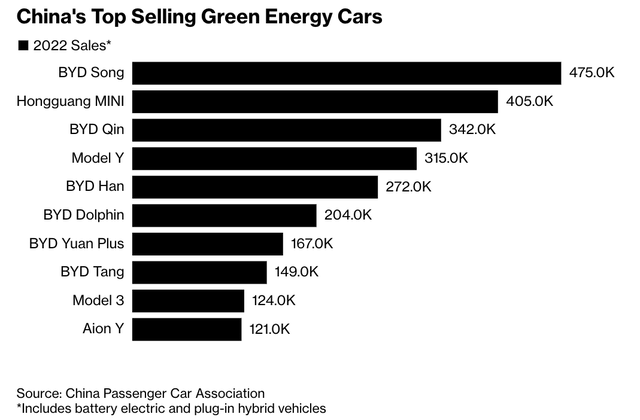

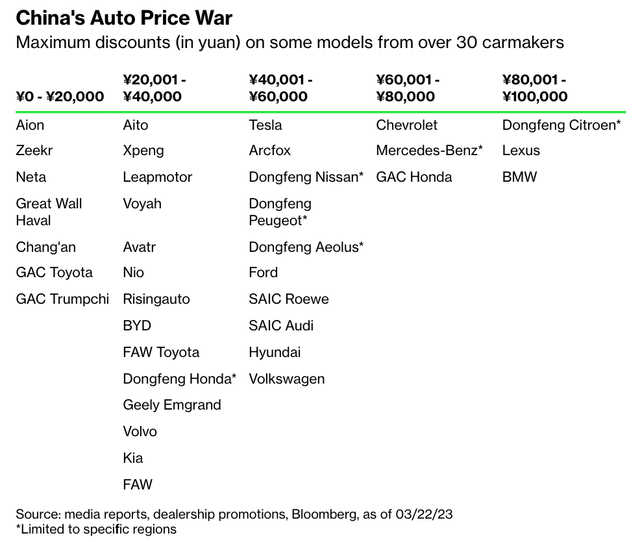

We expect the primary downside for XPeng’s demand issues is the atmosphere through which the corporate operates, the place it’s in the identical worth vary as Tesla and BYD, that are additionally at present going through cutthroat competitors and drastically lowered their costs earlier this 12 months to fulfill demand.

Bloomberg

XPeng’s autos are priced round 150,000 to 300,000 RMB, which is in the identical worth vary as mass-market autos similar to BYD, which expects 3 million gross sales in 2023, and Tesla, which made 710,000 gross sales in 2022. That is in stark distinction to BYD’s 120,757 gross sales in 2022.

However again to the value vary of RMB 150,000 to RMB 300,000, XPeng’s autos are at present priced very equally to its rivals. A Tesla Mannequin 3 at present begins at RMB 231,900 and a Mannequin Y at RMB 311,900. And that is for premium-priced autos, that are nonetheless seen as luxurious objects, even in the US. In comparison with BYD’s extra reasonably priced choices, XPeng has it much more up towards BYD, which lately started delivering its Seagull EVs beginning at a staggering RMB 73,800.

Whereas BYD and Tesla are already igniting a worth warfare, this comes as a blow to XPeng, which isn’t even worthwhile but and must decrease its costs even additional and face even better money move drain to fulfill demand and scale up manufacturing.

Bloomberg

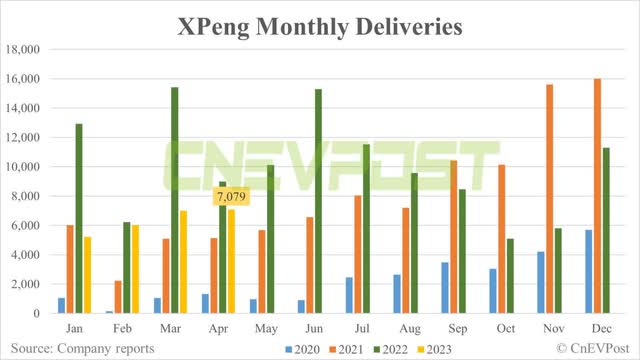

Deliveries are solely anticipated to come back in between 21,000 and 22,000, that means that deliveries within the coming months are prone to stay flat from the roughly 7,000 deliveries in April. That is a lot decrease than deliveries in 2022, and never removed from deliveries in 2021 and by the top of 2020.

CnEVPost

However even leaving deliveries apart, these macroeconomic pressures, which we’ll speak about in a second, mixed with expiring EV credit and a worth warfare between BYD and Tesla have additionally apparently erased XPeng’s gross margins, which at present stand at simply 1.7%. These are the worst margins since 2020, and it means XPeng solely grossed $9.76 million within the first quarter, not even talking concerning the $390.60 million in OpEx.

CnEVPost

On its steadiness sheet, XPeng has US$4.97 billion in money and short-term investments, which will be seen as a big buffer to additional downward stress on the inventory. Distinction this with the present working lack of $376.46 million, XPeng has simply over 13 quarters of runway left.

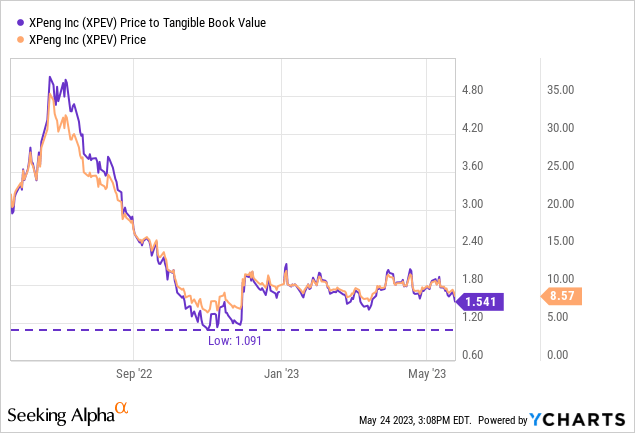

Nevertheless, if we have a look at the tangible e-book worth, this would possibly present some safety towards draw back danger: within the fourth quarter, the tangible e-book worth per share was $5.58, not removed from the $8.55 we’re buying and selling at now. We expect this might imply a backside round $5-6 for XPeng, or near the earlier lows round $6 for a greater entry level.

Since XPeng is just not but worthwhile, nor has it produced a constructive determine on the working earnings stage, we’ll primarily have a look at the aforementioned Worth/Tangible Guide Worth and P/S multiples.

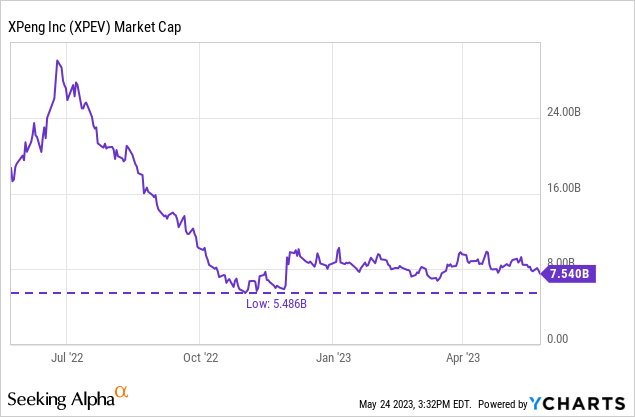

For instance, if we have a look at BYD, certainly one of XPeng’s rivals, as in addition they at present promote nearly all Chinese language EVs/PHEVs, it has RMB 468.13 billion in income on a TTM foundation. The inventory is at present buying and selling at RMB 723.42BN, that means it has a P/S ratio of 1.54x. On the identical P/S ratio, XPeng would commerce at $5.25BN on a TTM foundation with revenues of $3.40BN, which is way decrease than the $7.54BN it’s at present buying and selling for. And that determine appears slightly beneficiant to us, provided that BYD is at present producing important constructive free money move, together with 17.7% gross margins as of the primary quarter.

Subsequently, we expect the honest worth for XPeng is nearer to its earlier lows, round $6, or a market capitalization nearer to $5.25BN.

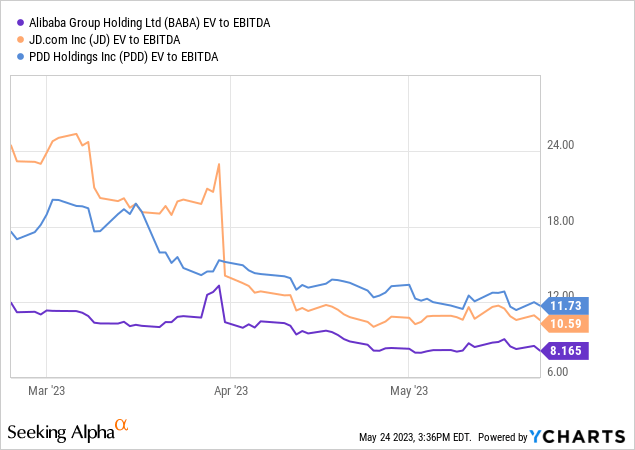

Even when we evaluate it to different corporations through which traders can make investments to achieve publicity to China and Chinese language innovation, we imagine there are a lot better alternatives. Presently, corporations like Alibaba (BABA), JD.com (JD) and Pinduoduo (PDD), which we wrote about lately, are arguably in “deep worth” territory in comparison with XPeng, which is at present burning money hand over fist and seeing its revenues decline.

Powerful Macroeconomics

Even on a macroeconomic foundation, we expect XPeng is going through important headwinds, which can additional harm its demand issues, profitability points and declining progress.

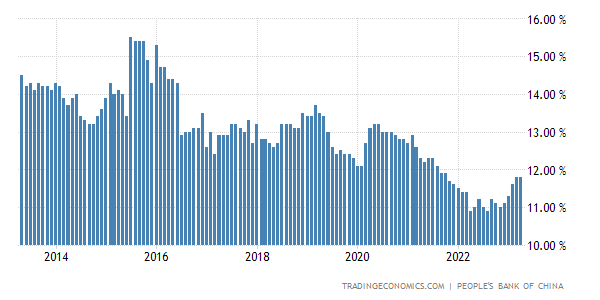

Many anticipated the Chinese language economic system to rebound, following the reopening after greater than 2 years of decrease progress, because the economic system was locked down. Nevertheless, current information present that this optimism could have been misplaced. If we have a look at the expansion price of Yuan Loans, which is essential for a rising economic system, we see that it’s at present round 11.8%, which at first look looks like loads. However it’s truly nearly the bottom price prior to now 20 years.

Buying and selling Economics

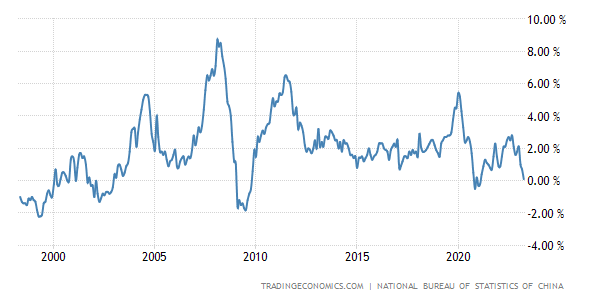

Chinese language CPI can be fairly completely different from the US, the place inflation approached double digits final 12 months. This 12 months, nonetheless, China has to fret concerning the reverse: deflation. Inflation is at present headed for certainly one of its lowest ranges over the previous 20 years and appears to be heading much more south, much like 2000 and 2008. An economic system can often deal with some inflation, however the “debt deflation” situation, is an unsightly situation that often happens throughout financial depressions similar to 1929 and 2008.

Buying and selling Economics

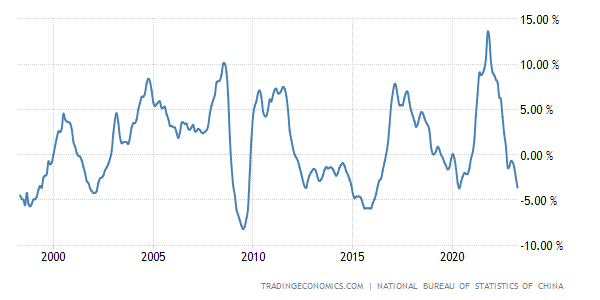

One other metric, the producer worth index, has additionally plunged and is heading into deep detrimental territory. A detrimental PPI might even have additional penalties, because it might result in decrease client spending and the postponement of purchases in anticipation of additional worth declines.

Buying and selling Economics

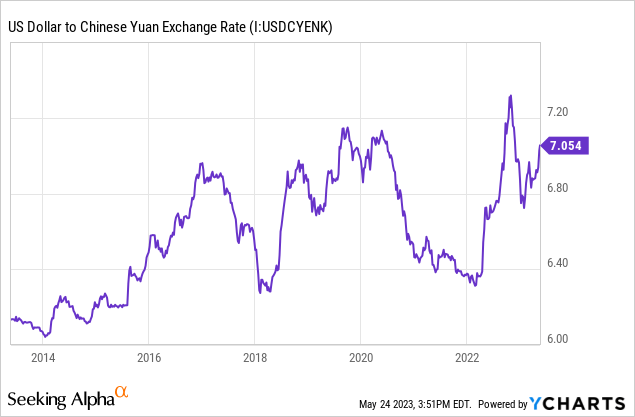

The Chinese language yuan can be weakening towards the U.S. greenback, which is at present pretty low cost at 7.06 RMB towards USD, because it has damaged via the 7:1 stage. All these indicators lead us to imagine that the Chinese language economic system and client are usually not experiencing a “reopening increase,” and are in worse form than anticipated.

The Backside Line

XPeng is working in a particularly tough atmosphere, with Tesla waging a worth warfare towards BYD, with each producers considerably slicing costs and seeing decrease margins in consequence. We expect one of many first casualties of this worth warfare shall be XPeng, with considerably weaker demand and an incapability to scale additional except it comes on the expense of gross margins.

For us, it’s at present unclear how XPeng can get to flee velocity and scale up its manufacturing, whereas competing with BYD and Tesla, which arguably have a a lot better worth proposition for the time being, resulting from their measurement and the size of time they’ve been lively within the EV sector. On high of all these headwinds, it doesn’t seem that the Chinese language macroeconomy will enhance anytime quickly. On a relative valuation foundation and tangible e-book worth, we expect XPeng’s honest worth is nearer to $6 per share. Nevertheless, we imagine there are different nice equities, similar to Alibaba, Pinduoduo and JD.com, which can be buying and selling at dirt-cheap valuations and in addition provide publicity to the Chinese language client and innovation.

We’d look ahead to additional indicators, similar to enhancing margins or stronger demand which will point out additional enchancment in profitability, as XPeng at present stays too speculative, shedding greater than $376 million per quarter, as of Q1.