Torsten Asmus

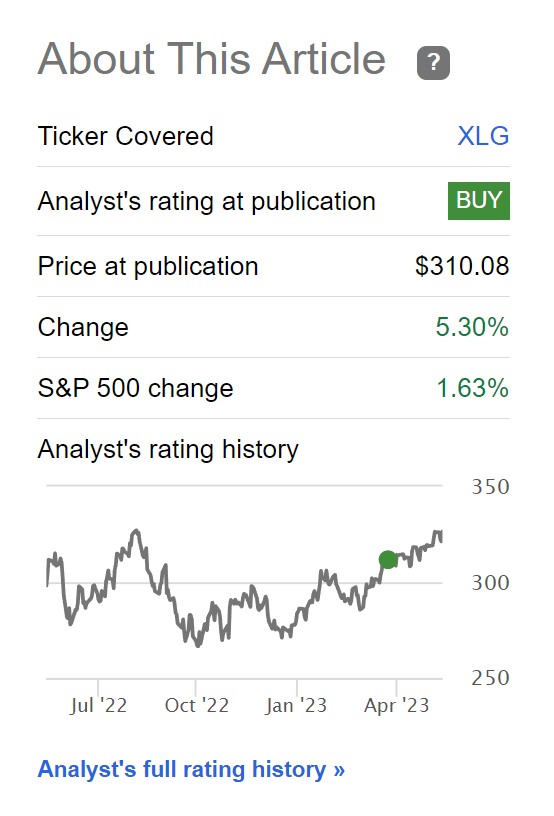

With a heightened danger of recession, I’ve been advising readers to scale back danger and improve the standard of their portfolios. For instance, I’ve steered traders transfer into mega-caps through the Invesco S&P 500 Prime 50 ETF (XLG), which has returned 5.3% since my article, outperforming the flattish efficiency of the S&P 500 Complete Return Index (Determine 1).

Determine 1 – XLG has outperformed S&P 500 since my suggestion (Looking for Alpha)

One other method traders can attempt profit from the approaching storm is to hunt out energetic bond managers that may reap the benefits of the approaching recession to select investments that may outperform over the approaching years. I not too long ago highlighted the Pimco Energetic Bond ETF (BOND) as probably one such fund, capitalizing on Pimco’s fastened revenue experience.

On this article, I’ll overview one other energetic bond fund, the Principal Funding Grade Energetic ETF (NYSEARCA:IG), to see if it’s also worthy of a suggestion.

Fund Overview

The Principal Funding Grade Energetic ETF is an actively managed bond ETF that focuses on funding grade bonds.

The IG ETF is a comparatively small fund with solely $43 million in belongings, though it solely prices a 0.19% expense ratio, low for an actively managed fund.

Technique

Though the Principal Funding Grade Energetic ETF is small by itself, the fund is sponsored by Principal Asset Administration, a big world asset administration firm managing near $500 billion in belongings.

The portfolio managers for the IG ETF believes the funding grade company bond market is inherently inefficient and that they’ll generate ‘alpha’ and ‘danger mitigation’ via an actively managed portfolio.

Determine 1 exhibits a portfolio development framework for the IG ETF that is filled with business jargon like dividing the investable universe into ‘danger group’s and weighing the ‘danger teams’ primarily based on the supervisor’s ‘macro-outlook’ to use inefficiencies and maximize ‘risk-adjusted’ returns. Securities are chosen with ‘engaging worth and high quality’ traits.

Determine 1 – IG ETF portfolio development framework (IG factsheet)

General, the fund’s factsheet, web site, and prospectus supply little or no particulars on how the IG ETF’s portfolio is constructed and managed on a day-to-day foundation.

Portfolio Holdings

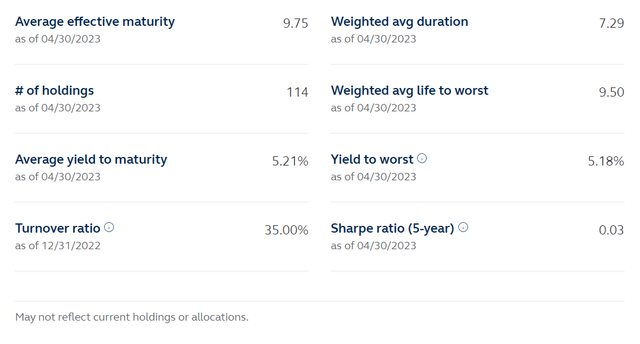

The IG ETF at the moment holds 114 positions with a weighted common length of seven.3 years and a portfolio yield to maturity of 5.2% (Determine 2).

Determine 2 – IG portfolio traits (principalam.com)

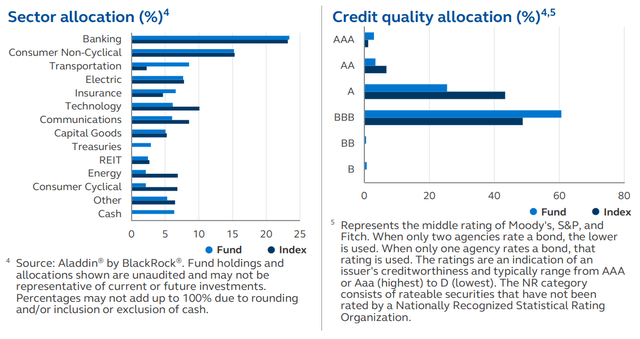

The IG ETF’s sector and credit score allocations as of March 31, 2023 are proven in Determine 3. Relative to the Bloomberg U.S. Company Funding Grade Bond Index (“Index”), the IG ETF has a bigger allocation to the transportation sector and an underweight in expertise, communications, power and shopper cyclical sectors. The fund additionally has a comparatively excessive money weight of 6.6%.

Determine 3 – IG ETF sector and credit score high quality allocation (IG factsheet)

When it comes to credit score high quality, the IG ETF is obese decrease high quality BBB-rated credit and underweight increased high quality A-rated credit, relative to the Index. Nevertheless, virtually the entire fund’s investments are funding grade, as per the technique mandate.

Distribution & Yield

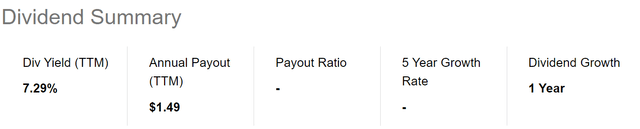

The IG ETF pays a beneficiant month-to-month distribution with trailing 12 month distribution of $1.49 / share or a 7.3% yield (Determine 4).

Determine 4 – IG pays a beneficiant trailing distribution yield (Looking for Alpha)

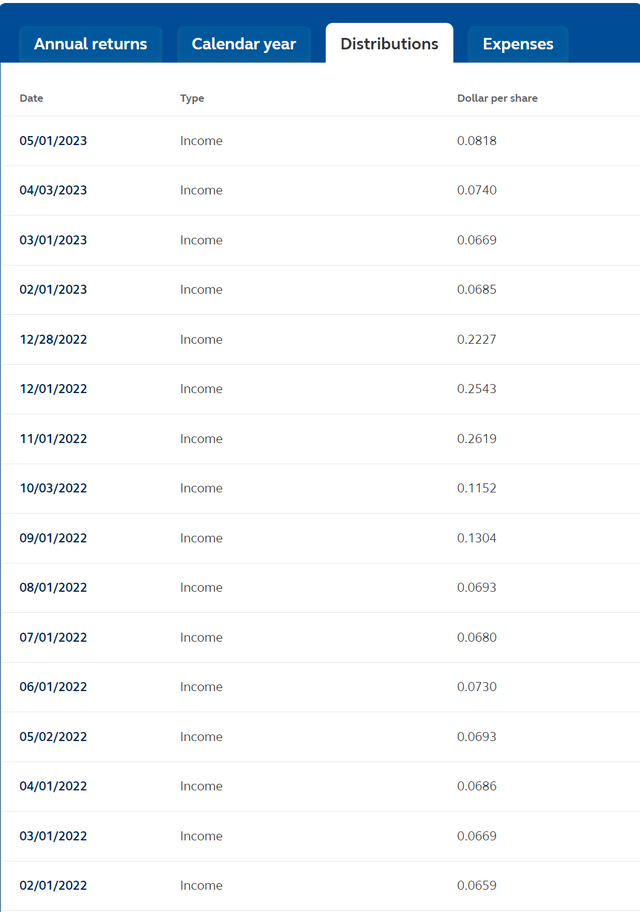

Nevertheless, traders ought to observe that the IG ETF’s distribution may be fairly ‘lumpy’, with a number of giant distributions on the finish of 2022 resulting in the excessive trailing yield (Determine 5)

Determine 5 – IG distribution quantities (principalam.com)

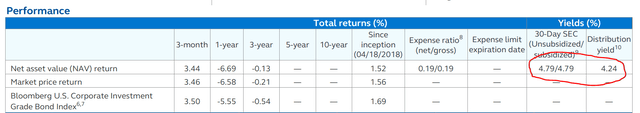

On a ahead foundation, the fund’s 30D SEC yield of 4.8% and annualized distribution yield of 4.2% could also be extra consultant (Determine 6).

Determine 6 – 30D SEC yield could also be extra consultant of IG’s distribution yield (IG factsheet)

Returns

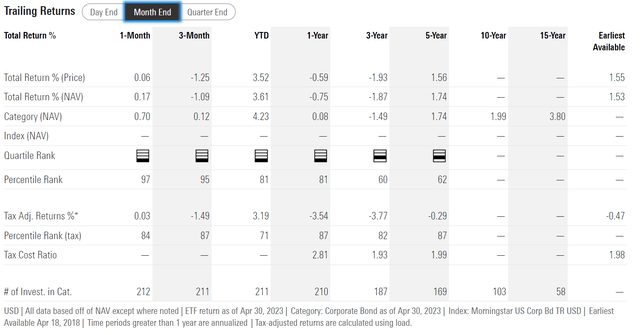

Determine 7 exhibits the IG ETF’s historic returns. General, the IG ETF has delivered very modest returns, with 1/3/5 Yr common annual return of -0.8%/-1.9%/1.7% to April 30, 2023.

Determine 7 – IG historic returns (morningstar.com)

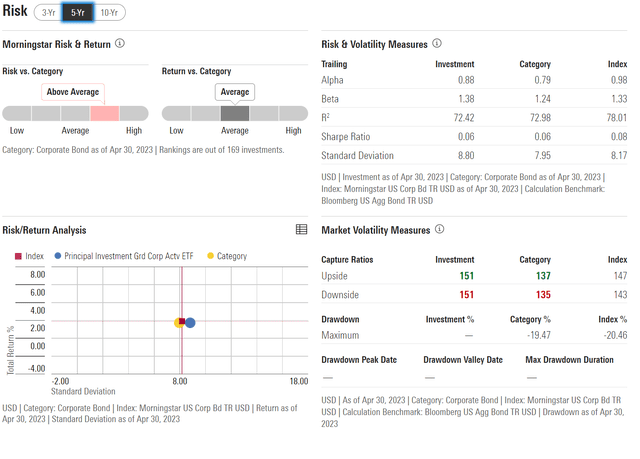

Notably, the IG ETF has ranked within the third or 4th quartile towards friends within the Morningstar class Company Bond. Relative to friends, the IG ETF additionally has above common danger (as measured by returns volatility) and common returns (Determine 8).

Determine 8 – IG danger vs. returns (morningstar.com)

Conclusion

Whereas I imagine energetic bond administration has the chance to ship above common returns within the coming years by shopping for ‘engaging belongings’ in the course of the pending recession, I’m not positive if the Principal Funding Grade Energetic ETF is the best automobile to take benefit.

With out particulars on the supervisor’s allocation philosophy and danger administration practices, we are able to solely assess the IG ETF primarily based on its historic returns. Based mostly on its 5 years of working historical past, the IG ETF has delivered modest efficiency that has underperformed friends regardless of being marketed as ‘actively managed’ to reap the benefits of ‘inefficient markets’. General, I see nothing that recommend the supervisor is ready to add any ‘alpha’ in managing funding grade company bonds.

I recommend traders skip this small ETF and search credit score publicity elsewhere. I’ll proceed to overview energetic bond funds and spotlight people who I imagine may help traders outperform.