The pandemic could have caused a storm, nevertheless it has additionally fostered fertile floor for innovation.

The rise of AI, led by generative AI instruments equivalent to ChatGPT and Secure Diffusion, has not solely aided the tech sector’s restoration however has additionally pushed it in direction of unprecedented progress. As we glance into the long run, one factor is obvious: AI isn’t just part of the tech trade; it’s changing into the tech trade.

Markets, on the whole, are rebounding post-pandemic. Nevertheless, the appearance of AI has been a specific windfall for tech shares, particularly {hardware} producers.

Probably the most evident latest instance, in fact, is NVIDIA, the corporate behind the main industrial-grade graphic processing {hardware} and the creators of CUDA know-how, with out which modern AI developments wouldn’t be possible.

In a mere 5 months, NVIDIA has skilled essentially the most vital surge to its inventory worth in its historical past. It has now recorded a 166% spike after enduring a 50% drop because of a tough mixture of political conflicts between the U.S. and China, the 2022 chip disaster, and a market standstill brought on by the COVID-19 pandemic. In lower than half a 12 months, the corporate has recuperated from these losses, and there isn’t any signal of it slowing down within the close to time period.

AI {hardware} producers are on hearth

Nevertheless, NVIDIA shouldn’t be the one firm reaping the advantages of the AI surge. Different competing and associated corporations are additionally profiting considerably from this new development. Listed here are a few of the winners.

Superior Micro Units Inc. (AMD)

AMD manufactures high-performance computing and graphics options which are utilized in AI purposes. They’ve developed particular GPUs and CPUs which are optimized for machine studying and AI workloads, and they’re the second-most in style alternative of GPUs for home customers.

Up to now this 12 months, the corporate’s shares have ascended 94% from $65 to their present worth of $125. If the share worth hits $145, it will compensate for all of final 12 months’s losses.

Story continues

Taiwan Semiconductor Manufacturing (TSM)

TSM is the world’s largest devoted impartial (pure-play) semiconductor foundry. As a foundry, they produce chips for numerous corporations, a lot of that are concerned in AI.

The corporate is up 39% for the reason that begin of the 12 months. With one other 20% rise, it will get well the losses from 2022. Chip disaster? The place?

Micron Know-how (MU)

Micron Know-how is a world chief within the semiconductor trade. They manufacture a broad vary of reminiscence and storage merchandise, that are essential elements for AI and machine studying methods that require fast and environment friendly information processing.

MU shares have elevated 47% up to now in 2023, and so they have progress potential of one other 27% earlier than encountering resistance marked by their very own all-time excessive.

Three AI-related software program shares to observe

Past the {hardware} realm, software program corporations are additionally experiencing a spectacular 12 months, significantly because of the explosion of generative AI, with ChatGPT main the hype.

Meta (META)

Beforehand often called Fb, Meta is without doubt one of the favorites amongst buyers. Shifting focus from the metaverse to AI is yielding outcomes for Mark Zuckerberg’s firm, which, along with implementing options in its conventional enterprise mannequin, has additionally printed vital open-source contributions, together with the Giant Language Mannequin LLaMa.

A Giant Language Mannequin (or LLM) is an AI mannequin skilled on a considerable amount of textual content information and is ready to generate human-like responces to totally different textual content prompts. (This simulates a dialog utilizing pure language.) LLaMA is a extremely in style LLM amongst AI customers and builders.

Meta has had its greatest half-year efficiency in historical past, rising 116% up to now in 2023.

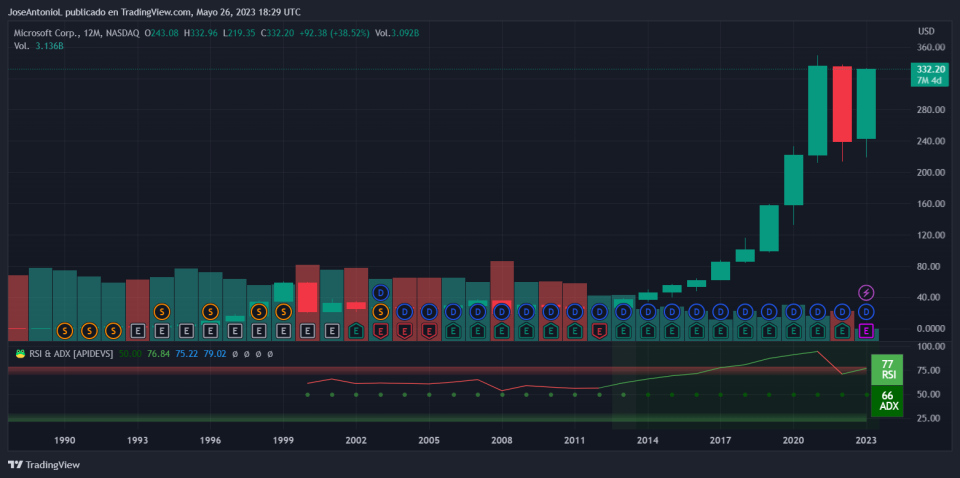

Microsoft (MSFT)

Invoice Gates’ firm is famend for being the creators of Home windows and the Xbox gaming console. However now it’s gaining floor for being the “godfather” of OpenAI, the corporate that developed LLM GPT-4 and ChatGPT, the chatbot that introduced AI into the media highlight.

OpenAI is valued at $29 billion, and Microsoft alone has invested $13 billion. The choice to include GPT-4 into their Edge browser and Bing search engine, in addition to utilizing Bing because the default search engine for ChatGPT, has been a catalyst for the tech big’s inventory worth. Up to now in 2023, Microsoft has risen practically 40%, offsetting the losses from the earlier 12 months,

Alphabet Inc (GOOGL)

Alphabet, the guardian firm of Google, is closely invested in AI. They’ve developed Tensor Processing Models (TPUs), that are custom-developed application-specific built-in circuits (ASICs) used to speed up machine studying workloads. They’re additionally the builders of TensorFlow, an open-source AI library, and supply cloud-based AI companies. Within the realm of software program, the corporate has been way more lively.

The launch of Bard with its improved PaLM2 has been a hit, positioning it as a direct competitor to ChatGPT. The discharge of LLM fashions tailor-made to clients’ wants has generated a optimistic response amongst its buyers (in contrast to what occurred when the corporate introduced its first chatbot and it began hallucinating). GOOGL shares have risen 40% up to now this 12 months and are 20% away from progress till they problem the resistance of their all-time excessive once more.