cemagraphics

Final week’s article outlined the subsequent upside targets for S&P 500 (SPY), but in addition warned of complacency and the potential for a transfer beneath 4098 to “flush out late bulls” earlier than resumption of the rally. The weekly low was 4103, which was shut, however was it sufficient?

To reply that, quite a lot of technical evaluation methods will probably be used to take a look at possible strikes for the S&P 500 within the week forward. The S&P 500 chart will probably be analyzed on month-to-month, weekly, and day by day timeframes. I’ll then present my very own conclusions and make a name for the week forward. My calls might not at all times be right, however they are going to be primarily based on stable technical proof and made with out bias.

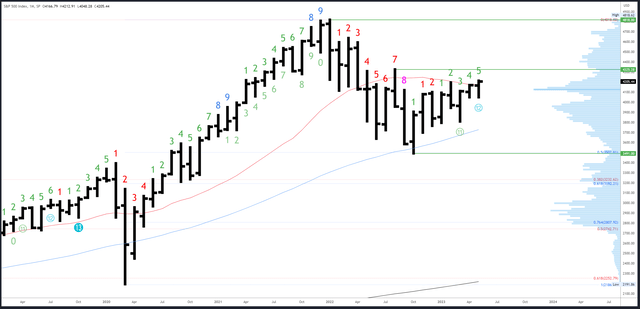

S&P 500 Month-to-month

With US markets closed on Monday for Memorial Day, there are solely 2 buying and selling days left in Might. Closing close to or above 4195 can be bullish and sign continuation.

Closing round 4170 would create a ‘doji’ bar and sign extra indecision – each larger and decrease costs (in comparison with April) had been examined in Might and each had been rejected to ultimately settle across the open. A doji forming after a brand new excessive is made has the potential to kind a reversal sign however the June bar would wish to comply with by beneath the 4048 low. Till this occurs, the bullish bias stays.

SPX Month-to-month (Tradingview)

Resistance is at 4212, then 4325 on the excessive of August.

Help is 4048-49.

An upside Demark exhaustion depend will probably be on bar 6 (of 9) in June.

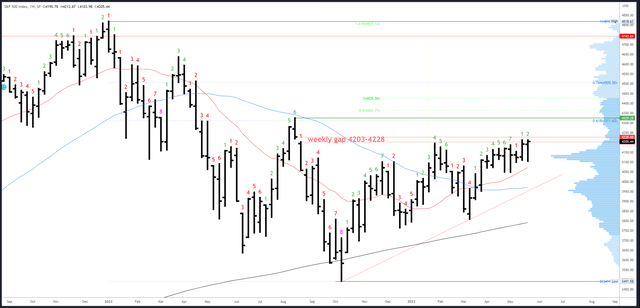

S&P 500 Weekly

The 4205 shut is the very best because the October ’22 backside. It’s extra bullish than the earlier week as not solely is the shut on the highs of the weekly vary, it’s above 4195 and the earlier resistance. Speedy comply with by appears probably.

SPX Weekly (Tradingview)

Hole fill at 4228 is minor resistance and solely prone to provoke a gentle response because of the sustained consolidation beneath the 4200 space.

The following main targets are the 61% Fib retrace of the 2022 bear market at 4311, with the August excessive of 4325 simply above.

4098-103 is first assist, then 4048.

The upside (Demark) exhaustion depend has reset and will probably be on bar 3 of 9 subsequent week.

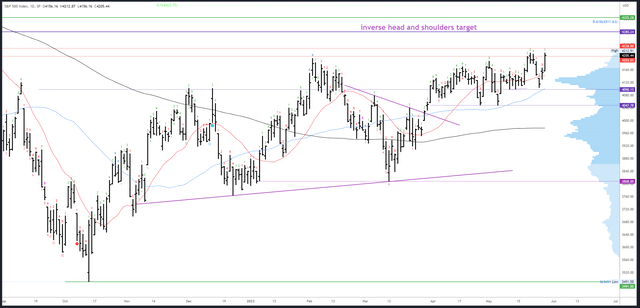

S&P 500 Each day

The bullish response from Wednesday’s 4103 tells us the flush decrease did its job and cleared the best way larger. Nevertheless, this week’s 4212.87 excessive was just under the 4212.91 excessive of the earlier week, and till this excessive is taken out, a second flush decrease is feasible (if not possible).

SPX Each day (Tradingview)

4130 is preliminary assist, then the plain 4098-103 and 4048.

Preliminary resistance is 4212-28.

An upside Demark exhaustion depend will probably be on bar 2 of 9 on Monday, so no exhaustion indicators are doable subsequent week.

Occasions Subsequent Week

US markets are closed on Monday for Memorial Day.

Debt ceiling negotiations will proceed as the primary driver. Assuming a deal will probably be reached subsequent week, the problem then will probably be how excessive the rally can get earlier than the inevitable ‘promote the information’.

US knowledge could be very mild till JOLTS Job Openings on Wednesday and NFP on Friday. The percentages of a June hike are at the moment 36% and will rise on a debt deal mixed with continued tightness within the job market. Yields proceed to rise throughout the curve and will begin to weigh as soon as the debt ceiling fiasco fades.

Possible Strikes Subsequent Week

Once more, continuation of the rally appears probably and the 4300 space stays the subsequent main goal. Now that there was a flush decrease, I do not anticipate one other one, and if 4212.91 might be exceeded, 4103 ought to maintain all dips till a high is reached.

As soon as 4300 goal has been reached, I’ll re-assess. 4363 is the subsequent potential goal, so 4300 isn’t essentially a spot to shut longs and go quick.

Within the very near-term, it isn’t but clear if the S&P500 can transfer instantly larger to 4300 or takes a extra roundabout means. Assuming a deal on the debt ceiling is struck earlier than Tuesday’s re-open and we see a niche larger, it may both be a continuation hole or a short-term exhaustion hole.

A continuation hole would wish to carry and consolidate the positive factors (the hole should not fill), and may then proceed to 4300 with solely minor dips.

An exhaustion hole would fade again in to hole fill at 4203 in a ‘promote the information’ transfer. It ought to then maintain the 4180s and rebuild for a second stage of the rally in the direction of 4300.

I can not predict which situation will unfold (and there are a lot of different prospects) however ready with a bias, targets and necessary ranges, the market ought to current alternatives.