Lemon_tm/iStock through Getty Photographs

It appears tough to foretell the place the market will transfer within the second half or over the course of the following 12 months, given the uncertainty surrounding the Fed’s pivot and the approaching recession. In such a situation, specializing in investments which have the potential to outperform in each bearish and bullish market circumstances could be prudent. One potential funding in a unstable surroundings is the Constancy Excessive Dividend ETF (NYSEARCA:FDVV). The ETF outperformed the S&P 500 throughout the bull market of 2021 and remained largely secure throughout the bear market of 2022. Even supposing the ETF has fallen a little bit greater than the general market index to date in 2023, it’s anticipated to get better over the following few months and looks like a dependable ETF to carry for the long run.

Why Is FDVV More likely to Carry out Nicely in Bull and Bear Markets?

FDVV Worth Change Since 2021 (Searching for Alpha)

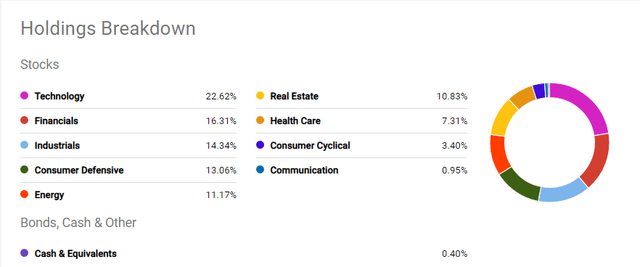

The important thing cause for FDVV’s skill to carry out properly in each bull and bear market circumstances is its well-diversified portfolio, which is closely weighted towards large-cap dividend shares. Furthermore, the mix of progress and worth shares allows FDVV to outperform in any market situation. The know-how sector, which has been the best-performing sector to date in 2023, accounts for roughly 20% of the general portfolio weightage. Certainly, large-cap shares resembling Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) are FDVV’s high three holdings, accounting for 15% of the overall weightage. If the present uptrend in tech shares extends the momentum and varieties a bull run within the second half, FDVV’s stakes in high-growth tech shares would assist the ETF to carry out properly within the bullish market situation.

FDVV Portfolio Breakdown (Searching for Alpha)

The monetary sector, which has been a laggard when it comes to value efficiency up to now, has the second-highest weightage in FDVV’s portfolio. It is also price noting that FDVV invests in large-cap monetary shares, with no publicity to struggling regional banks. JPMorgan Chase (JPM), Financial institution of America (BAC), and Wells Fargo (WFC) are amongst its high monetary sector inventory holdings. These three banks have benefited from greater rates of interest. For example, JPMorgan Chase reported a 24% enhance in income within the first quarter, whereas its earnings per share of $4.10 exceeded expectations by $0.69 per share. Equally, Financial institution of America’s earnings per share of $0.94 for the primary quarter exceeded the typical analyst estimate of $0.83, up from $0.85 within the fourth quarter of 2022 and $0.80 within the earlier 12 months.

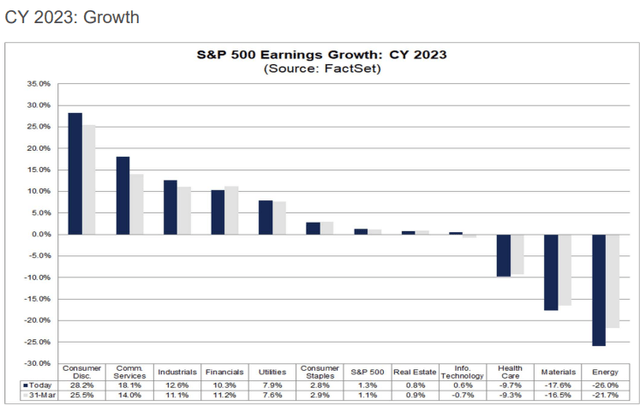

FY 2023 Earnings Projection (FactSet)

In response to FactSet information, the monetary sector is anticipated to be among the many finest performers when it comes to earnings progress in 2023 and 2024. The stress within the monetary sector is primarily brought on by regional banks, which aren’t a part of the FDVV’s portfolio and account for under a small portion of the overall monetary sector. Because of this, I anticipate the sector to get better within the coming quarters.

Industrial and client defensive sectors account for 14% and 13% of portfolio weightage, respectively. Giant-cap shares in these two much less capital-intensive sectors have a big amount of money to help progress actions. To this point in 2023, the S&P 500 industrial sector has not gained any floor, however fundamentals point out that earnings progress energy will assist shares get better within the coming quarters. Wall Road anticipates that the economic sector will submit double-digit share earnings progress in 2023, rating it third amongst S&P 500 sectors. The patron defensive sector, however, is usually adaptable to shifting financial circumstances. For example, Procter & Gamble (PG) skilled a 7% natural gross sales progress throughout the first quarter, and the corporate anticipates a 4% progress in full-year earnings per share. PepsiCo (PEP) expects 8% natural income progress and 9% earnings progress for your entire 12 months. Usually, it seems that FDVV’s well-diversified portfolio and publicity to the massive caps progress and worth class will proceed to assist in producing long-term sustainable returns.

The Dividend Issue

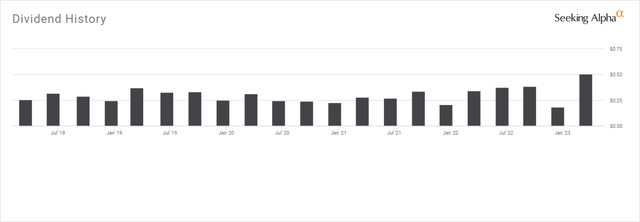

FDVV Dividend Historical past (Searching for Alpha)

The dividend issue is all the time necessary in rising whole returns and persuading traders to carry the inventory or ETF for an prolonged time period. Within the case of FDVV, the ETF provides an above-average dividend yield of round 3.8%, in comparison with 2.27% for all median ETFs. Its dividend payout elevated by 17.9% within the earlier 12 months, following a 6% enhance in 2021. Except for 2020, the ETF has a robust observe file of dividend will increase. It additionally seems to be able to make one other important dividend enhance in 2023. That is mirrored within the first-quarter dividend of $0.50 per share, the very best quarterly dividend in its historical past, and represents a big enhance from $0.33 per share within the earlier 12 months.

Giant-cap tech shares like Apple, Microsoft, and NVIDIA have loads of money on their stability sheets to maintain dividend progress going. Moreover, regardless of tough market circumstances, their monetary numbers proceed to develop. For instance, Microsoft, which has raised dividends for the previous 18 years, earned $2.45 per share within the March quarter, up from $2.22 per share within the earlier 12 months. Equally, Apple not too long ago introduced a 4.3% dividend enhance in addition to a large $90 billion inventory repurchase program. Moreover, as giant banks within the monetary sector proceed to generate sturdy earnings progress, there’s a excessive chance of great dividend will increase from them. Shopper defensive shares resembling PepsiCo and Coca-Cola (KO) have additionally elevated their dividends for 2023, whereas industrial firms are additionally poised to supply a strong dividend enhance given double-digit earnings progress expectations. General, there isn’t any danger to FDVV’s dividend progress in 2023.

Quant Scores

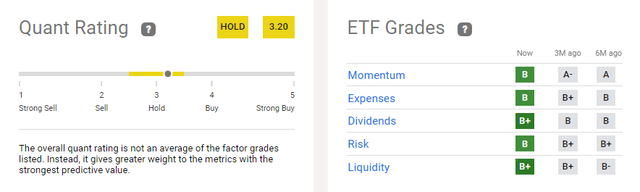

Quant scores (Searching for Alpha)

Constancy Excessive Dividend ETF fell simply wanting the purchase vary primarily based on SA’s quant rating of three.20. The maintain score is primarily as a result of a low momentum rating. Given the sturdy monetary efficiency of the vast majority of its holdings, I anticipate a rise in its momentum rating within the upcoming months. Along with momentum, the ETF scored B plus on liquidity, indicating sturdy inflows and rising buying and selling quantity. Moreover, a low-risk score and excessive dividend grade make it a great long-term funding.

In Conclusion

When it is unclear the place the market will go sooner or later, Constancy Excessive Dividend ETF looks like among the best ETFs to personal. It has the potential to carry out properly in each bullish and bearish market circumstances due to its well-diversified portfolio, which consists primarily of enormous caps. The excessive dividend yield and low expense ratio additionally make it a great ETF to carry for the long run.