TARIK KIZILKAYA

As I’ve written prior to now, the most effective issues about writing on In search of Alpha is having the ability to lookup previous articles and see how our suggestions turned out. Nobody will get it proper on a regular basis, and I am no completely different. However, let’s depend solely the winners, okay? I wrote this article on Mastercard Included’s (NYSE:MA) dividend development potential again in 2013 simply when the corporate had introduced a large and third consecutive dividend enhance whereas additionally asserting a ten:1 inventory break up. And boy has the inventory delivered since then in each capital and dividend returns. Please observe, though the inventory has carried out magnificently over time and earnings are anticipated to proceed rising, the main focus of this text might be on its dividend development.

Through the years, I’ve drifted away from each writing about and proudly owning Mastercard inventory. That is partly as a consequence of by no means seeing the inventory on sale for lengthy, however principally as a consequence of the truth that I’ve held shares in American Specific, Inc. (AXP) for a very long time and been pretty happy with the returns. I strive my greatest to not personal two very comparable shares. For instance, though I’ve admired PepsiCo, Inc. (PEP) as an organization and inventory, I made a wager on The Coca-Cola Firm (KO) as a substitute and caught with it for many years.

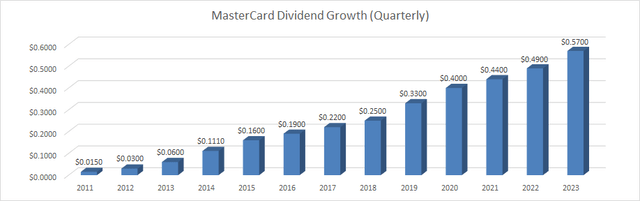

Anyway, again to the purpose, in direction of the top of 2022, Mastercard introduced its eleventh consecutive annual dividend enhance. How has Mastercard carried out with regards to dividend development since my protection nearly 10 years in the past? Let’s discover out.

In brief, the dividend has grown by a ridiculous issue of 38 since 2011 and greater than 5 folds since my 2013 article. In January 2011, Mastercard inventory was buying and selling at about $22 whereas paying an annual dividend of 6 cents per share, which labored out to a paltry yield of about 0.30%. Quick-forward 12 years, Mastercard is now paying an annual dividend of $2.28/share whereas the inventory is buying and selling at about $375, which works out to a present yield of 0.60%. However the yield on price for somebody who purchased in 2011 at $22 has reached an astonishing 10.36%. Huh, you suppose?

Mastercard DG (Compiled by creator, with knowledge from In search of Alpha)

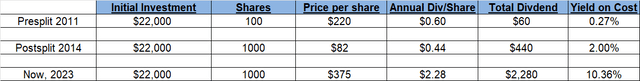

If that math appeared a bit sophisticated, don’t be concerned. The desk under goals to simplify it.

The primary row: For instance somebody purchased 100 shares of Mastercard in 2011 earlier than the corporate introduced its first dividend enhance in 2012. The inventory was buying and selling at round $220 again then (pre-split) and that meant an preliminary funding of $22,000 for an preliminary yield of 0.27%. The second row: It’s now 2014. Mastercard’s inventory value has gone up nearly 4 folds to $820 and the annual dividend has reached $4.40/share due to beneficiant dividend will increase. Mastercard then broadcasts a ten:1 inventory break up. By this time, the yield on price had grown to a extra respectable 2%. The third row: That is the actual now, Could 2023. Mastercard’s inventory value has greater than quadrupled since 2014 and the dividend has grown greater than 5 folds. The yield on price for that preliminary funding of $22,000 has now grown to 10.36% though the present yield on the inventory is a measly 0.60%.

Mastercard Yield on Price (Writer)

Okay, the dividend has certainly grown impressively, however how robust is the dividend protection? What if the corporate has been paying greater than it will possibly afford simply to maintain the dividend development intact? Let’s discover out.

Frequent readers of my article know I favor utilizing Free Money Movement (“FCF”) over Earnings Per Share (“EPS”) as FCF represents an organization’s uncooked capability to generate money from its day-to-day enterprise.

Shares excellent: 947.63 million. Quarterly dividend per share: 57 cents. FCF wanted to cowl quarterly dividends: $540 million (947.63 million shares instances 57 cents). Mastercard’s common quarterly FCF over the past 5 years: $1.955 billion. Payout ratio utilizing quarterly FCF metric: 27.62% (540 million divided by $1.955 billion). So robust is Mastercard’s FCF that even the bottom quarterly FCF within the final 5 years (March 2019) at $1.17 billion covers the present dividend dedication a minimum of two instances over. Even within the disastrous COVID 12 months of 2020 when many corporations noticed miserable FCF, Mastercard generated a mean quarterly FCF of 1.63 billion. Lastly, primarily based on ahead EPS estimate of $12.28, Mastercard has a payout ratio of 18.50% ($2.28 annual dividend per share divided by $12.28).

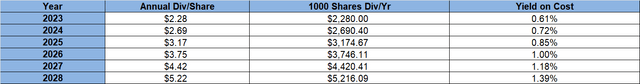

What about future returns?

I do not suppose Mastercard can match its previous 10 years by way of returns from each capital and dividend views. Nevertheless, given the present 5-year common dividend development price of 18%, it’s not exhausting to see them preserve the identical for the subsequent 5 years too, particularly given the room they appear to have as established above. The yield on price as soon as once more greater than doubles in a 5-year time span.

Mastercard Extrapolation (Writer)

Mastercard additionally continues lowering its shares depend step by step, because the shares excellent has gone down practically 10% within the final 5 years.

Conclusion

I’ve at all times used Yield on Price as one of many hindsight metrics to guage my investments. Some say, “YoC is nothing however patting your self on the again, and it gives nothing forward-looking”. That could be proper, quantitatively talking, however qualitative features (historical past) ought to imply one thing as nicely. Betting on a profitable inventory once more just isn’t a nasty concept. And on this case, Mastercard has the quantitative components in its favor as nicely.

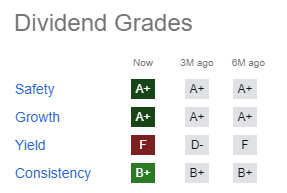

It’s no shock that In search of Alpha’s quant ranking provides Mastercard glowing grades on Dividend Security, Dividend Development, and Consistency whereas ranking the yield an F. The yield is an F undoubtedly if you happen to look solely on the present yield, however the dividend development has been so highly effective to this point and nonetheless has huge room for enchancment that the present yield doesn’t matter as a lot as the opposite three components on this case.

Don’t be your personal enemy and switch down completely nice long-term dividend development shares simply because the present yield is low. And I didn’t even get into the capital appreciation potential of high quality corporations like Mastercard. That is for an additional day, one other time. Adios.

Mastercard Dividend Grade (Seekingalpha.com)