Kevin Frayer

Introduction

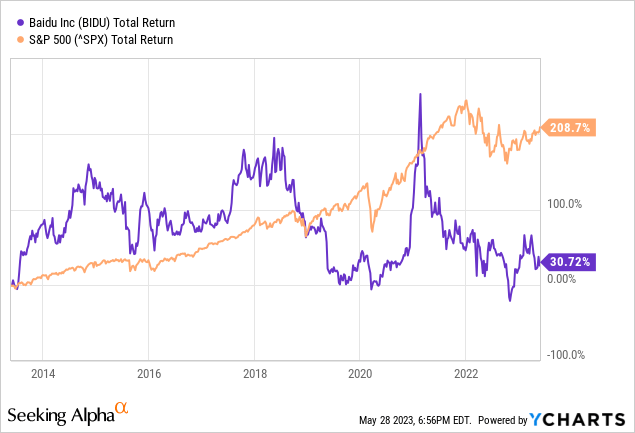

Baidu (NASDAQ:BIDU) is without doubt one of the firms I invested in between 2018 and 2019. On the time, Baidu skilled difficulties as a result of the well being advertisements Baidu displayed typically had disagreeable penalties. For instance, a pupil died after an experimental most cancers remedy he discovered via Baidu’s search engine. Baidu due to this fact needed to clear up their in-search well being advertisements and the paid search advertisements had been not allowed to be based mostly on the best bidder. These measures made for a safer Web, however Baidu’s robust progress stalled.

On the time, I noticed it as a shopping for alternative due to the sharply falling share worth. The share worth continued to fall in 2019 with lagging earnings progress. “Useless cash” I believed, after which I offered my funding. Moments later, the inventory accelerated to greater ranges. Now we see the value correction and it’s quoted on the similar worth stage as in 2019. It has been a wild trip.

Baidu is attention-grabbing due to 2 robust progress catalysts: Apollo Go and Ernie. Nonetheless, Baidu wants important innovation to develop into a market chief. The attractively valued inventory worth is adjusted for this threat and due to this fact Baidu is buyable for the long run.

Apollo Go

Baidu isn’t just a search engine but in addition presents Degree 4 self-driving autonomous automobiles known as Apollo. Baidu combines cameras, radar and lidar in order that their automobiles have good visibility in low visibility circumstances. This contributes to the protection of bystanders.

With Apollo Go, Baidu is introducing absolutely driverless robotaxis in a number of cities in China. Baidu is at present the one firm in China licensed to function a driverless taxi service in Beijing, Wuhan and Chongqing. Initially of 2023, about 100 absolutely driverless taxis are working in Wuhan and greater than 2 million rides have been provided. Throughout peak hours, every automobile receives about 20 orders per day in an working space of greater than 530 sq. kilometers.

In Q1 2023, Apollo Go delivered roughly 660k rides, up a whopping 236% YoY and 18% quarter on quarter. Customers are very glad, giving the Apollo Go app 4.9 out of 5 stars, with greater than 94% of customers giving 5 stars.

Baidu desires to create the most important absolutely driverless taxi space on the planet. I see this as a powerful progress catalyst and analysts count on the autonomous automobile market to develop at a CAGR of 12.1%.

Apollo’s robust progress suggests nice success. Moreover their robust progress numbers, I am left with some questions. I am questioning if these are one-offs or if individuals are simply attempting out the taxi service to see in the event that they prefer it. I additionally surprise if Apollo is providing these rides at a closely discounted price, and what the return on funding might be. These questions stay unanswered for now, which is why I’m considerably skeptical about progress charges for the approaching quarters. I see Apollo Go as a powerful progress catalyst, however the progress has to proceed within the coming quarters. There may also must be a transparent image of the return on funding.

Ernie Bot

The introduction of ChatGPT and Alphabet’s Bark additionally led Baidu to introduce a chatbot pushed by synthetic intelligence known as Ernie Bot. Ernie considerations Baidu’s 2nd robust progress catalyst and might be a great various to ChatGPT-based chatbots.

Ernie may help write books, provide you with an organization identify, clear up math issues, outline a conventional Chinese language idiom and write a poem, and assist generate multi-modals.

Throughout the announcement, buyers weren’t thrilled with the way in which Baidu introduced Ernie. Baidu opted for a protracted presentation with predetermined solutions as an alternative of a dwell demo of Ernie, after which the inventory fell sharply.

Ernie Bot is just not as dangerous as buyers count on. Evaluating Ernie to ChatGPT, we see that ChatGPT wins on textual content material, however Ernie presents the flexibility to attract footage, which ChatGPT doesn’t. Ernie typically struggles to grasp Chinese language context, and the chatbot can also be restricted in politically delicate content material. The place Ernie additionally lags is in mathematical calculations. When requested a query in regards to the month-to-month fee for getting a home with a mortgage, Ernie got here up with an incorrect end result, whereas ChatGPT confirmed the precise end result.

ChatGPT clearly has extra capabilities than Ernie. Each AI chatbots are evolving and studying to higher interpret human enter. AI chatbots are going to make our lives considerably simpler, however for now it’s too early to completely incorporate them into our lives. For the long run, I see large progress potential as a result of individuals can outsource many primary duties to the chatbots. Statista expects unprecedented progress of chatbots within the coming years. Nonetheless, Baidu will nonetheless have to speculate quite a bit to make Ernie a full-fledged AI chatbot.

First Quarter Earnings Beat Analyst’ Estimates

Along with having 2 robust progress initiatives, Baidu Core is sort of worthwhile by itself. First-quarter figures beat analysts’ estimates of income and revenue as firms had extra to spend on promoting. First-quarter income was 31.1 billion yuan (+10% year-on-year), and adjusted earnings per share 16.1 yuan (+43% year-on-year). In greenback phrases, income rose 1% and adjusted earnings per share rose to $2.31 (+38.3%), whereas analysts had anticipated income of 29.97 billion yuan.

Baidu Core revenues (together with search-based promoting gross sales, cloud choices and autonomous driving initiatives) rose 8% to 23 billion yuan. Month-to-month lively customers of Baidu App elevated 4% to 657 million. On-line advertising income rose 6% and income from Baidu’s streaming service iQIYI (IQ) elevated 15% year-on-year. iQIYI’s common day by day subscribers had been up 27.7% year-on-year and 15.2% quarter-on-quarter. And as talked about earlier, Apollo Go delivered 660k rides in Q1 2023 (up 236% year-on-year). Additionally, good show and good audio system from Xiaodu ranked #1 in shipments. Baidu is flourishing throughout all of its operational divisions.

Valuation

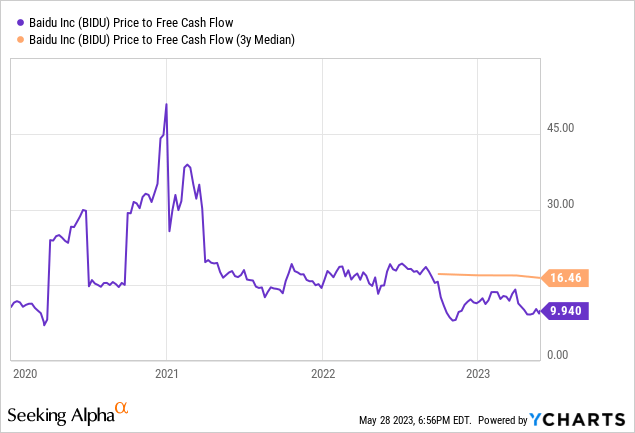

Subsequent, we check out the inventory valuation. It’s tough to color an image of inventory valuation based mostly on the GAAP PE ratio as a result of it has different broadly over the previous 5 years. YCharts can solely show the GAAP PE ratio as an alternative of the non-GAAP PE ratio. Due to this fact, I selected to show the value to free money circulation ratio. We see that the value to free money circulation ratio is simply 9.9, which represents a reduction of greater than 40% from the 3-year common. The inventory is clearly undervalued based mostly on this ratio.

Baidu’s progress charges and progress potential are superb. Nonetheless, I’ve a wholesome skepticism in regards to the progress prospects of each initiatives. The inventory appears undervalued, so the shares have already corrected for this skeptical view. Ought to progress proceed then buyers can take pleasure in great returns.

About 28 analysts are optimistic, projecting a 15% improve in adjusted earnings per share for this 12 months. Forecasts additionally name for progress within the low to mid double digits over the subsequent few years. So buyers can count on a pleasant return, offered Baidu can meet its progress expectations. The initiatives of Apollo Go and Ernie will present a progress spurt, however I’m uncertain of their potential profitability. What we do know is that innovation is in Baidu’s blood. And that makes Baidu resilient for the long run.