Prapat Aowsakorn/iStock through Getty Pictures

Funding Thesis

Provider World (NYSE:CARR) is making strikes recently, because it acquired Viessmann’s local weather options and deliberate to divest two of its present divisions. I consider this strengthens the corporate’s prospects as they at the moment are much more targeted on HVAC and sustainability, which preset large progress alternatives. As demonstrated within the newest earnings, HVAC continues to point out excellent progress, with income up double digits. I actually the route the corporate is taking, and I consider these modifications ought to enhance its long-term progress.

Progress Drivers

Provider World is a world chief in HVAC (heating, air flow, and air-con), Refrigeration, and Fireplace & Safety merchandise. The corporate operates in over 160 international locations, with blue-chip industrial clients resembling Pfizer (PFE) and BP (BP). HVAC at the moment accounts for 68% of complete gross sales, and the section ought to proceed to be the corporate’s main progress driver.

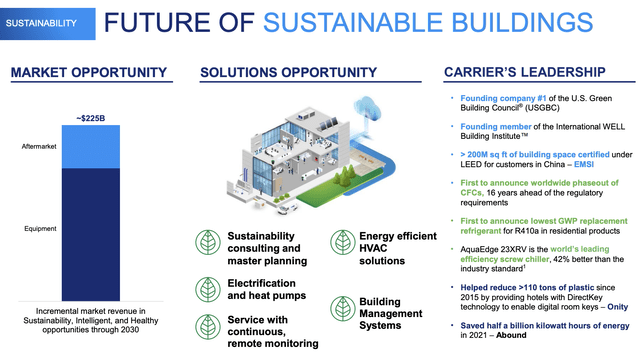

Sustainability is a significant tailwind for the HVAC market, as international locations proceed to emphasise the significance of energy-efficient merchandise. In accordance with the corporate, its TAM (complete addressable market) for sustainability is estimated to be $225 billion. As an example, the federal government established a brand new normal final yr that raised the minimal required effectivity for HVAC merchandise, which ought to speed up the alternative of older merchandise. They’re additionally contemplating providing incentives for extra energy-efficient merchandise, which must also additional the quantity of the corporate’s newer merchandise.

Aftermarket can also be an vital a part of the corporate’s progress. As the corporate’s put in base continues to develop, the necessity for upgrades, repairs, and modifications additionally will increase. It is usually introducing extra value-added companies resembling digital options, which ought to additional drive progress. The corporate expects aftermarket gross sales to succeed in over $7 billion in 2026.

Provider World

Doubling Down On Sustainability

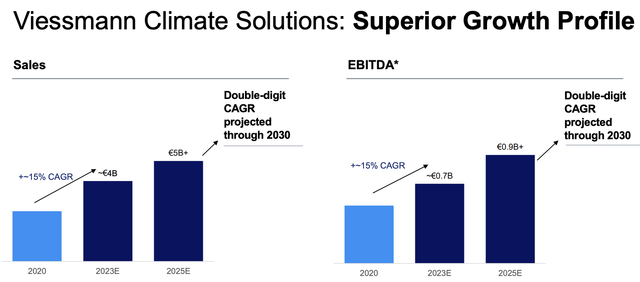

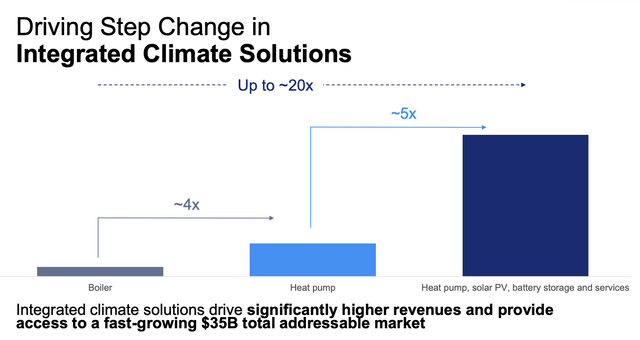

Provider World has additionally doubled down on sustainability via the latest $13.2 billion acquisition of Viessmann’s local weather options and the deliberate divestment of its industrial refrigeration and fireplace & safety unit. Viessmann’s portfolio primarily consists of premier warmth pumps, digitally enabled companies, photo voltaic photovoltaic, and battery choices. The acquisition is sort of expensive at 13x FY23 adjusted EBITDA, however I consider it ought to be accretive in the long term.

Not like Provider which is estimated to develop income at a CAGR (compounded annual progress fee) of 6% to eight%, Viessmann’s local weather answer section is forecasted to put up a double-digit CAGR via 2030, which ought to carry the corporate’s general progress. Whereas the corporate must difficulty €7 billion in further debt, its post-transaction web debt to EBITDA ratio of three.5x continues to be very cheap (administration expects the ratio to say no to 2x by 2025).

Provider World

After the acquisition, the corporate may have a way more expanded local weather and power portfolio with a a lot stronger presence in Europe, particularly in Germany and Italy. The continuing power transition in Europe ought to current important progress alternatives for Provider.

Because of the rising emphasis on power efficiencies, the corporate expects the put in base for air-to-water warmth pumps to develop from 8.5 million in 2022 to 40 million in 2030, representing a robust CAGR of 25%. In accordance with the administration group, its growth into the residential battery and photo voltaic PV market additionally additional improve its TAM by $35 billion. The acquisition is a daring transfer, however I consider it ought to yield nice returns shifting ahead.

David Gitlin, CEO, on photo voltaic PV and residential battery

Provider doesn’t supply photo voltaic PV and residential battery options right this moment. So Viessmann Local weather Options’ providing supplies Provider the proper alternative to pursue an incremental fast-growing annual TAM of $35 billion.

Provider World

Valuation

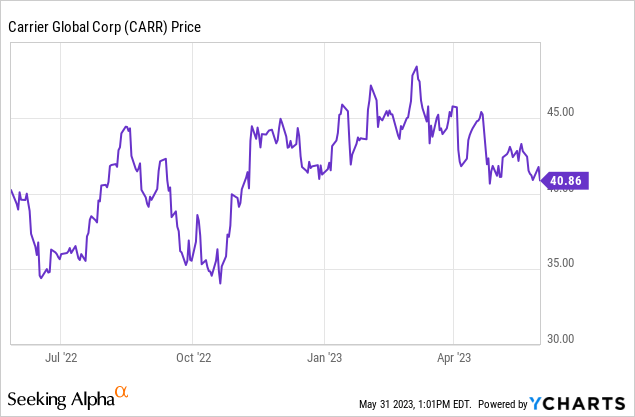

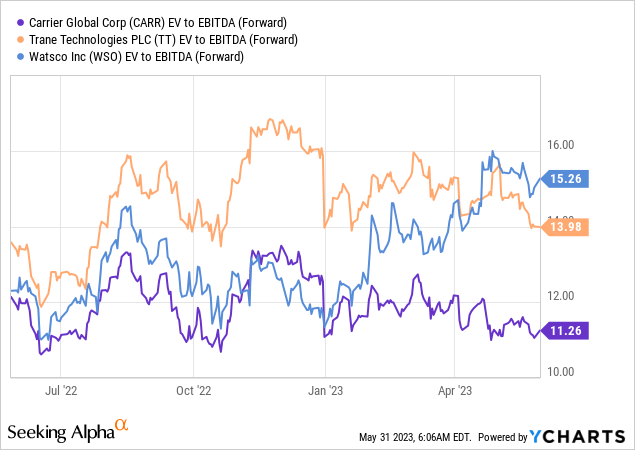

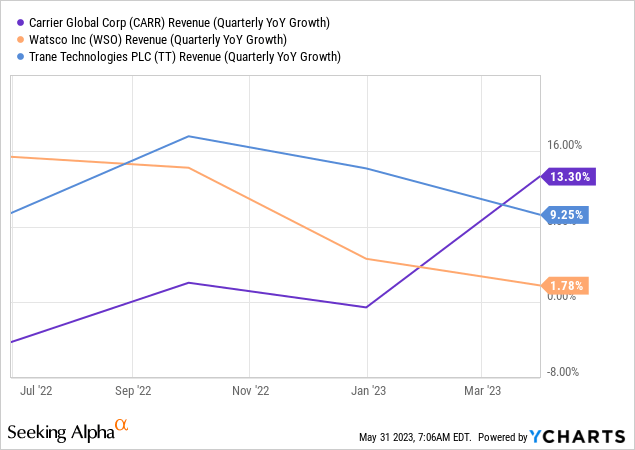

Provider World is at the moment buying and selling at a fwd EV/EBITDA ratio of 11.3x, which is sort of compelling for my part (I’m utilizing the EV/EBITDA ratio because it takes the debt load into consideration). Over the previous yr, the corporate’s valuation has diverted with different HVAC corporations resembling Trane Applied sciences (TT) and Watsco (WSO), as proven within the first chart under. They’re at the moment buying and selling at a fwd EV/EBITDA ratio of 14x and 15.3x, which characterize a significant premium of 23.9% and 35.4% respectively.

The valuation hole appears exaggerated contemplating the corporate’s strong efficiency. As proven within the second chart under, the corporate’s income progress of 13.3% is definitely greater than each friends’. The latest acquisition could also be weighing on the valuation, because the market is usually skeptical about large-sized offers. As talked about above, I stay optimistic in regards to the firm and its valuation ought to revert greater because the market proceed to digest the deal.

Buyers Takeaway

The latest modifications considerably sharpen Provider World’s give attention to HVAC and sustainability. I consider that is the correct transfer as HVAC continues to point out excellent momentum, with income up 22% within the newest quarter. It additionally removes the underperforming fireplace & safety and refrigeration segments, which grew 6% and declined 8% respectively.

The acquisition ought to be helpful for long-term progress as sustainability has been an rising pattern that’s driving the demand for extra environment friendly HVAC programs, warmth pumps, and many others. The acquisition additionally considerably diversifies the corporate’s geographical presence. The debt they took on ought to be manageable contemplating their steady income and robust profitability. Whereas fundamentals improved, the corporate’s valuation has remained compressed, with multiples meaningfully under friends. I consider its strong progress prospects and the discounted valuation presents a compelling investing alternative, subsequently I fee the corporate as a purchase.