David Becker

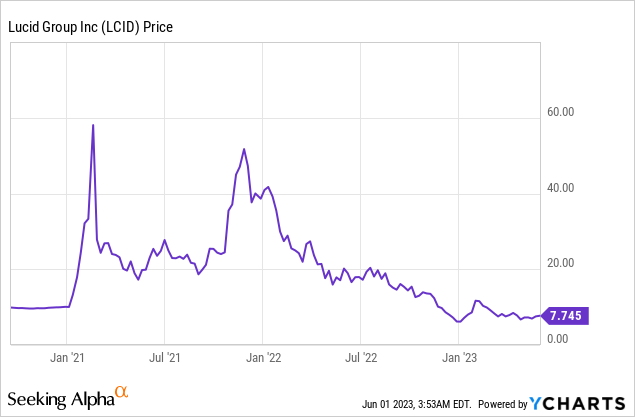

Lucid Group (NASDAQ:LCID) has suffered a cloth decline in its share worth since reaching a excessive north of $60 in 2021. The market has grown more and more involved with the EV maker’s ramp of its first-ever manufacturing automotive in current months… which partially pertains to Lucid decreasing its manufacturing forecast thrice (twice in FY 2022 and as soon as up to now in FY 2023). On Wednesday, Lucid introduced that it was doing one other inventory sale with a purpose to finance the ramp of the Lucid Air and Saudi Arabia’s sovereign wealth fund is buying extra shares within the EV start-up. The dimensions of Lucid’s fairness providing ($3B), nevertheless, could be very giant and poses a menace to the corporate’s valuation within the quick time period!

Saudi Arabia strikes once more: A brand new inventory sale within the quantity of $3B

Lucid introduced on Could 31, 2023 that it was conducting one other fairness providing, this time within the quantity of $3B, with shares being bought to the general public in addition to Saudi Arabia’s sovereign wealth fund, the Public Funding Fund.

Lucid stated that it was pricing 173,544,948 shares of its widespread inventory to the general public in its newest inventory providing which is anticipated to lead to gross proceeds of $1.2B. Concurrently, Lucid stated that it entered into an settlement with an affiliate of Saudi Arabia’s Public Funding Fund, Ayar Third Funding Firm, which states that PIF will purchase 265,693,703 shares of widespread inventory from Lucid in a non-public placement for complete proceeds of $1.8B.

Ayar Third Funding Firm owns roughly 60% of Lucid and has participated in Lucid’s inventory gross sales earlier than. The $1.8B funding additionally represents roughly 60% of Lucid’s complete fairness providing so the Public Funding Fund sticks to its 60% funding in Lucid (maintains proportional possession). Saudi Arabia is just not solely an investor within the electrical automobile start-up, nevertheless, but in addition signed an settlement that lays out phrases for the supply of as much as 100 thousand electrical automobiles over a ten-year interval (the settlement between Lucid and Saudi Arabia included a 50 thousand preliminary EV buy dedication plus the choice for the supply of one other 50 thousand EVs).

Lucid has stated that proceeds of the inventory providing are going for use for capital expenditures and dealing capital and Saudi Arabia will proceed to finance the ramp of the EV maker’s manufacturing ramp which in earlier quarters disenchanted.

Nonetheless, Lucid is just not underneath any critical stress to boost liquidity, versus different EV producers like Lordstown (RIDE). Lucid has an especially strong stability sheet for a start-up and had $3.4B in money obtainable (+$700M in further credit score amenities) on the finish of the first-quarter.

Lucid’s capital elevate is just not a small one: The EV maker at present has a market cap of $14.2B, which means the $3.0B anticipated to be raised signify roughly 21% of the agency’s market worth.

The occasion of a capital providing is often a unfavorable catalyst for an organization’s share worth as a result of current shareholders are getting diluted as extra shares get issued… which is the rationale why Lucid‘s shares dropped 5% after the fairness providing was introduced yesterday.

Lengthy-term potential within the EV business

Lucid did not precisely hit the bottom operating with the discharge of its Lucid Air electrical automobile. The ramp of the agency’s Lucid Air mannequin was marked by manufacturing setbacks and disappointments which were mirrored in a big decline within the firm’s share worth.

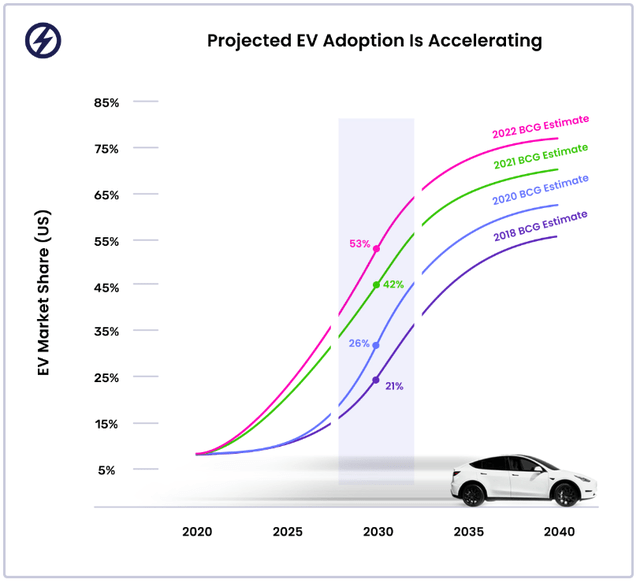

Nonetheless, Lucid continues to be a comparatively younger start-up within the aggressive EV area and, with EV adoption anticipated to rise strongly within the coming years as corporations launch extra merchandise with bigger ranges and at extra enticing worth factors. Adoption of EVs is accelerating and, based on projections by Boston Consulting Group, electrical automobiles are anticipated to attain a greater than 50% market share by 2030.

Supply: www.recurrentauto.com

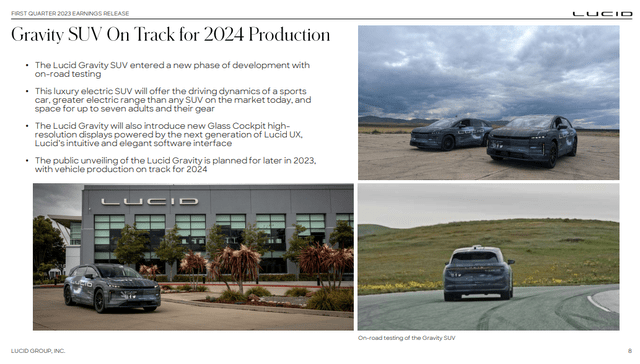

Lucid ought to due to this fact be seen as a long run guess on the EV market and never simply as a rebound play associated to the newest inventory providing. Lucid is investing closely into its manufacturing capability (in Arizona and Saudi Arabia) and is ready to launch a brand new EV product subsequent 12 months, the Gravity SUV… which can open up a brand new market section for Lucid as properly.

Supply: Lucid

Lucid’s premium valuation

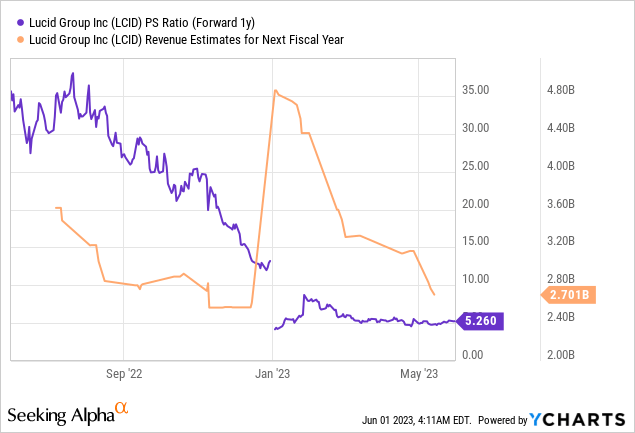

Regardless of a big decline within the firm’s market cap and valuation issue since 2021, Lucid continues to be extremely valued primarily based off of revenues… which is partially as a result of raving opinions the agency’s first-ever manufacturing automotive, the Lucid Air, has acquired in addition to to Lucid’s appreciable capital energy. Lucid has probably the greatest stability sheets within the EV sector, largely as a result of it has been backed by Saudi Arabia’s sovereign wealth fund.

Lucid is at present valued at a P/S ratio of 5.3X… which is considerably under the valuation ranges of 2021 and 2022. Within the quick time period, Lucid may see a fair decrease valuation, I imagine, as buyers have affordable issues concerning the agency’s manufacturing ramp. The fairness providing itself may proceed to weigh on Lucid’s valuation issue.

Dangers with Lucid

The 2 largest industrial dangers for Lucid are: (1) Slowing demand for its electrical automobiles because the line-up of EV merchandise within the market grows, and (2) A possible steerage down-grade for FY 2023 if the EV maker fails to ramp up manufacturing for its first-ever manufacturing automotive. Lucid has up to now revised its manufacturing forecast down thrice (twice in FY 2022 and as soon as in FY 2023) and now expects about “10 thousand or extra” produced EVs this 12 months. The capital providing, and the dilution that tends to return with it, are additionally headwinds for Lucid’s shares, however solely within the quick time period, for my part.

Ultimate ideas

Saudi Arabia is Lucid’s anchor investor and the sovereign wealth fund retains investing a substantial sum of money into the EV start-up which ought to be seen as a vote of confidence. Contemplating that Lucid’s share worth and market cap have declined significantly within the final two years, it’s comforting to see that Lucid’s anchor investor continues to take part in inventory gross sales on a proportional foundation (PIF is sustaining its ~60% possession stake in Lucid). Lucid additionally has a really robust stability sheet and has, from a liquidity perspective, the least ramp up dangers of any EV producer, maybe except for Rivian Automotive. Whereas quick time period headwinds exist when it comes to inventory dilution and manufacturing progress, it’s also true that Saudi Arabia retains investing into Lucid regardless of important valuation declines and EV adoption within the U.S. is accelerating!