Joe Raedle/Getty Pictures Information

Introduction

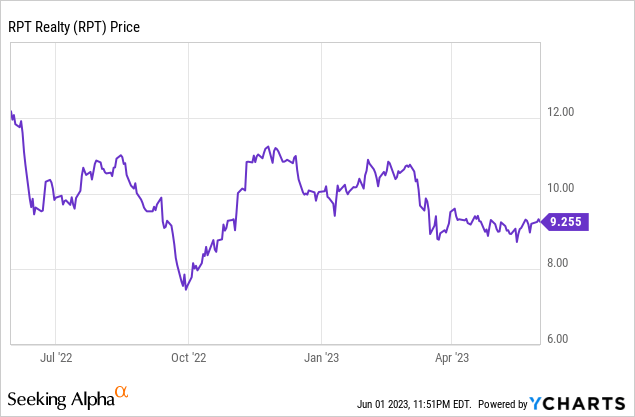

I initially began the popular shares of RPT Realty (NYSE:RPT) in the summertime of 2021 once they have been buying and selling above par. As these most popular shares (buying and selling with (NYSE:RPT.PD) as their ticker image) can’t be known as, the yield was fairly good again within the day at round 6.4% (as the popular shares did not have a name function, you merely couldn’t calculate a ‘yield to name’). As rates of interest on the monetary markets began to extend, the worth of the popular shares began to maneuver all the way down to replicate the impression of a better rate of interest atmosphere. In September final 12 months, the popular shares have been buying and selling just under the principal worth of $50 leading to a yield of seven.5%. Proper now, on the present share worth of $46.75, the yield has elevated to 7.75%. As three quarters have now handed since my earlier write-up, I assumed this was a superb second to catch as much as see if I ought to add to my comparatively small place.

The Q1 outcomes point out the popular dividends get pleasure from wonderful protection

This text is supposed as an replace to my thesis. For a greater understanding of the REIT’s focus and enterprise mannequin, I might prefer to refer you to the 2 older articles, which you could find right here. Moreover, fellow writer Weighing Machine just lately printed a superb overview of RPT’s efficiency, so if you’re fascinated about trying on the frequent items, it is best to positively learn his article.

As it’s possible you’ll know from earlier articles, after I take a look at a most popular share difficulty, I choose them based mostly on two standards: the dividend protection stage and the asset protection stage.

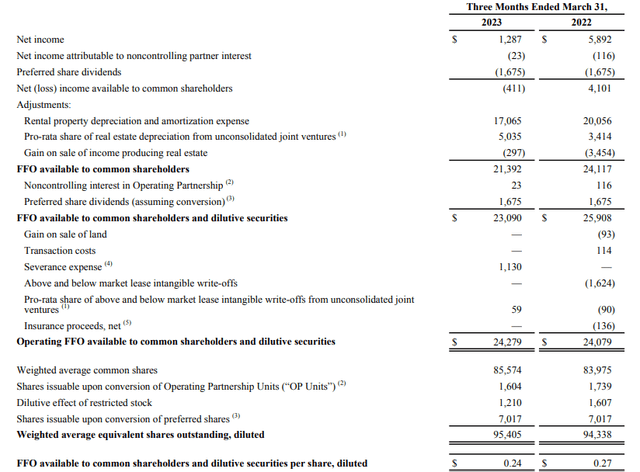

The FFO and AFFO ends in the REIT house are an important ‘earnings metrics’. The reported internet revenue is irrelevant as a result of it consists of the depreciation of the true property property. The picture under exhibits the FFO calculation and the Working FFO calculation, which is available in at $23.1M and $24.3M respectively. In accordance with the REIT, the entire FFO out there to frequent shareholders, together with the impression of dilutive securities, is $0.24 per share.

RPT Realty Investor Relations

This consists of the impression of the potential conversion of the popular shares into frequent items, which might add about 7.02M items to the entire. I might prefer to argue that there are two components that warrant a more in-depth look. To start with, an investor in the popular shares normally invests for the safer dividend funds as most popular distributions clearly rank senior to the distributions on the frequent items. Due to this fact, whereas theoretically potential, it is extremely unlikely all most popular shares can be transformed to frequent items.

Secondly, ought to that occur, there technically additionally will not be a most popular dividend payable anymore. So slightly than utilizing the $0.24 which is predicated on the $23.1M FFO and the 95.4M items excellent, one ought to truly add the popular dividends to the equation once more. In any case, I the dilutive impact of a further 7.02M shares takes place, there are not any extra most popular dividends to be paid out as there can be no most popular shares excellent. That may improve the FFO out there to frequent shareholders to $0.26 and the working FFO out there to frequent shareholders to $0.27.

Nevertheless, that’s not what this text is about. By evaluating the popular dividends of $1.675M to the $24.3M in underlying (working) FFO, the FFO earlier than making these most popular dividend funds is roughly $25.9M. Which implies RPT solely wants about 6.5% of its underlying FFO to cowl the popular dividends. In different phrases, the popular dividend protection ratio exceeds 1,500% and that is a superb place to be in, as a most popular shareholder. RPT Realty clearly passes the popular dividend protection ratio check.

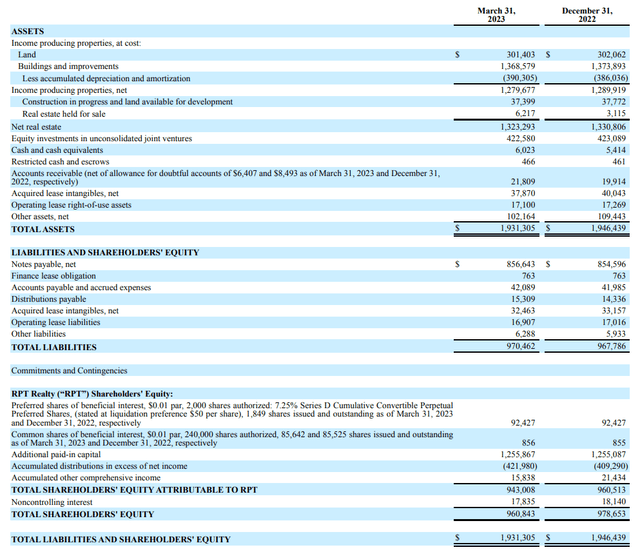

Shifting over to the asset protection stage ratio, we see the steadiness sheet of RPT Realty comprises about $943M in fairness, with about $92.5M of the entire fairness consisting of most popular fairness. This implies there’s about $850M in fairness rating junior to the popular fairness. Or in different phrases, the entire quantity of fairness attributable to the RPT shareholders represents about 10 occasions the entire most popular fairness. That once more is a superb a number of.

RPT Realty Investor Relations

On the picture above, you additionally see the entire ebook worth of the true property property of about $1.28B already consists of virtually $400M in depreciation bills. Regardless of the rising rates of interest on the monetary markets, the market worth of the true property property is probably going larger than the ebook worth which suggests there’s a further (hidden) layer of worth offering a further cushion to the popular shares.

RPT Realty Investor Relations

As a reminder: The popular shares have a 7.25% most popular dividend yield, leading to a quarterly most popular dividend of $0.90625 (for a complete most popular dividend of $3.625/12 months). An fascinating function is that there is no name provision included in these most popular shares: RPT Realty can’t name these securities, however homeowners of most popular shares are in a position and allowed to transform them into frequent items at a conversion worth of $13.17 per share as every most popular share entitles the proprietor to transform it into 3.7962 frequent items.

Funding thesis

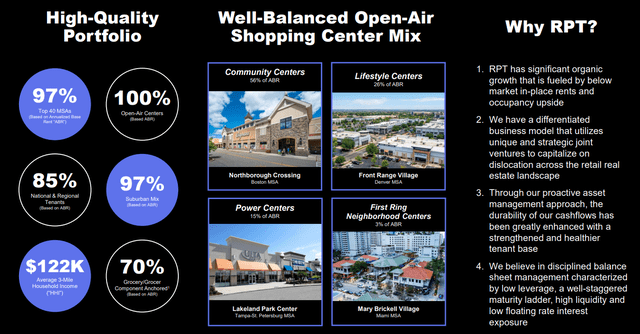

I hoped the popular shares of RPT Realty would drop under $45 however it would not appear to be that may occur anytime quickly because the market appears to comprehend the popular dividend protection ratio and the asset protection ratios are sturdy. The popular shares are presently yielding roughly 7.75% and I feel the chance/reward ratio of the popular shares is superb. That being stated, I am additionally warming up in direction of going lengthy on the frequent items as RPT’s frequent items are presently buying and selling at simply 9 occasions the anticipated FFO. And as Weighing Machine talked about in his article, this means the capitalization fee of the property is simply 9.2%, and that is too low for a REIT specializing in grocery shops as anchor tenants.