Anna Richard/iStock through Getty Photographs

Introduction

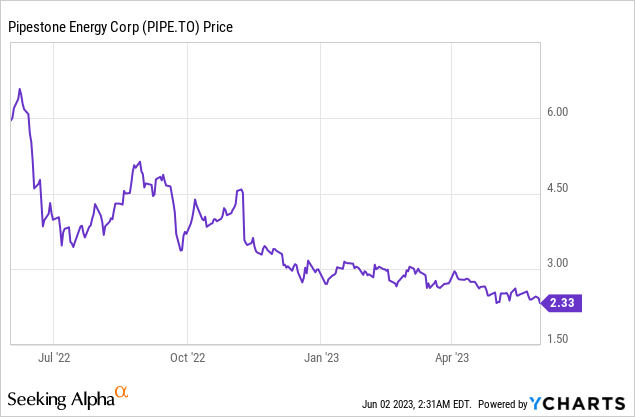

I’ve been maintaining a tally of Pipestone Vitality (TSX:PIPE:CA) (OTCPK:BKBEF) for some time now, however sadly the low pure gasoline worth in Canada (which has dropped under the C$3 I used in my earlier article) has undoubtedly held the share worth again. Q2 will seemingly be very smooth in addition to the corporate needed to scale back its manufacturing fee by greater than 50% for about two weeks, so the decrease manufacturing fee together with a decrease pure gasoline and condensate worth signifies Q2 will seemingly be very smooth. I will be affected person however I clearly additionally wish to preserve a finger on the heart beat.

As this text is supposed as an replace on older articles, I might prefer to refer you to these articles to get a greater understanding of Pipestone’s enterprise and its publicity to the pure gasoline and condensate costs.

The Q1 outcomes have been very first rate

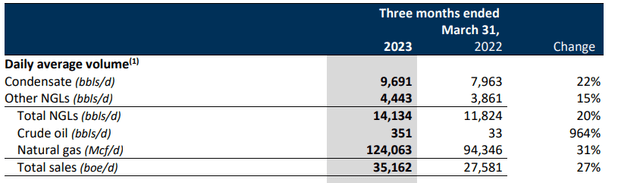

Through the first quarter of the present monetary yr, Pipestone produced a mean of 35,200 barrels of oil-equivalent per day. Roughly 14,100 barrels of oil-equivalent per day got here from the manufacturing of NGLs the place the condensate manufacturing performed an vital position. The rest of the oil-equivalent manufacturing fee (about 59%) got here from pure gasoline.

Pipestone Vitality Investor Relations

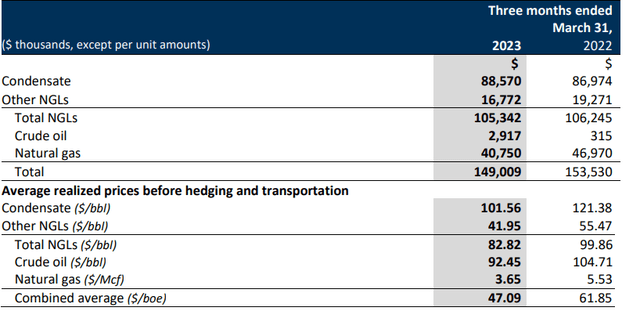

Due to the upper costs for condensate, not pure gasoline, which represented 59% of the manufacturing, however condensate generated nearly all of the income for Pipestone. The NGLs have been offered at just below C$42/barrel however the condensate was promoting for about C$101.5 per barrel. So though condensate represented simply 28% of the manufacturing, it represented virtually 60% of the entire income of roughly C$149M.

Pipestone Vitality Investor Relations

In a approach, the robust condensate pricing atmosphere was a blessing in disguise for Pipestone Vitality as the typical realized worth for its pure gasoline was simply C$3.65 per mcf (that is nonetheless greater than the benchmark worth through the quarter).

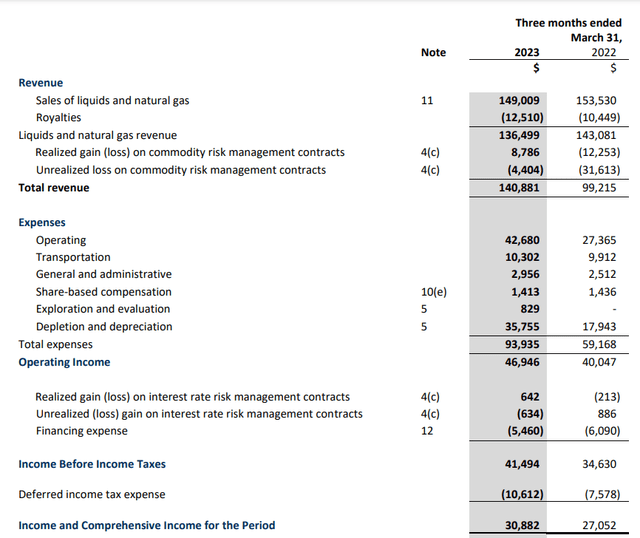

The overall income certainly got here in at about C$149M through the quarter, and the web income after deducting the royalty funds and including the C$4.3M in web realized and unrealized hedging positive aspects got here in at C$141M. As you’ll be able to see under, the entire manufacturing prices are very cheap and the (non-cash) depletion and depreciation bills represented virtually 40% of the entire working bills.

Pipestone Vitality Investor Relations

The corporate remained worthwhile with a pre-tax revenue of C$41.5M and a web revenue of C$30.9M which represented an EPS of C$0.11/share. That is nice however I am primarily involved in Pipestone’s money circulate efficiency.

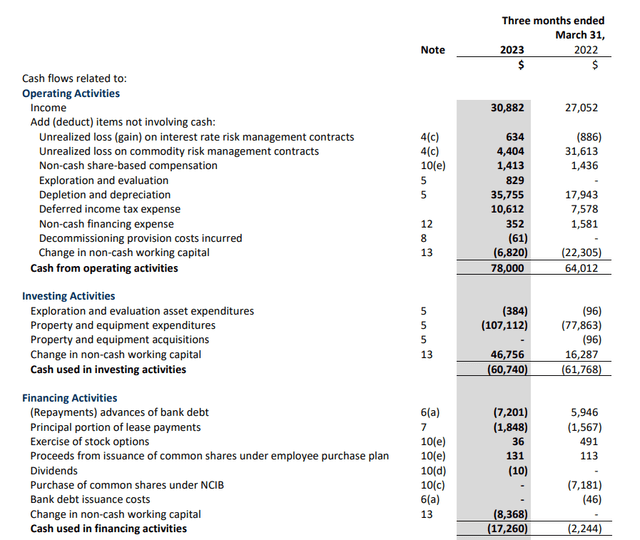

The overall working money circulate was C$78M within the first quarter, and after making some changes like including again the C$6.8M funding within the working capital place and deducting the C$1.8M in lease funds, the adjusted working money circulate was roughly C$83M.

Pipestone Vitality Investor Relations

That is wonderful, nevertheless it wasn’t ample to cowl the C$107M in capital expenditures and Pipestone Vitality was primarily free money circulate destructive within the first quarter of this yr. Whereas that does sound worrisome, let’s not overlook Pipestone’s first quarter was very capex-heavy. The corporate has reiterated its full-year steerage which requires a complete capex dedication of C$245-265M. Utilizing the midpoint of that, at C$255M, in extra of 40% of the full-year capex has already been spent within the first quarter. This implies the typical quarterly capex within the subsequent few quarters shall be lowered to lower than C$40M, which is only a fraction of the Q1 capex.

Pipestone Vitality Investor Relations

Trying on the steerage for subsequent yr, which makes use of US$80 WTI (maybe somewhat bit optimistic) and a pure gasoline worth of C$3 on an AECO foundation, the corporate expects to generate a web free money circulate results of C$125M. As Pipestone at the moment has roughly 280M shares excellent, the 2024 free money circulate steerage implies a free money circulate results of C$0.45 per share. That is only a provisional expectation as Pipestone has needed to refine its steerage prior to now as effectively. However as the present share worth has fallen to simply over C$2.30, the inventory is buying and selling at about 5 occasions the anticipated 2024 free money circulate outcome – primarily based on C$3 AECO. Luckily the corporate has some hedges in place which can assist to mitigate (however not offset because the natgas hedges symbolize a single digit share of the entire manufacturing) the influence of the decrease pure gasoline worth on the spot market.

Pipestone Vitality Investor Relations

Funding thesis

I count on the corporate’s second quarter to be fairly weak because the pure gasoline worth is not cooperating and because the wildfires in Alberta resulted in Pipestone having to curtail a few of its manufacturing for a couple of weeks. This may for certain have a really noticeable influence on the Q2 outcomes and buyers ought to mentally put together for a weak outcome.

The condensate manufacturing is unquestionably serving to Pipestone Vitality, however the next pure gasoline worth shall be wanted for the corporate to start out performing effectively. On the present share worth, Pipestone is buying and selling at roughly the PV20 of its 1P reserves (though the PV values are calculated primarily based on a C$4+ pure gasoline worth which I believe may be very cheap).

And if you’re a believer in pure gasoline buying and selling again as much as C$4-4.5/mcf and for those who count on the condensate worth to stay secure round C$100/barrel, the after-tax PV10 worth of the present reserves is estimated at virtually C$1.6B which might point out a web worth of C$5/share after deducting the web debt and dealing capital deficit.

I’ve a protracted place in Pipestone inventory and am prepared so as to add to this place, however I undoubtedly understand the pure gasoline worth should enhance earlier than the Pipestone share worth begins to extend once more.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.