Spencer Platt

Introduction

It is time to discuss Honeywell Worldwide (NASDAQ:HON), an organization I have not lined in additional than a yr. Previous to that article, in 2021, I known as the corporate an excellent different for an industrial ETF due to its well-diversified industrial publicity and talent to outperform its friends on a long-term foundation.

On this article, I need to deal with the present threat/reward. The corporate is buying and selling roughly 16% beneath its all-time excessive. The inventory is down 7% year-to-date and yielding 2.1%.

In mild of those developments and the corporate’s sturdy progress steerage and margin enhancements, I consider that Honeywell presents alternatives for long-term buyers.

Now, let’s dive into the small print!

What Makes HON So Particular

Headquartered in Charlotte, North Carolina, Honeywell is an enchanting firm. It was based in 1906 by Mark Honeywell, who initially benefited from his invention, the mercury seal generator.

Quick-forward to 2023, we’re coping with an industrial heavyweight with a market cap of $132 billion and main publicity in 4 segments:

Aerospace (33% of 2022 income) Efficiency Supplies and Applied sciences (30%) Security and Productiveness Options (20%) Honeywell Constructing Applied sciences (17%)

Primarily based on this section breakdown, I generally name the inventory an industrial ETF, because it has publicity in 4 well-diversified industrial segments.

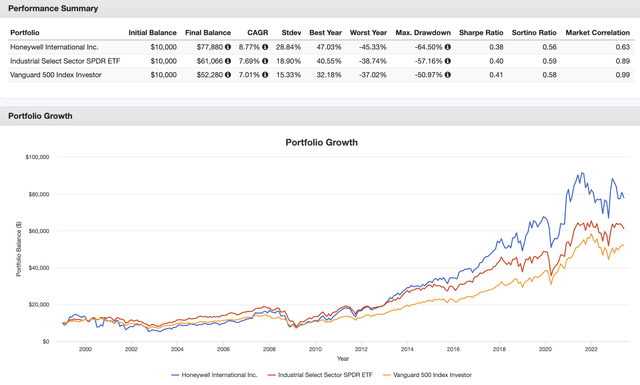

Since 1999, Honeywell shares have returned 8.8% per yr with a regular deviation of 29%. This efficiency beat each the S&P 500 and the Industrial Choose Sector SPDR ETF (XLI), which I exploit as a benchmark for industrial shares.

Portfolio Visualizer

Over the previous ten years, HON shares have returned 12.1% per yr, beating the S&P 500 by roughly 30 foundation factors per yr.

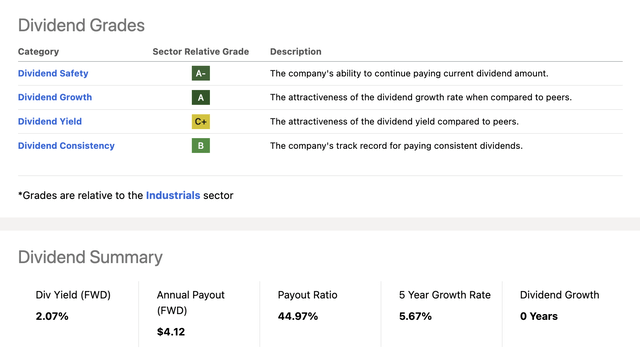

Moreover, the corporate has a powerful dividend scorecard.

Looking for Alpha

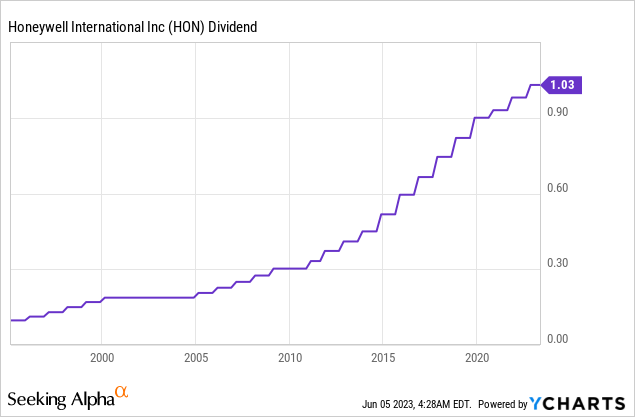

The corporate has a 2.1% dividend yield. This dividend is backed by a forty five% payout ratio. On common, over the previous 5 years, the corporate has hiked its dividend by 5.7% per yr. The latest hike was introduced in September 2022, when the corporate hiked by 5.1%. In October 2021, the corporate hiked by 5.4%.

Therefore, the dividend progress streak of zero years within the Dividend Abstract above is flawed. Additionally, dividend declines up to now had been brought on by spin-offs.

The dividend and shareholders, generally, are additionally protected by a 1.2x 2023E internet leverage ratio, which is extraordinarily low. It comes with an A credit standing.

Up to now, so good.

The excellent news is that new developments make it possible that the corporate can proceed each satisfying long-term dividend progress and outperformance.

Honeywell’s Enterprise Is Poised For Development

However first, we have to talk about inventory value weak point.

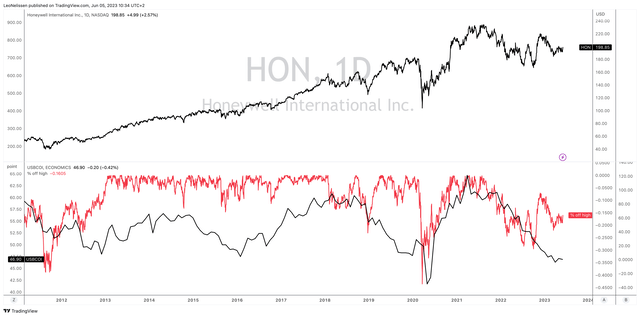

Excluding dividends, HON shares have been unchanged for roughly 2.5 years. Shares are down roughly 16% from their all-time excessive.

The chart beneath exhibits why that’s. I assume that just about no one studying this text will probably be shocked by the reply, however HON is affected by decrease financial progress expectations. The decrease a part of the graph beneath compares the full distance HON shares are buying and selling beneath their all-time excessive (in proportion phrases) to the ISM Manufacturing Index.

TradingView (HON, ISM Index)

What we see is that market members have de-risked their portfolios, shifting from cyclical shares to progress and tech shares, as confirmed by the large outperformance of tech shares.

Regardless of the decline in financial progress expectations, the corporate did an incredible job in 1Q23, which included reporting sturdy steerage.

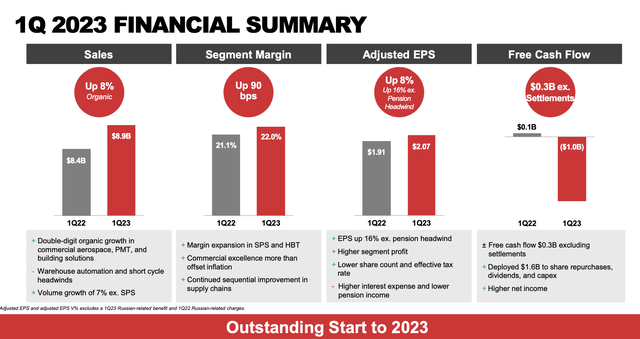

Honeywell Worldwide

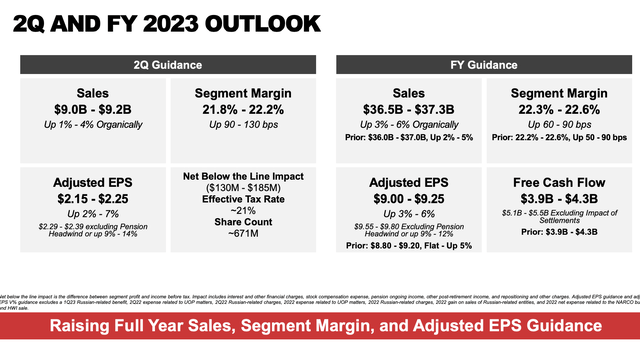

In its first-quarter earnings name, Honeywell offered gross sales steerage for 2Q23, anticipating a spread of $9.0-$9.2 billion, representing a 1% to 4% improve on an natural foundation.

The corporate additionally raised its full-year gross sales expectations to $36.5-$37.3 billion, with an upgraded natural progress vary of three% to six%.

Honeywell Worldwide

Honeywell anticipates a better stability of value and quantity in comparison with the earlier yr. They’ve upgraded their full-year expectations in Aerospace whereas softening their outlook for SPS.

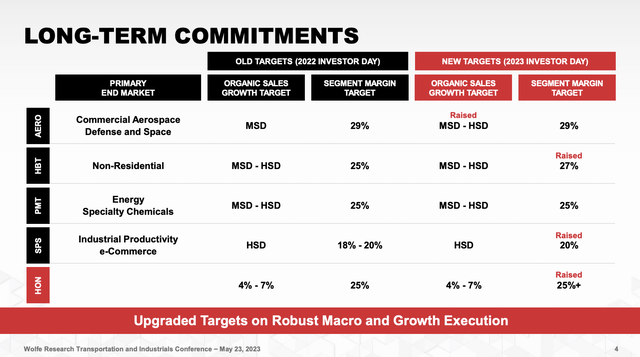

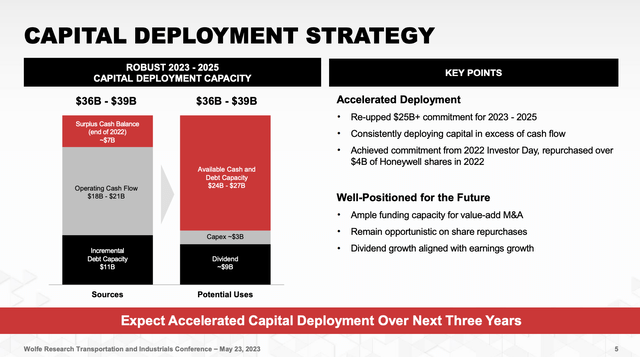

With that mentioned, the corporate reiterated its progress throughout the newest Wolfe Analysis International Transportation and Industrial Convention.

This features a deal with its margins.

Primarily, Honeywell’s constant margin enlargement has been a trademark of the corporate, and the corporate has raised its medium-term targets for margin enlargement. Honeywell now goals for 40 to 60 foundation factors of margin enlargement, up from the earlier goal of 30 to 50 foundation factors.

Regardless of some aerospace headwinds, the corporate expects stronger margin enlargement this yr. Elements contributing to this embrace:

efficient value value administration, quantity leverage because of general firm progress, and reallocation of sources to fund investments.

In line with the corporate, the precept of reallocation ensures that productiveness is prioritized to help the corporate’s investments. The combination of services, such because the Intelligrated enterprise changing into smaller, additionally contributes to improved margins.

Aerospace margins, though flat this yr, stay above the business common, and the corporate’s general progress will present leverage for margin enlargement.

Honeywell Worldwide

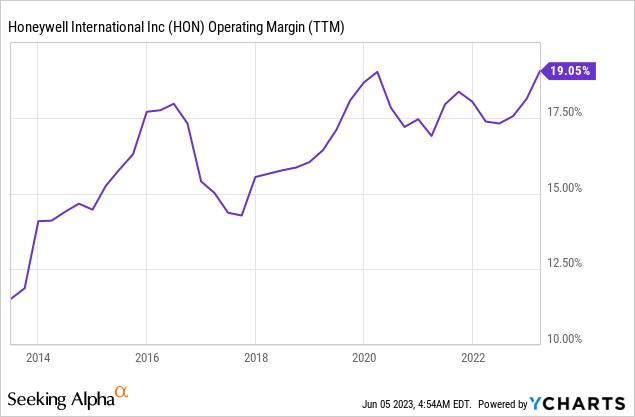

When trying on the greater image, HON has grown its working margin from the low-10% vary to the excessive 10% vary inside simply ten years and a number of cyclical headwinds just like the 2015/2016 manufacturing recession and the 2020 pandemic.

Additionally, concerning aerospace margins, the corporate famous that general progress of the aero enterprise at double digits or excessive singles might positively affect Honeywell’s margin trajectory on a longer-term foundation. I agree with that after having listened to numerous aerospace earnings calls.

On a associated observe, the corporate expects the navy ramp-up to have a constructive affect on margin charges. Whereas there isn’t a dependence on any particular platform, the deal with safety is anticipated to offer a wholesome tailwind for the protection enterprise. This, too, is confirmed by each main protection contractor in North America.

The excellent news continues. I already briefly talked about that the corporate has a really wholesome stability sheet with an A credit standing.

Now, Honeywell goals to leverage its stability sheet power for capital deployment, each internally by way of excessive ROI progress initiatives and externally by way of mergers and acquisitions.

Honeywell Worldwide

Honeywell’s monetary outcomes are anticipated to be enticing, with an emphasis on gross margins, that are projected to exceed 40% by way of optimization efforts and capital deployment plans.

Moreover, the corporate is anticipated to enhance its free money stream. The development in free money stream conversion is anticipated to be supported by lowering stock as provide chain challenges ease.

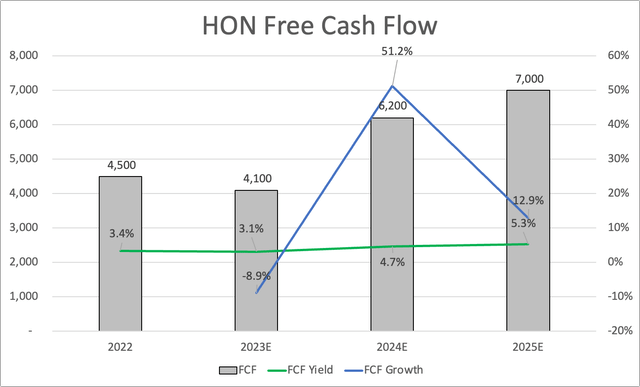

Wanting on the numbers beneath, free money stream is anticipated to be boosted to $7.0 billion in 2025, which suggests a >5% free money stream yield.

Leo Nelissen

Moreover, Honeywell has invested in digital platforms and community planning to optimize stock and enhance working capital. The corporate’s deal with threat and money administration by way of international initiatives and digitalization efforts may also contribute to raised free money stream conversion.

Valuation

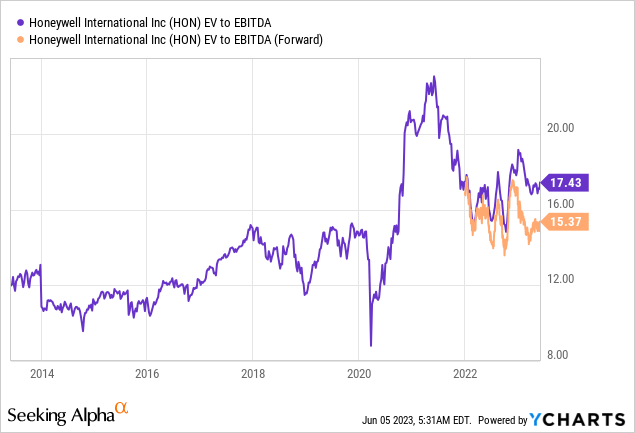

Honeywell’s valuation is truthful. The ahead EBITDA a number of has come down to fifteen.4x, which is anticipated to say no additional, as 2024 EBITDA is anticipated to be 7.4% increased in comparison with 2023E EBITDA.

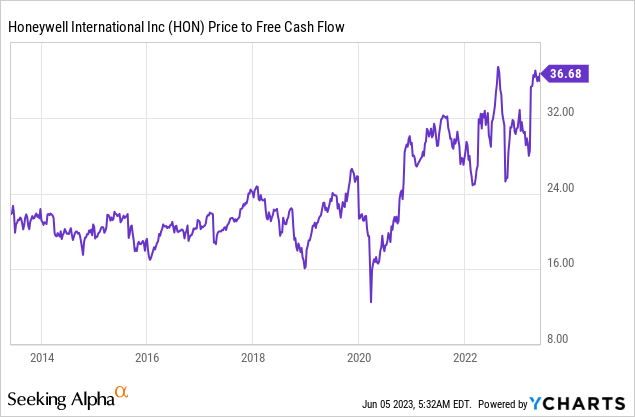

The identical goes for the free money stream a number of, which I normally desire as a valuation indicator, given the significance of free money stream for sustainable progress and shareholder distributions.

In his case, HON is buying and selling at 37x LTM free money stream. That quantity is anticipated to rapidly fall to 21x in 2024 because of the aforementioned anticipated enchancment in free money stream.

Primarily based on that context, I consider that HON’s truthful worth is near $240, which is barely above the consensus estimate of $220. On a longer-term foundation, I anticipate HON to return to what it did previous to the pandemic, which is returning between 8-10% per yr – outperforming its friends by a slim margin.

Nevertheless, because of financial challenges, I don’t rule out one other non permanent decline to $180 or decrease. Inflation continues to be stickier than anticipated, which can possible hold charges elevated for longer.

Given the continuing decline in financial expectations, we might see a draw back revision in HON’s enterprise expectations. I am not saying that may occur, however the dangers are elevated.

The excellent news is that this might present buyers with a greater entry down the highway.

If I had been seeking to purchase HON publicity (I am not as a result of I have already got near 50% industrial publicity with shares in the entire firm’s segments), I might be a purchaser at present ranges. Nevertheless, I might purchase regularly, which means with the possibility to common down in case HON shares do transfer to $180 or beneath.

My bullish score displays the inventory’s long-term potential.

Takeaway

Honeywell Worldwide presents a beautiful alternative for long-term buyers. Regardless of a current decline in inventory value, the corporate’s well-diversified industrial publicity and spectacular observe report make it a compelling alternative.

Through the years, Honeywell has outperformed each the S&P 500 and the Industrial Choose Sector SPDR, delivering annual returns of 8.8% since 1999. Moreover, the corporate advantages from a stable dividend scorecard backed by a conservative payout ratio and a wholesome internet leverage ratio.

Regardless of present financial challenges and potential draw back dangers, Honeywell’s current efficiency and constructive outlook for margin enlargement, pushed by efficient value administration, quantity leverage, and useful resource reallocation, sign future progress potential. The corporate’s deal with capital deployment, each internally and thru strategic acquisitions, additional enhances its prospects.

Whereas short-term uncertainties might persist, long-term buyers might discover Honeywell a beautiful funding alternative, particularly if the inventory experiences a brief decline.