The Nasdaq may proceed rallying

InvestingPro’s ‘Know-how Gems’ technique is for these seeking to achieve from it

Utilizing the technique, I recognized three shares poised to rally together with the index

The has had an excellent 2023 up to now, rallying nearly 27% for the reason that begin of the yr. However, if the rally continues, there are higher methods to achieve from it than shopping for ETFs or index funds.

That is the place InvestingPro is available in. The device permits customers to discover numerous funding methods that filter out firms based mostly on particular standards. Readers can do the identical analysis for each sizzling market subject by clicking on the next hyperlink: Enroll and begin your free trial right this moment!

For instance, these seeking to determine shares prone to soar with the index can use the ‘Know-how Gems’ technique.

This technique goals to determine alternatives utilizing the next standards:

InvestingPro Inventory Screener

Supply: InvestingPro

The choice course of has recognized over 200 US inventory market firms that meet the factors as potential funding alternatives.

However three firms stand out and are value contemplating to your portfolio. Let’s take a deeper dive into these firms’ present standing and prospects.

1. Broadcom

With about 75% of its income coming from the semiconductor sector, Broadcom (NASDAQ:) is poised to capitalize on the continued semiconductor growth.

Final month, the Silicon Valley-based firm’s inventory surged, reaching new file highs round $915. This surge is a mirrored image of the present upward development available in the market.

Broadcom Worth Chart

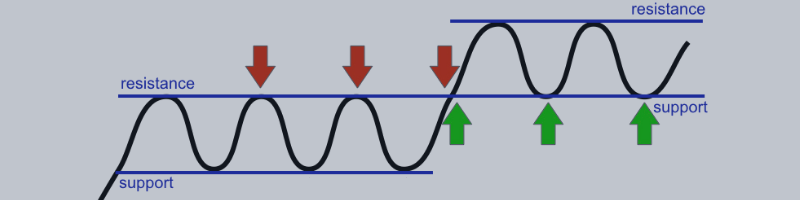

After a powerful rebound, Broadcom inventory is at the moment present process a consolidation section, as anticipated.

This may occasionally lead to a corrective sample, with a possible worth vary of $680-700 per share. The important thing help stage, confirmed by the upward development line, falls inside this vary.

From a elementary perspective, the corporate has demonstrated strong efficiency, with constant income and web revenue development since 2020.

This offers a stable basis for the continuation of the upward development, following the latest correction within the inventory worth.

Broadcom Income and Internet Revenue

Supply: InvestingPro

2. KLA Company

KLA Company (NASDAQ:), a semiconductor firm, makes a speciality of creating management techniques and efficiency administration instruments for manufacturing processes.

It collaborates carefully with NVIDIA (NASDAQ:), benefiting from the chipmaker’s rally in Could after publishing optimistic forecasts for the subsequent quarter.

The corporate stands out for constantly exceeding quarterly earnings forecasts and its inventory’s upward momentum.

Outcomes vs. Forecasts – KLA Company

Supply: InvestingPro

It’s value maintaining these behind your thoughts forward of the earnings launch subsequent month.

3. Adobe

Adobe (NASDAQ:) is scheduled to launch its Q1 2023 outcomes subsequent week on Thursday. Analysts’ forecasts point out an anticipated EPS (earnings per share) of $3.79 and revenues of $4.772 billion.

Adobe Earnings Forecast

Supply: InvestingPro

The corporate’s inventory worth is at the moment at a vital juncture because it exams a key resistance close to $440.

The profitable breakthrough and continuation of an upward transfer will rely upon the Federal Reserve’s determination on the upcoming assembly and the absence of any unfavorable surprises within the upcoming monetary report.

Adobe Inventory Worth Chart

Contemplating the dynamics of the demand impulse, essentially the most possible state of affairs from a technical perspective is a breakout adopted by a continuation towards $530.

InvestingPro instruments help savvy buyers in analyzing shares. By combining Wall Road analyst insights with complete valuation fashions, buyers could make knowledgeable choices whereas maximizing their returns.

Begin your InvestingPro free 7-day trial now!

Discover All of the Data you Want on InvestingPro!

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling, or funding suggestion. As such, it’s not meant to incentivize the acquisition of property in any means. I wish to remind you that any asset is extremely dangerous and evaluated from a number of factors of view; due to this fact, any funding determination and the related danger stay with the investor.