ryasick/E+ through Getty Photos

Funding Thesis

REV Group, Inc. (NYSE:REVG) positively stunned buyers in its fiscal Q2, 2023 outcomes with its upwards revised steering. This can be a inventory that had been for probably the most half a disappointment to buyers previously 2 years.

Consequently, the inventory was largely laying dormant and out of favor. Nevertheless, its not too long ago appointed CEO Mark Skonieczny declares that the enterprise will achieve rising its profitability all year long. And on this spirit, the corporate has now raised its revenues and EBITDA outlook for fiscal 2023.

Subsequently, on the again of its cheap valuation, along with prospects of improved profitability going ahead, plus its greater than 20% introduced share repurchase program, I assert a purchase score on REV Group, Inc. inventory.

Why REV Group? Why Now?

REV Group is an organization that manufactures specialty autos for a variety of industries. They supply car options for the industrial, hearth and emergency, and leisure markets, together with ambulances and hearth vans.

This funding has one essential bearish side that I imagine warrants consideration. Specifically, REV Group carries roughly $220 million of debt. That being mentioned, apparently, this debt on REV Group’s steadiness sheet is not proscribing its capacity to repurchase shares, one thing we’ll quickly talk about.

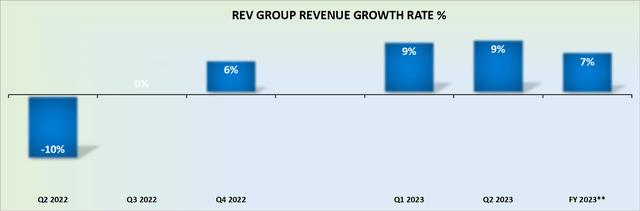

Income Progress Charges Guided Larger

REVG income progress charges

Above, we see that fiscal 2023 has been barely upwards revised and is now anticipated to develop at round 7% CAGR, in contrast with round 5% previous to this up to date steering being introduced.

In fact, one would hope that administration is being conservative with this steering, since fiscal Q2 2023 simply beat income estimates by $100 million (or a income beat of 18%, which is significant).

Subsequent, we’ll flip our focus to the core of the bull case.

The Bull Case in Focus

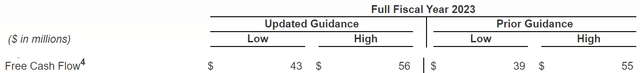

REV Group has now raised the midpoint of its steering, and we’re led to imagine that roughly $50 million of free money circulation may very well be on the playing cards.

REVG Q2 2023

This is able to put the inventory priced at a good a number of of 16x this yr’s free money flows.

Whereas I do not make the case that it is a significantly cheaply valued inventory, administration makes the case that these shares are undervalued. And apparently in an try to spotlight this to buyers, REV Group has opted to announce a brand new share repurchase program of $175 million.

Be aware, this introduced share repurchase program is barely greater than 20% of its market cap. A fairly substantial determine.

The Backside Line

The spotlight of the quarter was undoubtedly REV Group’s important income beat for fiscal Q2, 2023. REV Group notes how its fundamental section, Fireplace & Emergency, noticed elevated shipments of fireplace equipment, primarily the results of an improved provide chain, and labor efficiencies associated to initiatives put in place designed to extend productiveness.

One has to wonder if this may very well be right down to constructive dynamics that the brand new CEO has put in place, or a pure easing of the provision chain.

On the opposite aspect of the argument, as already mentioned, the one unfavourable consideration right here is that the enterprise is considerably leveraged.

Nevertheless, administration clearly believes that this isn’t an issue, and has now introduced a big buyback that quantities to greater than 20% of its market cap. After all, that is an open-ended buyback and will not be accomplished. But it surely highlights the intention, nonetheless.

If, certainly, REV Group can proceed to enhance its profitability, it is completely potential that the inventory may very well be priced at roughly 14x subsequent yr’s free money flows. A a number of that is not stretched, significantly if REV Group, Inc. can proceed to develop its revenues within the excessive single digits.