Urupong

Funding Thesis

Okta, Inc. (NASDAQ:OKTA) is a enterprise that I stay bullish on. The funding thesis will not be easy. There’s a whole lot of nuance for us to undergo.

Right here, I describe the bull case, pointing to its buyer adoption charges and levers that would drive its income development charges increased subsequent yr. However I additionally spotlight some destructive issues, together with, however not restricted to its valuation.

Why Okta? Why Now?

Okta gives identification and entry administration options. Okta is concentrated on guaranteeing safe and seamless person authentication. You may consider it as a login portal such as you in all probability use together with your ”Google Signal In” on web sites.

Okta’s single sign-on (”SSO”) product gives a centralized person administration providing delivering enhanced safety. Okta’s platform permits organizations to securely entry a multi-cloud setting from any system.

Transferring on, if you happen to’ve learn my earlier evaluation of SaaS firms, you may know that I strongly discourage investing in companies that depend on value hikes to gas their income development charges. I’ve described this on numerous events, however you may look to Snowflake Inc. (SNOW) right here as one instance.

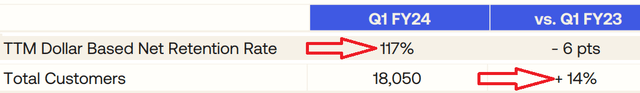

OKTA presentation

Enable me to elucidate what we see above. Above you see two figures:

You see internet retention charges for the trailing twelve months of 17% And whole buyer development of +14%.

The primary determine exhibits how a lot Okta is counting on cross-selling to its present buyer base, over the previous twelve months, which is up 17%.

In the meantime, its whole buyer depend grew by 14%. I consider that income development charges which are pushed by a quickly rising buyer base are of far increased high quality than one which depends on mountain climbing costs. Why?

As a result of within the first occasion, you may solely hike your product a lot. Within the second occasion, by rising your product an excessive amount of, you enable room for rivals to come back in, one thing you by no means need.

You by no means need to lose market share on pricing. As a result of when you lose a buyer, it is virtually not possible to get it again, due to all of the coding that’s required to include one’s programs, it is simply too prohibitively costly to modify from one product to a different and again once more.

In different phrases, Okta has a wholesome buyer adoption curve.

As we proceed, I will first talk about the bull case after which the bear case dealing with the inventory. Hopefully, offering you with sufficient insights that can assist you to make up your thoughts.

Income Development Charges Level Towards A Slowdown

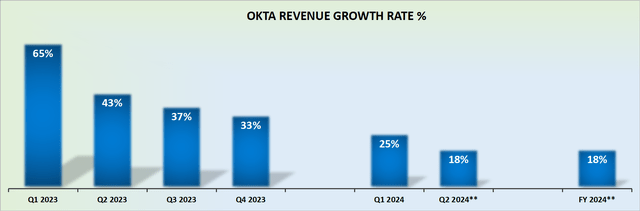

OKTA income development charges

Traders look in the direction of Okta as a enterprise that has misplaced its hyper-growth label. Nonetheless, I consider that buyers are misinterpreting Okta’s development charges.

Within the first occasion, fiscal Q1 2024 was essentially the most difficult comparable. Okta acquired Auth0 early in fiscal 2022, so there was nonetheless some inorganic development left in its fiscal Q1 2023 outcomes. Extra particularly, Okta acquired Auth0 in the course of fiscal Q1 2022.

Secondly, everybody is aware of that the IT sector has been via a interval of exaggerated enlargement and that now there is a interval of digestion. Accordingly, it is sensible that, because of this issue, Okta’s income development charges will decelerate.

This leads me to my third argument. This isn’t the place the story ends for Okta. Subsequent yr, the comparables will develop into dramatically simpler for Okta, which can present a tailwind to its development charges.

And now, my fourth level: I consider that administration is leaving itself substantial room to positively impress buyers in the direction of the again half of fiscal 2024.

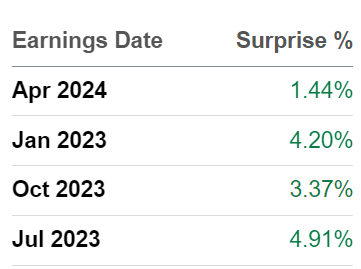

SA Premium

Above, I spotlight 4 completely different the reason why Okta’s development prospects are taking a breather, however its income development charges are usually not going to proceed slowing down on the tempo they’ve during the last 6 quarters; if we embody the following guided quarter fiscal Q2 2024.

Subsequent, we’ll talk about the bearish elements dealing with this inventory.

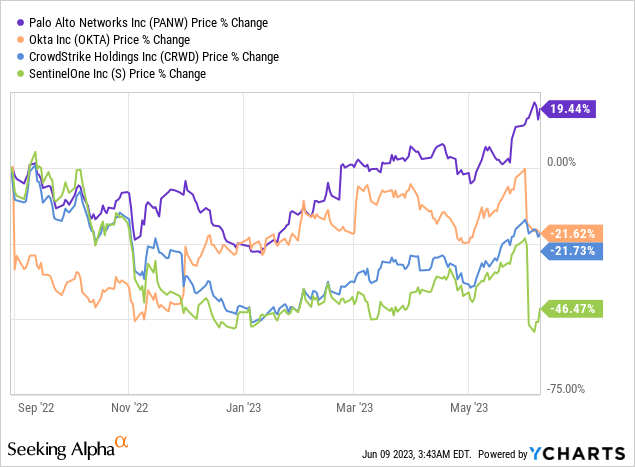

Okta Is No Palo Alto Networks

Take into account this graphic under:

I will admit that I am biased in what I am about to say. In spite of everything, I have been recommending Palo Alto Networks, Inc. (PANW) inventory to paying members for near a yr. And I acknowledge that buyers don’t love to listen to what I am about to say.

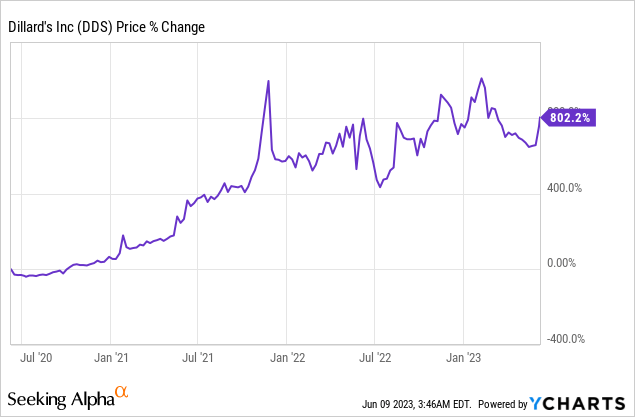

However valuation issues. You see, the factor is, within the brief time period, out there, all that issues is the story. Having one of the best story is one of the best driver of the inventory within the very close to time period. However over the long term, you do not have to say a lot. One of the best instance I do know of that is Dillard’s (DDS).

Dillard’s is such a poorly adopted firm, that even I’ve extra folks following me than they do. It is such a hated inventory with 20% of its inventory bought brief. Dillard’s would not even do convention calls. And but. And but, DDS inventory continues to maneuver up and to the fitting.

That is my essential rivalry: valuations matter. Individuals can say no matter they need within the brief time period, however in the long run the market is a weighing balance, as the person, Benjamin Graham, stated.

Based on my estimates, Palo Alto Networks is priced at about 40x subsequent yr’s EPS. That is my assumption. Palo Alto Networks has been targeted on being worthwhile earlier than being worthwhile ”was even cool.”

And Okta? You see, the factor is, if I say that Okta is priced at 74x ahead EPS it would not look as fascinating as Palo Alto Networks. Notably on condition that Palo Alto is rising at someplace near the excessive 20% CAGR, whereas Okta is anticipated to develop across the low 20%.

The Backside Line

Okta, Inc.’s valuation has been weighing down the inventory. Nonetheless, I consider that it is buyer adoption curve is a mirrored image of the general well being of the platform, notably because it compares in opposition to the prior yr quarter, which included the acquisition of Auth0.

I make the case that though Okta, Inc. will not be rising fairly as quick as Palo Alto Networks, there are sufficient levers to ignite Okta’s income development charges subsequent fiscal yr. Merely put, Okta’s story could seem to finish right here, nevertheless it’s intrinsic worth ought to proceed to develop. Resulting in new story to emerge within the not too distant future.