Damir Khabirov/iStock through Getty Photos

Recap

Wayfair’s (NYSE:W) inventory went up 10% at present as JPMorgan analysts added the inventory to their focus record. We welcome extra analysts to hitch our bull name. The inventory had gone up 52% since our preliminary protection, “Wayfair Can Shock At A Second Look” on Could 19, 2023. On this article, we are going to focus on considerations from traders about this inventory. Moreover, we offer our goal worth under based mostly on the DCF mannequin, which is commonly our most well-liked valuation technique.

Worrisome Round Profitability

Wayfair’s incapacity to make income post-pandemic has brought about some traders to specific concern, casting doubt on the corporate’s potential for future success.

Nevertheless, for a corporation that showcases development potential, we all the time advise traders to train warning when making purchase or promote suggestions solely based mostly on financials. As an alternative, we imagine that specializing in working metrics supplies a higher understanding of the corporate’s buyer base and operations.

Regardless of a latest lower in client visitors, which we attribute to macro challenges and the post-pandemic slowdown, Wayfair’s core prospects have proven energy. The online income per energetic buyer reached a brand new excessive of $552 over the previous two years, with repeat prospects accounting for 79% of purchases. Moreover, Wayfair has a considerable buyer base of twenty-two million individuals, representing roughly 6% of the mixed inhabitants of the USA and Canada. This means a stable market presence and potential networking results. Actually, the corporate was already GAAP worthwhile in 2020 and was rising within the international market. The corporate’s bills could fluctuate within the early phases of worldwide development.

DCF as Our Most well-liked Valuation Methodology

In our earlier article, we employed valuation multiples as the idea for our valuation evaluation. Nevertheless, on this article, we are going to make the most of the DCF technique to dig into its valuation.

Base case

In our base case, we assume the corporate may have no development in 2023 and develop 3% thereafter. We additionally ignore its worldwide market development potential.

Together with the next assumptions:

WACC: 12% Free money circulation margin: 10% Terminal development charge: 3% Internet debt:2090 million (Q1 2023 information) Shares excellent: 111 million (Q1 2023 information)

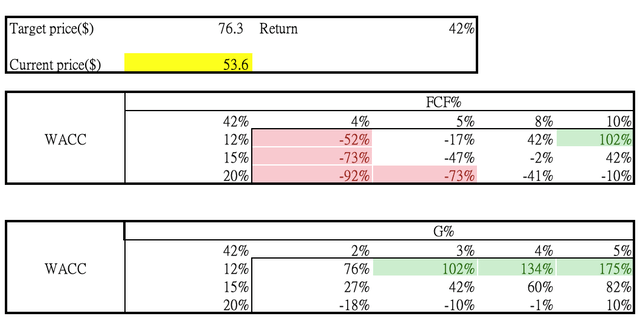

Via the DCF mannequin, we arrived at an $8.4 billion fairness worth ($76.3 per share), which is ~42% above the present worth.

Sensitivity evaluation (base case) (LEL Funding)

Bull case

In accordance with the U.S. Census Bureau, furnishings, house furnishings, electronics, and equipment shops complete gross sales have been $233 billion in 2022. Thus, Wayfair had a 4.3% market share by greenback quantity.

In our bull case, we assume the corporate would enhance its market share from 4% to 10% in 10 years, a CAGR of 6.7%. We nonetheless ignore its worldwide market development potential.

Together with the next assumptions:

WACC: 12% Free money circulation margin: 10% Terminal development charge: 3% Internet debt:2090 million (Q1 2023 information) Shares excellent: 111 million (Q1 2023 information)

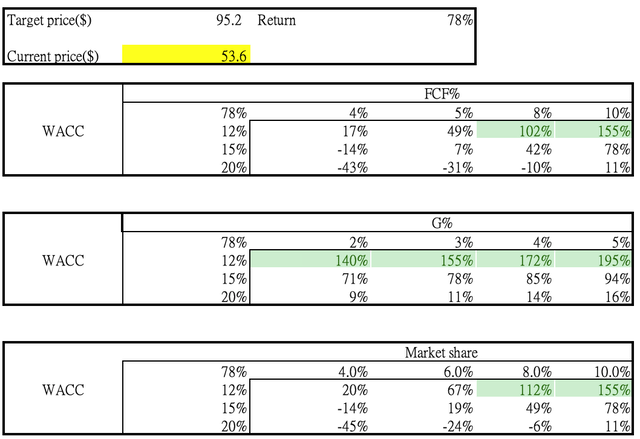

Via the DCF mannequin, we arrived at a $10.4 billion fairness worth ($95.2 per share), which is ~78% above the present worth.

Sensitivity evaluation (bull case) (LEL Funding)

JPMorgan assigned a worth goal of $63 to Wayfair, reflecting upside potential for the inventory, which aligns carefully with our bull case valuation.

It is price noting that the inventory could possibly be overvalued if the corporate fails to enhance its free money circulation margin to above 5%, if the WACC exceeds 15%, or if its long-term market share stays under 4%. We imagine the present market concentrate on the inventory can be margin. We analyzed the corporate’s margin potential as under:

A Nearer Take a look at Wayfair’s Margins

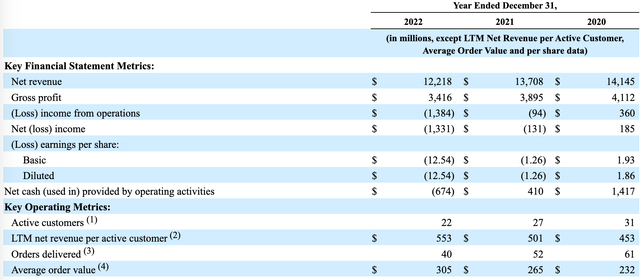

Wayfair achieved a ten% free money circulation margin in 2020 through the COVID period. In that yr, the corporate had a median order worth of $232 and a buyer base that was 31% energetic. Nevertheless, in 2022, though the typical order worth elevated by 31% in comparison with 2020, there was a 29% lower within the variety of prospects and a 34% discount in orders. Consequently, the rise in common order worth was inadequate to compensate for the decline in buyer rely and order quantity, resulting in a lower in total gross sales and profitability. Because of this, the corporate’s margin entered damaging territory.

Financials 2020-2022 (W)

The decline so as numbers could be attributed to a mix of things, together with modifications in product combine, lowered operational efficiencies as a result of fewer orders, and rising logistics prices, significantly within the worldwide market. The worldwide market skilled a extra important decline of twenty-two%, nearly double the 12% decline noticed within the US market between 2020 and 2022. The corporate confronted important deleveraging, primarily in its worldwide market, as it’s nonetheless within the early phases of improvement.

In accordance with the administration, the corporate has been engaged on enhancing its margins via numerous methods. One strategy includes lowering injury charges by addressing particular weak factors and enhancing packaging in collaboration with suppliers. Leveraging information science and expertise, the corporate makes use of info on injury charges to reinforce search outcomes for consumers.

Moreover, the optimization of last-mile prices has been a latest focus. By using information analytics instruments, the corporate determines whether or not a product needs to be categorized as a big or small parcel, contemplating elements like supply prices and injury charges. This ensures that prospects obtain one of the best retail worth and expertise whereas sustaining product integrity. The corporate’s skill to optimize delivery prices has been additional improved by driving extra suppliers via CastleGate, leading to advantages for each prospects and Wayfair.

Because of this, the corporate narrowed its loss in Q1 2023 in comparison with Q1 2022. This means that if the corporate can develop its buyer base or enhance order quantity to surpass its 2020 ranges, there’s potential for margin enlargement. The corporate’s core prospects have demonstrated energy, with web income per energetic buyer reaching a brand new excessive of $552 over the previous two years and repeat prospects accounting for 79% of purchases, highlighting a loyal buyer base. Moreover, based on the administration, the corporate is within the early phases of monetizing its platform by providing promoting alternatives to suppliers. This promoting providing serves as an ancillary high-margin income stream for the corporate, which continues to be in its early days however exhibiting promising development.

Conclusion

Contemplating all these elements, we imagine Wayfair has the potential to return to development and enhance its margin profile. Our valuation, excluding worldwide enlargement, signifies a sexy alternative. Subsequently, we charge the inventory as a “Purchase.”