JHVEPhoto

Funding Thesis

For my part, it’s of excessive significance to incorporate firms that may give you a gorgeous Dividend Yield in your long-term funding portfolio.

That is the case as they generate an extra revenue stream which you’ll profit enormously from when having a protracted investment-horizon. You possibly can profit much more from this extra revenue stream within the type of dividends when deciding on firms that not solely give you a gorgeous Dividend Yield at the moment, however are capable of enhance this quantity of dividend funds from yr to yr. This lets you steadily enhance your wealth without having the need of promoting shares out of your funding portfolio.

In at the moment’s article, I’ve chosen two firms that I at present take into account to be significantly engaging for dividend revenue buyers as they each supply a gorgeous Dividend Yield, have proven important Dividend Progress throughout the previous years, and are extremely worthwhile.

Moreover, the 2 chosen firms have robust aggressive benefits that gives them with an financial moat over their opponents in addition to firms that would presumably enter the market. Along with that, I consider that each firms are at present undervalued.

The 2 chosen firms wanted to fulfil the next necessities to be a part of a pre-selection of firms:

Dividend Yield [FWD] > 3% Common Dividend Progress Price [CAGR] over the previous 5 years > 2% Payout Ratio < 80% P/E [FWD] Ratio < 30 EBIT Margin [TTM] > 5% or Web Earnings Margin [TTM] > 5%

These are the 2 chosen firms for the month of June:

The Financial institution of Nova Scotia (BNS) Altria (MO)

The Financial institution of Nova Scotia

The Financial institution of Nova Scotia (BNS) was based in 1832 and is among the many 4 largest banks in Canada by way of Income and Market Capitalization. Whereas I’m writing this text, the financial institution has a Market Capitalization of $58.73B. In 2022, it generated a Income of $21,876M.

Among the many financial institution’s aggressive benefits are its worldwide presence (it offers companies in Canada, america, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and extra), its operations in diversified enterprise segments (the financial institution operates by means of the segments Canadian Banking, Worldwide Banking, World Wealth Administration, and World Banking and Markets) in addition to its experience within the space of danger administration.

Within the Second Quarter 2023 Earnings Launch, the financial institution reported a Return on Fairness of 12.3%, which underlines its power by way of Profitability. This power is additional confirmed by its Web Earnings Margin [TTM] of 29.36%, which is 13.82% above the Sector Median (25.80%).

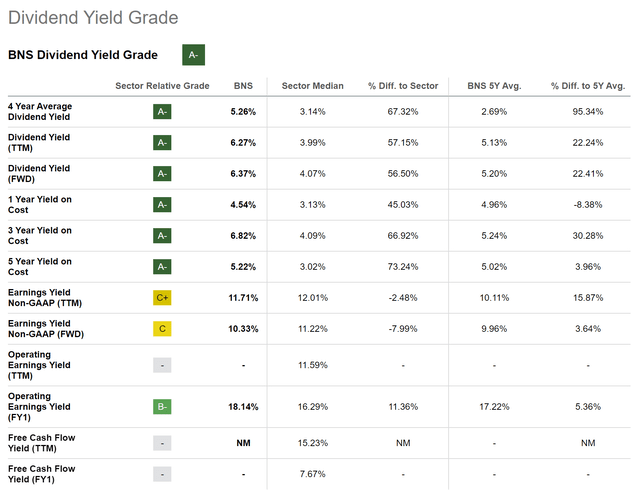

On the financial institution’s present inventory value of $49.05, it offers its shareholders with a Dividend Yield [TTM] of 6.27% and with a Dividend Yield [FWD] of 6.37%, indicating that it’s a gorgeous decide to be a part of this choice of excessive dividend yield firms.

The financial institution’s present Dividend Yield [FWD] stands 56.50% above the Sector Median of 4.07%. On the similar time, it’s 22.41% above its Common Dividend Yield [FWD] from over the previous 5 years (5.20%).

The financial institution’s present Dividend Yield [FWD] of 6.37% is above the one among opponents equivalent to Financial institution of Montreal (BMO) (Dividend Yield [FWD] of 5.04%), The Toronto-Dominion Financial institution (TD) (4.88%), Financial institution of America (BAC) (3.08%), JPMorgan (JPM) (2.88%) and Wells Fargo (WFC) (2.97%).

A number of metrics additional point out that the financial institution shouldn’t solely be capable to present your funding portfolio with dividend revenue, but in addition with dividend development: its Dividend Progress Price [CAGR] over the previous 5 years stands at 4.38% and its Dividend Progress Price [CAGR] over the past 3 years at 4.74%, thus confirming this thesis.

When it comes to Valuation, I consider that the Canadian financial institution is at present undervalued. I consider this as a result of its P/E GAAP [FWD] Ratio of 9.68 lies 4.55% beneath its Common from over the previous 5 years (10.14). Furthermore, its Value / E book [FWD] Ratio of 1.09 is 17.20% beneath its Common in the identical time interval.

Along with that, it may be acknowledged that the financial institution’s Value / Gross sales [FWD] Ratio of two.44 lies 23.88% beneath its Common over the previous 5 years (3.24), additional confirming my funding thesis that it’s undervalued at this second in time.

Moreover, The Financial institution of Nova Scotia’s P/E GAAP [FWD] Ratio of 9.68 stands considerably beneath its Canadian opponents equivalent to Financial institution of Montreal (P/E GAAP [FWD] Ratio of 15.93), Royal Financial institution of Canada (RY) (11.72) and The Toronto-Dominion Financial institution (11.27).

The Looking for Alpha Dividend Yield Grade, which yow will discover beneath, reinforces my perception that the Canadian financial institution is an interesting decide with regards to dividend revenue.

Supply: Looking for Alpha

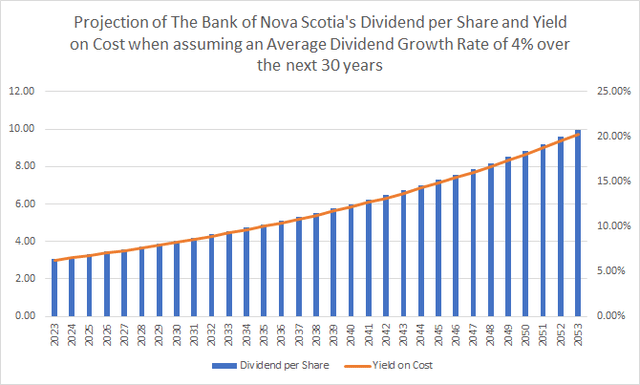

Projection of The Financial institution of Nova Scotia’s Dividend and Yield on Value

The graphic beneath illustrates the projection of The Financial institution of Nova Scotia’s Dividend and Yield on Value when assuming that the financial institution was capable of elevate its Dividend by 4% per yr for the next 30 years (this quantity relies on its Common Dividend Progress Price [CAGR] of 4.38% from over the previous 5 years). When investing within the financial institution at its present value degree, you can probably attain a Yield on Value of 9.26% in 2033, of 13.71% in 2043, and of 20.30% in 2053.

Supply: The Writer

Supply: The Writer

The graphic strengthens my perception that the financial institution could be a superb alternative for these buyers aiming to construct an additional revenue within the type of dividends whereas rising the quantity yr over yr.

Altria

Altria was based in 1822 and amongst its aggressive benefits are its broad distribution community, a product portfolio consisting of robust manufacturers (equivalent to Marlboro) in addition to the corporate’s huge pricing energy (which is a results of its model power). The big model loyalty of people who devour its tobacco merchandise allow the corporate to extend its costs yr over yr.

Along with that, it may be highlighted that Altria operates in a enterprise area, that gives it with an financial moat over doable opponents that would enter the market. That is the case as tobacco firms are topic to sure restrictions so as to perform product promoting.

Moreover, it may be highlighted that totally different metrics have contributed considerably to me deciding on Altria as one among my high 2 excessive dividend yield firms to purchase throughout this month of June.

To begin with, I take into account the corporate’s Dividend Yield [FWD] of 8.42% to be engaging for buyers looking for an extra revenue within the type of dividends. The corporate’s Dividend Yield [FWD] lies 227.25% above the Sector Median (which is 2.57%) and, on the similar time, stands 15.10% above its Common over the previous 5 years (which is 7.32%).

Along with that, it may be highlighted that Altria’s Free Money Circulate Yield [TTM] is at present 11.16%, which is 163.97% above the Sector Median of 4.23% and 22.27% above its Common from over the previous 5 years. This excessive Free Money Circulate Yield [TTM] of 11.16% clearly signifies that the corporate is a superb alternative with regard to danger and reward.

When it comes to Dividend Progress, I want to spotlight that its Common Dividend Progress Price [CAGR] over the previous 5 years stands at 7.18% whereas it has been 3.86% over the past 3 years. Each can function indicators that Altria may enable you to extend your extra revenue by way of dividend funds from yr to yr.

Moreover, I take into account the corporate’s Dividend to be comparatively secure, a minimum of throughout the subsequent years: my opinion relies on the truth that the corporate has a Payout Ratio of 75.92% and has proven 53 Consecutive Years of Dividend Progress. Along with that, Altria is rated with a B- by way of Dividend Security as in keeping with the Looking for Alpha Dividend Security Grade.

Furthermore, I consider that Altria is a superb alternative with regard to Valuation: the corporate has a P/E [FWD] Ratio of 9.12, which is 54.18% beneath the Sector Median (which stands at 19.91). Furthermore, it lies 29.12% beneath its Common from over the past 5 years.

Along with the entire above, I want to spotlight that I see Altria as being in entrance of its peer group with regard to Profitability: whereas Altria has an EBITDA Margin of 60.79%, British American Tobacco’s (BTI) is 44.09%, Philip Morris Worldwide’s (PM) is 40.99%, and Imperial Manufacturers’ (OTCQX:IMBBY) (OTCQX:IMBBF) is 21.18%. These numbers clearly point out that Altria is probably the most interesting decide amongst its peer group with regards to Profitability.

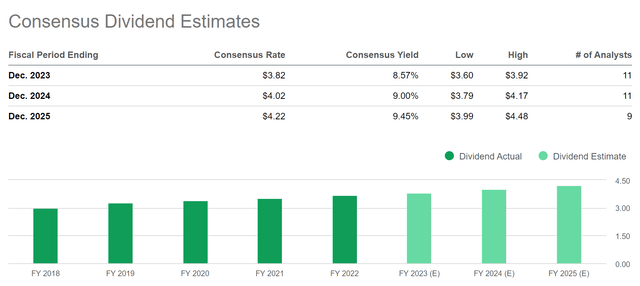

Consensus Dividend Estimates additional reinforce my perception that the corporate is a superb decide for dividend revenue buyers, which together with a gorgeous Dividend Yield, search Dividend Progress: the Consensus Yield stands at 8.57% for 2023, at 9.00% for 2024 and at 9.45% for 2025. These Consensus Dividend Estimates have additional contributed to me deciding on Altria as one among my high excessive dividend yield firms for this month of June.

Supply: Looking for Alpha

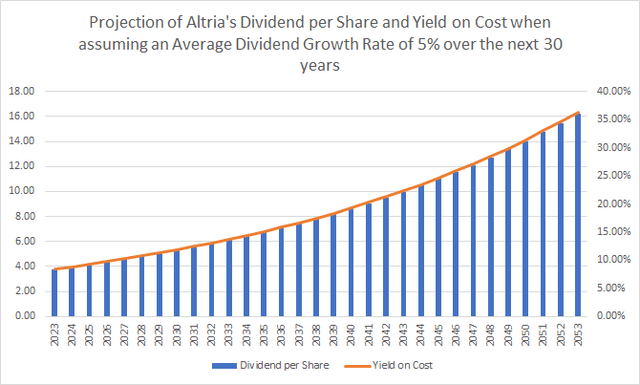

Projection of Altria’s Dividend and Yield on Value

The graphic beneath illustrates Altria’s Dividend and Yield on Value when assuming a Dividend Progress Price of 5% per yr on Common for the next 30 years. (I’ve chosen this Dividend Progress Price because it lies between its Common Dividend Progress Price [CAGR] of seven.18% over the previous 5 years and its Common Dividend Progress Price [CAGR] of three.86% over the previous 3 years.

Supply: The Writer

The graphic demonstrates that you can probably obtain a Yield on Value of 13.71% in 2033, of twenty-two.34% in 2043, and of 36.39% in 2053. These numbers assist my principle that Altria is an interesting decide for dividend revenue buyers.

Conclusion

I consider that firms which may give you a comparatively excessive dividend yield are necessary for any funding portfolio. That is significantly the case as they may also help you generate an additional revenue stream within the type of dividends.

On the similar time, by together with excessive dividend yield firms in your portfolio, you don’t have any have to promote shares so as to attempt to understand capital beneficial properties.

By investing in excessive dividend yield firms that additionally give you Dividend Progress, you possibly can steadily enhance your wealth by benefiting from repeatedly rising dividend funds from the businesses which are a part of your funding portfolio.

Altria and The Financial institution of Nova Scotia each have a gorgeous Dividend Yield [FWD] (8.42% and 6.37% respectively), have proven important Dividend Progress inside latest years (Dividend Progress Price [CAGR] of seven.18% and 4.38% over the previous 5 years), and at present have a gorgeous Valuation (P/E [FWD] Ratio of 9.12 and 9.68).

Subsequently, I consider each Altria and The Financial institution of Nova Scotia may enable you elevate the Weighted Common Dividend Yield of your portfolio whereas offering you with an extra stream of revenue which you’ll profit enormously from when having a protracted investment-horizon.

Writer’s Notice: I’d recognize your opinion on this text! For those who may solely select two excessive dividend yield firms for this month of June, which might you choose?