adventtr/E+ by way of Getty Pictures

Overview

The nascent electrical vertical takeoff and touchdown (eVTOL) plane market is receiving renewed consideration within the wake of current information stories and FAA releases. The dialog round this trade proper now’s one in every of progress and future integration of those small electrical plane into current transportation infrastructure. Excessive-profile FAA directors are placing their mark of approval on choose firms by pivoting their careers there in addition to taking up board seats.

Latest information ought to have probably the most vital impression on the 2 eVTOL frontrunners, firms which have steadily made progress on this early-stage market and proceed to carry forward of the pack. These are Joby Aviation (NYSE:JOBY) and Archer Aviation (NYSE:ACHR). Each have distinguished themselves by demonstrating market-leading ranges of progress on licensure and compliance for his or her eVTOL autos, though I’ll word that this course of is much from completed for both of them. They’re additionally comparatively well-capitalized and every has backing from distinguished traders.

When final I seemed, Joby and Archer have been roughly at parity by way of their progress throughout a number of crucial domains, together with product growth and buyer acquisition. Joby notably held the lead on Certification. Issues could have modified considerably during the last two quarters. Nonetheless, it nonetheless stands that these two are market leaders and warrant consideration aside from the remainder of the businesses within the area.

On this article, I’ll evaluation each of those corporations from a comparative lens, evaluating their relative efficiency throughout related monetary and enterprise metrics. This could set up a clearer image about who’s actually within the lead and who’s finest positioned to win on this rising aviation market.

Certification

The very first thing to check is how far alongside every of those firms is by way of getting their plane licensed by the Federal Aviation Administration. The FAA Certification course of is very rigorous and includes fulfilling 4 distinct units of regulatory necessities that cowl the kind, methodology of manufacturing, airworthiness, and operational standards of the plane being delivered to market. This compliance course of happens over the course of 5 phases, every of which depends on the earlier stage and thus have to be accomplished so as.

Joby Aviation continues to be within the lead in terms of certification and seems to have added room to its lead during the last two quarters. As of its newest quarterly report, Joby is properly into Stage 4 of the FAA Certification course of. At this stage, they’ve had their plane design accredited whereas additionally having completed submitting the means whereby they’ll take a look at it (Stage 3). Now at Stage 4, Joby is on the stage the place they’re actively operating assessments, together with the FAA, on manufacturing {hardware} (useful plane).

Archer Aviation is simply at Stage 3 of this course of, presently working to align itself with regulators on how finest to check its plane. It was delayed in its prior progress in direction of Stage 4 on account of regulatory shifts that affected the way it might want to construct its plane. This has resulted within the want for Archer to undergo a recertification course of for its G-1 (Stage 4) Certification, a course of which it’s nonetheless working via.

In the meanwhile, it appears to be like like Joby will seemingly be the primary eVTOL operator to get its planes licensed, which might be slated to happen about 2-3 quarters forward of Archer. Archer’s timeline may additionally change, nevertheless, as the top administrator of the FAA is near signing a contract to affix Archer. Assuming this rent occurs, it ought to make a distinction in serving to Archer regain momentum on its certification course of. Nonetheless, Joby has considerably extra traction proper now and likewise seems to have a greater cadence as to working with regulators. Finally, I anticipate this result in persist.

Financials

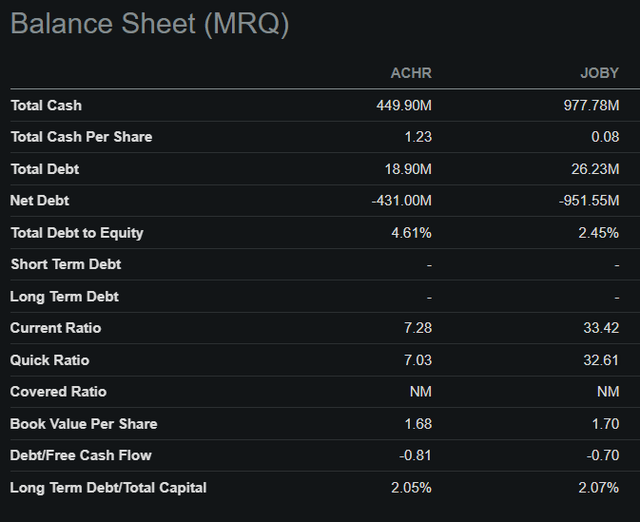

Having lined the place issues stand as to FAA Certification, we will now examine financials throughout these two firms. Neither firm has income in the meanwhile and have to be checked out as a startup nonetheless growing product-market match. Because of this we’re restricted to taking a look at these corporations’ steadiness sheets and respective capital buildings in an effort to decide the place they stand.

Because it stands, Joby has greater than double the money available that Archer does. Neither firm has an excessive amount of debt, each having relied totally on fairness financing thus far. Joby continues to be much less leveraged than Archer total and has superior leverage ratios. Ebook worth per share is basically similar throughout the 2, differing solely by $0.02. Because of this the corporations present roughly similar per-share margins of security in a liquidation situation, though I do not assume that ought to concern us at current.

In search of Alpha

General, the principle spotlight right here is that Joby has much more money than Archer. Whereas that is clearly a plus, Archer’s steadiness sheet additionally appears to be like wonderful. Neither agency is leveraged to any significant diploma, each have sturdy portions of money available, and each have maintained a constructive e book worth per share. If something, seeing these numbers provides me extra consolation in each of the businesses’ near-term ahead prospects.

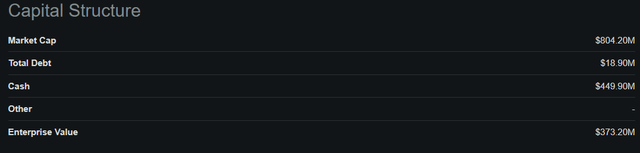

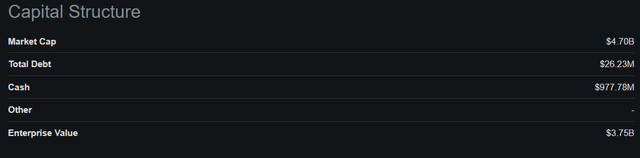

These wholesome steadiness sheets are mirrored within the capital construction for each firms. Joby is already a lot bigger than Archer, with a market cap of $4.7B in opposition to Archer’s $804.2M. Joby is roughly 5.8x the scale of Archer Aviation by way of market cap.

Archer Aviation

In search of Alpha

Joby Aviation

In search of Alpha

This has resulted in Joby buying and selling at a materially larger premium than Archer.

As of proper now, Joby has a 4.10 TTM value/e book ratio whereas Archer solely trades at a 1.93. This equation flips after we take a look at the 1 yr. ahead value/e book ratio for every. Joby trades at 4.02 whereas Archer trades at 4.26.

Given the restricted utility of the worth/e book ratio on this occasion, nevertheless, we aren’t in a position to deduce something about relative valuation. If something, we will conclude that each firms correctly replicate their per-share e book values for the 12 months forward, demonstrated by the small unfold between the ahead P/B a number of between the 2.

Probably the most informative metric now we have proper now’s every firm’s respective market capitalization. Given how a lot bigger Joby already is, it’s clear that the market has already priced it because the chief. I am unsure that it deserves to be this a lot bigger than Archer at a time when neither firm is doing any enterprise. Whereas some disparity could also be warranted, Joby being practically 6 occasions bigger at this stage appears speculative.

Dangers

The primary threat to those two corporations is being unable to get their companies off the bottom. This may occur for a number of causes, together with failed certification or operating out of cash. These two processes are associated as a result of an extended certification course of means an extended time with out getting a shot at income, rising the chance of burning via accessible sources with out making it to market. Whereas sturdy by way of their steadiness sheets, each firms should proceed to spend cash with out making it for the foreseeable future.

Moreover, these firms try to ascertain a wholly new shopper transportation market and will fail to take action. Whereas modes of journey similar to helicopters exist, eVTOL is distinct from helicopters and are anticipated to be far more financial, which in flip is anticipated to permit for a lot broader utilization amongst customers. This market may merely not exist within the type that these entrepreneurs consider.

There’s vital uncertainty right here, together with a extremely capital-intensive enterprise mannequin. Shopping for into these shares at this stage is a speculative and high-risk proposition.

Conclusion

I believe these shares are coming into a interval through which they might commerce properly and recognize on the idea of momentum and progress towards attending to market. The story of those two corporations is one in every of Modern expertise that’s designed to undergird a wholly new shopper transportation market. As these firms enhance of their profile and extra traders study them, I anticipate that their story will catch the attention of a bunch of traders which might be future believers in its enterprise. This might then create a span through which these shares generate vital returns, properly previous to the businesses even getting their merchandise into the market. This momentum commerce is my most well-liked method to commerce these shares for now. I might say that each are a purchase for a 6-month funding horizon.