Justin Sullivan

Roku, Inc. (NASDAQ:ROKU), a streaming distribution platform that produces streaming gadgets, audio merchandise, and ad-supported streaming providers has turn out to be one of many main gamers within the streaming gadgets market, competing with Apple TV, Amazon Fireplace TV, and Google Chromecast. Roku gadgets permit customers to entry varied on-line streaming providers, similar to Netflix, Disney+, Amazon Prime Video, and extra. Roku additionally has its personal streaming channel, which gives free and premium content material from totally different suppliers. The corporate makes cash from promoting {hardware}, promoting, and subscriptions. Roku has been witnessing a surge in its inventory worth not too long ago, pushed most likely by the brand new developments within the streaming trade such because the introduction of ad-based tiers by main streaming platforms. With the rising prevalence of advertising-supported video on demand (AVOD), Roku stands to learn considerably as a consequence of its reliance on promoting income. Going by latest earnings revision traits, I imagine Roku inventory will likely be extremely risky within the brief run and I’d not be stunned if ROKU sheds some latest beneficial properties within the coming months. Nevertheless, there are long-term development alternatives that stay to be explored.

Streaming And Advert Market Dynamics

The shift in direction of ad-based streaming has gained important momentum lately, pushed by varied components that point out a change in client habits and preferences. The linked TV advert market, specifically, has proven indicators of a rebound within the second quarter, sparking optimism amongst buyers. Moreover, the success of Netflix, Inc.’s (NFLX) “paid sharing” rollout and its rising advert enterprise has garnered constructive consideration.

The streaming market has reached new highs with nearly all of households now using not less than one over-the-top streaming service (OTT). This section, encompassing OTT, linked TV, and YouTube, continues to develop and presents ample alternatives for advertisers, even throughout an financial downturn. Amongst 18 to 43-year-olds, streaming TV accounts for not less than two-thirds of TV time spent viewing. Analysis performed by the Leichtman Analysis Group in 2023 signifies that 86% of U.S. households have subscribed to not less than one streaming video service from the highest fifteen Subscription Video On-Demand (SVOD) and direct-to-consumer (DTC) platforms.

The common client now subscribes to 2.8 streaming TV providers, with 10% of shoppers paying for greater than 5 providers concurrently. This proliferation of streaming providers has led to elevated competitors and rising prices. Consequently, shoppers are re-evaluating their spending habits, notably as a consequence of inflationary pressures. In consequence, the adoption of AVOD platforms is poised to extend. Deloitte International’s TMT Predictions 2023 forecasts that almost two-thirds of shoppers in developed international locations will use not less than one ad-supported service month-to-month by the top of the 12 months, representing a 5% improve from the earlier 12 months.

Main SVOD providers in developed markets are anticipated to introduce ad-supported tiers alongside their current ad-free choices to deal with this evolving panorama and client calls for. By the top of 2024, half of those suppliers are projected to supply a free, ad-supported streaming TV service. This transition displays the understanding that the absolutely ad-free expertise has turn out to be pricey for shoppers, notably as a result of must-watch content material is unfold throughout a number of platforms.

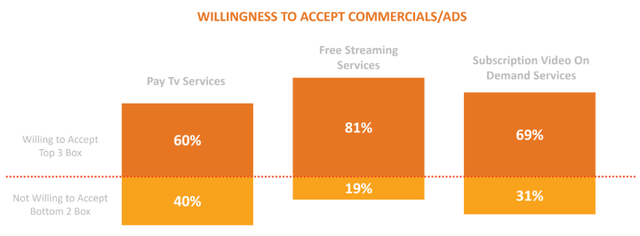

The expansion of linked TV advert spend is a testomony to the rising recognition of ad-based streaming. In 2022, CTV advert spending rose by 33%, reaching $18.9 billion. This accounted for over two-thirds of U.S. upfront digital promoting spending. The trajectory signifies a rising acceptance amongst shoppers for ads in trade for entry to streaming content material. A survey performed by Magid reveals that 81% of free streaming service subscribers and 69% of SVOD subscribers are prepared to just accept commercials in trade for entry to premium content material.

Exhibit 1: Willingness to just accept commercials

CTAM

Wanting forward, the worldwide subscription streaming providers panorama is predicted to include ad-funded fashions to cater to various client preferences and financial issues. By 2030, most on-line video service subscriptions are anticipated to be partially or fully ad-funded, mirroring the long-standing pattern in rising markets the place ad-funded video-on-demand has been the norm. This transition, in my view, will create a degree enjoying discipline for Roku to compete with not simply streaming system producers but additionally premium streaming providers.

Roku’s Benefits In The Advert House

Roku, a outstanding participant within the streaming trade, holds a big benefit within the advert area because of the widespread adoption of advert merchandise by main streaming platforms. The corporate derives a considerable portion of its income from promoting and secures 30% of its advert stock from its streaming companions. Within the first quarter of 2023, Roku exceeded analyst expectations by gaining 1.6 million lively streaming accounts, surpassing Wall Avenue’s projections.

Whereas viewing hours on conventional TV within the U.S. skilled a ten% year-over-year decline, the Roku platform witnessed substantial development, with international streaming hours rising by 20% year-over-year. This was a notable improvement for Roku as platform customers streamed a complete of 25.1 billion hours within the first three months of 2023. This translated right into a record-breaking 3.9 streaming hours per lively account per day, demonstrating the platform’s sturdy engagement, person loyalty, and increasing monetization alternatives.

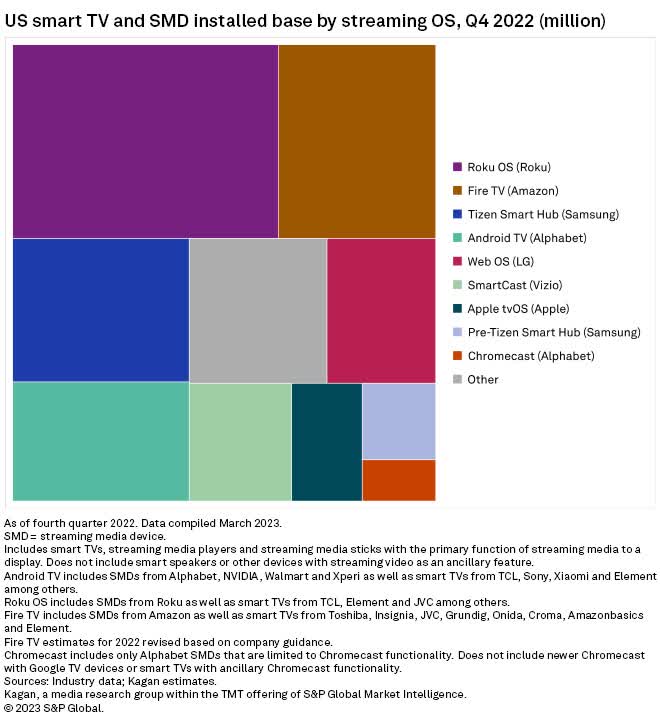

Moreover, Roku’s sturdy efficiency within the sensible TV market displays its skill to ship worth and a superior person expertise to shoppers. In Q1, the Roku working system maintained its place because the main sensible TV OS within the U.S., capturing a powerful 43% of TV unit share. This achievement surpassed the mixed market share of the following three largest TV working programs. Notably, Roku skilled year-over-year share beneficial properties throughout varied TV display sizes, notably within the larger-screen section, indicating the widespread attraction of its platform.

Exhibit 2: U.S. sensible TV put in base by streaming OS

S&P International

The success of Roku’s OS prolonged past the U.S. market within the first quarter. In Mexico, the Roku OS was as soon as once more the top-selling sensible TV OS for the second consecutive quarter, whereas in Germany, Roku expanded its TV program with the addition of Coocaa as its third TV OEM companion. With over 20 licensed Roku TV companions worldwide, the corporate’s TV program continues to ship wonderful outcomes and additional solidifies its market place.

Roku’s entry into manufacturing its personal TVs with the Roku Choose and Roku Plus Collection has been met with constructive reception. These Roku-branded TVs, accessible solely at Greatest Purchase, supply a spread of fashions with varied sizes and superior options similar to QLED Expertise, 4K Dolby Imaginative and prescient Image, and the Roku Voice Distant Professional. The mix of Roku’s experience in {hardware}, intuitive TV software program, and connectivity has resonated with shoppers searching for worth, simplicity, and selection of their TV expertise. The popularity acquired from trade specialists, together with Tom’s Information, TechHive, and Yahoo, additional highlights the standard and attraction of Roku-branded TVs.

Past {hardware}, Roku’s software program improvements and content material partnerships have garnered acclaim. Quick Firm acknowledged Roku as one of many Most Progressive Corporations for 2023, acknowledging the corporate’s developments in each {hardware} and software program, such because the Roku Voice Distant Professional and content material choices on The Roku Channel. Leveraging its intensive platform scale and person engagement, The Roku Channel has witnessed exceptional development in streaming hours, with a 65% year-over-year improve in Q1. Sustaining its place among the many top-five channels on the platform, The Roku Channel continues to be a preferred selection for viewers, solidifying Roku’s presence within the streaming market.

Roku continues to develop its partnerships and choices, solidifying its place as a number one streaming platform. One in all its notable collaborations is with Instacart, the web procuring service, geared toward serving to consumer-packaged items advertisers measure the influence of their adverts on Roku by monitoring client purchases on Instacart. This partnership demonstrates Roku’s dedication to offering advertisers with worthwhile insights into the effectiveness of their promoting campaigns and the flexibility to attach advert publicity to real-world client habits.

Along with the Instacart partnership, Roku additionally introduced a big partnership with TelevisaUnivision, the world’s main Spanish-language media and content material firm. As a part of this collaboration, ViX’s premium tier, providing an enormous library of Spanish-language content material throughout varied genres, turned accessible on Roku’s lineup of Premium Subscriptions. This transfer enhances Roku’s attraction to Spanish-speaking audiences and additional expands its content material choices to cater to various viewer preferences.

Moreover, Roku unveiled its groundbreaking Roku Metropolis Neighborhoods, with Paramount+ changing into the primary leisure model to launch a customized neighborhood. These city-themed experiences throughout the Roku platform create an immersive and fascinating setting for viewers, that includes brand-specific buildings, visuals, and locations. By integrating manufacturers into the streaming expertise, Roku enhances model visibility and supplies advertisers with a possibility to captivate viewers from the second they begin their streaming session.

These strategic partnerships and initiatives showcase Roku’s dedication to delivering modern promoting options and enhancing the streaming expertise for each viewers and advertisers. By specializing in measuring advert effectiveness, increasing content material choices, and creating immersive model experiences, Roku is constructing on its place as a dominant drive within the streaming trade.

Challenges

Roku faces a number of challenges within the evolving promoting panorama, regardless of experiencing elevated engagement on its platform. Within the first quarter, the corporate noticed a 1% decline in Platform income, which encompasses varied income streams similar to advert gross sales, streaming service distribution, and Roku Pay. This decline may be attributed to the difficult macro setting, with the entire U.S. promoting market experiencing a 7.4% year-over-year decline. Conventional TV advert spending was much more adversely affected, with a 12.7% year-over-year decline, and conventional TV advert scatter dropped by 20%.

Though some verticals, like journey and well being and wellness, confirmed enchancment in advert spending on the Roku platform, verticals similar to monetary providers and media and leisure remained underneath strain. The corporate stays cautious in regards to the future, anticipating macro uncertainties to persist all through 2023. Shoppers are dealing with inflation and recessionary considerations, resulting in restricted discretionary spending. The corporate expects to return to profitability in 2024.

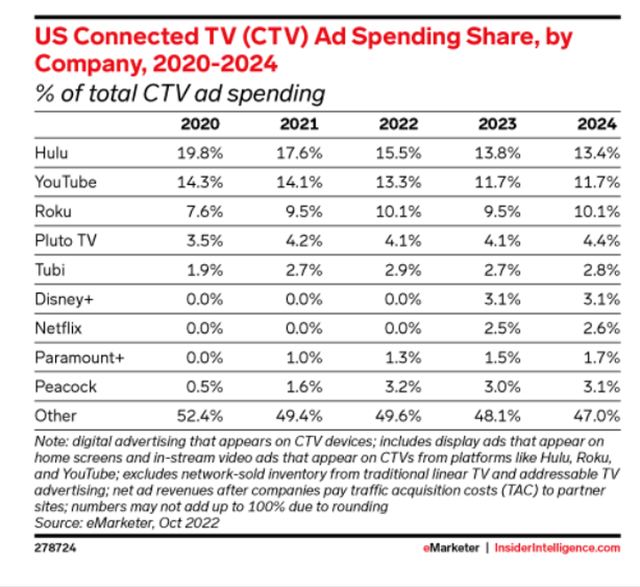

Regardless of Roku, Hulu, and YouTube accounting for nearly half of the U.S. CTV advert market earlier than the pandemic, their mixed share is predicted to say no to roughly one-third of the $26.92 billion CTV advert spend in 2023. This means a big growth of the CTV market and elevated competitors from different gamers.

Exhibit 3: U.S. linked TV advert spending share

eMarketer

Roku buyers must intently monitor the aggressive panorama on this trade to determine inflection factors.

Development Alternatives Amid The Anticipated Restoration Of The Advert Market

Roku’s enterprise mannequin, which revolves round {hardware} gross sales and monetizing its platform by promoting, has confronted challenges in latest instances as a consequence of a slowdown within the digital advert market. Tightening advertising and marketing budgets and diminished advert spending has impacted the corporate’s promoting income. Nevertheless, there are promising indicators of restoration on the horizon, as the worldwide financial system is anticipated to enhance within the second half of 2023. Roku, with its sturdy person acquisition monitor file and increasing worldwide presence, is well-positioned to capitalize on the anticipated restoration within the advert market.

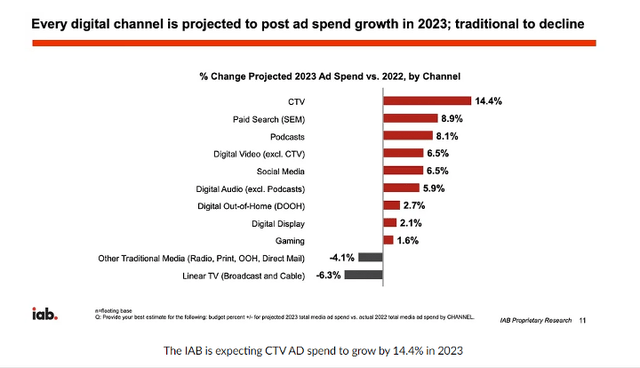

Whereas 2023 might not be a 12 months of serious development for advert budgets, forecasts recommend that the digital promoting panorama will progressively rebound. Digital advert spending worldwide is projected to extend by round 5%-9% in 2023, nonetheless decrease than projected development charges in 2022. The CTV market, specifically, is predicted to develop quicker than the general promoting market, with a forecasted development fee of 14.4% in 2023. This presents a possibility for Roku, given its place because the main sensible TV working system which makes it attainable to seize a considerable share of the CTV advert market.

Exhibit 4: Projected advert spending development by class

IAB

Investing in Roku will give buyers publicity to each the digital promoting market and the worldwide streaming market, which makes ROKU an fascinating decide for buyers who’re bullish on the restoration of those two enterprise sectors.

Takeaway

Regardless of the challenges confronted by the digital advert market in latest instances, Roku is well-positioned to capitalize on the anticipated restoration of this market. With the corporate’s sturdy monitor file of person acquisition, and advertisers shifting focus towards streaming platforms, Roku’s platform section holds important potential for monetization. Whereas competitors within the streaming video trade stays fierce, Roku’s distinctive mixture of streaming expertise and promoting platform units it aside from its opponents. On condition that subsequent fiscal 12 months’s earnings estimates have trended decrease within the final three months, I anticipate ROKU inventory to offer again a few of its latest beneficial properties within the coming months, which could create a possibility to spend money on Roku at a greater valuation.