Kwarkot

Focus of Article:

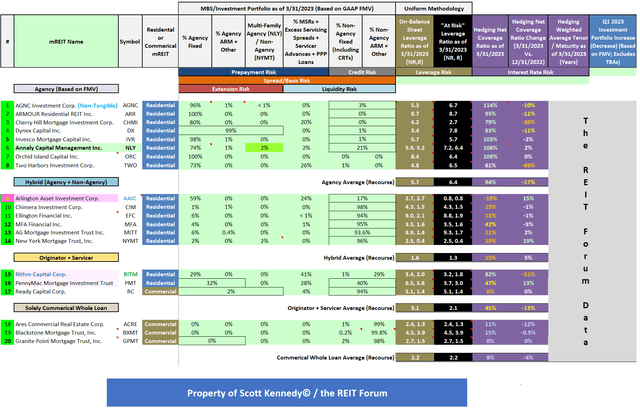

The main focus of half 1 of this text is to research Annaly Capital Administration Inc.’s (NYSE:NLY) current outcomes and examine a number of of the corporate’s metrics to 19 mortgage actual property funding belief (mREIT) friends. This evaluation will present previous and present knowledge with supporting documentation inside 4 tables. Desk 1a will examine NLY’s mortgage-backed securities (“MBS”)/funding composition, current leverage, hedging protection ratio, and alter in funding portfolio dimension to the 19 mREIT friends. Desk 1b will examine NLY’s BV, financial return (loss), and premium (low cost) to estimated present BV utilizing inventory costs as of 6/9/2023 to the 19 mREIT friends. Desk 2 will present a quarterly compositional evaluation of NLY’s company MBS portfolio whereas Desk 3 will present the corporate’s current hedging protection ratio over the prior 5 quarters (solely contributor/staff to present steady detailed hedging metrics).

I am penning this two-part article as a result of continued requests that such an evaluation be particularly carried out on NLY vs. its mREIT friends at periodic intervals. This text additionally discusses the significance of understanding the composition of NLY’s MBS/funding and derivatives portfolios concerning projecting the corporate’s future quarterly outcomes as rates of interest/yields fluctuate. Understanding the traits of an organization’s MBS/funding and derivatives portfolios can shed some gentle on which firms are overvalued or undervalued strictly per a “numbers” evaluation. This isn’t the one knowledge that ought to be examined to provoke a place inside a selected inventory/sector. Nonetheless, I imagine this evaluation is an efficient “start line” to start a dialogue on the subject.

On the finish of this text, there shall be a conclusion concerning the next comparisons between NLY and the 19 mREIT friends: 1) trailing 24-month financial return (loss); 2) leverage as of three/31/2023; 3) hedging protection ratio as of three/31/2023; and 4) premium (low cost) to my estimated CURRENT BV (BV as of 6/9/2023). My BUY, SELL, or HOLD advice and up to date value goal for NLY shall be within the “Conclusions Drawn” part of this text. This consists of offering a listing of the mREIT shares I presently imagine are undervalued (a purchase advice), overvalued (a promote advice), or appropriately valued (a maintain advice).

Overview of A number of Classifications inside the mREIT Sector:

I imagine there are a number of totally different classifications in terms of mREIT firms. For functions of this text, I am specializing in 4. It ought to be famous in gentle of a number of prior acquisitions and sure adjustments in general funding methods, some mREIT firms have minor-modest sub-portfolios outdoors every entity’s fundamental focus. Nonetheless, I’ve continued to group sure mREIT firms in every entity’s fundamental classification for functions of this text. Some market individuals (and even some mREIT firms) have totally different classifications when in comparison with Desk 1a. Some market individuals/firms base classifications on the share of capital deployed in every entity’s funding portfolio. Nonetheless, my choice is to base an organization’s classification on the financial “truthful market worth” (“FMV”) of every underlying portfolio which, for a truth, is what drives valuation fluctuations. In my skilled opinion, there is not any “uniform” methodology in terms of classifying mREIT firms however extra of an underlying choice. Readers ought to perceive this because the evaluation is offered under.

First, there are mREIT firms that earn a majority of earnings from investing in fixed-rate company MBS holdings. These investments consist of economic/residential MBS, collateralized mortgage obligations (“CMO”), and company debentures for which the principal and curiosity funds are assured by government-sponsored enterprises/entities (“GSE”). That is extraordinarily essential to grasp (particularly when markets incorrectly priced on this notion on the onset of COVID-19 in early 2020). Since these investments usually have increased durations vs. most different investments inside the broader mREIT sector, firms inside this classification usually make the most of increased hedging protection ratios in occasions of rising mortgage rates of interest/U.S. Treasury yields (or a projected rise over the foreseeable future). NLY, AGNC Funding Corp. (AGNC), ARMOUR Residential REIT Inc. (ARR), Cherry Hill Mortgage Funding Corp. (CHMI), Dynex Capital Inc. (DX), Invesco Mortgage Capital Inc. (IVR) (moved to an company mREIT again in 2020), Orchid Island Capital Inc. (ORC), and Two Harbors Funding Corp. (TWO) are presently labeled as a fixed-rate company mREIT. Out of those eight company mREITs, presently CHMI and TWO have a big mortgage servicing rights (“MSR”) sub-portfolio as nicely.

Second, there are mREIT firms that earn various parts of earnings from investing in company MBS holdings, non-agency MBS holdings, different securitizations, and non-securitized mortgage-related debt and fairness investments (together with residential entire loans/properties). This kind of firm is called a “hybrid” mREIT. With regard to non-agency MBS, this consists of (however is just not restricted to) Alt-A, prime, subprime, and re/non-performing loans the place the principal and curiosity should not assured by a GSE. Since there isn’t a “authorities assure” on the principal or curiosity funds of non-agency MBS and residential entire loans (or rental earnings on properties), coupons are usually increased when in comparison with company MBS of an analogous maturity. Nonetheless, borrowing prices (together with repurchase agreements) for these particular investments are also increased (no authorities assure; credit score threat). As a result of refined but identifiable variations between company and non-agency MBS/residential entire loans/properties, I wish to differentiate between an company and a hybrid mREIT firm. Since there’s credit score threat in terms of non-agency MBS and residential entire loans/properties, leverage ratios are usually decrease when investing in these securitizations/investments when in comparison with company MBS (even when credit score threat stays low). Arlington Asset Funding Corp. (AAIC), Chimera Funding Corp. (CIM), Ellington Monetary Inc. (EFC) (transformed to a REIT in 2019), MFA Monetary Inc. (MFA), AG Mortgage Funding Belief Inc. (MITT), and New York Mortgage Belief Inc. (NYMT) are presently labeled as hybrid mREITs. It ought to be famous, throughout July 2022, AAIC was moved from a fixed-rate company mREIT to a hybrid mREIT as a result of firm’s current gradual shift away from fixed-rate company MBS right into a larger proportion of non-agency MBS, non-securitized mortgage-related investments, and mortgage servicing rights (“MSR”) financing receivables. AAIC exited the corporate’s single-family residential (“SFR”) sub-portfolio late final 12 months.

Third, there are mREIT firms that spend money on (however should not restricted to) a mix of company MBS, non-agency MBS, credit score threat transfers (“CRT”), different mortgage-related investments (together with direct originations of mortgages and/or correspondent manufacturing), non-securitized debt investments (together with residential, multifamily, and business loans), and MSRs. There are also mREIT firms which have underlying subsidiaries who originate mortgage-related/debt merchandise. I presently imagine Rithm Capital Corp. (RITM), PennyMac Mortgage Funding Belief (PMT), and Prepared Capital Corp. (RC) ought to be labeled as an “originator and servicer” mREIT. Since RITM and PMT presently have at the least a modest portion of the corporate’s funding portfolio in MSR and MSR-related investments, which act as an “oblique” hedge (the identical will be mentioned concerning curiosity solely [IO] securities), these firms don’t must make the most of as excessive of a hedging protection ratio when in comparison with the company mREIT sub-sector (some might even argue to not have spinoff devices in place; if something, “contra” hedges to counter a drop in charges/yields). Oblique hedges should not calculated inside every firm’s hedging protection ratio inside this evaluation (not the primary function of those investments). As I’ve identified previously, these investments truly profit, from a valuation standpoint, in a rising rate of interest setting as prepayment threat (and in a majority of eventualities credit score threat) decreases whereas there is a rise in projected future discounted money flows (and vice versa).

Lastly, there are mREIT firms that mainly solely spend money on non-securitized, business entire loans with underlying collateral (actual property) tied to workplaces, multifamily items, resorts, retail shops, industrial complexes, and different miscellaneous varieties of properties. Concerning the three business entire mortgage mREIT friends I presently cowl, Ares Business Actual Property Corp. (ACRE), Blackstone Mortgage Belief, Inc. (BXMT) and Granite Level Mortgage Belief Inc. (GPMT), these firms usually originate/spend money on variable-rate, interest-only senior secured (usually first lien) debt. Since ACRE, BXMT, and GPMT all had 98%+ of its funding portfolio in variable-rate debt as of three/31/2023, these firms presently don’t must make the most of a excessive hedging protection ratio (some might even argue to not have spinoff devices in place; LIBOR flooring are substitute as nicely). That is the primary quarter I/we’re offering full protection of ACRE.

Now allow us to begin the comparative evaluation between NLY and the 19 mREIT friends.

Leverage, Hedging Protection Ratio, BV, Financial Return (Loss), and Premium (Low cost) to Estimated Present BV Evaluation – Overview:

Allow us to begin this evaluation by first getting accustomed to the data offered in Desk 1a and 1b under. This shall be useful when explaining how NLY compares to the 19 mREIT friends regarding the metrics said earlier.

Desk 1a – mREIT Asset Composition, Leverage, Hedging Protection Ratio, and Change in Funding Portfolio Measurement

The REIT Discussion board (Supply: Desk created by me, calculating asset compositions, leverage, and hedging protection ratios from knowledge offered by the SEC’s EDGAR Database.)

Desk 1a above supplies the next info on NLY and the 19 mREIT friends (see every corresponding column): 1) generalized MBS/funding portfolio composition as of three/31/2023; 2) on-balance sheet leverage ratio as of three/31/2023; 3) at-risk (whole) leverage ratio as of three/31/2023; 4) hedging protection ratio as of three/31/2023; 5) quarterly change in hedging protection ratio (3/31/2023 versus 12/31/2022); 6) hedging weighted common tenor/maturity; and seven) change in funding portfolio dimension (excludes off-balance sheet transactions). Some readers could discover some mREIT friends have “two units” of leverage ratios. That is as a result of truth I escape each non-recourse and recourse leverage. Inside the two units of leverage ratios inside one column, recourse leverage ratios are represented by the decrease determine on the right-hand facet and are deemed extra essential.

Desk 1b – BV, Financial Return (Loss), and Premium (Low cost) to Estimated Present BV Evaluation

The REIT Discussion board (Supply: Desk created by me, acquiring historic inventory costs from Nasdaq and every firm’s 12/31/2022 and three/31/2023 BV per share figures from the SEC’s EDGAR Database [link provided below Table 1a])

Desk 1b above supplies the next info on NLY and the 19 mREIT friends (see every corresponding column): 1) BV per share on the finish of the fourth quarter of 2022; 2) BV per share on the finish of the primary quarter of 2023; 3) BV per share change throughout the first quarter of 2023 (share); 4) financial return (loss) (change in BV and dividends accrued for/paid) throughout the first quarter of 2023 (share); 5) financial return (loss) throughout the trailing 24-months (share); 6) my estimated CURRENT BV per share (BV as of 6/9/2023); 7) inventory value as of 6/9/2023; 8) 6/9/2023 premium (low cost) to my estimated CURRENT BV (share); 9) 2/21/2020 valuation evaluation (pre market sell-off resulting from coronavirus [COVID-19]); 10) 4/3/2020 valuation evaluation (submit majority of market sell-off resulting from COVID-19); 11) 6/11/2021 valuation evaluation (submit majority of market rally resulting from COVID-19 epidemic and previous to extra “hawkish” rate of interest and financial coverage rhetoric);and 12) 6/9/2023 valuation evaluation.

Evaluation of NLY:

As of three/31/2023, NLY’s funding portfolio consisted of 74% and 1% fixed- and variable-rate company MBS holdings, respectively (based mostly on FMV). When in comparison with 12/31/2022, NLY’s share of fixed- and variable-rate company MBS remained unchanged. NLY additionally had 2% allotted to each multifamily company MBS and MSR investments, respectively. When calculated, each sub-sectors additionally remained unchanged. Lastly, NLY continued to spend money on non-agency MBS and non-MBS holdings which accounted for 21% of the corporate’s funding portfolio steadiness as of three/31/2023 which was additionally unchanged. This included NLY’s investments in most popular fairness, company debt, residential entire loans, and seniors housing. In the course of the first quarter of 2023, NLY mainly expanded all sub-portfolios to a proportionately comparable quantity when in comparison with allocations as of 12/31/2022. NLY mainly offered the corporate’s complete business actual property sub-portfolio to Slate Asset Administration L.P. (“Slate”) for $2.33 billion. This sale closed/was finalized throughout the third quarter of 2021. NLY’s center market lending portfolio was pretty not too long ago offered to Ares Administration Corp. (ARES) for roughly $2.4 billion. ARES (together with all subsidiaries) is the exterior supervisor of one other inventory I cowl, Ares Capital Corp. (ARCC). This sale closed throughout the second quarter of 2022.

Utilizing Desk 1a above as a reference, when excluding borrowings collateralized by property held in “securitization trusts” (non-recourse debt), NLY had an on-balance sheet leverage ratio of 5.2x whereas the corporate’s at-risk (whole) leverage ratio, when together with its off-balance sheet web lengthy “to-be-announced” (“TBA”) MBS place, was 6.4x as of three/31/2023. NLY had an on-balance sheet and at-risk (whole) leverage ratio of 5.4x and 6.3x as of 12/31/2022, respectively. As such, NLY very barely decreased the corporate’s on-balance sheet leverage throughout the first quarter of 2023 whereas very barely growing its at-risk (whole) leverage. This was primarily resulting from a minor-modest enhance in NLY’s funding portfolio dimension and a minor-modest enhance in whole fairness as a result of firm’s “at-the-market” (“ATM”) frequent inventory fairness choices throughout the quarter.

As of three/31/2023, NLY had the third highest at-risk (whole) leverage ratio when in comparison with the seven different company mREIT sub-sector friends inside this evaluation. As a result of notable impacts from the COVID-19 pandemic to the mREIT sector when it got here to the fast “spike” in leverage and liquidity threat (rising credit score threat extra of a longer-term impression concerning all non-agency investments), outdoors the business entire mortgage mREIT friends (BXMT and GPMT), all sector friends I presently cowl had varied methods at play when it got here to funding portfolio composition and threat administration methods. Even when a number of mREIT friends had very comparable MBS/mortgage-related investments, 2020 methods notably differed from company-to-company. Straight depending on the quantity/share of margins calls on sure excellent borrowings (and the underlying investments pledged as collateral) and spinoff devices, most mREIT friends had a notable change in 2020 leverage ratios. Resulting from NLY’s general dimension and asset composition, this firm was not “pressured” to de-lever to the identical extent as among the smaller-capitalized company mREIT friends (extra “cushion” when it got here to its current capital base).

Beforehand, administration implied NLY had a reasonably “defensive posture” with regard to leverage throughout 2017 – 2018 as a result of threat of widening spreads/decrease MBS costs as Fed financial coverage dictated broader market dynamics (particularly, the Fed Funds Fee and the Fed Reserve’s non-reinvestment of U.S. Treasuries and company MBS). Nonetheless, with the Fed’s extra “dovish” rhetoric in 2019 concerning U.S. financial coverage over the foreseeable future, I beforehand appropriately anticipated NLY would enhance leverage which was in keeping with company mREIT sector traits as web spreads narrowed. This benefited most mREIT friends throughout late 2019.

Nonetheless, this led to extra extreme BV declines throughout the first quarter of 2020 when the COVID-19 “pandemic panic” occurred throughout all monetary markets (particularly March). This was partially offset throughout the second quarter of 2020 as MBS pricing/valuations (and most different mortgage-related investments outdoors some CMBS and business entire loans) rebounded in value/valuation as monetary panic/stress eased (primarily as a result of Fed’s swift response concerning monetary help and financial coverage). This normal development continued into the third and fourth quarters of 2020 as broader market pricing/valuations (outdoors remoted pockets) rebounded additional. As such, most mREIT friends reported BV will increase throughout the third and fourth quarters of 2020 (together with NLY).

In the course of the first quarter of 2021, despite the fact that extreme company MBS value decreases occurred inside decrease coupons, spreads notably tightened when in comparison with most spinoff devices which led to outperformance inside sure company mREIT friends (and broader sector friends) who utilized increased hedging protection ratios (particularly with increased period hedges). Nonetheless, throughout the second quarter of 2021, I imagine markets lastly began to start pricing within the eventual announcement of the Federal Open Market Committee’s (“FOMC”) finish to its asset tapering program and eventual enhance within the Fed Funds Fee. Keep in mind, the market is all the time “ahead considering” in its processes. As such, hypothesis seemed to be on the rise for my part. The Fed was beforehand buying $80 billion of U.S. Treasury securities and $40 billion in company MBS every month. This worry/hypothesis instantly resulted in a widening of spreads inside fixed-rate company MBS relative to spinoff instrument valuations throughout the summer time of 2021 (enhance in unfold/foundation threat).

In the course of the first two weeks of June 2021, together with the primary couple weeks of July 2021, markets skilled a modest widening of spreads between most company MBS coupons (together with specified swimming pools) versus rate of interest payer swaps, web (brief) U.S. Treasury securities, and Eurodollar futures.As such, spinoff valuation decreases “trumped,” in mainly all coupons and traits, MBS value fluctuations. Merely put, this negatively impacted BVs inside the company mREIT sub-sector (and to a lesser diploma different mREIT friends who spend money on company MBS and make the most of spinoff devices designed to fight rate of interest threat) throughout the second quarter of 2021.This development continued into July-August 2021 to some extent (simply not as extreme). A few of this threat briefly abated in September-October 2021 however “re-announced itself” starting in November 2021. This 2022 rise in unfold/foundation threat was beforehand appropriately anticipated and constantly identified to subscribers of the REIT Discussion board throughout 2021. That is essential to grasp. I imagine this was primarily the results of financial indicators/stories exhibiting robust inflationary knowledge. Usually, robust inflationary knowledge leads to a rise to charges/yields as we noticed in September 2021 and once more in early November 2021.

Transferring to extra very late 2021-early 2022 traits, FOMC Chairman Powell said there was robust knowledge to quicken the Fed’s asset tapering program resulting from robust inflationary knowledge (primarily by way of the Shopper Worth Index; CPI). This led to a quicker “lift-off” of the Fed Funds Fee vs. earlier 2020-2021 expectations. This was a little bit of a “curveball” for markets as this was a brand new Fed narrative. The change in financial coverage instantly impacted the shorter-end of the yield curve with all charges/yields with 1-, 2-, and -3-year maturities modestly growing throughout the second half of 2021. This narrative “shifted” the timing for the each the tip of the Fed’s quantitative easing program (“QE4”) and the “lift-off” of the Fed Funds Fee. As a substitute of the Fed’s asset tapering program ending in June 2022, occasions “pegged” QE4 to finish by March 2022 (3 months earlier). This was all however confirmed by Mr. Powell throughout his press convention after the FOMC’s December 2021 and January 2022 conferences. This, in flip, led to market individuals accelerating the dates for when the Fed Funds Fee will enhance from its 0-25 foundation level (“bp”) vary (and a number of subsequent raises).

As international economies sporadically opened again up for enterprise throughout 2022, shopper demand for all types of products shortly elevated. Nonetheless, pockets of the globe continued to expertise the direct impression of the COVID 19 pandemic by way of sporadic shutdowns which notably disrupted provide chains. Merely put, this was one of many main components to speedy value will increase (fundamental provide and demand reasoning) in a big selection of products; together with a “aggressive” labor power which needed stronger wage value hikes. Many companies had little or no selection however to provide in essentially the most calls for. This cycle mainly brought about a “snowball” impact which has instantly led to the pretty current 40-year excessive inflation. In direct response to this worrying inflationary knowledge, the FOMC elevated the Fed Funds price by 50, 75, 75, 75, 75, and 50 bps in Might, June, July, September, November, and December 2022.

Up to now, throughout 2023, the FOMC elevated the Fed Funds price by 25 bps in early February (technically the January assembly), March, and Might 2023. My private projection is the Fed Funds Fee shall be in a variety of 5.00% – 5.50% by December 2023. That is additionally my projection for the Fed Funds “terminal” price (plateau) this mountaineering cycle. This projection is unchanged when in comparison with final quarter’s evaluation.

Bringing this again to the inventory market, this has not too long ago brought about a notable enhance in borrowing prices all through monetary markets. I imagine portion (however not all) of this enhance was “baked” into monetary markets. Nonetheless, this has (and can proceed) put some stress on monetary markets/fairness valuations/multiples in my skilled opinion. Final quarter, we witnessed what occurred when Silicon Valley Financial institution Monetary Group (“SIVB”) shortly bumped into hassle instantly resulting from depressed asset pricing, poor rate of interest/threat administration, and a run on deposits (a easy point out right here ought to suffice). As such, even outdoors this particular and normal sector occasion (regional banks), some normal warning stays warranted concerning inventory market efficiency as an entire. I imagine the primary half of 2022 was an ideal instance concerning how markets will usually react to the notion of rising rates of interest on the whole (decrease market multiples; particularly in excessive progress sectors like know-how). One thing I/we’ve got identified because the summer time of 2021.

Rising short-term rates of interest have not too long ago had a rising detrimental impression on repurchase (“repo”) settlement borrowing prices, particularly on company MBS. Common company MBS repo charges remained in a good vary of 0.10%-0.25% from the spring of 2020 – early 2022. Extra not too long ago, “spot”/present company MBS repo charges are north of 5.00%. As a the rest, there is a very robust, direct relationship between the Fed Funds Fee and company repo settlement charges. As such, the current accelerated Fed Funds Fee timeline have brought about modestly – notably increased company repo settlement charges throughout late 2022 – early 2023. Nonetheless, there has (and can possible proceed to be) some “reduction” on conditional/fixed prepayment charges (“CPR”) which might result in decrease premium amortization expense which might assist alleviate rising borrowing prices from a web unfold perspective. In truth, markets are already experiencing a rising proportion of mortgage-related investments buying and selling under par which technically switches premium amortization expense to low cost accretion earnings (on new purchases). Moreover, with possible company MBS value decreases and better accessible coupons with new provide, new purchases would possible have a greater general yield versus purchases throughout 2020-2021. Corporations who “locked in” some very low-low rate of interest payer swaps/swaptions would additionally report much less of an expense/extra earnings with rising short-term rates of interest for a while.

So, there was 2022 stress on most mREIT BVs (and a few earnings) however an EVENTUAL GRADUAL enhancement to most peer’s earnings; particularly for company mREITs (so long as administration groups appropriately formulate and act upon an accurate funding and spinoff portfolio methods) ought to happen. We’re NOT there but so readers need to be affected person. As I’ve all the time said, the mREIT enterprise mannequin is all the time a balancing act. Administration groups simply need to appropriately determine which kind of financial cycle is more likely to happen over the foreseeable future and arrange methods to each mitigate threat and speed up earnings. Every firm’s prospects are factored into mREIT’s advice ranges and normal threat ranking.

Tying this development again to unfold/foundation threat, wider spreads continued throughout most of January-early Might 2022. These actions had been instantly in relation to U.S. short- intermediate-term monetary coverage. Might-very early June 2022 skilled a brief “plateau” in unfold/foundation risok which was an encouraging signal (particularly in terms of the company mREIT enterprise mannequin). That mentioned, on the time, I beforehand appropriately projected we weren’t out of the woods but with unfold/foundation threat concerning the mREIT enterprise mannequin. I said spreads will stay beneath stress with the FOMC/Fed financial coverage and financial indicators equivalent to value indices and shopper sentiment surveys (which instantly impacts the FOMC’s/Fed’s Fed Funds Fee selections). Additionally, the entire Russia/Ukraine state of affairs has added to market uncertainty/volatility and spurs international inflation; most notably sure agriculture merchandise (particularly, however not restricted to, wheat). Once more, we anticipate this “ebb and circulate” will proceed for a while. Unfold/Foundation threat abated some throughout July 2022 which was encouraging. Nonetheless, unfold/foundation threat shortly elevated, as soon as once more, throughout August-October 2022.

In the course of the second week in November 2022, spreads shortly, and notably, tightened. This momentum continued heading into early December 2022, paused the rest of December, however notably picked again up throughout January 2023.Nonetheless, BV beneficial properties throughout January 2023 have largely “evaporated” throughout February – early March 2023. Most sector BVs moved decrease throughout April – Might 2023 however have partially rebounded the previous 2 weeks (early June 2023).

Transferring on, NLY had a BV of $20.79 per frequent share on the finish of the fourth quarter of 2022. NLY had a BV of $20.77 per frequent share on the finish of the primary quarter of 2023. This calculates to a quarterly BV lower of (0.08%). When together with NLY’s not too long ago decreased quarterly dividend of $0.65 per frequent share, the corporate had an financial return of three.05% for the primary quarter of 2023. When in comparison with fixed-rate company mREIT friends like AGNC and DX, a modest – notable quarterly BV outperformance. In truth, NLY recorded the least extreme quarterly lower out of the 8 company mREIT friends I presently cowl.

I appropriately projected most company mREIT firms would expertise a minor – modest BV lower throughout the first quarter of 2023. I additionally appropriately projected most company mREIT sub-sector friends would underperform most hybrid, originator and servicer, and business entire mortgage mREIT sub-sector friends concerning BV fluctuations throughout the first quarter of 2023. Every mREIT’s earnings outcomes had been beforehand mentioned with Market subscribers in “actual time” by earnings chat notes and subsequent earnings articles.

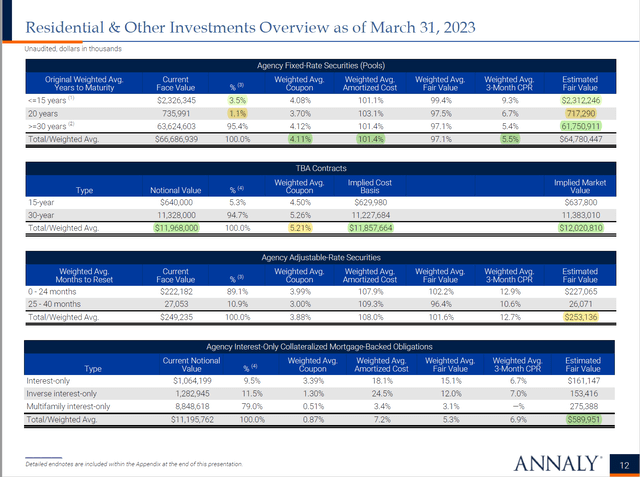

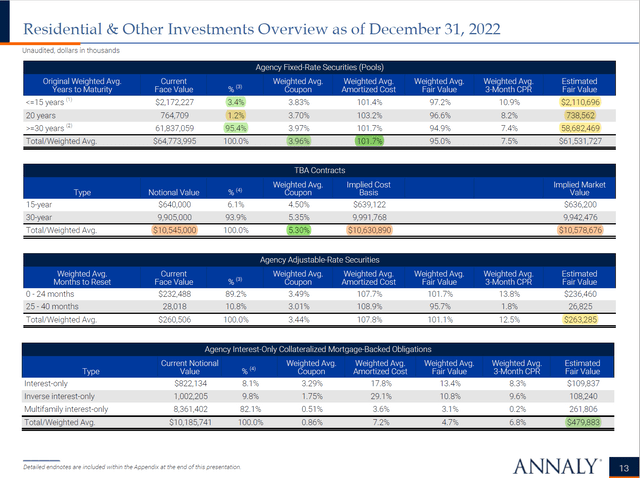

Allow us to now talk about NLY’s MBS and derivatives portfolios to identify sure traits which is able to impression future outcomes. Desk 2 under supplies NLY’s proportion of fixed- and variable-rate company MBS holdings as of three/31/2023 versus 12/31/2022 (the overwhelming majority of the corporate’s funding portfolio).

Tables 2a + 2b – NLY Company MBS Portfolio Composition (3/31/2023 Versus 12/31/2022)

NLY Shareholder Presentation (Supply: Desk obtained [with added highlights] from NLY’s quarterly shareholder presentation for the fourth quarter of 2022 and first quarter of 2023. Permission to be used has beforehand been granted by NLY’s investor relation’s division [copyright shown in slides].)

NLY Shareholder Presentation (Supply: Desk obtained [with added highlights] from NLY’s quarterly shareholder presentation for the fourth quarter of 2022 and first quarter of 2023. Permission to be used has beforehand been granted by NLY’s investor relation’s division [copyright shown in slides].)

Utilizing Desk 2 above as a reference, NLY continued to keep up a portfolio closely invested in 30-year fixed-rate company MBS holdings throughout the first quarter of 2023. NLY’s proportion of 15-year fixed-rate company MBS holdings very barely elevated from 3.4% to three.5% throughout the quarter (based mostly on par/face worth). NLY’s proportion of 20-year fixed-rate company MBS holdings very barely decreased from 1.2% to 1.1%. As such, NLY’s proportion of 30-year fixed-rate company MBS remained unchanged at 95.4%. Most company sub-sector friends continued to have an especially excessive proportion of 30-year fixed-rate company MBS holdings throughout the first quarter of 2023.

NLY’s on-balance sheet fixed-rate company MBS holdings had a weighted common coupon (“WAC”) of 4.11% as of three/31/2023 which was a 15 foundation factors (“bps”) enhance when in comparison with 12/31/2022. This ought to be thought-about a minor – modest quarterly rise in WAC. Persevering with to reverse a development throughout 2020-2021, NLY’s TBA MBS place had a better WAC of 5.21% which was in keeping with a number of different fixed-rate company mREIT friends concerning ahead/generic MBS methods (moved up in coupon). As well as, NLY’s weighted common three-month conditional prepayment price (“CPR”) decreased from 7.5% to five.5% which additionally was a reasonably constant development throughout the sector as mortgage rates of interest quickly elevated throughout 2022 (a little bit of a “delayed” impression to this metric; together with seasonal traits). NLY’s quarterly CPR ought to proceed to stay suppressed throughout 2023. Allow us to now transfer on to NLY’s derivatives portfolio.

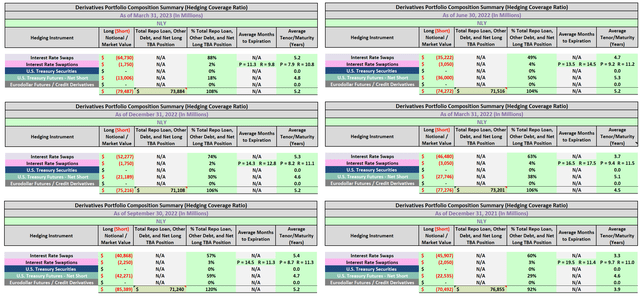

Whereas administration has, previously, diversified the corporate’s funding portfolio into much less rate of interest delicate holdings (decrease durations), a majority of the corporate’s funding portfolio (from a valuation standpoint) was nonetheless in fixed-rate company MBS as of three/31/2023. Together with the “plummet” within the Fed Funds Fee to close 0% in March 2020 (which additionally brought about a proportionately giant lower to the London Interbank Supplied Fee (“LIBOR”) throughout all tenors/maturities and all different relevant short-term funding/rates of interest) and subsequent margin calls in sure spinoff devices, NLY notably decreased the corporate’s hedging protection ratio throughout the first quarter of 2020. Nonetheless, as NLY entered into new rate of interest swap contracts throughout the second, third, and fourth quarters of 2020 (at notably extra enticing phrases), administration progressively “rebuilt” the corporate’s derivatives portfolio. NLY mainly maintained this beforehand built-up derivatives portfolio throughout the first, second, and third quarters of 2021 (slight alterations inside a number of sub-accounts). With the danger of continued increased mortgage rates of interest/U.S. Treasury yields heading into 2022, administration grew to become extra defensive throughout the fourth quarter of 2021 and first quarter of 2022. NLY mainly maintained the corporate’s hedging protection ratio throughout the second quarter of 2022, grew to become much more defensive throughout the third quarter of 2022, and have become much less defensive throughout the fourth quarter of 2022. NLY remained defensive throughout the first quarter of 2013. To spotlight the current exercise inside NLY’s derivatives portfolio, Desk 3 is offered under.

Desk 3 – NLY Hedging Protection Ratio (As of three/31/2023 Versus Prior 5 Quarters)

The REIT Discussion board (Supply: Desk created by me, partially utilizing NLY knowledge obtained from the SEC’s EDGAR Database [link provided below Table 1a])

Utilizing Desk 3 above as a reference, NLY had a web (brief) rate of interest swaps and swaptions place of ($45.9) and ($2.1) billion as of 12/31/2021, respectively. NLY additionally had a web (brief) U.S. Treasury futures place of ($22.5) billion. When calculated, NLY’s hedging protection ratio modestly elevated to 92% as of 12/31/2021. This was now slightly-modestly above the company mREIT common hedging protection ratio of 79% as of 12/31/2021.

NLY had a web (brief) rate of interest swaps and swaptions place of ($46.5) and ($3.1) billion as of three/31/2022, respectively. NLY additionally had a web (brief) U.S. Treasury futures place of ($27.7) billion. When calculated, NLY’s hedging protection ratio modestly elevated to 106% as of three/31/2022. This was now barely above the company mREIT common hedging protection ratio of 100% as of three/31/2022.

NLY had a web (brief) rate of interest swaps and swaptions place of ($35.2) and ($3.1) billion as of 6/30/2022, respectively. NLY additionally had a web (brief) U.S. Treasury futures place of ($36.0) billion. When calculated, NLY’s hedging protection ratio barely decreased to 104% as of 6/30/2022. This remained barely above the company mREIT common hedging protection ratio of 100% as of 6/30/2022.

NLY had a web (brief) rate of interest swaps and swaptions place of ($40.9) and ($2.3) billion as of 9/30/2022, respectively. NLY additionally had a web (brief) U.S. Treasury futures place of ($42.3) billion. When calculated, NLY’s hedging protection ratio modestly elevated to 120% as of 9/30/2022. This was now modestly above the company mREIT common hedging protection ratio of 106% as of 9/30/2022. Merely put, a majority of company mREIT friends remained defensive concerning their hedges throughout the third quarter of 2022.

NLY had a web (brief) rate of interest swaps and swaptions place of ($52.3) and ($1.8) billion as of 12/31/2022, respectively. NLY additionally had a web (brief) U.S. Treasury futures place of ($21.2) billion. When calculated, NLY’s hedging protection ratio modestly decreased to 106% as of 12/31/2022. This was now very barely under the company mREIT common hedging protection ratio of 111% as of 12/31/2022.

NLY had a web (brief) rate of interest swaps and swaptions place of ($64.7) and ($1.8) billion as of three/31/2023, respectively. NLY additionally had a web (brief) U.S. Treasury futures place of ($13.0) billion. As such, a reasonably large “swap” from web (brief) U.S. Treasury futures into rate of interest payer swaps. When calculated, NLY’s hedging protection ratio barely elevated to 108% as of three/31/2023. This was now modestly above the company mREIT common hedging protection ratio of 94% as of three/31/2023. This was primarily the results of the very giant quarterly lower in web (brief) spinoff devices carried out by CHMI and TWO.

As soon as once more utilizing Desk 1b above as a reference, as of 6/9/2023 NLY’s inventory value traded at $20.70 per share. When calculated, NLY’s inventory value was buying and selling at a (3.38%) low cost to my estimated CURRENT BV (BV as of 6/9/2023). Merely put, NLY’s inventory value traded at a minor (lower than a 5%) low cost to my estimated CURRENT BV and at a barely – modestly increased valuation when in comparison with most different company mREIT friends inside Desk 1b. When monitoring historic traits, NLY usually trades at a barely – modestly increased valuation (much less of a reduction/extra of a premium) to the corporate’s company mREIT friends. I proceed to imagine NLY “deserves” to commerce at a barely – modestly increased valuation (which has been defined in varied mREIT sector articles and thru the REIT Discussion board discussions).

I imagine the 24-month whole financial return (loss) metric is a good software in recognizing every mREIT’s historic efficiency. An amazing software when additionally contemplating future normal expectations versus friends. As such, as said later within the article, I presently imagine NLY is now appropriately undervalued (a HOLD advice) from a inventory value perspective. Solely a pair months in the past, I/we had an undervalued classification (BUY advice) on NLY (and a lot of the broader mREIT sector) which shortly “paid off” to readers/subscribers who deeded our recommendation with the current rally.

Comparability of NLY’s Latest Financial Return (Loss), Leverage, Hedging Protection Ratio, and Valuation to 19 mREIT Friends in Rating Order:

The REIT Discussion board Function

Conclusions Drawn (PART 1):

PART 1 of this text has analyzed NLY and 19 mREIT friends regarding the following metrics: 1) trailing 24-month financial return (loss); 2) leverage as of three/31/2023; 3) hedging protection ratio as of three/31/2023; and 4) premium (low cost) to my estimated CURRENT BV.

First, NLY’s trailing 24-month financial lack of (23.60%) was barely extra enticing (much less extreme lower) vs. the company mREIT sub-sector common of (29.89%). Nonetheless, this loss was notably much less enticing when in comparison with the hybrid, originator + servicer, and business entire mortgage common of (3.81%), 12.40%, and seven.82%, respectively. NLY outperformed a lot of the firm’s company mREIT sub-sector friends concerning this metric and barely – modestly outperformed certainly one of its closest sector friends, AGNC. This was primarily as a result of current composition of NLY’s MBS/funding and derivatives portfolio and the web motion of mortgage rates of interest/U.S. Treasury yields throughout this timeframe. I’d level out DX modestly – notably outperformed all company mREIT sub-sector friends concerning this particular metric however the firm gave up some earnings to realize this notable 24-month outperformance (to stay non-bias since I presently personal DX).

Second, NLY’s at-risk (whole) leverage as of three/31/2023 was modestly above the broader mREIT sector common. Nonetheless, when in comparison with the corporate’s fixed-rate company mREIT friends inside this evaluation, NLY’s at-risk leverage ratio common. Over the prior a number of years, NLY usually ran under common leverage versus the corporate’s fixed-rate company mREIT friends so a bit extra aggressive on NLY’s leverage extra not too long ago.

Third, NLY’s hedging protection ratio was now modestly above the company mREIT common as of three/31/2023. With the danger of continued increased mortgage rates of interest/U.S. Treasury yields heading into 2022, administration grew to become extra defensive throughout the fourth quarter of 2021 and first quarter of 2022. NLY mainly maintained the corporate’s hedging protection ratio throughout the second quarter of 2022, grew to become much more defensive throughout the third quarter of 2022, and have become much less defensive throughout the fourth quarter of 2022. NLY remained defensive throughout the first quarter of 2013. That mentioned, unfold/foundation threat shortly elevated throughout the first, second, and third quarters of 2022 which led to notable BV losses inside the company mREIT sub-sector (even inside firms who’ve utilized increased hedging protection ratios). Company mREITs who utilized MSRs usually had much less extreme losses when in comparison with friends who didn’t spend money on MSR investments.

Lastly, NLY’s present valuation, when in comparison with my estimate of every mREIT’s present BV (BV as of 6/9/2023), was at a barely – modestly increased valuation vs. the mREIT friends inside this evaluation. By the metrics offered inside this two-part sector comparability article (together with components/metrics in a roundabout way mentioned), I imagine NLY “deserves” to commerce at a slight – modest premium valuation to most mREIT friends. As such, I presently imagine NLY’s stage of premium, versus sub-sector friends, is justified. As such, this is among the the reason why I imagine NLY is presently appropriately undervalued (versus being overvalued in January 2023 and undervalued in April 2023). I’d strongly counsel readers think about present BVs (versus prior interval BVs) when assessing whether or not a inventory is attractively valued or not. The REIT Discussion board subscribers have entry to weekly BV projection updates.

Dependent upon the metrics specified by the tables above, outcomes throughout the broader mREIT sector will barely – notably fluctuate from peer-to-peer; dependent upon particular asset classifications and threat administration methods put into place. The connection between MBS/funding pricing and spinoff instrument valuations must be continually monitored (which I frequently carry out all through the quarter). If I begin to see a extra notable constructive/detrimental relationship unfold, I’ll inform readers by a number of avenues inside In search of Alpha (by articles, the stay chat characteristic of The REIT Discussion board, and/or feedback).

My BUY, SELL, or HOLD Advice:

From the evaluation offered above (utilizing Desk 1b as a direct reference), together with extra catalysts/components not mentioned inside this text, I presently price NLY as a SELL once I imagine the corporate’s inventory value is buying and selling at or larger than a 2% premium to my projected CURRENT BV (BV as of 6/9/2023; $20.70 per share), a HOLD when buying and selling at lower than a 2% premium by lower than a (8%) low cost to my projected CURRENT BV, and a BUY when buying and selling at or larger than a (8%) low cost to my projected CURRENT BV.

Due to this fact, I presently price NLY as APPROPRIATELY VALUED from a inventory value perspective.

As such, I presently imagine NLY is a HOLD advice.

My present value goal for NLY is roughly $21.10 per frequent share. That is presently the value the place my advice would change to OVERVALUED/a SELL advice. The present value the place my classification/advice would change to UNDERVALUED/a BUY advice is roughly $19.05 per frequent share.Put one other method, the next are my CURRENT BUY, SELL, or HOLD per share advice ranges (the REIT Discussion board subscribers get such a knowledge on all 20 mREIT shares I presently cowl on a weekly foundation):

$21.10 per share or above = SELL

$19.06 – $21.09 per share = HOLD

$16.96 – $19.05 per share = BUY

$16.95 per share or under = STRONG BUY

Together with the information offered inside this text, this advice considers the next mREIT catalysts/components: 1) projected future MBS/funding value actions; 2) projected future spinoff valuations;and three) projected near-term (as much as 1-year) dividend per share charges. As mentioned earlier, this consists of all current, present, and projected macroeconomic indicators and FOMC financial coverage.

mREIT Sector Suggestions as of 6/9/2023:

As soon as once more utilizing Desk 1b above as a reference, I need to spotlight to readers what I/we’re conveying to subscribers in terms of sector suggestions as of 6/9/2023 (final Friday’s shut).

As of 6/9/2023, I/we had a STRONG BUY advice (notably undervalued) on the next mREIT shares analyzed above (in no explicit order): 1) CIM; 2) MITT; 3) RITM; 4) RC; and 5) GPMT.

As of 6/9/2023, I/we had a BUY advice (undervalued) on the next mREIT shares analyzed above (in no explicit order): 1) EFC; 2) MFA; 3) PMT 4) ACRE; and 5) BXMT.

As of 6/9/2023, I/we had a HOLD advice (appropriately valued) on the next mREIT shares analyzed above (in no explicit order): 1) DX; 2) IVR; 3) NLY; 4) ORC; 5) TWO; 6) AAIC; and seven) NYMT.

As of 6/9/2023, I/we had a SELL advice (overvalued) on the next mREIT shares analyzed above (in no explicit order): 1) AGNC; 2) ARR; and three) CHMI.

So, as of 6/9/2023 I/we now have 5 mREITs rated as a STRONG BUY, 5 rated as a BUY, 7 rated as a HOLD, 3 rated as a SELL, and 0 rated as a STRONG SELL. Merely put, extra bullish when in comparison with the summer time of 2021 – early fall of 2022 and December – February 2023 however a bit much less bullish when in comparison with April 2023.

PART 2 of this text will cowl dividend metrics and projections for the second quarter of 2023.

Readers searching for my/our mREIT dividend projections for the second quarter of 2023 can look in final quarter’s article.

Latest NLY/AGNC Inventory Disclosures:

On 3/18/2020, I initiated a place in NLY at a weighted common buy value of $5.05 per share (giant buy). This weighted common per share value excluded all dividends obtained/reinvested. On 6/9/2021, I offered my complete NLY place at a weighted common gross sales value of $9.574 per share as my value goal, on the time, of $9.55 per share was surpassed. This calculates to a weighted common realized achieve and whole return of 89.6% and 112.0%, respectively. I held this place for roughly 15 months.

On 3/18/2020, I as soon as once more initiated a place in AGNC at a weighted common buy value of $7.115 per share (giant buy). This weighted common per share value excluded all dividends obtained/reinvested. On 6/2/2021, I offered my complete AGNC place at a weighted common gross sales value of $18.692 per share as my value goal, on the time, of $18.65 per share was surpassed. This calculates to a weighted common realized achieve and whole return of 162.7% and 188.6%, respectively. I held this place for roughly 14.5 months.

On 10/11/2022, I as soon as once more initiated a place in AGNC at a weighted common buy value of $7.445 per share. On 10/24/2022, I elevated my place in AGNC at a weighted common buy value of $7.500 per share. When mixed, my AGNC place had a weighted common buy value of $7.473 per share. This weighted common per share value excluded all dividends obtained/reinvested. On 11/9/2022, I offered my complete AGNC place at a weighted common gross sales value of $8.750 per share as my value goal, on the time, of $8.75 per share was surpassed. This calculates to a weighted common realized achieve and whole return of 17.1% and 18.7%, respectively. I held this place for roughly 3 weeks.

Ultimate Observe: All trades/investments I’ve carried out over the previous a number of years have been disclosed to readers in “actual time” (that day on the newest) by way of both the StockTalks characteristic of In search of Alpha or, extra not too long ago, the “stay chat” characteristic of the Market Service the REIT Discussion board (which can’t be modified/altered). By these assets, readers can search for all my prior disclosures (buys/sells) concerning all firms I cowl right here at In search of Alpha (see my profile web page for a listing of all shares coated). By StockTalk disclosures and/or the stay chat characteristic of the REIT Discussion board, on the finish of Might 2023 I had an unrealized/realized achieve “success price” of 86.4% and a complete return (consists of dividends obtained) success price of 93.9% out of 66 whole previous and current mREIT and enterprise improvement firm (“BDC”)positions (up to date month-to-month; a number of purchases/gross sales in a single inventory rely as one general place till totally closed out). I encourage different In search of Alpha contributors to supply actual time purchase and promote updates for his or her readers/subscribers which might finally result in larger transparency/credibility. Beginning in January 2020, I’ve transitioned all my real-time buy and sale disclosures solely to members of the REIT Discussion board. All relevant public articles will nonetheless have my “fundamental ticker” buy and sale disclosures (simply not real-time alerts).

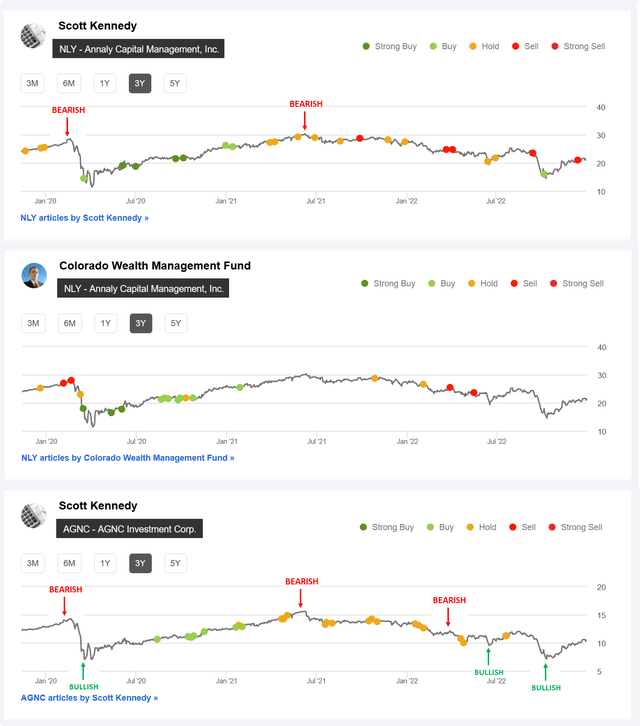

Desk 8a – The REIT Discussion board NLY + AGNC In search of Alpha Suggestions (November 2019 – March 2023 Timeframe)

Supply: Desk instantly from In search of Alpha; 1st AGNC “Bearish” indicator included by me instantly from the general public AGNC article dated 2/5/2020 advice [which can’t be changed once public], AGNC “Bullish” indicator included by me instantly from the general public AGNC article dated 4/17/2020 advice [which can’t be changed once public], 2nd AGNC and 1st NLY “Bearish” indicator included by me instantly from the REIT Discussion board’s weekly subscriber advice article sequence [week of 6/4/2021 for AGNC and week of 6/11/2021 for NLY], third AGNC “Bearish” indicator included by me instantly from the REIT Discussion board’s weekly subscriber advice article sequence [week of 4/8/2022], 2nd AGNC “Bullish” indicator included by me instantly from the REIT Discussion board’s weekly subscriber advice article sequence [week of 6/17/2022], and third AGNC “Bullish” indicator included by me instantly from the REIT Discussion board’s weekly subscriber advice article sequence [week of 9/30/2022].

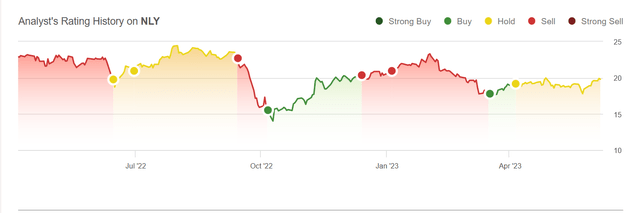

Desk 8b – NLY Public In search of Alpha Suggestions (June 2022 – June 2023 Timeframe)

Supply: Desk instantly from In search of Alpha

I simply need to shortly spotlight my/our AGNC and NLYSeeking Alpha advice ranges over the previous a number of years. In my private opinion, a inventory with a BUY advice ought to enhance in value over time, a SELL advice ought to lower in value over time, and a HOLD advice ought to stay comparatively unchanged in value over time (fairly logical). Merely put, my/our “valuation methodology” has appropriately timed when each AGNC and NLY have been undervalued (a BUY advice; bullish), overvalued (a SELL advice; bearish), and appropriately valued (a HOLD advice; impartial).

Utilizing Desk 8a above as a reference, I imagine we’ve got achieved a fairly good job in my/our AGNC and NLY advice rankings. For NLY, each pricing charts ought to actually be considered as 1 mixed chart since CO and I are a part of the identical Market service staff. Not solely do I/we need to present steerage/a advice that enhances whole returns for subscribers, I/we additionally need to shield these generated returns by subsequently minimizing whole losses. I personally imagine this technique/technique is essential. In different phrases, appropriately recognizing each constructive catalysts/traits and detrimental components/traits as financial and rate of interest cycles fluctuate.

This technique/technique was extraordinarily helpful/correct when going again to very late 2019 and early 2020 (each pre-COVID-19) the place I/we had a SELL advice on each AGNC and NLY. For some motive, this S.A. pricing chart doesn’t present my AGNC SELL advice pre-COVID-19 however one can merely look again to previous public articles in early 2020 (simply an omission on S.A.’s finish on this explicit case). In its place, merely have a look at the NLY SELL advice highlighted in CO’s pricing chart (AGNC and NLY usually have very comparable advice ranges when contemplating comparable time durations). Moreover, after the preliminary “pandemic panic”, I/we had a STRONG BUY advice on each AGNC and NLY later within the spring of 2020.

Merely put, a contributor’s/staff’s advice monitor report ought to “rely for one thing” and may all the time be thought-about in terms of credibility/profitable investing. You’ll not see most (if not all) different contributor groups use such a factual, recommendation-driven value chart as a result of the outcomes should not practically as “enticing” when in comparison with our personal.

Understanding My/Our Valuation Methodology Concerning mREIT Widespread and BDC Shares:

The fundamental “premise” round my/our suggestions within the mREIT frequent and BDC sectors is worth. Concerning operational efficiency over the long-term, there are above common, common, and under common mREIT and BDC shares. That mentioned, better-performing mREIT and BDC friends will be costly to personal, in addition to being low cost. Simply because a well-performing inventory outperforms the corporate’s sector friends over the long-term, this doesn’t imply this inventory ought to be owned at any value. As with every inventory, there’s a value vary the place the valuation is reasonable, a value the place the valuation is dear, and a value the place the valuation is acceptable. The identical holds true with all mREIT frequent and BDC friends. As such, concerning my/our investing methodology, every mREIT frequent and BDC peer has their very own distinctive BUY, SELL, or HOLD advice vary (relative to estimated CURRENT BV/NAV). The higher-performing mREITs and BDCs usually have a advice vary at a premium to BV/NAV (various percentages based mostly on general outperformance) and vice versa with the common/underperforming mREITs and BDCs (usually at a reduction to estimated CURRENT BV/NAV).

Every firm’s advice vary is “pegged” to estimated CURRENT BV/NAV as a result of this manner subscribers/readers can monitor when every mREIT and BDC peer strikes inside the assigned advice ranges (day by day if desired). That mentioned, the underlying reasoning why I/we place every mREIT and BDC advice vary at a distinct premium or (low cost) to estimated CURRENT BV/NAV is predicated on roughly 15-20 catalysts which embody each macroeconomic catalysts/components and company-specific catalysts/components (each constructive and detrimental). This investing technique is just not for all market individuals. As an illustration, not going a “good match” for very passive buyers. For instance, buyers holding a place in a selected inventory, irrespective of the value, for say a interval of 5+ years. Nonetheless, as proven all through my articles written right here at In search of Alpha since 2013, within the overwhelming majority of cases I’ve been capable of improve my private whole returns and/or reduce my private whole losses from particularly implementing this explicit investing valuation methodology. I hope this supplies some added readability/understanding for brand spanking new subscribers/readers concerning my valuation methodology utilized within the mREIT frequent and BDC sectors.

Every investor’s BUY, SELL, or HOLD resolution is predicated on one’s threat tolerance, time horizon, and dividend earnings objectives. My private advice is not going to match every reader’s present investing technique. The factual info offered inside this text is meant to assist help readers in terms of investing methods/selections. Please disregard any minor “beauty” typos if/when relevant.