Liberal Democrats: emergency mortgage safety fund wanted

Sir Ed Davey, chief of the Liberal Democrats, is asking for a £3bn emergency mortgage safety fund to guard individuals who would in any other case be repossessed.

Talking on Radio 4’s In the present day programme, Davey says the federal government ought to present the sort of assist that was out there after the final monetary disaster.

Davey explains:

We’ve already seen the variety of folks’s houses been reposessed going up massively – surging by 50% within the newest quarter, and my fear is that we’re going to see plenty of different households dropping their houses, and we may very well be in a spiral of repossessions.

The banks have gotten to play an even bigger function. They should step in and assist people who find themselves in hassle.

However simply as there was earlier than, there must be extra safety for individuals who are actually struggling and the federal government simply aren’t doing that.

Q: However this is able to be regressive – individuals who don’t personal houses shouldn’t help those that do? It will warmth up demand, when the Financial institution of England is making an attempt to chill it, and aren’t there higher makes use of of public cash? Plus, lax financial coverage has helped individuals who personal belongings…

Davey says the Lib Dems’ proposal is “fairly focused and time-limited” and it’ll get assist to individuals who would in any other case lose their houses.

If we don’t give that kind of assist to these folks, you’d see a spiral down and it’ll hit the entire economic system.

He provides that there additionally must be extra help for carers, and for renters “who’re getting a very poor deal”.

Davey argues that MPs ought to spend subsequent Monday debating the price of residing disaster, not all day debating Boris Johnson following yesterday’s privileges committee report.

Davey says:

We must always spend the day fascinated about how we assist folks, whether or not it’s the Liberal Democrat thought of a mortgage safety fund, our proposals to assist folks with vitality payments…

We have to assist folks. Households and pensioners, thousands and thousands of them are struggling and the Conservatives are simply failing due to their chaos.

Q: You’re proposing spending £3bn to assist individuals who borrowed to purchase houses, when many individuals can’t afford to, and youthful persons are trying ahead to a housing crash to allow them to get onto the housing latter. What does that say about your priorities?

Davey says the Liberal Democrats need to reverse the tax cuts given to the banks in the previous couple of years, and use a few of that more money to assist individuals who would in any other case lose their houses.

This isn’t their solely coverage, he factors out – citing the necessity to put money into the well being service so the UK has sufficient GPs, and to deal with the broader value of residing disaster.

But when we don’t deal with the mortgage disaster, it’s going to see a spiral downwards.

Up to date at 03.15 EDT

Key occasions

Firm insolvencies climb in Could in England and Wales

Newsflash: Firm insolvencies in England and Wales have jumped by 40% year-on-year

There have been 2,552 registered firm insolvencies in Could, new statistics from the Insolvency Service present, up from 1,825 in Could 2022. It’s additionally a rise on April, when 1,688 insolvences in England and Wales had been reported.

That is “greater than ranges seen whereas the Authorities help measures had been in place in response to the coronavirus (COVID-19) pandemic and in addition greater than pre-pandemic numbers”, the report says.

There have been 189 obligatory liquidations in Could 2023, 34% greater than in Could 2022, as extra firms collapse underneath the pressure of rising prices and better rates of interest.

The variety of Collectors’ Voluntary Liquidations (the place administrators decide to wind up an bancrupt firm with no prospect of restoration) rose by38% to 2,181.

The Insolvency Service explains:

Numbers of obligatory liquidations have elevated from historic lows seen through the coronavirus pandemic, partly on account of a rise in winding-up petitions introduced by HMRC.

A help package deal for mortgage holders could be a mistake, says Tim Pitt of consultancy Flint, a former senior adviser to former chancellors Philip Hammond and Sajid Javid.

Pitt argues it might undermine the transmission of financial coverage (the method by which greater rates of interest attain the economic system), would unfairly assist wealthier folks, distort the housing market, and be a poor use of fiscal sources.

Massive scale Covid and vitality help packages had been the correct coverage response. However they’ve cemented the concept that the federal government can and may act to remove all financial ache. It could possibly’t and shouldn’t.

Brief🧵w/ 4 the explanation why subsidising mortgage funds is a horrible thought: https://t.co/FrBO7wmDTe

— Tim Pitt (@TimPitt11) June 15, 2023

1/ Inflation. Mortgage funds are one of many principal transmission mechanisms the Financial institution of England has to chill demand. Subsidising mortgage funds acts in opposition to that, making it tougher to get inflation down. That is horrible economics and unhealthy politics.

— Tim Pitt (@TimPitt11) June 15, 2023

2/ Distributional. Much less rich non-homeowners shouldn’t be subsidising wealthier owners – significantly throughout a value of residing disaster.

— Tim Pitt (@TimPitt11) June 15, 2023

3/ Market distortion. Low-cost cash has fueled a home value increase, that means dwelling possession is out of attain for too many. Subsidising mortgage would maintain home costs artificially excessive, with varied unfavourable knock on penalties.

— Tim Pitt (@TimPitt11) June 15, 2023

4/ Fiscal. I couldn’t probably do a thread with out mentioning the dire state of the general public funds. This might be a really unhealthy use of very scarce fiscal firepower.

— Tim Pitt (@TimPitt11) June 15, 2023

Sharp mortgage will increase are going to be very painful for thousands and thousands, and politically very tough for the Tories. However the politics and economics of intervening could be a lot worse / ENDS

— Tim Pitt (@TimPitt11) June 15, 2023

Deutsche Financial institution expects the Financial institution of England to hike Financial institution Charge for a thirteenth consecutive assembly subsequent Thursday, by a quarter-point to 4.75%.

However the choice by the financial coverage committee most likely received’t be unanimous; they predict a 7-2 vote tally, with each Silvana Tenreyro and Swati Dhingra voting to maintain charges on maintain.

Deutsche then count on two additional charge hikes taking Financial institution Charge to five.25% in September, earlier than a pause in November.

Senior economist Sanjay Raja explains:

Inflation, we expect, will proceed to stay unstable and skewed to stronger prints within the near-term.

And the labour market may also doubtless stay scorching within the very near-term because the ONS incorporates extra of the forthcoming pay offers into the onerous information. We do, nevertheless, see draw back dangers rising from late Q3 to early This fall, permitting the MPC to push the pause button on the November assembly.

If mortgage charges do hit 6% thent owners might be spending 23.6% of their incomes on mortgage repayments, probably the most since 1991, Neal Hudson, a property market analyst at BuiltPlace, has calculated (through The Instances).

He’s additionally made this wonderful chart, displaying how efficient mortgage prices are near their ranges within the Nineteen Eighties despite the fact that rates of interest are decrease:

(as a result of mortgage are a lot larger as we speak, that means repayments are a big chew of earnings).

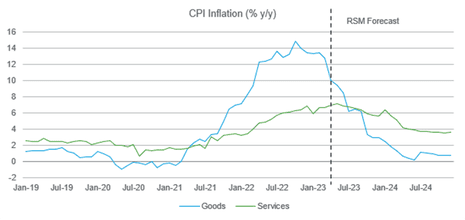

RSM predicts UK rates of interest will peak at 5%

Economists at RSM, the accountancy group, have predicted this morning that UK rates of interest will peak at 5%.

That’s half a proportion level greater than as we speak, however decrease than the 5.75% peak presently implied within the cash markets.

RSM argue that falling gas, vitality and meals costs on the worldwide markets will pull UK inflation all the way down to 4% by the top of this yr (hitting the federal government’s goal of halving it).

Meaning the case for additional charge hikes turns into a bit much less convincing, argues RSM economist Thomas Pugh.

He says:

‘One other two rate of interest hikes appear doubtless, which might take rates of interest to five%. It will, due to this fact, appear wise for the MPC to take a hawkish pause in a lot the identical method that the Fed did on Wednesday. This might enable the MPC to look at the impression of its earlier charge hikes, whereas giving it the choice to hike additional if wanted.

‘Because it occurs, we expect by September it’ll turn into clear that inflation is on a steep downward observe and that sufficient slack has emerged within the labour marketplace for the MPC to cease its tightening cycle at 5%. Nonetheless, the dangers are positively weighted towards intertest charges going greater.

Monetary markets are most likely “over-egging” the probabilities that charges attain 6%, Pugh says, cautioning “however don’t rule it out”….

Owners are spending an even bigger slice of their earnings on mortgage repayments than at any time for the reason that monetary disaster of 2008 as charges proceed to rise in the direction of 6%, The Instances reviews this morning.

They clarify:

Mortgage repayments on new loans made up 20.4 per cent of debtors’ incomes on common between January and April, in line with the commerce affiliation UK Finance.

That is up from underneath 17 per cent in 2020 and the most important proportion since November 2008.

Aaand @resi_analyst tells me owners are poised to spend the best % of earnings on mortgage repayments (23.6%) since 1991 if charges hit 6%.

New information from UK Finance out as we speak confirmed repayments reached a 14-year excessive of 20.4% between Jan and Aprilhttps://t.co/oVxdbA8Fip

— George Nixon (@George_Nixon97) June 15, 2023

Retailer Tesco says Britain has handed peak meals inflation

There are “encouraging early indicators” that meals value inflation is beginning to ease, in line with the boss of Tesco.

Tesco CEO Ken Murphy informed reporters this morning:

“We do consider that we’re previous the height inflation.”

That will cheer the Financial institution of England, because it weighs up how excessive rates of interest should rise to struggle the price of residing disaster.

Murphy additionally claimed the BoE has been unfair in blaming supermarkets for Britain’s stubbornly excessive inflation degree.

Requested if he believed the Financial institution of England was being unfair in calling out the trade, Murphy stated: “Sure I do.”

Murphy was talking after Tesco reported a 9% rise in UK gross sales within the 13 weeks to 27 Could.

Britain’s largest grocery store says it has “led the way in which” in reducing costs on on a regular basis important gadgets, amid criticism of the retail sector for value rises.

No indicators of “greedflation” in Tesco’s outcomes. Like-for-like gross sales grew by 8.8% within the quarter. But it surely’s clearly absorbing a few of the greater costs to take care of market share. Profitability took a success.

— Ben Wright (@_BenWright_) June 16, 2023

Travis Perkins warns on revenue as excessive rates of interest hit housing market

UK constructing provider housebuilder Travis Perkins has warned its earnings will miss expectations, in an indication that difficulties are constructing within the UK housing market.

Travis Perkins has 1,400 branches across the UK, and says it’s the nation’s largest distributor of constructing supplies, supplying cement, bricks, roof tiles, instruments, plumbing, heating equipment and electricals merchandise to constructors.

However this morning, the corporate warns that the housing market is being hit by greater rates of interest and weaker shopper confidence.

In mild of ongoing difficult market situations, full yr adjusted working earnings at the moment are anticipated to be round £240m, lacking the £266m which the Metropolis anticipated.

It informed shareholders:

The Group delivered a resilient efficiency within the first quarter however has not seen the anticipated easing of market situations within the second quarter so far.

Volumes in each the brand new construct housing and personal home RMI [repair, maintenance, and improvement] markets proceed to be impacted by greater rates of interest and weaker shopper confidence pushed by persistent, greater than anticipated shopper value inflation.

Travis Perkins warns on revenue 👇

“Travis stated the bounce in mortgage charges and ongoing excessive ranges of inflation meant that the development trade was holding again in constructing new houses.”https://t.co/4lg24Q0MiW

— Andy Bruce (@BruceReuters) June 16, 2023

Shares in Travis Perkins have fallen over 6% in early buying and selling, whereas housebuilder Barratt Improvement has dipped 1.5%.

Up to date at 03.39 EDT

Within the Metropolis, the pound has hit a brand new one-year excessive above $1.28 agains the US greenback.

The rally, to the very best degree since April 2022, comes as merchants anticipate additional will increase in UK rates of interest, whereas America’s central financial institution paused its charge will increase on Wednesday.

Explainer: What may authorities do to assist mortgage debtors?

My colleague Hilary Osborne has examined what help the federal government may show.

It may, for instance, widen the present help for folks on advantages who’re struggling to fulfill their month-to-month mortgage funds.

Tax reduction on mortgage funds may probably be introduced again, which would supply monetary reduction to debtors, or lenders may very well be urged to train extra forbearance fairly than repossessing houses.

Or (and that is fairly unlikely), the federal government may take management of rates of interest again off the Financial institution of England. At this stage, although, the federal government has been backing the BoE because it tries to tame inflation.

Right here’s the complete piece:

Atom Financial institution says extra help wanted, because it raises charges

Atom Financial institution can also be lifting its mortage charges as we speak – by between 0.25% to 0.6% on sure merchandise.

Mark Mullen, Atom’s chief government, says the financial institution raised charges as a result of the monetary markets are pricing in additional will increase in Financial institution of England base charge.

Mullen isn’t positive that UK rates of interest will hit 6%, as some have forecasts, however believes we’re in the next charge atmosphere:

I believe that the present rate of interest atmosphere is more likely to stay there-or-there abouts the place we’re as we speak for for much longer than maybe folks would possibly want.

Q: So do dwelling homeowners and debtors want help, because the Liberal Democrats are calling for?

Mullen says they do, including that help can take many kinds.

In addition to the rate of interest atmosphere, but in addition, “what are banks doing to assist them of their financial savings charges?” and are they serving to clients earlier than they miss mortgage repayments, Mullen asks.

So there’s heaps that banks can do, however positive, they completely wants help.

Q: However when public funds are strained, is it proper to offer cash to individuals who have borrowed cash to purchase a home?

Mullen warns that individuals who took out mortgages a couple of years are going to “get a shock” once they remortgage, and transfer onto a fairly greater charge.

The fact is there’s ache throughout in a high-inflationary atmosphere.

Liberal Democrats: emergency mortgage safety fund wanted

Sir Ed Davey, chief of the Liberal Democrats, is asking for a £3bn emergency mortgage safety fund to guard individuals who would in any other case be repossessed.

Talking on Radio 4’s In the present day programme, Davey says the federal government ought to present the sort of assist that was out there after the final monetary disaster.

Davey explains:

We’ve already seen the variety of folks’s houses been reposessed going up massively – surging by 50% within the newest quarter, and my fear is that we’re going to see plenty of different households dropping their houses, and we may very well be in a spiral of repossessions.

The banks have gotten to play an even bigger function. They should step in and assist people who find themselves in hassle.

However simply as there was earlier than, there must be extra safety for individuals who are actually struggling and the federal government simply aren’t doing that.

Q: However this is able to be regressive – individuals who don’t personal houses shouldn’t help those that do? It will warmth up demand, when the Financial institution of England is making an attempt to chill it, and aren’t there higher makes use of of public cash? Plus, lax financial coverage has helped individuals who personal belongings…

Davey says the Lib Dems’ proposal is “fairly focused and time-limited” and it’ll get assist to individuals who would in any other case lose their houses.

If we don’t give that kind of assist to these folks, you’d see a spiral down and it’ll hit the entire economic system.

He provides that there additionally must be extra help for carers, and for renters “who’re getting a very poor deal”.

Davey argues that MPs ought to spend subsequent Monday debating the price of residing disaster, not all day debating Boris Johnson following yesterday’s privileges committee report.

Davey says:

We must always spend the day fascinated about how we assist folks, whether or not it’s the Liberal Democrat thought of a mortgage safety fund, our proposals to assist folks with vitality payments…

We have to assist folks. Households and pensioners, thousands and thousands of them are struggling and the Conservatives are simply failing due to their chaos.

Q: You’re proposing spending £3bn to assist individuals who borrowed to purchase houses, when many individuals can’t afford to, and youthful persons are trying ahead to a housing crash to allow them to get onto the housing latter. What does that say about your priorities?

Davey says the Liberal Democrats need to reverse the tax cuts given to the banks in the previous couple of years, and use a few of that more money to assist individuals who would in any other case lose their houses.

This isn’t their solely coverage, he factors out – citing the necessity to put money into the well being service so the UK has sufficient GPs, and to deal with the broader value of residing disaster.

But when we don’t deal with the mortgage disaster, it’s going to see a spiral downwards.

Up to date at 03.15 EDT

Introduction: Mortgage charges transfer in the direction of 6%

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

UK mortgage charges are heading in the direction of 6% because the squeeze on debtors tightens – prompting requires the federal government to supply emergency assist.

The common charge on a two-year mounted mortgages rose to five.92% yesterday, up from 5.9% on Wednesday, and 5.26% at first of final month.

Common five-year mounted charge mortgage charges hit 5.56 per cent, up from 5.54% 24 hours earlier – and 4.97% at first of Could.

Nationwide, the constructing society, is becoming a member of the push to lift charges as we speak – rising its new mounted charges by as much as 0.7 proportion factors.

These strikes come as Metropolis merchants predict UK rates of interest may hit 5.75% by the top of this yr, up from 4.5% as we speak. The Financial institution of England appears sure to lift rates of interest subsequent week.

The yield (or rate of interest) on two-year authorities bonds – used to cost fixed-term mortgages – is buying and selling at 15-year highs this week.

UK inflation taking ‘longer than anticipated’ to chill down🚨🧵

Two-year gilt yields on Tuesday rose 0.26 factors to 4.89%, in contrast with their peak of 4.64% in late Sept.

Markets count on the BoE to extend charges from 4.5% to five.76%.$FTSE $SPX $QQQ $BTC $AMD pic.twitter.com/yLkp0kNeGJ

— Kapoor Kshitiz (@kshitizkapoor_) June 13, 2023

Though charges are under their ranges earlier than the Nineties housing crash, mortgages as we speak are a lot greater – and mortgage funds make up a bigger slice of individuals’s earnings.

So, the squeeze is already the worst for the reason that early 90s, analysts say:

Not fairly.Proper now, primarily based on charges presently out there, these refixing or taking out new loans are getting into the largest mortgage squeeze since 1991.This isn’t a projection. It’s occurring RIGHT NOW.NB the ’91 mortgage squeeze contributed to a mammoth housing crash/recession pic.twitter.com/mktnI8rxfa

— Ed Conway (@EdConwaySky) June 14, 2023

The Liberal Democrats are calling for an emergency help fund for mortgage debtors, which would supply non permanent grants to these most liable to dropping their houses.

Liberal Democrat Treasury spokesperson Sarah Olney MP stated earlier this week:

“This Conservative authorities has unleashed mortgage hell for thousands and thousands of house owners however isn’t lifting a finger to assist.

“Rishi Sunak is completely out of contact with the issues of individuals throughout the nation fearful sick about how they are going to afford their month-to-month mortgage funds.

“The Prime Minister ought to haul the banks into Downing Avenue and focus on what further help will be given to owners on the brink. The very least that Conservative Ministers ought to do is take duty for the mess they’ve created as a substitute of sitting on the sidelines.”

The inflation squeeze within the eurozone prompted the European Central Financial institution to elevate its rates of interest once more yesterday.

However earlier as we speak, the Financial institution of Japan maintained its ultra-easy financial coverage despite the fact that Japanese inflation is greater than anticipated. The BoJ signalled it might give attention to supporting Japan’s fragile financial restoration, and stays assured that inflation will sluggish later this yr.

European inventory markets are set to open just a little greater:

The agenda

Up to date at 02.53 EDT