anankkml

When measured on a value to gross sales foundation, the US Info Expertise sector is now extra overvalued relative to the broader US market than at any time because the very previous few months of the tech bubble that ended in March 2000. Euphoria over the potential for Synthetic Intelligence is driving the bubble, the identical means the arrival of the web drove the Nineties bubble. Whereas there’s potential for the tech sector to spike additional if its December 2021 highs are taken out, observe that the MSCI Info Expertise index continues to be underwater relative to US bonds since its 2000 peak, regardless of seeing sturdy gross sales and earnings progress seen since then. I’m quick the Vanguard Info Expertise ETF (NYSEARCA:VGT) as I see deeply detrimental long-term returns.

The VGT ETF

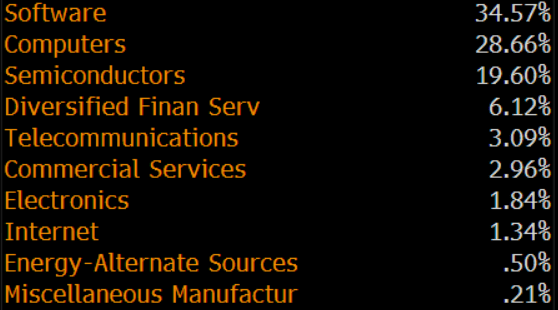

Vanguard Info Expertise ETF seeks to trace the funding efficiency of the MSCI US Investable Market Info Expertise 25/50 Index, an index of shares of huge, medium-size, and small U.S. firms within the info expertise sector, as labeled below the International Business Classification Customary (GICS). This GICS sector is made up of firms within the following three normal areas: web providers and infrastructure firms, together with information facilities and cloud networking and storage infrastructure; firms that present info expertise consulting and providers, expertise {hardware} and gear, together with producers and distributors of communications gear, computer systems and peripherals, digital gear, and associated devices; and semiconductors and semiconductor gear producers. The sector breakdown is proven beneath.

VGT Sector Publicity (Bloomberg)

By way of firm publicity, the fund is closely concentrated in direction of Apple (AAPL) and Microsoft (MSFT), which have a mixed share of 43% of the index. Nvidia (NVDA) is the third-largest holding, with a 6% weighting. The fund expenses a charge of 0.1% and pays a dividend yield of simply 0.7%.

VGT Firm Publicity (Bloomberg)

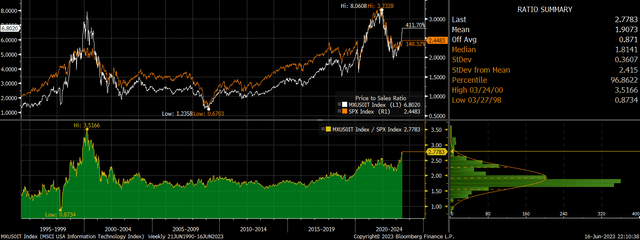

The Valuation Premium Has Reached New Extremes

The worth-to-sales ratio for the MSCI IT index is at present 6.8x, which is within the prime 5% of valuations seen going again to 1995, double its long-term common. The extent of overvaluation is much more important when measured relative to the S&P500. The MSCI IT’s price-to-sales premium is within the prime 3% of all observations going again to 1995 and is 2.4 customary deviations from its long-term common. The one time the tech sector has traded at the next premium was in the previous couple of months of the 2000 dot com bubble.

MSCI USA IT Vs S&P500 Worth To Gross sales Ratios (Chart)

This excessive valuation premium on a price-to-sales foundation doesn’t have in mind the development in revenue margins seen within the tech sector over the previous twenty years. Nonetheless, even on a price-to-earnings foundation, the tech sector nonetheless trades at 67% above the S&P500 at 35.4x.

Wanting into the breakdown of the change in revenue margins between the MSCI IT index and the S&P00, the only greatest driver of the relative enchancment in tech margins has been the decline in curiosity and tax bills. In 2000 curiosity and tax bills diminished web earnings by round 35%, and this determine is now a 5% constructive contribution. If we strip out the curiosity and tax and deal with price-to-operating earnings, the MSCI IT index trades at a 75% premium to the S&P500. If we additional strip out depreciation and amortization, the valuation premium rises to 85%.

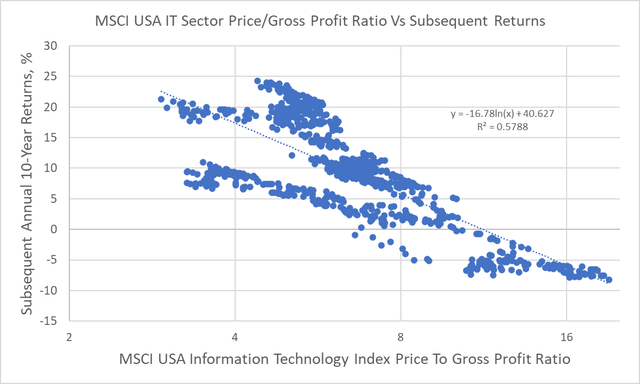

Deeply Unfavorable Lengthy-Time period Returns Doubtless

The explanation I desire to strip out the influence of non-core bills is that they are usually extremely risky and imply reverting. Because of this, earnings metrics that strip out non-core bills are usually extra intently correlated with precise subsequent returns. It seems that the earnings metric most intently associated to subsequent long-term returns is the price-to-gross revenue ratio as this captures structural slightly than cyclical adjustments in revenue margins. The MSCI IT’s present value to gross revenue ratio sits at 13x. The chart beneath reveals the correlation between the connection between the MSCI IT’s price-to-gross revenue ratio and subsequent 10-year complete returns. The present ratio is per annual returns of -2% over the following decade.

Bloomberg, Writer’s calculations

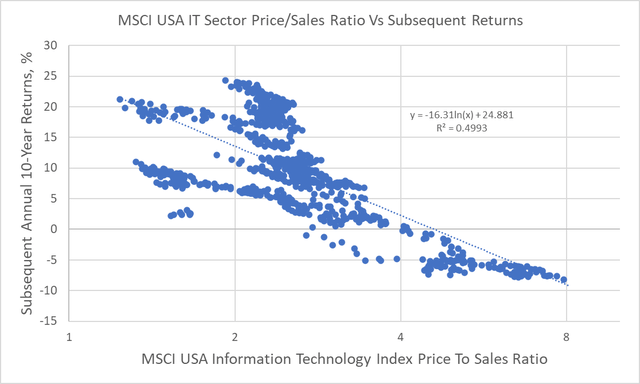

Even this weak outlook might show too optimistic, as embedded in these implied returns is the gradual enlargement in gross revenue margins, which isn’t one thing we should always anticipate to proceed. If we strip out revenue margins all collectively and deal with the price-to-sales ratio, the present determine of 6.8x is per 10-year annual returns of round -6% based mostly on information over the previous 30 years. This could mark the worst interval of long-term tech sector underperformance because the very peak of the 2000 bubble and depart the VGT round 50% decrease than present ranges in complete return phrases.

Bloomberg, Writer’s calculations

This may increasingly appear overly pessimistic, however all it might take is for traders to require barely increased long-term returns than historic gross sales progress and the present dividend yield indicate. Over the previous twenty years, gross sales progress has averaged 6% yearly. Even when we assume that this progress charge continues and revenue margins stay at present elevated ranges, with a dividend yield of simply 0.7%, this is able to lead to 6.7% annual returns assuming no change in valuations. If traders had been to require returns of 10% yearly in step with the post-Warfare S&P500 common, this is able to require the dividend yield to rise to 4%, which in flip would require an 83% decline in valuations.

Unlikely To Be Totally different This Time

Whereas excessive valuations make detrimental long-term returns extremely possible, we can not rule out the likelihood that Synthetic Intelligence is profitable in addressing the long-term decline in US productiveness and permitting the economic system to develop quick sufficient to permit earnings to meet up with present valuations. Nonetheless, the assets that might be required to construct the {hardware}, practice the machines and the folks utilizing them, and the assets that might be required to manage and (hopefully) make sure that unhealthy actors don’t use the expertise for nefarious functions, have to be considered. Additionally observe that the creation of the web itself was unable to make a dent within the US’s long-term productiveness progress decline.