lucky-photographer

Abstract of revised funding thesis

Six months after its sharp selloff following the BeAT-HF trial readouts, traders have proven conviction in CVRx Inc (NASDAQ:CVRX) as soon as once more. Shares are up 38% since my final publication, with all of the autopsy of the Barostim information now totally priced in my opinion.

Shares have now damaged out above earlier highs, with a number of catalysts rising on basic grounds, together with Barostim, plus on sentimental components. The inventory is priced at a premium given the revised expectations, however there’s a cheap worth to be paid given the expansion prospects on provide. I’m seeking to c.$40mm in turnover from CVRX this 12 months, and look to a $20 share worth goal with the catalysts talked about right here. Internet-net, reiterate purchase.

Determine 1.

Information: Updata

Newest BeAT-HF/Barostim updates

The most important speaking factors are across the firm’s BeAT-HF and Barostim story. As famous, final quarter was a tough one because the market reacted (arguably over-reacted)to the corporate’s BeAT-HF trial readouts. I lined this extensively within the final publication. Turning to the newest updates, I’d advise the next to traders:

Interactive discussions with FDA: The corporate has began discussions with the FDA to get its BeAT-HF submission rolling. CVRX goals to current data that’s most helpful for the regulatory authorities to get Barostim’s label enlargement, which can or might not expedite the method. No matter is chosen to be introduced shall be essential in demonstrating Barostim’s efficacy and security holds up effectively. Labeling: CVRX is searching for treatment-effect labeling for Barostim. There are two methods to file a PMA complement, and CVRX has opted to decide on the interactive route to realize it. This shall be simpler in my opinion, because it will get the corporate in entrance of the FDA, the place it will probably exhibit the case for label enlargement, on the proof from BeAT-HF is supported as remedy for sufferers with coronary heart failure.

The result of those discussions, and the potential augmentation or lower of labeling, are but to be decided. From an funding perspective, clever traders shall be watching the FDA’s language very carefully when it makes the subsequent choices on BeAT-HF. The purpose being that, if CVRX will get the outcome it’s chasing (that’s, to increase the Barostim label to help the remedy of coronary heart failure) this may very well be an enormous catalyst for the inventory worth in my opinion.

The chance is that if the corporate does not get what it desires. We noticed the market’s response to this final time, highlighting the worth it’s inserting on Barostim in CVRX’s valuation.

Alas, the vital issue which might flip CVRX’s market worth in both course is the subsequent strikes surrounding BeAT-HF.

Run-down of Q1 financials

CVRX clipped Q1 FY’23 gross sales of $8mm, one other 96% upside on final 12 months. The U.S. coronary heart failure enterprise contributed $6.8mm to the highest line, up ~132% YoY. Notably, March was the corporate’s best-performing month on file, underscoring the accelerating top-line gross sales ramp within the U.S..

Critically, in response to the CEO on the decision:

Whereas we do not know the way a lot of the income efficiency in March is attributable to the introduced unblinding of the BeAT-HF examine in February or to our business execution over current quarters, we are able to undoubtedly say our technique is working.”

The corporate additionally expanded its attain by including 3 new territories, bringing its whole to 29. By capturing new territories, securing new accounts, and elevating consciousness amongst physicians about Barostim, CVRX appears to be like to have achieved an inexpensive return on this, as seen in U.S. coronary heart failure income totaling $6.8mm in Q1. Regardless of all of the calamity in CVRX’s monetary markets, in its end-markets, adoption is accelerating at tempo.

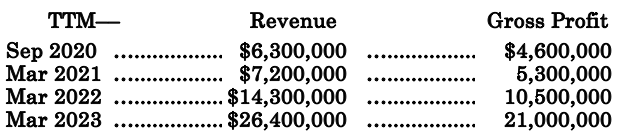

“Development firm” is a time period that’s unfold loosely amongst fashionable funding markets. There merely is not the quantity of certified development firms that traders appear to suppose there are. CVRX however, does actually qualify as an genuine purveyor of development, as noticed under:

Desk 1. CVRX income development

Information: Creator, CVRX SEC Filings

Revenues are close to doubling every quarter (TTM foundation) with super gross revenue margins clipped on this. With readability on Barostim, this might lengthen this efficiency even additional in my opinion.

Including to the above level, CVRX’s had 122 lively implanting facilities on its books on the finish of Q1 FY’23, in comparison with 56 facilities in March FY’22, and 106 facilities in December final 12 months. Once more, that is additional proof of the speedy uptake of its core choices.

Peeling again the superficial layers, my further quarterly take outs embody:

The corporate’s market enlargement: CVRX’s enlargement into new gross sales territories and accounts presents a compelling funding implication in my opinion. You’ve got acquired 66 new facilities from Q1 final 12 months, and one other 16 in 1 quarter. That’s a median of 16 new websites per quarter, with every web site contributing a median $216,400 per heart in Q1. Like-for-like, that is down off $255,250 the 12 months prior, indicating that every heart wants much less common income per 12 months to be able to hit its future development targets, taking the stress off every particular person web site. Rising doctor consciousness: Administration notes {that a} bulk of Q1 development got here from enhanced consciousness amongst physicians on Barostim. That is vital to the success, so it’s good to see administration nonetheless closely pushing its core gross sales routes.

Each factors are conducive to the revised thesis, together with the opposite factors raised to date.

Sentiment modifications

Chief to my view that CVRX will commerce greater into the approaching months is the current modifications in sentiment. We see this in a variety of methods.

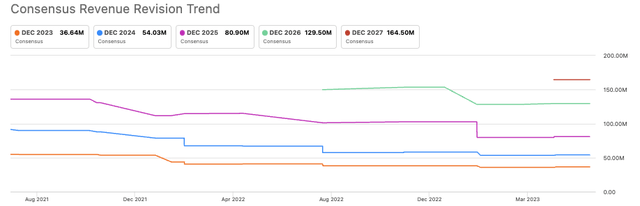

One, there have been 5 upward revisions from analysts over the approaching 3-months, with no revisions to the draw back. Consensus expects one other 63% YoY development in income this 12 months, with one other c.50% in FY’24. These modifications are welcomed and completely important to CVRX ranking greater in my opinion. It’s corroboration from different refined investor circles that prospects on the corporate’s outlook need to be revised greater. This provides some confidence to my very own assumptions too.

Determine 2.

Information: Looking for Alpha

Very attention-grabbing information is noticed within the choices chain for July 2023 expiry. For these contracts at present within the cash, there’s heavy demand centered across the $20 strike mark on the decision ladder, suggesting that traders are closely bullish at that mark. Which means traders are projecting CVRX to commerce greater than this, the place they will train their calls and purchase CVRX inventory at a reduced market worth. Key level is, they consider it can go greater than $20,, one other 42% upside potential as I write.

Collectively, this evaluation exhibits the sentiment on CVRX is popping extra bullish, based mostly on the actions of precise market contributors who’re assuming precise danger and placing precise cash to work. Therefore, I kind the view that there are sentimental catalysts that might drive the corporate’s valuation greater too.

Valuation components

Buyers aren’t parting with their CVRX inventory with ease, asking 8x gross sales to promote their place to you. Otherwise you’d pay 4x guide worth, take your choose. That is fairly the premium on each multiples, however CVRX’s valuation is mirrored in each ahead gross sales development and fairness components, that are each represented in these multiples. Additional, traders are paying these costs with no objection, as seen within the worth motion and momentum components.

Therefore, the market is anticipating CVRX to commerce at 8x its projected gross sales, an incredible projection that tells me of the expansion potential. Second, the market is anticipating its internet asset worth to extend by an element of 4x, additional indication of those development percentages.

Therefore, while these may look dear on face worth, suppose a bit additional as to what it could be getting you:

Administration challenge $35-$38mm in FY’23 gross sales, calling for 68% YoY development. Consensus expects roughly the identical, and my numbers are in the identical ranges. The Barostim potential, which merely can’t be ignored. Administration demonstrated their unwavering dedication to getting the precise outcome from BeAT-HF.

These are engaging options and if the expansion percentages do work out over the approaching 3-years, these multiples do not appear too inappropriate at simply $14.90 per share as I write. At 11x ahead, I get to a valuation of $20 on $38mm in FY’23 income estimates (11×38/20 = $20), c.40% upside potential. This helps a purchase ranking.

In brief

The end result of those components counsel that CVRX warrants a revised purchase ranking. The BeAT-HF information has undoubtedly been priced in, and administration are engaged on securing the subsequent best choice, which remains to be an incredible alternative. A $35-$40 income clip just isn’t unreasonable to count on for the corporate this 12 months in my opinion, and that is supported by administration and consensus estimates. Internet-net, revise to purchase at $20 worth goal.