Imgorthand/E+ through Getty Photos

Co-authored with Treading Softly.

If you had been a child, did your father hassle you about turning off the lights? I noticed I had turn into a father when I discovered myself spending extra time day by day turning off lights that I had not turned on than doing different issues round the home. There’s a basic saying attributed to fathers asking their kids, who left the lights on, “Do you suppose we personal the ability firm?”

How typically do you get into your automobile, and solely then bear in mind you determined to not refill your gasoline tank in your method house final night time? For many of us, buying gas is solely an errand that have to be accomplished and a value that have to be borne. It is a necessity to drive to and from work day by day. It was once referred to as the “commuting tax” as a result of they had been compelled to pay it with a view to go to work and earn the cash that will pay for the gas that they had been burning.

With regards to the market, my purpose is to generate earnings from actions that folks don’t have any selection however to pay for. As a result of I am not a taxing authority, I can’t levy a tax on everybody’s earnings, however I can personal utilities and gasoline stations. Everybody has to pay their energy invoice so long as they’re linked to the grid. Everybody has to purchase gas as long as they’re driving a automobile that burns it. These are payments or prices that we pay with out even a second thought. They’re fundamental requirements in most of our minds.

At the moment, I wish to have a look at two alternatives to have the ability to receives a commission for the essential requirements that others spend their cash on.

Let’s dive in!

Decide #1: NEP – Yield 5.4%

NextEra Vitality Companions, LP (NEP) is an vitality “yieldco” specializing in “inexperienced” vitality, primarily photo voltaic and wind energy. Yieldcos are structured very equally to MLPs within the oil and gasoline sectors however file taxes as a C-corporation. Which means that traders get a 1099 at tax time and keep away from a variety of the complicated tax implications that MLPs typically have.

NEP’s supervisor is NextEra Vitality, Inc. (NEE). NEE owns and operates the biggest electrical utility in america – Florida Energy & Mild. Moreover, it owns NextEra Vitality Assets (“NEER”), a world chief in wind, photo voltaic, and battery storage.

NEP primarily works with NEER, which invests in setting up wind and photo voltaic farms. After development is full and the asset is operational, NEER sells it to NEP. This frees up NEER’s capital to start out new developments. NEP then sells the generated electrical energy to NEE, creating an earnings stream that funds distributions to NEP shareholders, rewarding them for the capital they supplied.

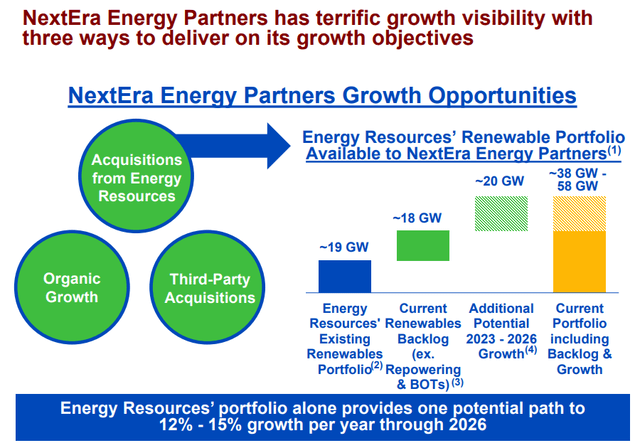

This technique gives NEP with glorious visibility of its future development. In spite of everything, the supervisor owns the corporate that sells NEP most of its property. NEER has a big backlog of initiatives which are already completed and able to be acquired – together with plans to construct much more. Supply.

NEP Could Presentation

Nevertheless, there’s a fly within the pudding, and that’s the present state of the fairness markets. In an effort to fund new acquisitions, NEP must get capital from someplace. When share costs are excessive, that is straightforward – NEP can simply subject new shares. Nevertheless, with the share costs having fallen since early 2022, issuing fairness at present costs is not a very engaging possibility.

We have seen some administration groups simply subject shares at poor costs and never fear about slowing development for traders; thankfully, NEE is just not that form of administration.

Quite than permit NEP to battle, NEE determined to waive its incentive distribution rights (“IDRs”). In 2022, NEP paid IDR charges of $152 million. This may permit NEP to promote its pure gasoline pipelines with out compromising money out there for distribution (“CAFD”) to shareholders. In flip, proceeds from the sale will present sufficient capital for NEP to fund its growth plans by means of 2026 with out having to show to the fairness markets and subject shares at poor costs.

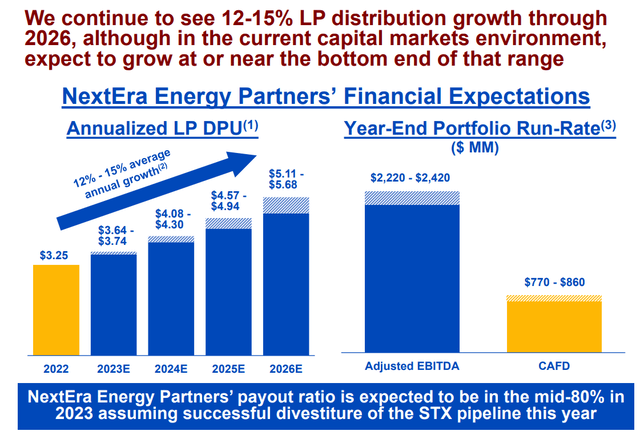

NEP already hiked its distribution as soon as this yr and stays on observe to attain its 12-15% distribution development goal.

NEP Could Presentation

NEP has rebounded from lows however continues to be buying and selling at a really engaging worth paying roughly a 5.4% yield that’s anticipated to have 12-15% annual development.

Decide #2: CAPL – Yield 10.5%

CrossAmerica Companions LP (CAPL) is the smallest of the “massive 3” gas distributors and one we have been carefully anticipating some time now.

Once we have a look at CAPL, we discover its giant and beneficiant yield of 10.5% engaging, so we’re not on the lookout for development however sustainability. 2022 was an unusually excessive yr for gas revenue margins. So we’re anticipating decrease margins in 2023.

All through 2022 administration was very targeted on sustaining the distributions and decreasing leverage – that is necessary as we glance to 2023. As revenue margins decline, leverage ratios will climb on account of nothing greater than decrease earnings. The large query is: by how a lot and the way will distribution protection fare?

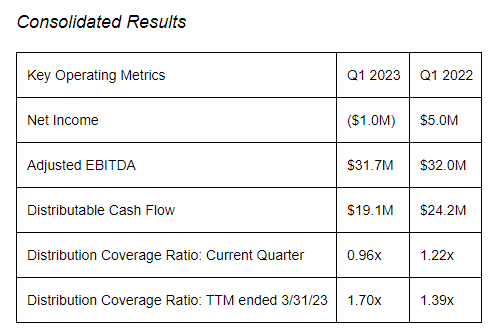

Q1 of 2022 was only the start of the gas revenue margins ramping as much as increased ranges. Subsequently, we’re seeing that Q1 2023 revenue margins are elevated in comparison with 2022 however nonetheless considerably decrease than the tip of final yr. Supply.

CAPL Incomes Launch

When trying on the key outcomes from final yr to this yr, we will see that general, it was comparatively flat. That is because of the decline in revenue margins in Q1 of 2023 versus the rest of the yr of 2022. The underside line outcomes are decrease because of the nearly double enhance of their curiosity expense. That is comprehensible, given the massive variety of price will increase we noticed all through 2022. With regards to gas distributors, the primary and final quarters of the yr are at all times the weakest. It’s because quarter two and quarter three are sometimes known as summer time journey season – there is a a lot increased stage of gas demand throughout these time intervals permitting for higher earnings.

For CAPL, it was lower than a 1x protection ratio for the distribution this final quarter. This will likely be regarding if it turns into a seamless pattern. Nevertheless, trying during the last 12 months, we see sturdy protection, after which trying by means of 2021, we see sturdy protection as properly, albeit decrease than 2022.

The important thing for CAPL to take care of sturdy distribution protection will likely be on account of the truth that they’ve lowered their debt considerably all through 2022. Administration’s deal with decreasing debt greater than natural development or rising the distribution made the distribution extra sustainable. We did see the leverage ratio tick up over 4x, however simply barely. That is partially on account of the truth that they refinanced their credit score line facility and eliminated one of many two of them, amalgamating every part right into a single upsized facility.

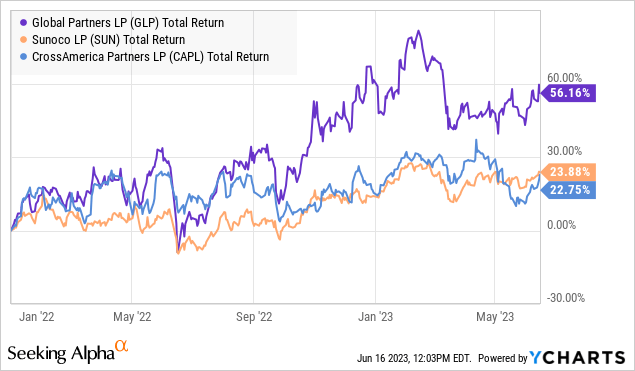

All three main gas distributors supplied sturdy returns since January 1st, 2022. We discover that CAPL is essentially the most engaging presently. Beforehand, HDO members had been in a position to exit GLP with sturdy returns close to the highest of its worth motion. We moved to a safer stage in the popular securities and conventional bond choices provided by World Companions LP (GLP). With regards to CAPL, we discover that the frequent models at present present one of the best worth, and we receives a commission sturdy distributions whereas administration rigorously strikes to cut back leverage.

Word: CAPL points a Okay-1 at tax time.

Conclusion

With NEP and CAPL, we will generate excessive ranges of earnings within the common on a regular basis spending on others. Each time any individual flips on the sunshine change or begins their automobile, you may be incomes cash immediately into your checking account.

That is the form of earnings {that a} retiree goals of. This isn’t an earnings that’s relying in the marketplace to climb or rise after which having to promote shares at a revenue to pocket earnings. That is earnings you may depend on, month after month as a result of others depend on the providers supplied by these firms. Similar to you rely in your utility firm to energy your home and your native gasoline station for gas. The large distinction is which you could select to be paid by these firms as an alternative of merely paying them.

This fashion, your retirement would be the one that’s utterly funded by the spending of others. This isn’t discretionary spending that comes and goes with recessions however required spending that folks must do each single month and each single day. You should have bills whereas retired, so you are going to want earnings to match them and exceed them to do different stuff you get pleasure from. These firms can present that earnings.

That is the great thing about our Earnings Technique. That is the great thing about earnings investing.