Debalina Ghosh

Navigating As we speak’s Surroundings It is Simply Math

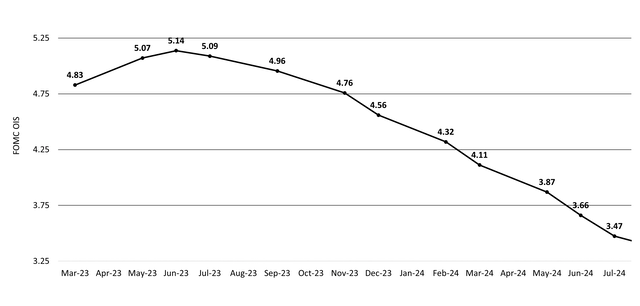

Starting in March 2022, the Federal Reserve (Fed) raised rates of interest on the quickest tempo for the reason that 1980. Monetary markets are actually pricing in for the central financial institution to be close to the tip of its mountaineering cycle (Determine 1).

Determine 1: The Fed could also be pausing quickly

Supply: Bloomberg, BlackRock as of April 24, 2023. FOMC OIS stands for Federal Open Market Committee In a single day Listed Swap.

With yields at present ranges, bond funds can lock in longer-term yields, supply value appreciation potential, and general function a hedge in opposition to a doable exhausting touchdown. Although elevated money balances labored throughout the Fed’s mountaineering cycle, we imagine now is a chance for shoppers to think about including length given the potential for a Fed pause.

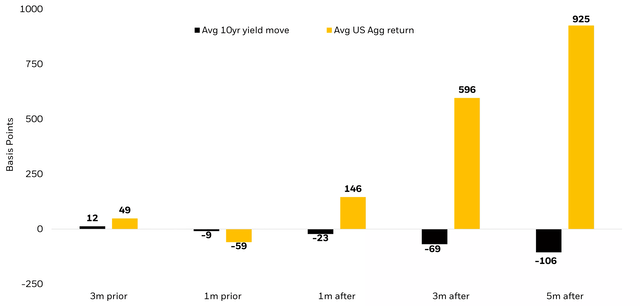

Whereas buyers should not penalized for being early to including length, there’s a potential value to being late (Determine 2). Traditionally, money underperforms when the Fed stops mountaineering (Determine 3).

Determine 2: Act shortly – there’s a possibility value to being late. Core bond yields have fallen shortly when the Fed stops mountaineering.

Common change in 10-year yield in months across the final Fed price hike cycle (%).

Supply: Bloomberg, BlackRock as of March 30, 2023. Time interval as of 1979-2019. Previous efficiency is not any assure of future outcomes. Index efficiency is proven for illustrative functions solely. It’s not doable to speculate instantly in an index

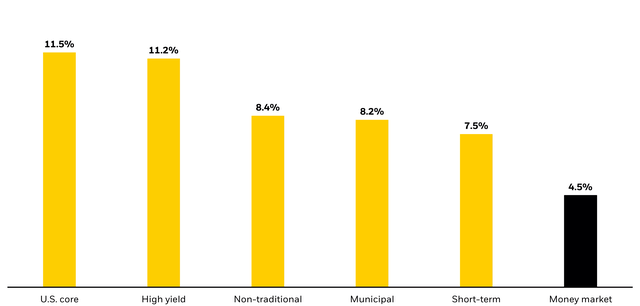

Determine 3: Potential Fed rate of interest hike pause and historic bond efficiency

Common 12 months following the final Fed hike (2/4/94 – 4/30/23).

Supply: Morningstar as of April 30, 2023. Asset class returns represented by respective Morningstar class. Previous efficiency doesn’t assure or point out future outcomes.

Length as a Hedge

In in the present day’s setting of slowing progress and inflation volatility, length could supply a hedge in opposition to potential market volatility and be used as a portfolio ballast. Amidst the Fed getting near pausing, this bodes properly for core bond funds, just like the BlackRock Complete Return Fund (MAHQX) and the BlackRock Core Bond Fund (BFMCX), that might be able to supply protection in instances of market stress within the type of revenue. For instance, during times when the Fed is mountaineering rates of interest, the correlation of US Treasuries to equities is optimistic (+27%), nonetheless when the Fed is on maintain or chopping charges the correlation drops (-16%)1.

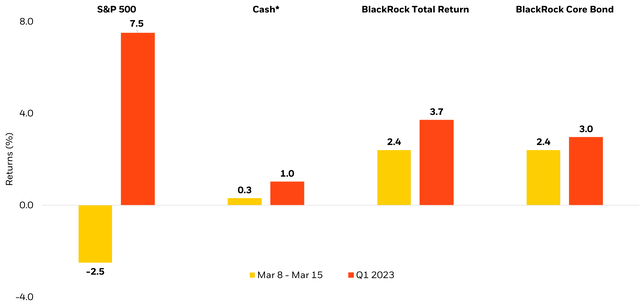

As well as, as markets have been rattled by the US regional banking disaster in March of this yr, Complete Return and Core Bond noticed optimistic returns as equities offered off (Determine 4).

Determine 4: When shares offered off, bonds offered ballast

Returns throughout US Regional Banking Disaster (March 8, 2023 – March 15, 2023)

Supply: Bloomberg, BlackRock as of March 30, 2023. Institutional shares class is used for each BLK Complete Return and BLK Core Bond. *Money is outlined as US Treasury Quick Bond Index. Previous efficiency is not any assure of future outcomes. Index efficiency is proven for illustrative functions solely. It’s not doable to speculate instantly in an index

Case Examine: Positioning the 60/40 Portfolio

As of September 30, 2022, the common advisor’s portfolio was underweight fastened revenue by 9percent2. In a market regime with over half of fastened revenue yielding over 4%, advisors ought to take into account bringing bonds again to the benchmark degree or to an chubby as greater yields could present draw back safety for bonds, doubtlessly reducing your likelihood of loss (Determine 5). In intervals of slowing progress, shares could expertise greater volatility, whereas high-quality bonds could supply a steady supply of returns.

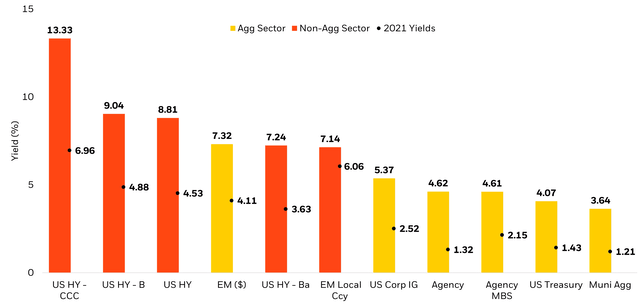

Determine 5: Yields are again

With rising yields, lively sector rotation stays key in navigating this risky market setting.

Supply: Bloomberg, as of Could 31, 2023. 2021 yield is as of January 7, 2021. Previous efficiency is not any assure of future outcomes. Index efficiency is proven for illustrative functions solely. It’s not doable to speculate instantly in an index.

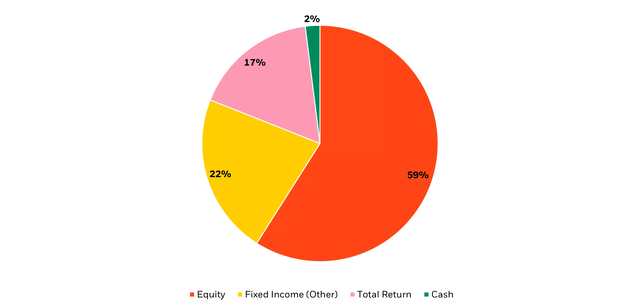

As of the newest rebalance in March 2023, BlackRock’s Goal Allocation Hybrid 60/40 Mannequin newest rebalance at present holds 59% and 39% of its portfolio in equities and glued revenue, respectively – with the rest being in money. On this rebalance, the Mannequin regarded to boost the general high quality of the portfolio and keep its chubby to length.

To extend fairness diversification, dynamically navigate in the present day’s bond market, and supply lively returns, the Mannequin now holds a 17% allocation to BlackRock’s Complete Return Fund, making it the Mannequin’s largest fastened revenue allocation (Determine 6).

Determine 6: Positioning BlackRock’s Complete Return in a Entire Portfolio Resolution

Under exhibits BlackRock’s Goal Allocation Hybrid 60/40 Mannequin as of the newest rebalance, March 17, 2023

Be aware: As of March 17, 2023, the entire quantity of fastened revenue allocation within the BlackRock Goal Allocation Hybrid 60/40 Mannequin is 39%, with BlackRock Complete Return making up 17%.

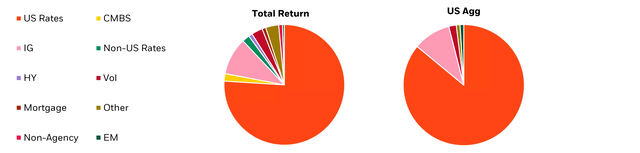

The Complete Return Fund is an actively managed fastened revenue technique which seeks to understand a complete return exceeding that of the benchmark, Bloomberg US Combination Index. The Fund profile might be able to present buyers with core-bond like protection with core-plus like efficiency. The fund employs a diversified multi-sector strategy constructed to navigate totally different market environments (Determine 7).

Determine 7: Complete Return is extra diversified than the Bloomberg US Combination Bond Index

Contribution to threat by technique

Supply: BlackRock, as of Could 31, 2023.

Abstract

Because the Federal Reserve nears the tip of its mountaineering cycle, we imagine now is a chance for buyers to think about including length again to their portfolios. Length could present protection in opposition to potential market volatility and be used as a portfolio ballast during times of slowing progress and inflation volatility. Historical past exhibits that core bonds act as a diversifier when fairness markets offered off.

The BlackRock Complete Return Fund, employs a diversified strategy with adequate flexibility with a purpose to navigate intervals of market volatility, whereas offering a cushion within the type of revenue, and broad portfolio diversification. This has resulted in producing Core Plus-like returns with Core-like threat. As of Could 31, 2023, the fund has a Yield to Worst (YTW) of 5.49% vs. 4.58%, Bloomberg US Combination.

As well as, BlackRock Core Bond supplies buyers with a diversified, core-bond publicity that seeks to generate engaging risk-adjusted returns that exceed the fund’s benchmark, Bloomberg US Combination Index. The fund has a YTW of 5.08% as of Could 31, 2023.

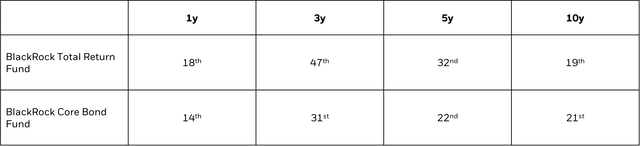

Determine 8: Fund Efficiency

Supply: Morningstar as of April 30, 2023. The above lists out the percentile rating for the fund’s respective Morningstar classes. BlackRock Complete Return Fund is within the Morningstar Intermediate Core Plus Bond Class, and BlackRock Core Bond Fund is within the Morningstar Intermediate Core Bond Class. Complete Return Fund was ranked 1yr, 109/618; 3yr, 258/567; 5yr, 161/544; 10yr, 82/469. Core Bond Fund was ranked 1yr, 104/467; 3yr, 115/438; 5yr, 92/422; 10yr, 86/374. Rankings are primarily based on complete return excluding gross sales expenses, independently calculated and never mixed to create an general rating.

1 Supply: Bloomberg as of March 31, 2023.

2 Supply: BlackRock, Aladdin. Information as of September 30, 2022, primarily based on 5,417 portfolios.

3 The BlackRock Goal Allocation Hybrid 60/40 Mannequin invests in each BlackRock Change Traded-Funds and Mutual Funds.

This publish initially appeared on the iShares Market Insights.