fazon1/iStock Editorial by way of Getty Photos

Current information exhibits that China’s post-COVID financial reopening has been a lot softer than anticipated. Because the economic system slides, the CCP is scrambling to stem the decline. China’s central financial institution not too long ago minimize rates of interest, and hypothesis is rising that they’re going to enact fiscal stimulus to attempt to kick-start the economic system. This wasn’t alleged to occur.

Economists had broadly anticipated Chinese language customers to comply with Western customers embracing a YOLO mentality by massively ramping up borrowing and spending after reopening. As an alternative, relatively than spending massive, customers in China appear to largely be paying down debt and deleveraging. With main financial indicators within the US at their weakest ranges since 2008, US customers would do properly to heed the instance of their friends in China. In distinction to Chinese language customers, Individuals have defied expectations of a slowdown by ramping up borrowing and pushing financial savings charges to near-all-time lows. These contrasting tales have implications for not solely the US and Chinese language inventory markets but in addition for the oil market and geopolitics.

In The West, We Perceive Little About China

In case you’re like most of my readership, you are studying this from someplace in the USA or Canada. If not, then you definately’re in all probability in Western Europe or Australia. English is both your first language otherwise you’re extremely educated sufficient to talk, learn, and write in a number of languages. Since I am writing completely in English, we’re in a position to talk and share concepts relatively simply. Nonetheless, even sharing a typical language, it is considerably simple to be misinformed by the media about what is going on on in different states, cities, and international locations.

If Bloomberg or WSJ writes one thing about one thing in England or Canada or California, then I can simply decide up the cellphone and ask pals there what they consider the story and if it is true. This fashion, we are able to largely filter the propaganda from true underlying developments. China is a special ballgame. The language barrier between Chinese language and English is huge. Whereas it takes the standard diplomat 24-30 weeks to rise up to hurry in French or Spanish, it takes 88 weeks to succeed in proficiency in Chinese language. So what does this should do with investing on the earth’s second-largest economic system? It signifies that except you have spent years learning China and the Chinese language language, then you do not know a lot about it in any respect as a result of every part you recognize is filtered via the media. After all, this is applicable to me as properly, regardless of taking just a few school courses on China and being within the enterprise of publishing macro analysis.

Can statistical evaluation assist to bridge the hole between our lack of awareness and the ocean of cash flowing via China? That is the place we begin getting someplace. Math and statistics can uncover truths which might be kind of common, and if we’re humbly in a position to acknowledge our identified unknowns, then there could also be alternatives. Nevertheless, statistics in China are onerous as a result of information is closely manipulated by the federal government there. In line with Chinese language authorities figures, the unemployment charge by no means in historical past topped 5% till the pandemic, after they acknowledged a spike to about 6%. Refined statistical modeling exhibits that that is utter nonsense. Youth unemployment in China has skyrocketed to over 20%, and it is not fairly clear if there’s an instantaneous repair.

Problematic China statistics prolong from macro statistics like GDP and unemployment to earnings. Just a few years again, researchers used a statistical mannequin to detect earnings manipulation in varied international locations. For instance, the speed of doubtless earnings manipulation in Chinese language firms was discovered to be about 20%, vs. about 2% in Australia (the US is larger than Australia however quite a bit decrease than China). After all, the US is legendary for Enron and different accounting scandals, however that is Little League in comparison with what occurs in Chinese language small caps daily. That is why I do not suggest placing any cash into rising markets- funding returns are correlated with the rule of regulation, not GDP progress.

Here is what we do know:

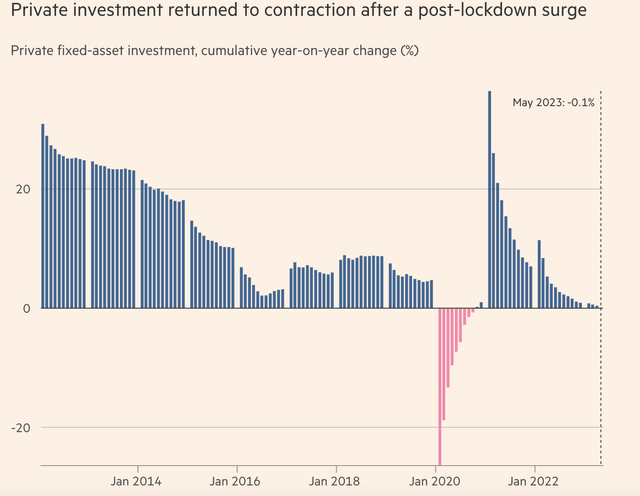

Funding in China has fallen sharply in recent times, solely briefly interrupted by a pandemic lockdown and subsequent surge.

China Non-public Funding (Monetary Instances)

The issue is a large debt load, a lot of it used to finance constructing property. Nevertheless, China’s inhabitants is now falling. Who’s going to reside in all of those homes when the inhabitants is declining? That is an enormous drawback, and that is why the Get together is making an attempt to promote the concept “homes are for dwelling in, not for hypothesis.” Present estimates are that China’s inhabitants will quickly begin to shrink by as many as 10 million individuals per yr, from 1.4 billion to properly underneath 1 billion by the tip of the century. In the long term, that is in all probability a great factor for China’s residents, who will not should compete as closely for assets. This identical development hasn’t occurred within the US but, but it surely’s coming. Nevertheless, inhabitants decline is a catastrophe for closely indebted speculators. In case your inhabitants is flat or shrinking, then basing a lot of your economic system on establishing housing isn’t going to fly.

In the meantime, within the US, housing begins confirmed an acceleration to 1.6 million items (annualized). Assume 300,000 homes or so go out of date, and that is nonetheless sufficient to accommodate over 3.3 million new individuals, whereas the precise inhabitants progress within the US is more likely to be about a million. This can be a development that has occurred yearly since 2019 and is more likely to abruptly finish when there isn’t any extra demand to tug ahead. What is going on on in China is a wake-up name in some ways for the US economic system, as a result of the US will quickly be in an analogous demographic place.

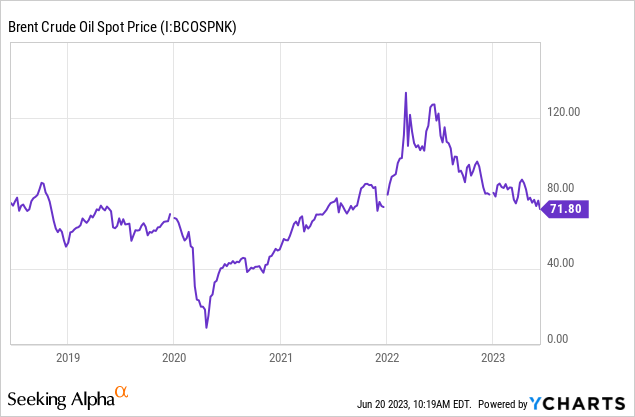

China’s Slowdown: Implications For Shares

To my shock, the oil market has traded fairly bearish, regardless of OPEC+ provide cuts and Russia’s warfare in Ukraine. I feel it is time to take earnings in oil shares like Exxon (XOM), Chevron (CVX), and Occidental (OXY). That is partly a macro name as a result of the oil market is promoting off and oil shares have held excessive, but it surely’s partly a valuation name. Everybody thought oil was lifeless in 2020 when it was clearly coming again, and now many of those identical persons are paying peak multiples for oil shares. If China does shock buyers and their economic system begins roaring again, then you definately may reload on oil shares, however the present information means that China’s slowing economic system mixed with elevated electrical car adoption are making a giant dent. China additionally notably is looking for a thaw in relations with the US. The timing is curious with home points seeming to be mounting there.

For Chinese language tech, the story is definitely attention-grabbing. The CCP appears to be enjoying good with tech firms once more now that the economic system is slowing down. Alibaba (BABA) founder Jack Ma made an look in China at an Alibaba occasion. This got here after wild hypothesis that Ma had “disappeared.” Ma reportedly lives in Tokyo now. With regards to Japan, I feel it is total a significantly better place to take a position than China. Warren Buffett not too long ago upped his bets on Japanese firms, Japanese firms persistently present far much less earnings manipulation than China, and Japan has a extra steady authorities with higher rule of regulation. I would not pay the additional charges to put money into a Japan-specific fund however for long-term buyers, I just like the Vanguard Worldwide Excessive Dividend Fund (VYMI), Vanguard’s Complete Worldwide Market (VEA), and the Avantis Worldwide Small Cap Worth Fund (AVDV). There may be massive cash to be made in China, but it surely’s excessive danger and excessive reward. Nevertheless, as a consequence of endemic ranges of corruption and accounting points, I would not even take into consideration shopping for an index fund of Chinese language shares.

BABA and JD.com (JD) are the 2 most definitely beneficiaries of this thawing within the enterprise group there and are progress shares priced at worth costs. The Chinese language economic system might not be doing properly, however deep worth investing is all the time in season. Plus, they cross the earnings manipulation take a look at.

With China’s Financial system Stalling, Is The US Subsequent?

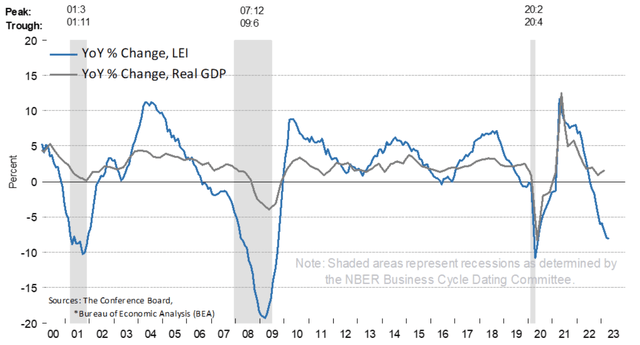

Chinese language customers are battening down the hatches, whereas US customers are able to social gathering. The issue, after all, is that the story that main financial indicators within the US are telling is extremely ugly.

US Main Financial Indicators (Convention Board)

These come because the Fed is all however compelled to hike much more to stop inflation from spiraling uncontrolled.

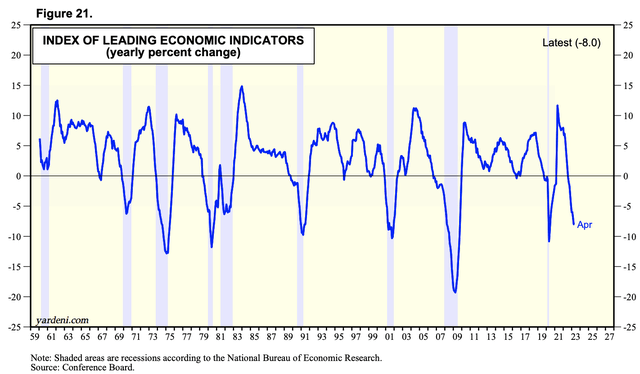

Traditionally each time main financial indicators get to the place they’re now, it is a 100% recession sign, with a median 35% fall in inventory costs and a subsequent massive rise in unemployment. Financial coverage takes some time to kick in, however when it does, it tends to hit onerous. The index is displaying a recession is more likely to happen with an analogous magnitude to the post-9/11 recession, however not fairly as unhealthy as 2008 but.

Right here, the blue line is main indicators going again to the Fifties, whereas the vertical bars point out recession. Anytime it falls under -4% or so, a recession happens fairly quickly after. This usually results in shares falling 35% or so, and housing costs falling sharply as properly in markets the place values are larger than fundamentals assist.

Main Financial Indicators, US (Yardeni Analysis)

This provides meals for thought, particularly with a big tax enhance as a consequence of kick in quickly with the coed mortgage pause ending. The joke about economists is that they predict 10 of the final three recessions, however the development right here is unambiguous. Each time main financial indicators (the yield curve, manufacturing hours, preliminary jobless claims, constructing permits, shopper sentiment, credit score situations, and many others.) go sharply unfavorable, a recession happens. There have been no false positives. American customers are partying whereas Chinese language customers are battening down the hatches. I simply would not count on the social gathering to final.

Backside Line

We’re seeing a pointy and sustained slowdown in China’s economic system. Is the US subsequent? Main indicators are saying that it’s. Worth investing by no means goes out of favor, however there merely is not a lot worth in large-cap US equities in any respect. The place is the worth? For one, it is in sitting in cash market funds and ready for the enterprise cycle to totally flip, however Warren Buffett and others are wanting overseas to make the most of the robust greenback and low valuations. Chinese language tech shares are additionally probably price a glance, however they’re dangerous.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.