ismagilov

All sorrows are much less with bread. ― Miguel de Cervantes Saavedra.

Right now, we take a deeper have a look at a monetary title that appears very low cost on the floor regardless of the present turmoil in some components of the monetary system. The shares even have some shopping for from a helpful proprietor lately. An evaluation follows under.

In search of Alpha

Firm Overview:

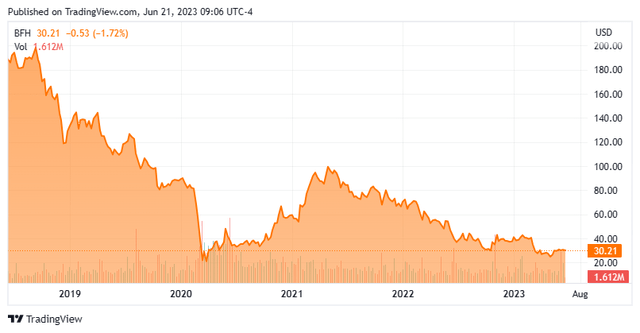

Bread Monetary Holdings, Inc. (NYSE:BFH) is a Columbus, Ohio, based mostly monetary companies concern, offering cost, lending, and financial savings options to shoppers, primarily via its ~100 bank card companions, together with Ulta Magnificence (ULTA) and Victoria’s Secret (VSCO). The corporate additionally affords direct-to-consumer options via its branded Bread Cashback American Categorical (AXP) bank card and financial savings merchandise. Bread was fashioned via a merger of The Restricted’s bank card financial institution operation and J.C. Penny’s transaction companies enterprise in 1996. It went public as Alliance Knowledge Methods in 2001, elevating web proceeds of $160.8 million at $12 a share. After peaking at $249.00 a share in 2015, Bread at present trades simply over $30.00 a share, translating to an approximate market cap of simply over $1.5 billion.

February Firm Presentation

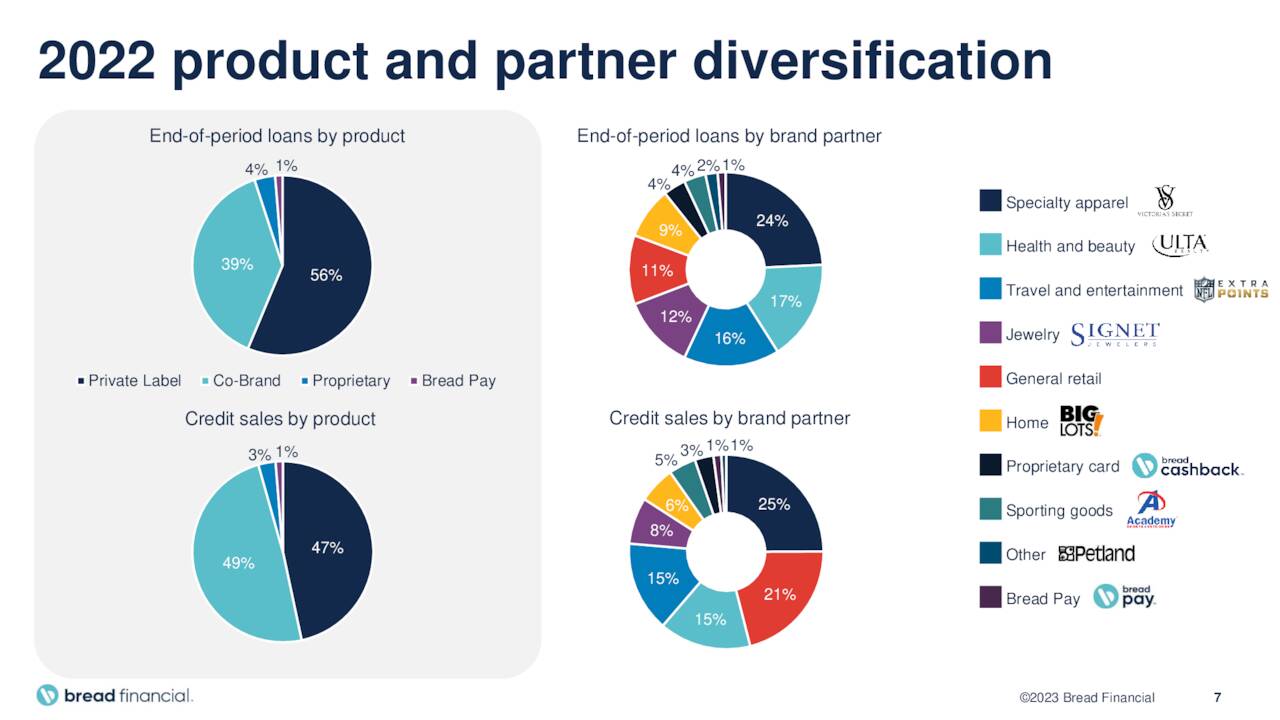

The corporate’s funding combine at YE22 was comprised of wholesale deposits (39%), retail deposits (26%), secured borrowings (25%), and unsecured borrowings (10%). Over 90% of the retail deposits are FDIC insured. Co-branded and proprietary bank cards (versus non-public label playing cards) account for roughly half of Bread’s credit score gross sales.

February Firm Presentation

Transformation

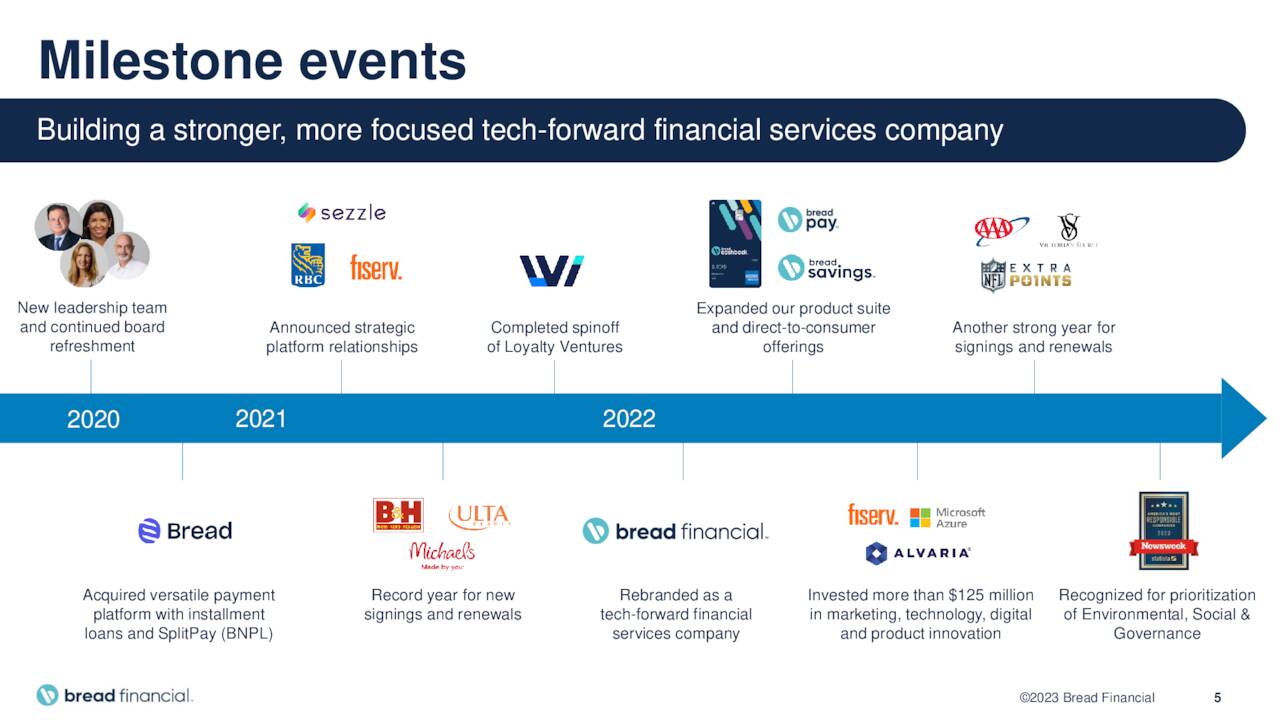

Starting in 2018, Alliance started a change that resulted within the divestment of its Epsilon advertising and marketing and information companies operation in 2019, the spinoff of its low-margin LoyaltyOne advertising and marketing phase in 2021, and the transition of its bank card processing companies unit in 2022. In 2020, Alliance acquired Bread’s omnichannel know-how platform integrating retailers and financial institution companions with the objective of providing installment and purchase now, pay later (“BNPL”) loans at point-of-sale. For $450 million, Alliance not solely superior in direction of its goal of turning into a tech-forward monetary companies supplier, but in addition acquired its new moniker, which it formally rebranded to in March 2022.

Share Worth Efficiency

After incomes (at the moment) $14.10 a share (GAAP) in FY17 and on its solution to $17.49 a share (GAAP) in FY18, administration introduced that it had accomplished a evaluation of its portfolio of companies in October 2018, concluding that its inventory value didn’t replicate the worth of stated portfolio. That announcement actuated the aforementioned transformation and marked a excessive watermark for Bread’s inventory ($164.27 a share). Already down by about half getting into 2020, shares of BFH cratered to $16.37 throughout the pandemic selloff because the market anticipated (and acquired) a big drop in retail exercise throughout FY20.

To proper the ship, a brand new administration group was onboarded that 12 months. Because the economic system reopened with shoppers flush with pandemic assist whereas rates of interest (i.e., Bread’s funding prices) remained muted throughout FY21, the bank card concern rallied again to a post-pandemic intraday excessive of $102.28 in June of that 12 months. Curiously, web curiosity revenue was basically flat FY21 vs. FY20, however owing to the Goldilocks situation, mortgage loss provisions dropped $722 million to $544 million, permitting Bread to earn $15.95 a share (GAAP) in FY21.

With the return of excessive power value pushed inflation and consequent Fed tightening, shares of BFH started their slide, additional exacerbated by the run on Silicon Valley Financial institution (OTCPK:SIVBQ) in early 2023.

FY22 Outcomes

That stated, Bread’s FY22 was not unhealthy, particularly relative to its preliminary projections. Regardless of the difficult macroeconomic atmosphere, Bread generated pretax, pre-provision earnings (PPNR) of $1.89 billion on web curiosity revenue of $4.18 billion versus PPNR of $1.59 billion on web curiosity revenue of $3.49 billion in FY21. Internet curiosity margin elevated 100 foundation factors to 19.2%. Common loans excellent rose 13% to $17.77 billion, whereas its web loss price grew from 4.6% to five.4%. Retail deposits on its Bread Financial savings platform spiked 72% to $5.47 billion. General, whole deposits grew 25% to $13.8 billion. All these outcomes have been according to administration’s outlook on the onset of FY22.

Negatives included the announcement (on the onset of FY22) that it had misplaced BJ’s Wholesale Membership (BJ) enterprise (efficient FY23), which accounted for 10% of its web curiosity revenue in FY22; and the worth of its former LoyaltyOne enterprise, of which Bread nonetheless owned shut to twenty%, had cratered – ultimately submitting for chapter in March 2023.

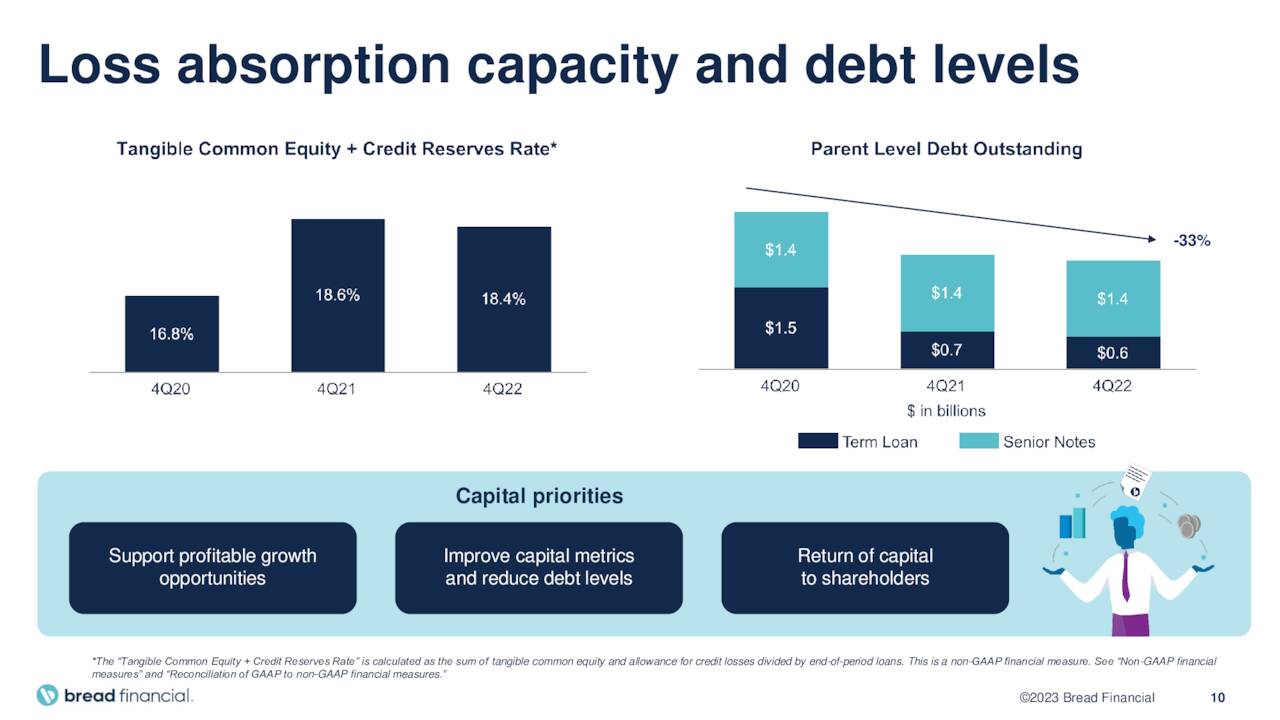

Bread did improve its credit score loss absorption capability via rising mortgage loss reserves by $1.05 billion to $1.59 billion. That transfer considerably impacted GAAP earnings, which fell from $16.02 a share in FY21 to $4.46 a share in FY22. However with PPNR bettering 19%, FY22 might rightly be characterised as successful.

The market “rewarded” this efficiency by promoting its inventory off 42% over calendar 2022.

FY23 Outlook

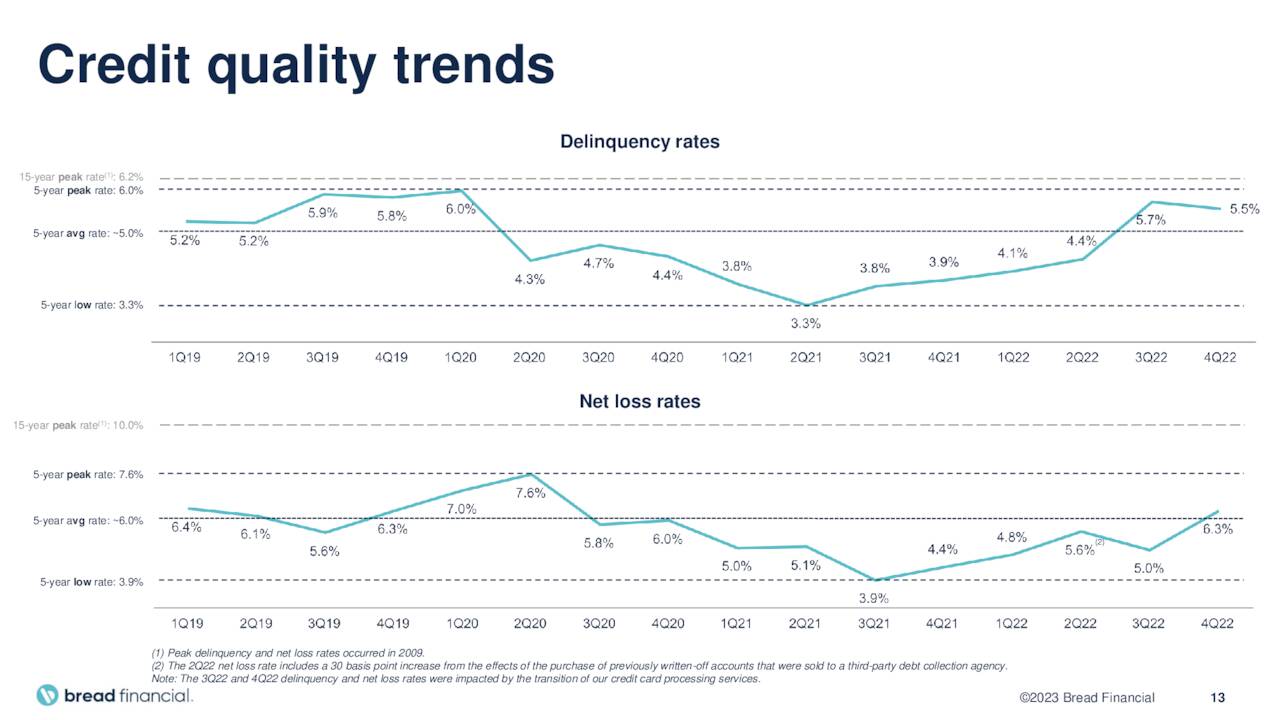

After administration hit on all its predictions in FY22, it supplied its outlook for FY23 in February 2023. According to its tougher financial outlook that features greater unemployment, Bread anticipated mid-single digit mortgage development, which included the anticipated sale of its BJ Wholesale mortgage portfolio. Internet curiosity revenue was projected to be according to that development as web curiosity margin was anticipated to be flat at 19.2%. Internet loss price was anticipated to rise from 5.4% to ~7.0%. As a matter of perspective, the online loss price peaked at 10.0% throughout the 2008-2009 banking disaster. On condition that Bread can ship on its inner predictions, it may be argued that its inventory is considerably undervalued.

1QFY23 Outcomes

Step one in direction of delivering on its forecast got here on April 27, 2023, when the monetary companies concern delivered Q1 earnings of $9.08 a share (GAAP) on income of $1.28 billion, besting the Avenue consensus by $1.63 a share and $220 million. Whole web curiosity revenue rose 13% year-over-year to $1.12 billion, as common mortgage steadiness elevated 17% to $19.4 billion whereas web curiosity margin fell 40 foundation factors to 19.0%. PPNR improved 50% year-over-year to $745 million, though that enchancment was nearly completely a perform of two gadgets: a $230 million pretax achieve on the sale of BJ’s Wholesale portfolio and seasonal paydowns. On an apples-to-apples foundation, it was up 4% year-over-year.

Administration didn’t change its FY23 outlook.

Steadiness Sheet & Analyst Commentary:

With a whole bunch of billions of deposits exiting the banking system because the Fed started its tightening marketing campaign, it was encouraging to see Bread understand a 3% sequential improve in direct-to-consumer deposits to $5.6 billion (1Q23 vs 4Q22), which additionally represented a 70% improve year-over-year. That stated, Bread’s whole deposits fell $700 million sequentially to $13.1 billion and its total price of deposits elevated sequentially from 3.1% in 4Q22 to three.5% in 1Q23.

February Firm Presentation

The Bread steadiness sheet is in stable form, with the bank card concern holding money of $3.6 billion in opposition to long-term debt of $1.9 billion. Debt has dropped 39% since 1Q20 – when the brand new administration group arrived. Capital ratios are in glorious form with its CET1 ratio at 20.2% and tangible frequent fairness / tangible belongings at 9.1%. Allowance for credit score losses reserves have been $2.22 billion, or 12.3% (up from 11.5% in 4Q22, merely to regulate for the lack of BJ’s greater high quality portfolio). In idea, these conservative metrics would give administration the pliability to extend the dividend, which at its present $0.21 per quarter, supplies a yield of two.8%. Additional buttressing administration’s efficiency, Bread’s tangible ebook worth elevated at a CAGR of 36%, from $15.41 a share in 1Q20 to $38.44 a share in 1Q23.

Regardless of its stable efficiency in FY22 and good begin to FY23, Avenue analysts are considerably spooked by falling M2; thus, that includes 5 purchase/outperform rankings and 6 holds. In late April, Keefe Bruyette lowered its score on Bread from outperform to carry and its value goal from $35 to $30, citing the macroeconomic backdrop. Financial institution of America did reissue its Purchase score and $43 value goal of the inventory final week. On common, they anticipate Bread to earn $11.76 a share (non-GAAP) on income of just below $4.3 billion in FY23, adopted by $9.85 a share on related gross sales in FY24.

Helpful proprietor Turtle Creek Asset Administration has used the depressed ranges as a chance to price common its place in Bread, buying 447,618 shares in early Might between $23.50 and $27.00 a share.

Verdict:

It is difficult to catch a falling knife in an atmosphere the place inflation is consuming into client discretionary spending and a slowing economic system (courtesy of Fed tightening) is deteriorating credit score high quality. And the lack of BJ’s higher-credit high quality portfolio is not going to assist the standard of its credit score threat.

February Firm Presentation

That stated, with a powerful steadiness sheet and over 90% of its direct-to-consumer deposits FDIC-insured, Bread is poised to climate the storm. Buying and selling at round thirty bucks a share with a tangible ebook worth of $38.44 a share, it’s anticipated to earn $21.61 a share over the subsequent two years. I feel these estimates are more likely to come down considerably as I see the nation heading right into a recession.

That stated, Bread Monetary Holdings, Inc. inventory appears low cost sufficient to benefit a “watch merchandise” holding for now, and I lately added a small place by way of coated name orders to my very own portfolio.

… Carb-e Diem. Seize the bread.”― Ryan La Sala, Be Dazzled.