Matteo Colombo

Funding Abstract

As we’re round midway by FY’23 it has been a pleasure to see among the healthcare longs I’ve positioned towards come into the cash. I am now extending the protection universe searching for extra selective alternatives. My searches, deep throughout the entrails of the worldwide monetary markets, led me to Varex Imaging Company (NASDAQ:VREX), a reputation that is caught a 15% bid within the final 6-months.

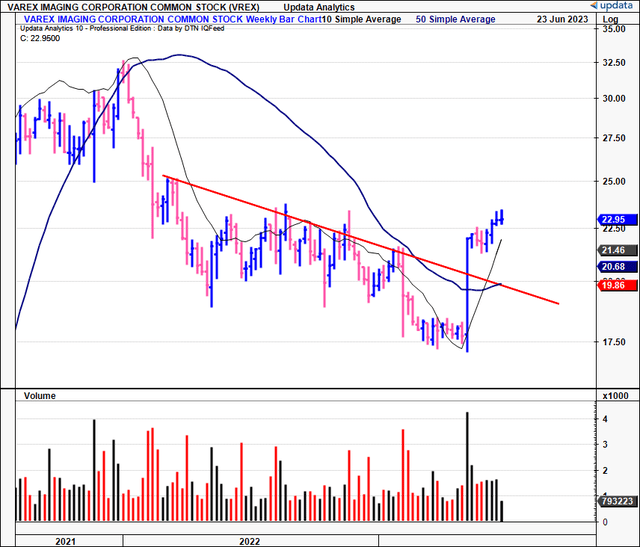

Analyzing the financial traits of VREX’s enterprise and the figures are unappealing in my opinion. Nevertheless, the market has actually revised its expectations on the corporate, evidenced by the sharp repricing described above. Additional, the breakout is critical because it brings VREX out of an intensive long-term downtrend, and thus should be investigated additional.

VREX is similar to RadNet (RDNT), an organization I’m closely bullish on and have acknowledged sturdy positive aspects with in 2023. I’d encourage you to examine that publication out to make an correct comparability between two competing names. See the most recent RNDT publication right here. Web-net, I charge VREX as a maintain for now, seeking to a value vary of $15 per share.

Determine 1. VREX breakout from long-term downtrend.

Information: Updata

Vital information to VREX funding debate

Peeling again the superficial layers to research the entire shifting components, my evaluation factors me to three protection areas for VREX– 1) elementary drivers, 2) sentiment elements, and three) valuation. Detailed evaluation of all parts follows.

1. Elementary drivers

Newest numbers

The corporate’s newest numbers are telling of the revised expectations. It clipped Q2 FY’23 gross sales progress of 6% YoY and 11% sequentially. Underscoring this progress, the agency’s medical phase was up 9% from This fall and a pair of% YoY. Additional, the commercial phase clipped a 19% sequential progress sample and was up 22% YoY. On face worth, the agency’s progress percentages point out a well-diversified income stream, successfully hedging the top-line to giant sigma occasions going ahead. You see this within the firm’s unimpacted income clip from 2019–’23.

Transferring down the P&L, I might be aware the next takeaways:

The agency introduced the income progress to 33% gross margin, which is tight. For instance, the sector affords a median 55% gross, 42 factors above the corporate. It pulled this to $30mm in adj. EBITDA. While these are skinny margins, one constructive is the corporate’s publicity to non-destructive inspection merchandise (“NEPs”) and photon counting detectors positions it effectively to seize a higher-margin over time in my view. For instance, the worldwide NEP market is poised for 8.7% CAGR into 2030, a high-growth phase. It is simply as much as the corporate to transform on this. It additionally exited Q2 with money of $122mm, representing a $14mm improve from the prior quarter. Money flows had been improved by a $9mm stock lower as gross sales pulled by.

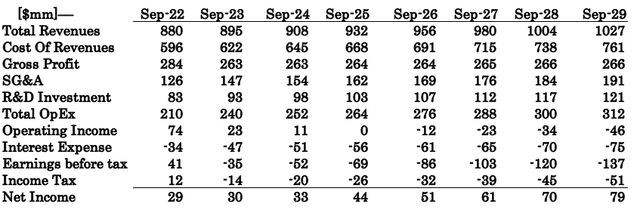

Trying forward, administration anticipates income progress of three% to five% over FY’22, calling for $902mm on the top-line in FY’23. This is not thrilling, and there is been no updates to earnings projections on this.

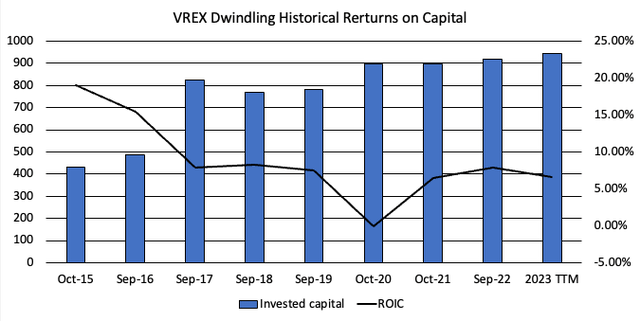

Unfavorable financial traits

Since FY’15 VREX has delivered blended outcomes on the capital it has invested into operations. As potential traders within the enterprise, we wish to know precisely what income VREX is producing on the capital it has at work, as, on this occasion, capital produces the income for the corporate. Therefore, once I observed the run-down in trailing ROIC from 20% in 2015 to simply 6.65% within the TTM [Figure 2], I used to be shocked. It suggests the corporate has had a tough time in assembly its value of capital, and definitely in assembly the market return on capital.

Determine 2.

Information: Creator, VREX SEC Filings

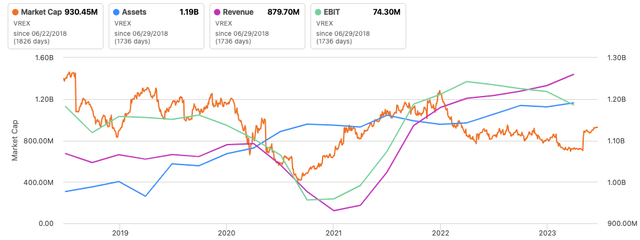

The relevance of this level is noticed in Determine 3. It might seem the market is valuing VREX with a detailed relationship to gross sales and pre-tax earnings, extra so than asset elements. This is smart– the corporate allocates capital to generate further gross sales and income over time (the capital produces the income bear in mind). Therefore, that VREX is producing much less and fewer profitability on its capital, hasn’t been conducive to its score any increased. Notably, the uptick and gross sales from Q2 ––and the FY’23 projections–– could also be one motive behind the latest rally. Thus, I’m trying immediately on the agency’s pre-and-post-tax earnings progress scaled by its asset progress over the approaching durations. For now, this information is supportive of a maintain in my opinion.

Determine 3.

Information: Looking for Alpha

2. Sentiment elements

The latest improve in VREX’s market worth will be attributed largely to modifications in investor sentiment, in my opinion. The significance of sentiment in driving inventory costs increased can’t be overstated, and we will observe this phenomenon in 3 distinct methods right here.

Firstly, we be aware a major enchancment in analyst scores up to now 3 months, with sell-side analysts revising gross sales and earnings upwards 4 occasions. Consensus now forecasts a 4.5% progress charge for this 12 months and the subsequent, with anticipated income figures of $898mm and $940mm, respectively. These upward revisions mirror a rising bullish sentiment on The Avenue.

Secondly, options-generated information reveals that calls are closely stacked at a strike value of $25 for each July and August expiries. This means a bullish outlook amongst traders with cash in danger, betting on a rally to $25. Such knowledgeable opinions characterize a notable issue within the ongoing debate over the corporate’s future worth.

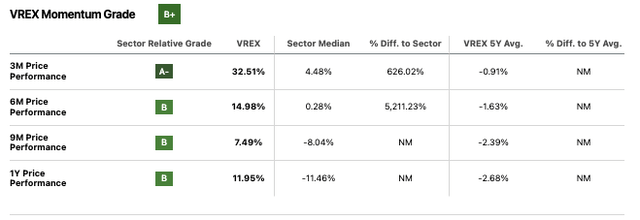

Lastly, you’ll observe that momentum indicators are aligning effectively with the present sentiment. The inventory is at present buying and selling above all shifting averages (10, 50, 100 and 200-day averages), surpassing key psychological ranges. On the similar time, the latest break has despatched VREX above all earlier time frames apart from the 5-year mark. This value motion means that traders are pricing in more and more bullish expectations, additional supporting a constructive outlook for the inventory.

Determine 4.

Information: Looking for Alpha

3. Valuation

VREX trades at 19.7x ahead earnings, and this can be a shade under the sector’s a number of of 20x, with the inventory priced at 1.8x e book worth of fairness. With the sharp rally from Might–June, my query instantly is how a lot farther these multiples can prolong.

Development projections inform us an excellent deal on this as a call rule– would you pay 19x ahead, just for a PEG ratio of 85x? This suggests a stagnant progress charge for an in any other case comparatively unattractive valuation. Therefore, utilizing my funding standards, there isn’t any approach I will pay this a number of with out the expansion elements to again it up. As an train, presuming no earnings progress shifting ahead, paying 19x ahead, you’d get your payback in 19 years. Not enticing. My assumptions have the corporate to do $30mm on the backside line. At 19x ahead, this will get me to ~$15, about in line the place the corporate was earlier than the most recent rally. That is supportive of a impartial view.

Appendix 1. VREX ahead estimates

Information: Creator

In brief

Collectively, there are constructive factors worthy of debate for VREX. Nevertheless, on nearer inspection, there’s a lack of torque feeding into the corporate’s flywheel, that means the most recent shopping for rally within the firm would not seem effectively supported on a elementary foundation. My numbers have the corporate to do $30mm in earnings this 12 months and on the market’s a number of of 19x ahead this will get me to a worth of $15/share, under the present market value. All of the factors raised right here right now, due to this fact, are supportive of a impartial viewpoint in my view. In that vein, I’m score the corporate a maintain for now. I stay up for offering further protection.