halbergman/E+ by way of Getty Photographs

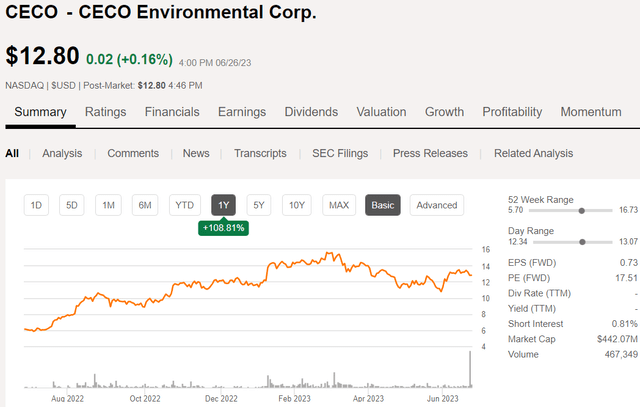

Whereas the general inventory market continues to vacillate between bullish and bearish sentiment over considerations about ongoing inflation and continued price will increase from the Federal Reserve, one firm has been quietly rising and remodeling the enterprise to reap the benefits of alternatives for growth. I final lined CECO Environmental (NASDAQ:CECO) again in November 2022 once I described their capacity to develop the enterprise regardless of the fears of a coming recession. In that article, I discussed that the corporate has been executing very efficiently on a turnaround plan over the previous couple of years regardless of macroeconomic pressures. I rated the inventory a Robust Purchase at the moment when it was buying and selling for lower than $12.

Searching for Alpha

Now on the finish of June, and after reporting a robust Q1 outcome, the inventory nonetheless trades at a really cheap ahead P/E of about 17.5x and is positioned to proceed rising the enterprise after finishing two current acquisitions. After reporting report Q1 revenues and report backlog, the corporate once more raised steering for the 12 months (the second time since Q422). I proceed to price CECO a Robust Purchase on the present value of $12.81 as of market shut on June 26.

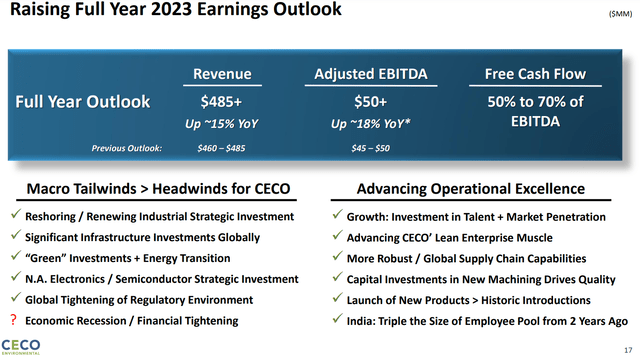

The corporate up to date its anticipated full 12 months 2023 steering to replicate income to exceed $485 million, up a minimum of 15 p.c 12 months over 12 months, from a earlier vary of $460 to $485 million. The corporate additionally up to date its anticipated full 12 months 2023 adjusted EBITDA to exceed $50 million, up greater than 18 p.c 12 months over 12 months, from a earlier vary of $45 to $50 million.

Development by way of Acquisitions

With two acquisitions accomplished within the first half of 2023, together with Wakefield Acoustics in January adopted by Transcend Options in April, the corporate has now closed six offers prior to now 18 months. The Wakefield deal expanded their presence in Industrial Air and noise abatement, whereas the Transcend deal gives extra revenues from the Power Transition section. CECO is remodeling the enterprise to ship balanced development throughout a number of, numerous markets as illustrated on this slide from the Q123 earnings presentation.

CECO Q123 earnings presentation

Whereas CECO had labored with Transcend for greater than 7 years previous to the acquisition as a companion/provider of filtration and separation options, the corporate expects to greater than double revenues over the subsequent 3 years as defined by CECO CEO Todd Gleason within the press launch asserting the deal.

“Transcend checks all of the packing containers for CECO once we consider strategic acquisitions and the place to deploy our capital. Transcend gives differentiated, high-value superior options to a broad set of markets and purposes. The corporate has the potential to double income in a three-year interval when plugged into the prevailing CECO community of worldwide clients and places. Transcend improves our short-cycle and long-cycle combine and has extremely accretive working margins. And eventually, we now have accomplished this transaction with very engaging pricing based mostly on each a trailing and ahead foundation.”

The Transcend acquisition closed on April 3, 2023, so any extra revenues is not going to probably be acknowledged till after Q2 outcomes are reported, however clearly the chance exists for development to proceed within the vitality transition a part of the portfolio, which represents about 30% of total revenues.

Q1 Outcomes and Monetary Efficiency

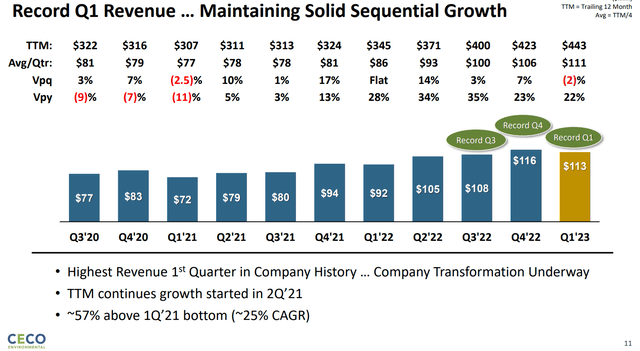

The Q123 report included $146M in new orders, marking the fifth consecutive quarter of orders booked exceeding $100M and leading to TTM orders booked of $512M resulting in a report backlog for the corporate. Document Q1 revenues of $113M had been reported which represents YOY income development of twenty-two% and the best Q1 revenues reported in firm historical past. The transformation that has been underway since 2020 is clearly illustrated on this slide from the Q1 earnings presentation.

CECO Q123 presentation

Gross revenue for the quarter was $34.9M, additionally a report for Q1 gross revenue $ and represents a gross margin of 31%. The adjusted EBITDA for the quarter was $9.7M, up 2% YOY, nevertheless, the Q122 quarter was greater as a consequence of an insurance coverage settlement that was acknowledged in that quarter. When eliminated, the EBITDA was improved by 50 to 75 bps over Q122. When trying on the TTM adjusted EBITDA of $42.5M, the rise was about 48% YOY. Free money movement was detrimental ($14.5M) within the quarter as a consequence of timing of accounts receivables and the usage of money for acquisitions and dealing capital as defined by CEO Gleason on the earnings name transcript.

Given the timing of accounts receivables and our must construct some stock, our working capital development, resulted in a use of money in Q1. We count on money receipts to be very sturdy within the coming quarters, delivering an excellent complete 12 months free money movement, reflecting the seasonal nature of undertaking deliveries and money movement technology.

Gross margins are anticipated to extend much more with the current acquisitions, improved productiveness, and report backlog to ranges approaching 33% to 35% or greater. Traditionally, gross margins have averaged at round 33% so the anticipated development represents a pleasant leap from present ranges. That enchancment together with double-digit gross sales development over the subsequent a number of years ought to lead to 15% EBITDA development by 2025 or so based mostly on feedback made in the course of the earnings name.

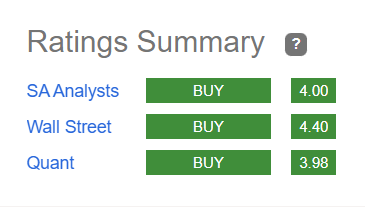

Scores and Outlook

With Purchase rankings throughout the board from SA Analysts, Wall Avenue, and the SA Quant system, there isn’t a doubt that this development inventory is prone to outperform over the approaching years with a report backlog, bettering margins, tailwinds from Industrial Air, Industrial Water, and Power Transition markets, together with vital infrastructure investments throughout the globe.

Searching for Alpha

There’s some threat to the enterprise if a extreme recession does occur later this 12 months or in 2024, however even when some monetary tightening does happen, a lot of their enterprise is pretty recession resistant. This slide from the Q1 presentation illustrates the raised 2023 full 12 months outlook and the explanation why the sturdy development is prone to proceed.

CECO Q1 presentation

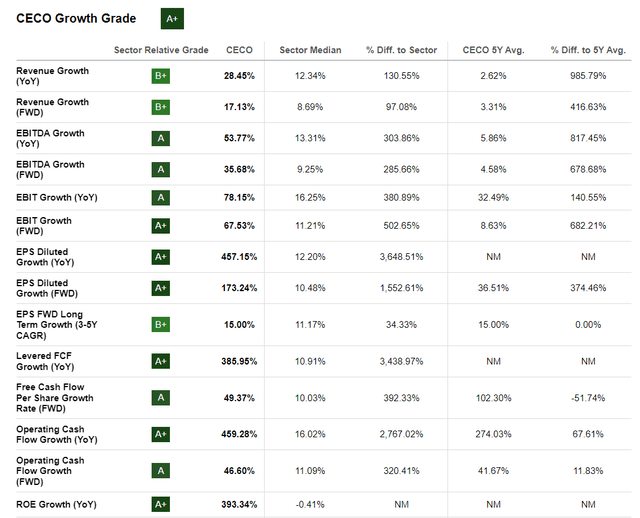

The Quant ranking system provides CECO an A+ for Development and I consider that it deserves such a ranking given their development trajectory and profitable enterprise transformation that has been occurring over the previous a number of years. With the current acquisitions which have but to affect the underside line, I really feel that the inventory may be very undervalued on the present value and will simply double over the subsequent 2 to three years.

Searching for Alpha

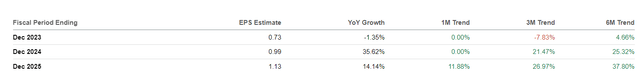

Consensus income revisions have been steadily shifting upwards with 5 upward revisions over the previous 3 months, and EPS revisions are prone to be revised upwards as properly. Present EPS estimates point out 35% YOY development in 2024 and one other 14% YOY development in 2025, nevertheless, these estimates almost definitely don’t take the Transcend deal under consideration. I count on that after the Q2 earnings report we’ll see extra upward EPS revisions.

Searching for Alpha

Though the inventory value has risen by greater than 100% over the previous 12 months, I can simply envision the worth doubling once more over the subsequent 2 to three years. Nevertheless, with a small market cap of solely about $440M and comparatively gentle buying and selling quantity, there might be some volatility within the value motion within the brief time period. In case you are contemplating beginning a brand new place in CECO inventory, it might be clever to look at the worth motion to see if it pulls again beneath $12 once more, particularly if the broader market retreats over the approaching weeks. My expectation is that the worth will shoot up once more after they report Q2 outcomes, however till then there might be a chance to “purchase the dip” if that ought to happen.

Searching for Alpha

Dangers and Alternatives

The best threat to the inventory value on the present time in my view is predicated on what occurs to the broader world financial system, and particularly the US financial system. With the Fed nonetheless speaking about elevating charges and inflation nonetheless elevated, there will likely be some aversion to investing in development shares because of the uncertainty surrounding the macroeconomic situations. Usually, small cap shares like CECO get caught up within the mindset of “promoting earlier than the crash” although the basics communicate to a stable development alternative. There isn’t a assure that the Q2 report will likely be as glowingly exceptional because the Q1 outcomes counsel, however in my expertise the development is your pal, and I might say that the chance of a robust Q2 report is in your favor.

If I’m unsuitable and the inventory tanks even with a stable report, don’t be dismayed as it’s prone to get well because it did after the Q1 report when the inventory value plummeted by as a lot as -10% the day of the report, adopted by a leap in value just a few days later. All in all, I consider that CECO is heading in the right direction for a stable long-term development alternative that’s properly positioned for the rising investments in environmental cleanup applied sciences that it gives to clients throughout the globe.