John M. Chase

Salesforce, Inc. (NYSE:CRM) traders who braved the pessimism and picked its lows late final yr have been well-rewarded, as CRM took off in 2023, considerably outperforming the S&P 500 (SP500, SPX, SPY).

I final up to date traders with a Purchase score in early December 2022, which was barely early as CRM did not backside out till mid-December. Nonetheless, it was nonetheless a stable purchase level for traders who ignored the market’s pessimistic calls, as CRM surged practically 80% from its December lows towards its latest highs.

Subsequently, given the outstanding restoration, I consider it is an opportune time to assist CRM holders assess whether or not the present ranges are nonetheless constructive to purchase extra shares.

I am happy to spotlight that I gleaned the chance in restoration play in CRM stays legitimate, as its valuation continues to be at pessimistic ranges, regardless of the restoration over the previous six months. Its worth motion has additionally not demonstrated important momentum spikes, suggesting traders had rushed into CRM, which might result in bull traps or false upside breakouts previous doubtlessly steep pullbacks.

Apparently, the market stays lukewarm over CEO Marc Benioff and his group’s generative AI technique, as they introduced a collection of upgrades to the Salesforce ecosystem.

However why? Does the market assume CRM deserves to commerce at a steep low cost in opposition to its historic averages because it strikes towards a greater stability between profitability and development?

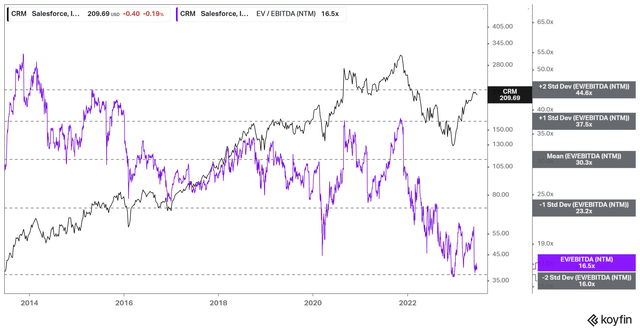

CRM ahead EBITDA a number of pattern (koyfin)

As seen above, CRM final traded at a ahead EBITDA a number of of 16.6x, near the 2 commonplace deviation zone below its 10Y common of 30.3x. In different phrases, CRM is affordable, comparatively talking.

It is also buying and selling effectively under Microsoft’s (MSFT) ahead EBITDA a number of of 21.7x and under its SaaS friends’ median of 21.9x (in accordance with S&P Cap IQ knowledge). Subsequently, whereas CRM has recovered remarkably from final yr’s battering, because it closed in on its 2020 COVID lows, I assessed that its valuation continues to be interesting.

Salesforce launches a sequence of generative AI choices anticipated to drive higher integration with its ecosystem. Nonetheless, I assessed that the market might stay tentative over the corporate’s capability to drive near-term topline development after its first-quarter earnings launch in early June.

Eager traders ought to recall that the corporate did not elevate its full-year income forecast regardless of the stable FQ1’24 efficiency, though it improved its outlook for adjusted working profitability.

As such, the market is probably going assessing the corporate’s capability to drive greater income accretion by its new AI cloud and knowledge integration earlier than re-rating it additional upward.

Does it make sense? I feel it is justified. The revised consensus estimates point out that Salesforce is anticipated to ship income development of 10.5% for FY24, in step with administration’s steering. Nonetheless, that is down considerably from FY23’s 18.3% and much more from FY22’s 24.7%.

Subsequently, I consider the market is adjusting its expectations over the corporate’s new income development cadence, given its heightened deal with improved bottom-line metrics. Furthermore, analyst estimates do not count on a much-improved prime line development in FY25, with a projected enhance of simply 10.8%. Subsequently, I gleaned that the market is probably going awaiting extra constructive progress from the corporate’s generative AI choices earlier than readjusting their expectations on CRM’s development cadence.

Regardless of the market’s pessimism, Salesforce’s large financial moat is underpinned by its capability to cross-sell a number of options throughout its ecosystem. As such, the attraction of its multi-cloud technique, coupled with its capability to combine third-party AI fashions, ought to assist appeal to prospects to its AI choices. Furthermore, Salesforce’s deal with compliance and “trusted AI” ought to assist bolster extra sturdy enterprise adoption.

Regardless of that, I consider the market’s demand for a wider margin of security, given its a lot slower topline development cadence, is known. The adjustments are markedly completely different from Salesforce’s earlier acquisitive-heavy method to rising its enterprise. As such, a major low cost is justified and anticipated till the market totally understands how Salesforce’s new AI choices might assist bolster its capability to maneuver again into the “performant” part.

With that in thoughts, traders have to have a excessive conviction over Benioff’s capability to proceed Salesforce’s restoration by its AI technique, which stays a piece in progress. Nonetheless, I assessed that there aren’t many wide-moat SaaS gamers with Salesforce’s capabilities nonetheless buying and selling at such depressed ranges that ought to warrant the market’s consideration subsequently.

Furthermore, CRM’s worth motion means that it is on the cusp of recovering its long-term uptrend, indicating that the restoration continues to be in its earlier phases.

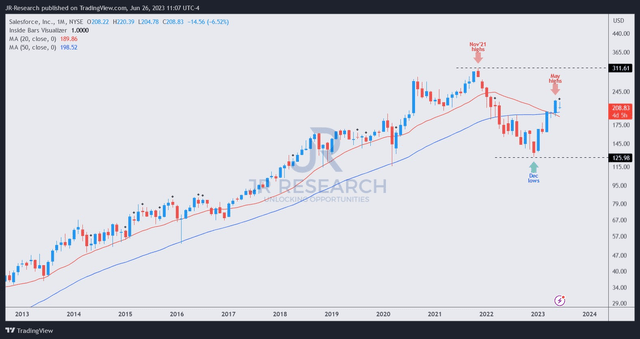

CRM worth chart (month-to-month) (TradingView)

CRM misplaced its long-term bullish bias even because it bottomed out in December 2022. Nonetheless, the resurgence in dip shopping for sentiments has helped it get well its uptrend momentum, regardless of the pullback in June.

After such a outstanding restoration, a welcomed pullback shouldn’t be sudden. Therefore, if Salesforce, Inc. inventory might keep above the 50-month shifting common or MA (blue line), it ought to present extra confidence for momentum traders to return. As such, it ought to assist elevate CRM from its depressed valuation ranges, suggesting that consumers are assured that the market’s notion of CRM’s valuation is just too pessimistic on the present ranges.

Ranking: Preserve Purchase.

Necessary be aware: Buyers are reminded to do their very own due diligence and never depend on the data supplied as monetary recommendation. The score can be not supposed to time a particular entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have further commentary to enhance our thesis? Noticed a vital hole in our thesis? Noticed one thing essential that we didn’t? Agree or disagree? Remark under and tell us why, and assist everybody locally to study higher!