Darren415

This text was first launched to Systematic Earnings subscribers and free trials on June 19.

On this article, we spotlight a closed-end fund, or CEF, funding technique that we use throughout revenue portfolios. Briefly, it depends on holding one in every of two strong-performing comparable funds and rotating between them as their relative valuation modifications.

We focus on this technique within the context of the CEF pair:

Credit score Suisse Asset Administration Earnings Fund, Inc (NYSE:CIK) Credit score Suisse Excessive Yield Bond Fund (NYSE:DHY)

The important thing takeaway right here is {that a} double-barreled technique of specializing in a few very comparable high quality funds and infrequently rotating between them can generate very sturdy returns that may convincingly beat common sector publicity.

Fast Fund Snapshots

CIK and DHY are CEFs that allocate primarily to high-yield company bonds with a candy spot score being single-B. The funds additionally maintain a minority of the portfolio in floating-rate loans and CLOs.

The benefit of this sort of portfolio is that it roughly offsets the rise in leverage prices that we have now seen for the reason that begin of 2022 with the rise within the revenue obtained from floating-rate positions. As an example, 2022 web revenue of CIK was flat to its 2021 degree – a superb end in a interval of falling incomes throughout most credit score CEFs.

CIK and DHY are funds that have been initially arrange by Credit score Suisse Asset Administration. As many traders know, Credit score Suisse Group AG was taken over by UBS Group AG (UBS), with CS changing into an oblique wholly-owned subsidiary of UBS.

The funds’ boards authorised an interim advisory settlement which permits CS to proceed to offer funding advisory companies for as much as 150 days till the funds acquire shareholder approval of a brand new funding advisory settlement. In a latest submitting, UBS stated that it doesn’t anticipate modifications to the funds’ funding methods or portfolio managers and it expects advisory companies to be transferred to UBS topic to any approvals.

CIK and DHY have sturdy observe data within the HY CEF sector, so there’s some threat that this may change after a brand new advisory settlement. That is one thing that bears watching.

Technique Overview

As highlighted above, there are two elements to the technique we focus on on this article. One is to allocate to a strong-performing pair of funds. It is because rotating between underperforming pairs of funds is much less compelling since no matter extra return is produced by the rotation, i.e., alpha is more likely to be given away by underperformance, i.e., beta. Within the context of our technique, even when there aren’t any rotations to make the most of, traders will be comfy realizing they’re allotted to a top quality fund.

The second side of the technique is the rotation. This a part of the technique just isn’t important as many traders would moderately set a buy-and-hold place. Nonetheless, as we focus on beneath, this technique can also be not one which requires an enormous dedication. As an example, in our portfolios we have now solely made 3-4 modifications (relying on the portfolio) over 18 months. Even this small quantity of energetic administration allowed us to, in impact, double the yield over a buy-and-hold place.

General, this double-barreled side of sturdy efficiency and opportunistic rotation can considerably increase the return of both one of many funds. It will probably additionally considerably outperform the broader sector as we present beneath.

CIK/DHY Case Research

On this part, we spotlight how we have now made use of this pair of funds in our funding technique.

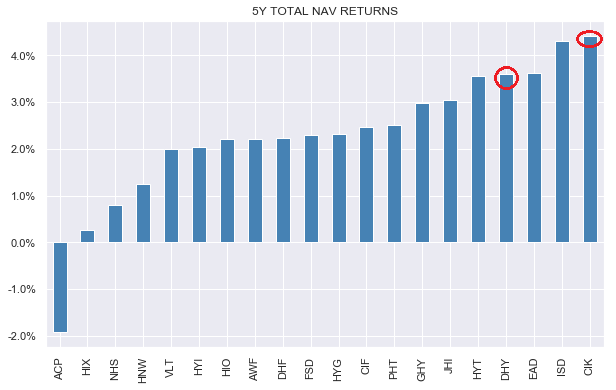

First, the 2 funds are historic sector outperformers. During the last 5 yr, CIK is the top-performing fund within the Excessive Yield Company Bond Sector and DHY just isn’t far behind. The 2 funds additionally boast a few of the greatest risk-adjusted returns in addition to persistently sturdy returns.

Systematic Earnings

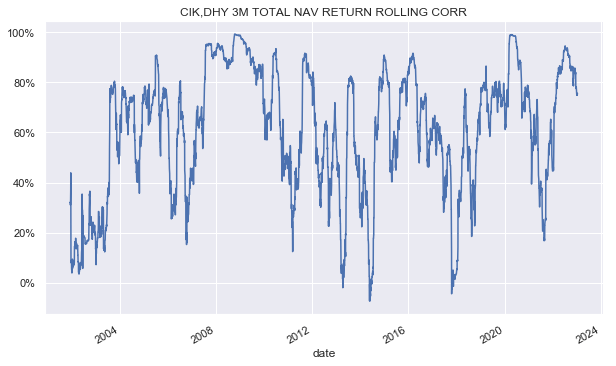

Two, the funds are pretty comparable to one another, although not as comparable as many different sister funds. Their 3-month rolling complete NAV return correlation usually stays above 60%.

Systematic Earnings

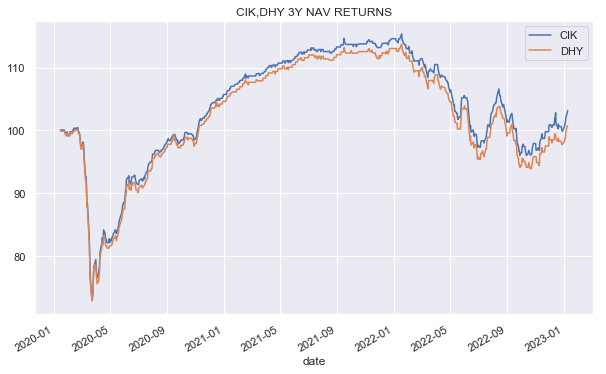

And their complete NAV returns have tracked one another properly over the past 3 years. The explanation CIK has slowly pulled forward is because of its decrease administration payment.

Systematic Earnings

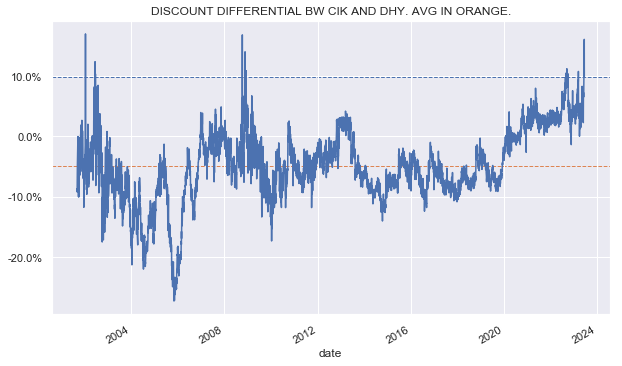

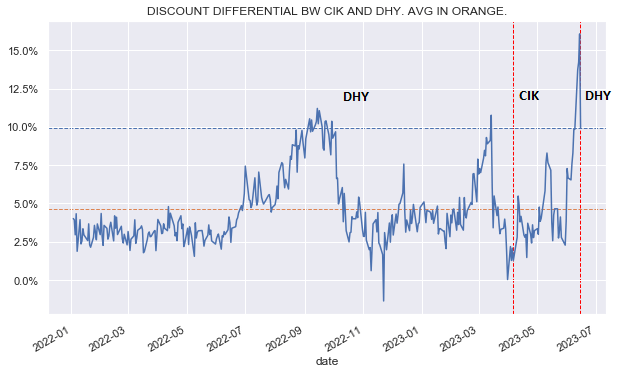

Till about 2020, the low cost differential traded usually between zero and -10%, i.e., DHY used to commerce at a richer valuation. Since round 2020, CIK has moved out to a richer valuation. This makes much more sense in our view given its decrease administration payment, one thing we have now highlighted through the years, so we count on this to proceed going ahead.

Systematic Earnings

Technique Outcomes

We’ve got used this technique in our Core Earnings and Excessive Earnings Portfolios.

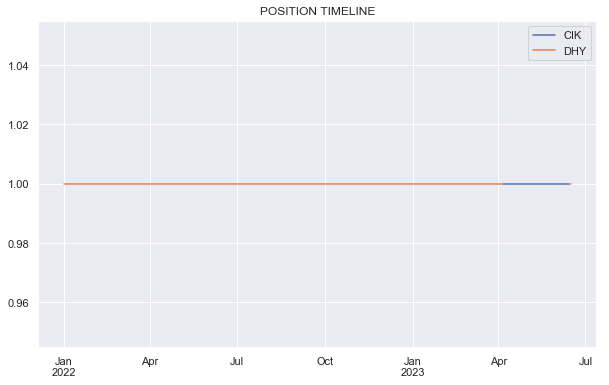

Within the Core Earnings Portfolio, we made two trades after the preliminary allocation to DHY, one to CIK in April of this yr and one other again to DHY in June (there’s a small orange dot on the finish of the road beneath indicating a rotation again to DHY).

Systematic Earnings

This exhibits the identical timeline however by way of the low cost differential. Particularly, we held DHY from 2022 to April 2023 after we rotated to CIK when the low cost differential fell to lower than 2.5% (i.e., CIK traded at a reduction round 2.5% tighter than DHY). We then rotated again to DHY when CIK moved out to commerce at a premium 16% greater than DHY.

Systematic Earnings

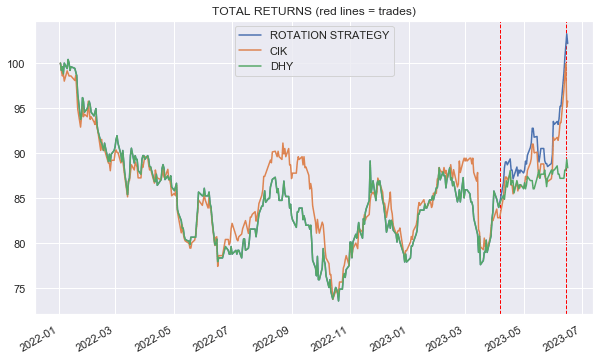

The chart beneath exhibits the efficiency of CIK, DHY and the rotation technique in blue with purple vertical traces exhibiting the rotations.

Systematic Earnings

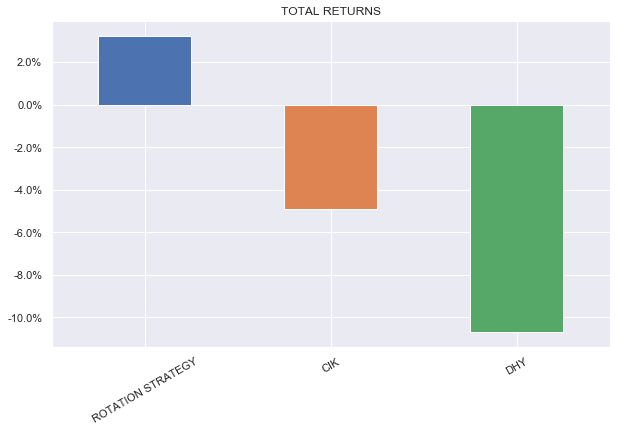

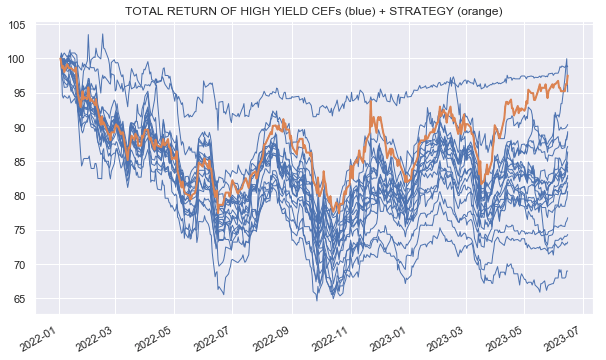

Right here is one other strategy to view the outcomes – the rotation technique outperforms one of the best performing fund, i.e., CIK by about 8% for the reason that begin of 2022. Absolutely the complete return just isn’t spectacular, nevertheless, that is solely attributable to what’s occurred to revenue belongings since 2022.

Systematic Earnings

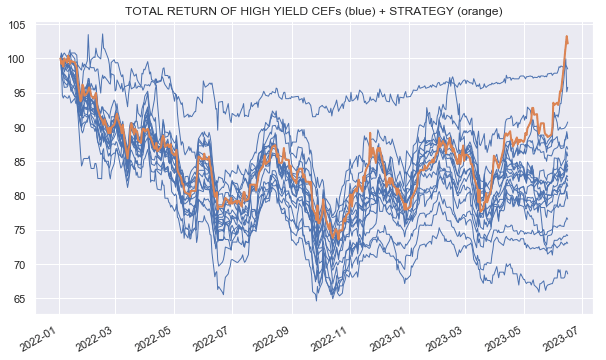

This chart exhibits the overall return since 2022 of all HY CEFs (blue traces) and the return of the technique. It exhibits that this straightforward technique has outperformed all HY CEFs since 2022.

Systematic Earnings

We additionally pursue the identical technique in our Excessive Earnings Portfolio. Nonetheless, as a result of that portfolio is extra tactical we have now finished extra trades on the pair. Because it occurs, the end result within the Excessive Earnings Portfolio was barely worse than that of the Core Earnings Portfolio. It is because we rotated away from CIK earlier earlier than its valuation elevated even additional relative to DHY. General, the technique added over 2% over the return of CIK and eight% above the return of DHY within the Excessive Earnings Portfolio.

Systematic Earnings

Key Challenges

The technique just isn’t with out challenges. One, traders want to concentrate on which funds are sufficiently comparable that it is sensible to rotate between them. It is actually attainable to rotate between dissimilar funds, nevertheless, in that case the technique may have publicity to completely different ranges and kinds of threat which is able to create extra return noise.

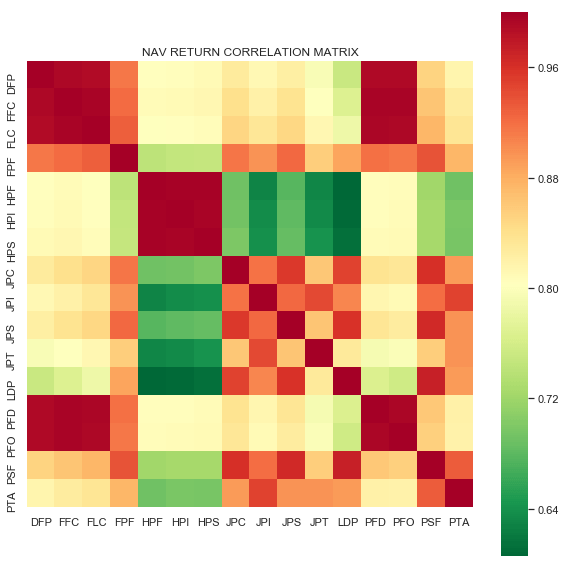

Our favourite sector to make use of for instance CEF similarity is the preferreds sector, which boasts a number of funds from the identical issuers, which occur to have very comparable portfolios.

A fast strategy to gauge fund similarity is to take a look at the pairwise 1Y complete NAV return correlation matrix proven beneath. Squares which might be purple present funds which might be very comparable, and vice-versa. If we learn throughout the primary row, for instance, we see that DFP is very associated to (FFC), (FLC), (PFD), and (PFO) – no shock, since all 5 funds are run by Flaherty.

Systematic Earnings

Not all funds run by the identical supervisor are this comparable. For instance, many PIMCO Multi-sector funds haven’t got the identical technique, i.e., (RCS) and (PGP) are very completely different of their portfolios from (PTY) and (PDI).

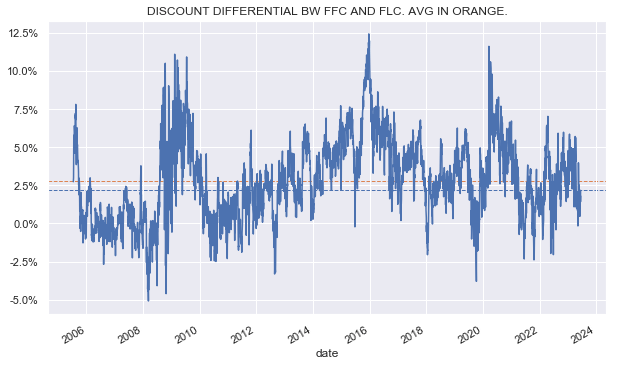

One other problem is that monitoring alternatives will be troublesome because it requires gauging each the low cost differential between two funds in addition to realizing when it is out of line with the historic common. The chart beneath exhibits the low cost differential between FFC and FLC, which principally stays between 7.5% and -2.5% (i.e., FFC tends to commerce at the next valuation than FLC attributable to its decrease administration payment). The truth that the low cost differential is mean-reverting can provide traders confidence within the rotations.

Systematic Earnings

Lastly, there are operational challenges, resembling executing the rotations which might take a while and could also be difficult for much less liquid funds. There are additionally potential capital positive aspects penalties in taxable accounts.

Takeaways

Our key takeaway right here is {that a} technique of specializing in a pair of high quality funds and doing an occasional rotation can present double-barreled efficiency for revenue traders, producing returns properly in extra of one of the best funds within the sector. And though there are some challenges executing this technique, they don’t seem to be insuperable for many traders. For that reason, we think about the pair of CIK and DHY as sturdy contenders in all however essentially the most defensive revenue portfolios.