Wirestock/iStock Editorial through Getty Pictures

A few week in the past, we wrote an article titled “Nvidia, It is Time To Trim”, the place we argued that Nvidia (NVDA) was an incredible firm, however the worth of the inventory at that second was excessive and set to drop considerably.

Whereas the inventory is down about 6% from our report (as of writing), we anticipate a lot additional draw back because the momentum runs out of the A.I. commerce, and funds trim positive aspects for quarterly rebalances.

In the identical vein as Nvidia, we expect Apple’s (NASDAQ:AAPL) inventory is now equally positioned.

The corporate’s shares have not too long ago reached ranges of euphoria that may solely be described as speculative. Now priced to perfection, there is not any room for Apple’s underlying operations to disappoint, which is asking lots of the corporate.

All in all, we nonetheless suppose Apple is an unbelievable firm, however there is not any denying the inventory is on precarious footing heading into earnings season.

If you happen to’re not but invested in Apple, we expect a greater entry will probably be obtainable later this 12 months in some unspecified time in the future. In case you are invested, to us, essentially the most prudent plan of action is to trim some publicity right here as a way to re-enter decrease.

Let’s soar in.

Monetary Efficiency

First, the great.

Apple stays extremely, extremely worthwhile. The corporate, in its most up-to-date quarter, beat on EPS and Income, and delivered stable gross and web revenue margins of 43.1% and 25.5%, respectively.

Incomes a 25% web revenue margin when reported prime line revenues are almost $100 billion is extraordinarily spectacular. It is merely tough to execute on one thing so properly on that scale.

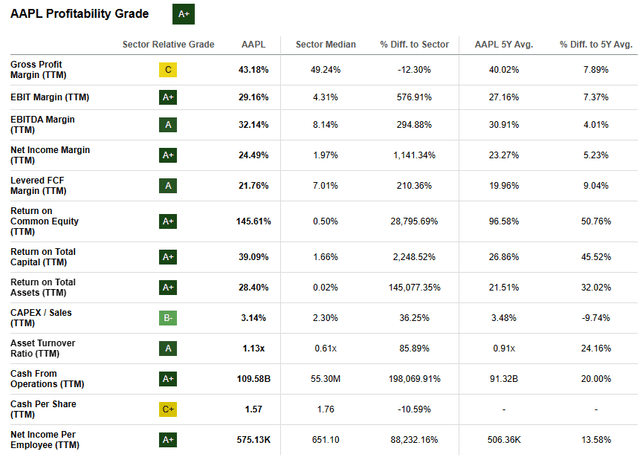

Looking for Alpha’s Quant Rankings underscore this level, assigning Apple a profitability ranking of “A+”, an evaluation we wholeheartedly agree with:

Looking for Alpha

The corporate’s money conversion is robust, worker effectivity is up, and money from operations over the trailing twelve-month interval has been strong.

As well as, the corporate’s beats weren’t out of character. As you’ll be able to see, the corporate has missed/met on EPS and Income in solely 2 and three instances respectively out of the final 16 quarters, which is extremely spectacular:

Looking for Alpha

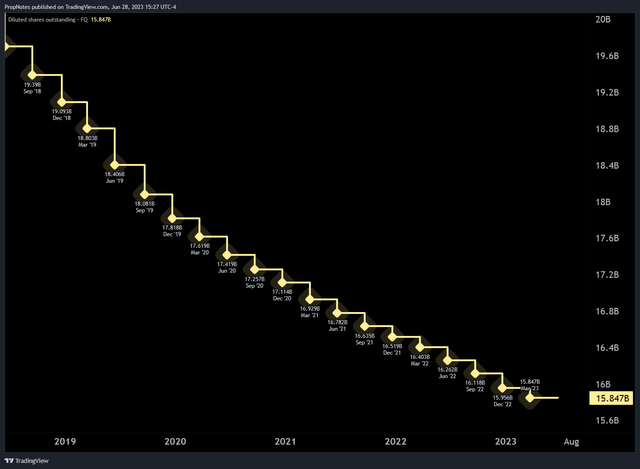

The corporate has additionally been diligent in terms of returning capital to shareholders, having purchased again almost 20% of the corporate’s inventory during the last 5 years:

TradingView

In brief, we’re followers of Apple. It is an incredible firm with an incredible observe document of incomes for its shareholders.

Saturation

That mentioned, regardless of the current and sustained energy in monetary outcomes, there’s one looming situation for Apple: saturation.

The dreaded phrase.

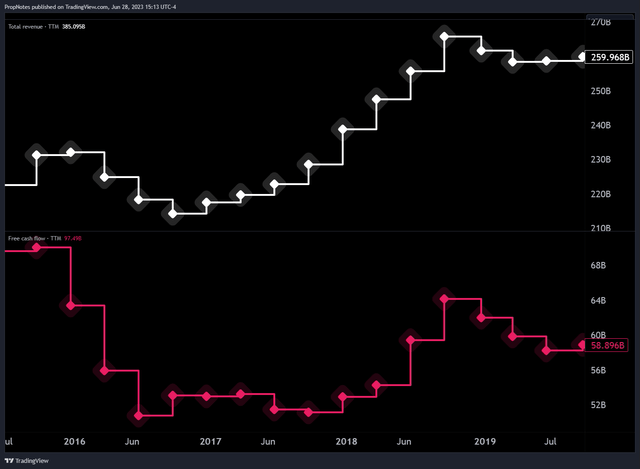

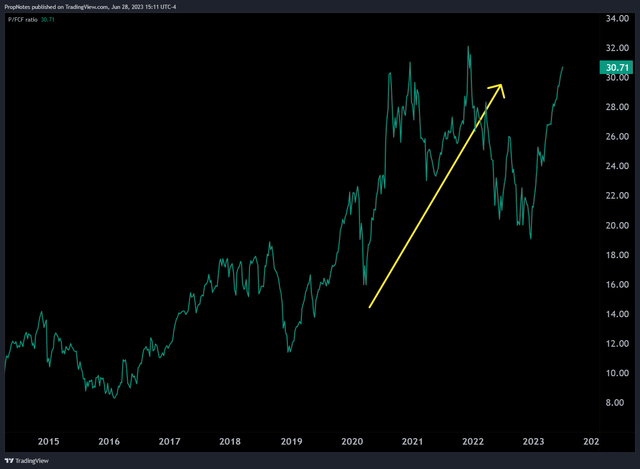

Zooming out considerably, you’ll be able to see that again in 2016, Apple truly noticed declining TTM revenues and money flows for a 12 months or two:

TradingView

Analysts on the time attributed this to a lengthier-than-expected improve cycle, and infrequently speculated that the iPhone 6 was so good that the corporate struggled to encourage prospects to improve to the 7 and eight in subsequent years. In different phrases, the market was saturated, and everybody who wished an iPhone, and will afford one, had one.

To fight this, Apple pulled on the few levers it may as a way to enhance development and profitability, however it had little instant impact.

In 2017, Apple got here out with the iPhone X, which launched with no dwelling button, Face ID, a a lot better display, and a a lot greater price ticket of $1,000.

This cellphone, mixed with a push into companies within the latter half of 2019, despatched revenues greater. Nonetheless, it took one other full 12 months free of charge money circulate to catch up, which principally occurred on account of the worldwide pandemic.

The mix of a brand new and improved Mac lineup, improved leisure choices in Apple TV Plus and Apple Arcade, and the top of an extended improve cycle, paired with limitless hours of lockdown, lastly re-invigorated demand for Apple’s merchandise. The stimulus checks did not damage, both.

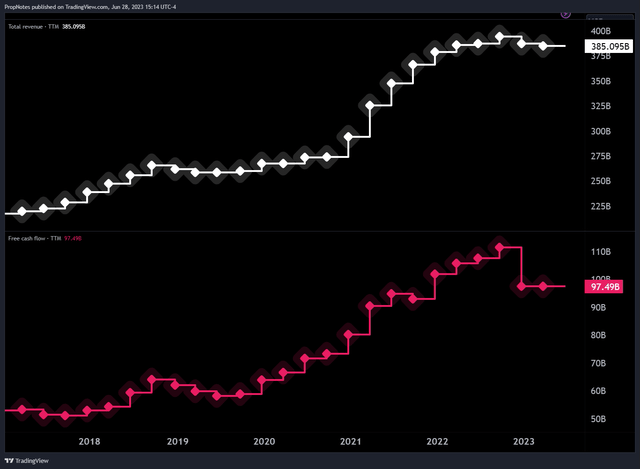

And thus, for the primary time since 2016, the FCF ceiling was shattered:

TradingView

Not solely did financials enhance, however the development story was again; the a number of grew significantly, and the inventory raced greater:

TradingView

The problem with Apple proper now could be that it appears to be having one other iPhone 6 second. Most customers have comparatively new private computing {hardware} on account of the pandemic, and Apple Providers is now a mature enterprise. Mixed with weak shopper sentiment throughout the board, and it is not a rosy demand image for Apple’s premium merchandise prefer it was 24 months in the past.

Certain, the corporate can develop income and revenues incrementally, however the firm is as soon as once more up towards a figurative ceiling of saturation.

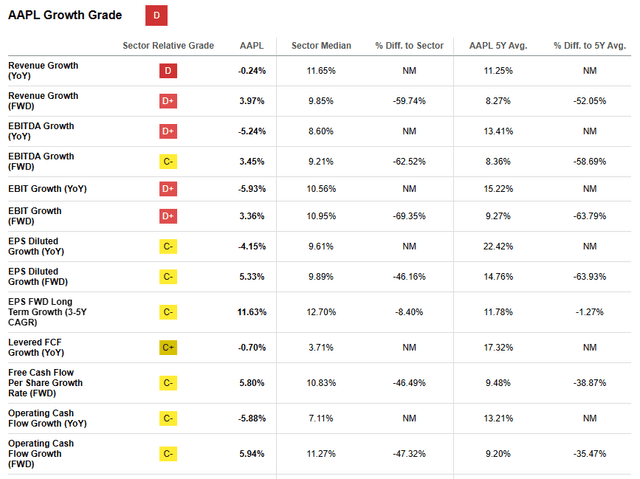

You’ll be able to see this in current development numbers, which have been disappointing:

Looking for Alpha

Income in the latest quarter truly declined YoY, and quarterly gross sales development has been flat for the higher a part of a 12 months and a half. This is sensible, and we anticipate a continued interval of weak spot till the Imaginative and prescient Professional gadget hits markets and re-invigorates broader curiosity within the firm’s line of merchandise.

The Rally

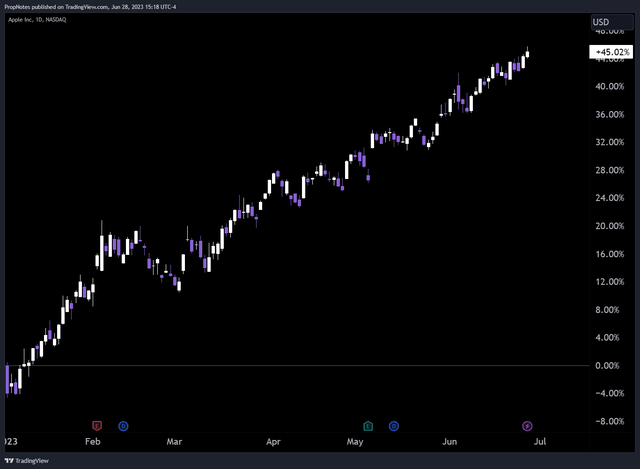

Regardless of the potential for demand destruction as we have outlined, thus far, in 2023, Apple’s inventory is up 45%:

TradingView

In our eyes, there are three most important causes that the inventory has made the transfer it has. Nonetheless, we do not suppose they’re highly effective sufficient arguments to maintain the inventory the place it’s, particularly when put next with the bigger aforementioned points round flatlining demand.

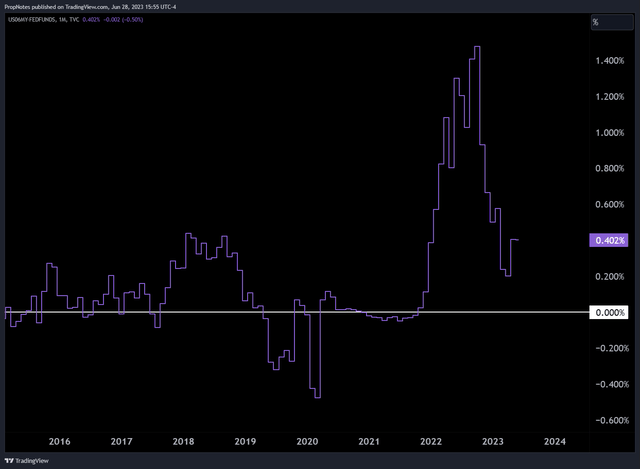

First, the market has seen inflation start to taper off. Thus, fee hikes, in type, are seen by the market as having much less of a long-term affect than doubtlessly imagined. If fee hikes pause for some time or are literally in the reduction of to decrease ranges, then Apple’s a number of ought to naturally re-inflate on account of NPV of FCF.

We get that, however given the weak financial outlook, it appears a bit untimely to be bidding the corporate up this a lot on that view.

Plus, extra fee mountain climbing continues to be anticipated, as 6 month payments presently commerce above the Fed Funds fee:

TradingView

Second, all huge expertise firms have caught a severe bid in 2023 on account of having the assets and expertise to construct new generative AI functions into present merchandise. Nvidia has been the go-to ‘picks and shovels’ play, Google (GOOG) (GOOGL) has launched Bard, together with a ton of different instruments, and Meta’s (META) LLaMA leaked, which has led to an explosion in open-source improvement.

Nonetheless, Apple stays silent on this race. The corporate’s current WWDC occasion got here and went, with no significant AI product launches or information. We expect there’s room for Apple to construct merchandise on this space (taking a look at you, Siri), however proper now, mum’s the phrase. We expect the potential affect of AI instruments constructed by Apple is being overestimated by the market.

Lastly, we come to Imaginative and prescient Professional. Sure, the headset seems wonderful. And sure, we expect demand will probably be important, even on the headset’s present worth level. Nonetheless, we’re involved about demand cannibalization vs. Apple’s different merchandise. Who wants a brand new MacBook when you’ll be able to simply purchase a brand new Imaginative and prescient Professional?

It appears to us that some consumers at this worth within the inventory are pondering that Imaginative and prescient Professional is the product wanted to interrupt by way of the following demand ceiling. Nonetheless, the tech is unproven, and has an extended method to go earlier than we expect it should see true mass adoption. If the value comes down, it immediately competes with the MacBook’s present capabilities, which is able to possible result in cannibalization.

We see Apple rising revenues and FCF previous the present stage, however incrementally, not shortly.

It is Overbought

All in all, there’s some causes to be bullish, and a few causes to be bearish. It appears to us that the problems round saturation in demand ought to outweigh hypothesis about merchandise which are greater than a 12 months away, or mountain climbing cycles which have but to materialize.

Nonetheless, the present valuation has the story backwards.

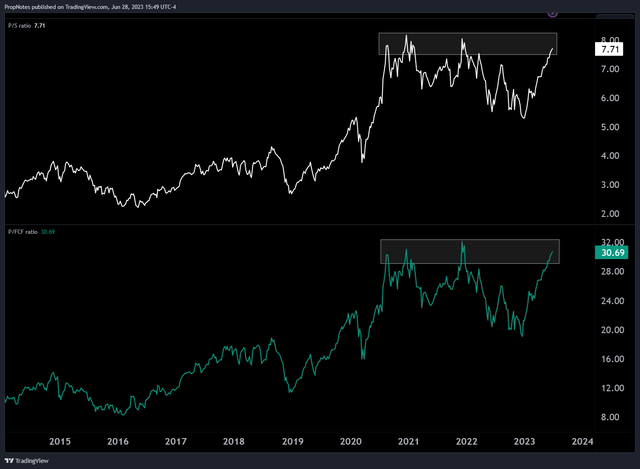

The corporate is buying and selling at a peak-growth gross sales and free-cash-flow multiples in our view:

TradingView

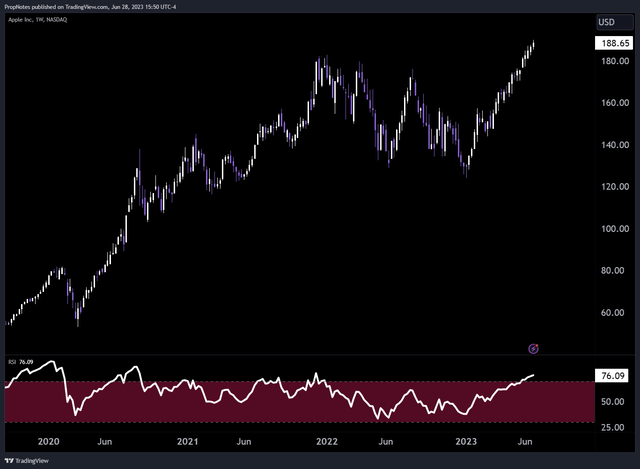

If that weren’t sufficient, the inventory additionally has a weekly RSI studying of 76, indicating that the inventory is considerably overbought:

TradingView

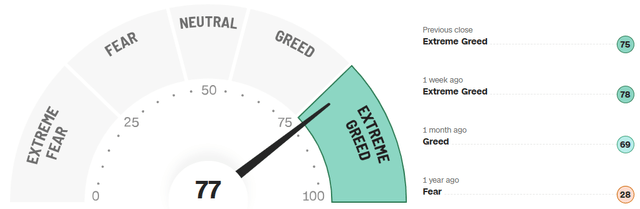

Collectively, we have a narrative that is merely mispriced on account of sturdy momentum and greed available in the market:

CNN

Abstract

In consequence, we expect shrewd traders ought to trim stakes and new market entrants ought to wait to deploy capital on this overpriced, overbought behemoth.