Bet_Noire

The CBOE Volatility Index has been in a downtrend after spiking on the onset of the pandemic; a development that has accelerated since no less than October of final 12 months. The index is now buying and selling at ranges not seen since late 2019/early 2020. The index as calculated and printed by the CBOE is at present at about 13.50. For context, its lowest degree during the last 30+ plus years was November 3, 2017, when it reached 9.14.

The imply worth for the VIX since January 1990 is nineteen.65 with an ordinary deviation of about 7.94. This tells us a few issues: 1) The present degree of the VIX is beneath common, however inside 1 customary deviation of the imply, and a pair of) the volatility index itself is risky.

Regardless of its low degree and identifiable potential dangers to the monetary markets, utilizing the VIX to hedge towards the unknown is just not an environment friendly solution to hedge. The primary concern is with gaining publicity to the index itself. Quite than personal VIX futures, most buyers will buy a fund that tracks the index. Considered one of, if not the most well-liked, is the iPath Sequence B S&P 500 VIX Quick-Time period Futures ETN (BATS:VXX).

VXX’s goal is to supply publicity to the motion of VIX futures that are supposed to measure the return volatility of the S&P 500. The VIX index is constructed utilizing costs of S&P 500 places and calls throughout strike costs and expirations with common weighted publicity concentrating on a relentless 30 days. I’ll focus on extra particulars relating to the index building, and particularly how rising rates of interest influence the index worth beneath.

Potential Market-Transferring Dangers

There are numerous recognized and unknown dangers which have the potential to maneuver markets. Regardless of that, volatility has been low and falling. Primarily based on this actuality, it seems that the inventory market could also be both extra resilient or has grown complacent.

The next is simply a small pattern of what’s at present recognized and could possibly be of enough magnitude to maneuver markets.

The most recent information out of Russia is troubling and will result in higher issues

The continuing conflict in Ukraine has the potential to turn out to be a higher international concern. Whereas an escalation and use of nuclear weapons could be catastrophic, there are lots of different outcomes that might additionally trigger extreme disruptions. Not solely are Ukraine and Russia vital producers and exporters of wheat, corn, and fertilizer, however Russia can be a serious producer of nickel and cobalt, two main parts used for renewable power and EVs. The conflict within the area is disruptive to this manufacturing and its exportation. Any escalation may trigger these provide traces to be severed in addition to inflicting wider destabilization within the area. The latest alleged tried coup by personal mercenary Wagner Non-public Army Firm in Russia fizzled quick however highlighted that dangers can come up rapidly with the potential to exacerbate an already tense state of affairs.

China’s plans for taking up Taiwan

The need of the Chinese language authorities to “unify” Taiwan with mainland China, by power if essential, has prompted higher rigidity between the 2 international locations and between China and the remainder of the world. Taiwan has been independently ruled since 1949 and its present president has made it clear that it doesn’t wish to be “unified” with China. The U.S. has indicated that it’s going to again Taiwan’s independence and supply army help if/when essential. Though there are extra questions than solutions, this example has the potential to escalate rapidly. Like with Russia, China can be a serious producer of key commodities utilized in renewable power era and EVs, together with vanadium, graphite, molybdenum, aluminum, lithium, and a smaller, however necessary share of copper.

U.S. financial coverage

The speedy tightening of U.S. financial coverage has strained sure areas of the financial system and has the potential to create additional points sooner or later. The aggressive charge hikes over the 16+ months prompted a number of financial institution failures in March of this 12 months and have contributed to rising housing prices. The ripple results of upper charges and better vacancies are anticipated to be felt in different areas of actual property, specifically workplace. Many house owners of workplace properties, who’re already going through shrinking money circulate, shall be pressured to refinance money owed at larger rates of interest supported by decrease money circulate because of larger emptiness charges. For some firms in that house, the end result will possible be pressured and/or fireplace gross sales of property or doable chapter.

However what we don’t know is how the broad financial system and monetary markets will finally reply to a shrinking cash provide as measured by M2. The cash provide within the U.S. has not shrunk because the Nineteen Thirties so there isn’t loads of knowledge to work with. The results could possibly be extreme, and buyers could be smart to organize their portfolios for a spread of doable outcomes.

Unknown dangers

The final merchandise that ought to be included in any record of recognized dangers is the opportunity of unknown dangers, someday known as unknown unknowns. These are the dangers which are lurking within the shadows, doubtlessly growing into black swans, market-moving occasions which are at present unknown and largely unpredictable.

The aim of mentioning these few examples is to not create concern, however to spotlight the truth that there are lots of recognized sources of threat and market volatility that simply haven’t mattered but. This highlights the significance of portfolio positioning and hedging the place wanted. Nonetheless, it additionally reveals that hedging should be performed effectively because the timing of dangers is unpredictable. That unpredictability of timing disqualifies VXX as a great hedge as its worth is eroded over time as defined beneath.

Latest Efficiency

As talked about on the outset of this text, efficiency has been unfavorable for an prolonged interval. That is pushed by relative quiet in monetary markets in addition to some mechanical elements that erode worth over time. That is additionally a great place to emphasise that even for those who disagree with my perspective on VXX, it shouldn’t be bought as a long-term funding (ever.) It’s meant to be held for brief intervals (if in any respect) for use as a hedge towards doubtlessly larger volatility in shares.

12 months-To-Date Whole Return (In search of Alpha)

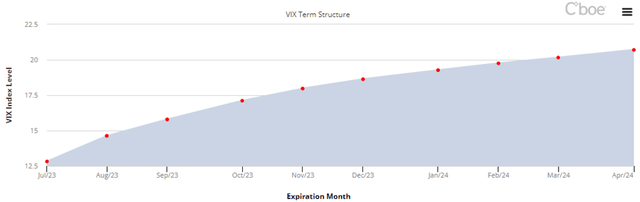

Buying and selling in futures contracts can erode worth over time. VIX futures are traded equally to these in commodities, currencies, and so forth. If the time period construction of these futures contracts is in contango, in different phrases priced larger for longer expiration dates and subsequently upward sloping, then the index experiences what’s known as unfavorable roll yield. A unfavorable roll yield happens when the entrance month futures contract should be traded and changed with an extended dated contract. As a result of the curve is in contango, that longer dated contract prices extra, leading to losses to the index. This creates a further headwind for holders of VXX and equally structured funds that usually ends in declining share costs to the purpose that the issuer is pressured to conduct reverse inventory splits. For VXX, it has accomplished two reverse inventory splits since April of 2021. In March of 2023 and April of 2021, VXX reverse break up 1:4 every time. That implies that 4 shares grew to become 1 twice in two years.

VIX Time period Construction (CBOE)

Impression of Curiosity Charges

Possibility costs are immediately impacted by rates of interest. With out diving too deep into the main points of the mechanics explaining the impact, rising charges create a headwind for put costs and tailwind for name costs. This dynamic has the potential to suppress the index’s estimate of market volatility because the index is derived from aggregating the weighted costs of places and calls. Wanting on the generalized method for the index calculation from CBOE additionally reveals {that a} larger rate of interest will result in a decrease VIX worth, all issues equal (see web page 5 within the linked PDF.

Dangers

Along with the challenges with VXX talked about above, the next is a extra direct abstract description.

1. Monitoring error – It will at all times be a difficulty given the development of the ETN and the underlying index it tracks. In VXX’s case, there was a state of affairs final 12 months throughout which an administrative error at Barclays resulted within the firm being unable to promote further shares till receiving SEC approval to take action. Within the meantime, the present shares misplaced worth and the monitoring error relative to the underlying index widened. Though there’s a lawsuit pending, that concern mustn’t influence present shares or shareholders in VXX.

2. Damaging roll yield – When shopping for any futures contract or establishing an index primarily based on these future contracts, if the time period construction is in contango, then there shall be a unfavorable roll yield. The consequence of that is an erosion of worth over time. That is one more reason why VXX and comparable securities are meant for short-term buying and selling and aren’t appropriate for a long-term funding.

3. Unsuitable timing – given the erosion of worth within the absence of a pointy uptick in market volatility, the timing of trades in VXX is necessary. Nonetheless, as a result of unpredictability of market-moving occasions, appropriate timing is close to unattainable and being early or holding VXX long-term is expensive.

4. Low volatility persists – low volatility can persist for longer than anticipated, making a place in VXX in expensive. Volatility can proceed to say no and even break beneath the November 2017 low, leading to capital losses for VXX shareholders.

5. ETNs are topic to credit score threat – ETNs are technically debt devices backed by the issuer and subsequently carry credit score threat, on this case Barclays Financial institution PLC. It is a low likelihood threat, however one which buyers ought to pay attention to prior to buying a place in VXX or every other ETN.

Why Would Anybody Purchase VXX?

If VXX could possibly be structured to keep away from erosion of worth from the unfavorable roll yield and different points, there could be (no less than the potential) some hedging advantages.

1. Comparatively low cost at present – As measured by the CBOE Volatility index, the anticipated return volatility for the S&P 500 is nicely beneath its long-term common and rapidly approaching multi-year lows regardless of quite a few recognized potential causes of market disruption.

2. VXX doesn’t expire – Not like put choices which have an expiration date, VXX is perpetual. That mentioned, given the construction and mechanics of the fund, worth will evaporate over time and not using a bounce larger in volatility within the brief run.

3. Not a binary final result – Even when a commerce in VXX is directionally incorrect or the timing off, the worth of the place won’t go to $0.

4. Hedge strategic allocations – Theoretically, permits buyers to stay invested for the long-term whereas hedging towards short-term dangers. Nonetheless, there are higher methods to perform this goal with out utilizing VXX.

Portfolio Technique

Don’t purchase VXX.

I charge VXX as a ‘STRONG SELL’.

Nonetheless, . . .

. . . for those who do really feel inclined to purchase VXX, then please restrict the place measurement to no bigger than a pair % of your fairness allocation. When you determine to purchase this fund, then additionally, you will have to decide on an entry level and goal worth to exit. Regardless of the dangers to monetary markets highlighted above, VXX has been steadily declining for greater than 3 years. What may make it change path? And extra importantly, when?

When you do buy VXX, and the commerce works, then the place must be trimmed again to its preliminary measurement or bought utterly. Like many hedging methods, as soon as the commerce “works” buyers should be disciplined sufficient to take the good points off the desk and redeploy elsewhere within the portfolio.

Last Ideas

That is the primary article I’ve written for In search of Alpha wherein I’ve a ‘Sturdy Promote’ suggestion. VXX and comparable securities seem to supply a helpful perform on the floor however fall brief because of their construction and execution. Merely put, the dangers to proudly owning VXX outweigh any potential advantages. In some ways, it’s stunning that securities like this are allowed to be bought to the final investing public. I believe that the affect of enormous monetary establishments that concern the sort of safety performs a serious position of their legality. Regardless of over promising and below delivering, they function a pleasant income supply for the issuers.

Whereas my typical caveats (“As at all times, this suggestion ought to be thought of inside the broader context of strategic asset allocations in addition to private wants and constraints. Any obese or underweight positions should be thought of rigorously to grasp the influence on long-term whole returns.”) stay legitimate, hopefully they won’t be wanted on this case.

Thanks for studying. I look ahead to seeing your suggestions and feedback beneath.