Mario Tama/Getty Photographs Information

The speak out of the Federal Reserve today is that there might be two extra will increase within the Fed’s coverage price of curiosity this yr.

The economic system continues to be displaying sudden power.

Actual GDP in the primary quarter of 2023 has been revised upwards to a 2.0 % annualized price of progress. That is up from earlier estimates of 1.1 % and 1.3 %.

Now the Fed has even revised its forecast for the complete yr of 2023 to 1.1 %, up from a earlier forecast of 0.4 %.

These are usually not substantial adjustments, however, for one, they push off a potential recession additional into the longer term.

In addition they trigger us to have a look at the economic system in a different way to ask what has modified in how the economic system features. What’s totally different now? Has the “tech” revolution modified the best way the economic system features?

In addition they trigger us to ask about how a lot of the “sudden” financial power is linked with the after-effects of the asset bubble created by the Fed in preventing the unfold of the Covid-19 pandemic.

Lastly, there may be the query concerning the fiscal coverage stimulus coming from the Biden administration and the U.S. Congress.

Regardless of the trigger, it seems that the actual economic system is acting at the next stage, for an extended time period, that Fed officers initially thought would occur.

Consequently, Federal Reserve officers are speaking about the necessity to lengthen the time horizon for potential coverage price will increase. Most often, the timeframe continues to be restricted to the second half of 2023.

There might be 4 extra conferences of the Federal Open Market Committee within the subsequent six months, the primary one might be held on July 25 and 26.

The dilemma that Federal Reserve officers face is that loads of various things are taking place on the planet and nobody has an actual clear image of what they’ll be going through.

That’s one motive that Fed Chairman Jerome Powell retains hedging on all his statements. There may be loads of uncertainty concerning the future, and Powell simply would not wish to commit an excessive amount of in any specific course due to the concern of being incorrect.

Radical uncertainty dominates the setting.

Quantitative Tightening

To Mr. Powell and his associates, quantitative tightening nonetheless dominates Fed coverage actions.

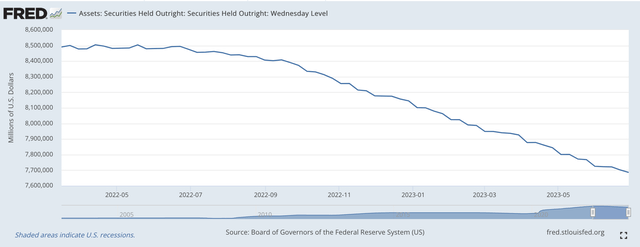

Within the final banking week, the one ending on June 28, 2023, the Fed oversaw a $15.9 billion discount in its portfolio of securities held outright.

This brings the whole discount within the securities for June as much as $39.2 billion.

The entire discount within the securities portfolio for the reason that quantitative tightening started in the midst of March 2022 is $804.9 billion.

The image of this declining portfolio appears like this.

Securities Held Outright (Federal Reserve)

The Federal Reserve has achieved what it stated it was going to do with the securities portfolio. The Fed has overseen a gentle discount, over time, a time interval lasting fifteen months.

Notice: The size of this time interval is in line with the 4 earlier efforts at quantitative easing that the Fed carried out earlier to the battle towards inflation.

Financial Coverage

That is what the Federal Reserve has achieved to its securities portfolio.

Nonetheless, this has not been the one factor happening throughout this time interval.

As an example, in early March 2023, the banking trade started to expertise some business banks having solvency issues…like Silicon Valley Financial institution.

The Federal Reserve couldn’t and didn’t “sit on its fingers” throughout this time interval. It equipped reserves to the banking system that eased the issues being confronted by numerous particular person banks.

For instance, reverse repurchase agreements have been opened as much as permit business banks in want of liquidity a straightforward supply of funds.

Moreover, the Fed labored with the U.S. Treasury Division to maneuver funds into and out of the Treasury’s Normal Account on the Fed to supply extra funds, when wanted.

Thus, the Fed was capable of handle its method via these short-run difficulties, with out having to disrupt the efforts that have been being made to scale back the dimensions of the securities portfolio held outfight.

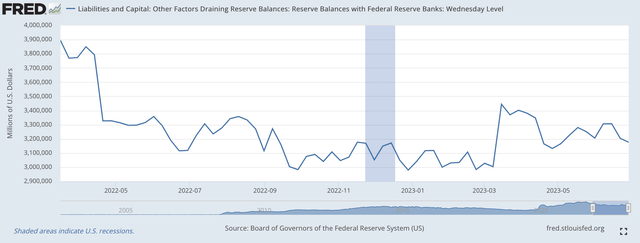

The outcomes of those efforts present up within the Fed’s line merchandise “Reserve Balances With Federal Reserve Banks,” which I typically seek advice from because the “extra reserves” within the banking system.

Right here is the chart reflecting on how “extra reserves” within the banking system moved throughout this time period.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Discover that in March 2022, the Federal Reserve oversaw the discount in these “extra reserves” because the Fed started elevating its coverage price of curiosity. That’s, this reveals how the Fed “tightened” up on financial institution reserves to help the trouble to lift charges.

The reserve balances proceed to say no, solely not as quickly as at first, throughout the remainder of 2022 and thru February 2023.

Then the banking difficulties hit the system and the Federal Reserve responded by permitting banks to make use of the reverse repurchase settlement window and the U.S. Treasury Division diminished its balances on the Fed.

The “extra reserves” within the banking system rose in order to assist banks via any “cash” issues they may have had.

“Extra reserves” didn’t improve that a lot and their use moderated with time, however, the image is proven that the Fed didn’t simply sit by throughout this era and let the financial institution difficulties work themselves out.

Within the month of June, U.S. Treasury deposits with the Fed within the Normal Account rose by $360.0 billion, and this took reserves out of the banking system.

Throughout this time interval, reverse repurchase agreements fell by $345.0 billion, including reserves to the banking system.

The 2 nearly precisely offset one another, indicating, I consider, how intently the Federal Reserve was managing the very tough “liquidity” scenario.

And, the banking system moved alongside easily into the beginning of July.

Going Ahead

Going ahead from right here shouldn’t be going to be straightforward.

There may be some thought that quantitative tightening may not final for much longer.

The issue right here is that authorities spending would possibly turn into so dominant within the close to future that the Fed simply will be unable to proceed lowering the dimensions of its securities portfolio. That’s, a lot debt might be coming to the monetary market that the Fed can not additional take away itself from the market.

That will sign an finish to the present effort to battle inflation.

So what then?

Many analysts consider that Mr. Powell is less than pulling off a “Paul Volcker” on the subject of an excessive battle of elevating rates of interest to combat inflation.

One drawback is that Janet Yellen, U.S. Treasury Secretary, could not be capable of pull off a “Robert Rubin” on the subject of getting authorities spending beneath management.

As I’ve written elsewhere, the battle for the longer term could also be about authorities spending, with Federal Reserve points serving simply as a residual curiosity.

I hope it would not come to this, however…