f9photos

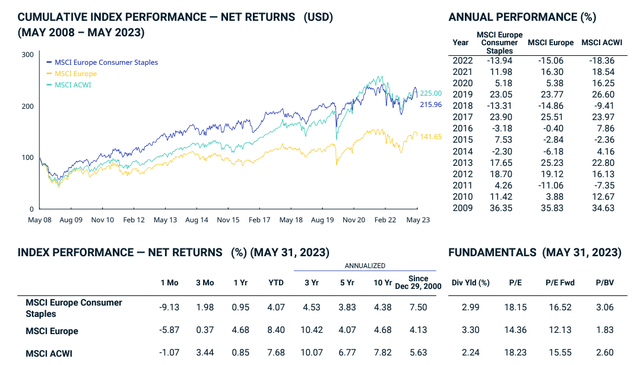

Warfare in Ukraine, vitality shock, and rising transport costs despatched meals prices to an all-time excessive. Since wages have remained unchanged, end-costumers’ buying energy has been below strain. Due to its diversified product portfolio, Unilever PLC (UL) (OTCPK:UNLYF) remains to be a very good participant in a resilient sector. The MSCI Europe Shopper Staples Index efficiency supported our Unilever purchase funding thesis. Certainly, only some European fairness sectors managed to outperform the MSCI Index and make new all-time highs; nonetheless, Unilever nonetheless must meet up with the index. Given the newest quarterly efficiency, we consider that buyers have to be adequately valuing the corporate on a MACRO foundation and on a MICRO foundation.

Mare Ev. Lab vs Wall Avenue mispricing

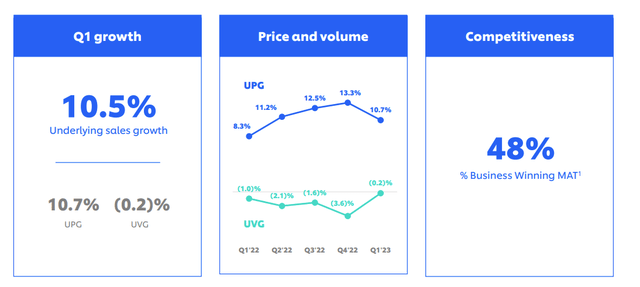

Final time, in our October 2022 publication titled “Adjustments In Shopper Demand May Not Be At Danger,” we anticipated increased gross sales versus Wall Avenue consensus expectations. Our detailed income forecast predicted Underlying Gross sales Development (‘USG’) of 9.5% in comparison with Vara’s forecast at +7.8%, with increased promoting value evolution absolutely offsetting quantity decline. In Q1, USG elevated income at a double-digit fee, signing a plus 10.5% versus Seen Alpha consensus at +7.3% (Fig 1). As soon as once more, Wall Avenue was not appropriately forecasting Unilever’s pricing energy and development story trajectory. As a reminder, Unilever achieved a income CAGR development of plus 5.8% over the past 4 years. Once more, this beat was volume-driven, with output down by -0.2% within the quarter, nicely above consensus at -3.3%, whereas product value elevated by +10.7%.

The MSCI Europe Shopper Staples Index evolution (MSCI Index)

Supply: MSCI Index

Why are we nonetheless optimistic?

We should always notice that value will increase don’t have an effect on all merchandise equally. Shoppers’ value sensitivity is extra vital for some objects, equivalent to fruit, greens, and meat, than for others, equivalent to cleaning soap, ice cream, and dairy merchandise. Whereas value elasticity is mostly a dependable information for estimating buyer conduct, we nonetheless advise a cautious stance, particularly since rising prices are current in virtually all staples classes. Because of this, demand adjustments could also be much less intense, given the truth that substitute merchandise have additionally elevated in value.

What the analyst neighborhood wants to think about is quantity enchancment over the 12 months. As well as, 30% of Unilever’s top-line gross sales come from merchandise launched within the final two years, significantly up from 2021. Unilever’s MAT enterprise profitable share was 48% in Q123 in comparison with 47% achieved in This fall (Fig 1).

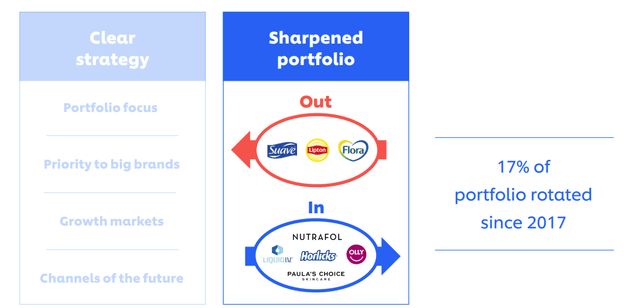

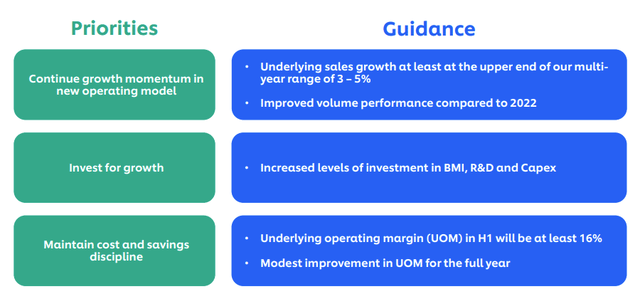

The corporate now expects increased steerage. Intimately, Unilever foresees underlying gross sales development on the higher finish of the vary of +3% to five% and a core EBIT margin of at the least 16% in comparison with a earlier outlook of “round 16%” (Fig 3). Regardless of a number of destructive one-offs, equivalent to Indonesia’s destocking, with SKU rationalization and portfolio rotation (Fig 2), Unilever’s administration forecasts higher margin improvement. Within the quarter in-home care, 650 SKUs have been eliminated in Africa and Europe.

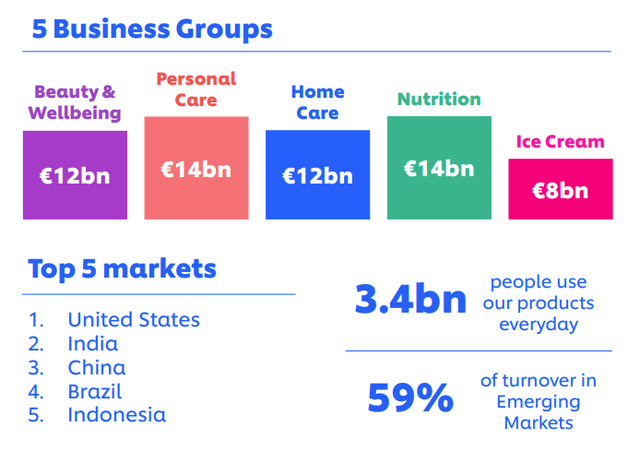

Final 12 months, Unilever introduced 1,500 jobs reduce, with specific emphasis on decreasing senior administration roles. That is a part of a brand new organizational mannequin that has simplified the company construction. Presently, Unilever is organized into 5 new divisions (Fig 4), and this allowed the corporate to develop into extra attentive to consumer demand and channel developments.

Regardless of destocking actions in Indonesia, Unilever is recording strong development in India and the APAC area. If we mixed this with a transparent technique to not scale back value and a flat promotional exercise, we must also anticipate higher profitability estimates.

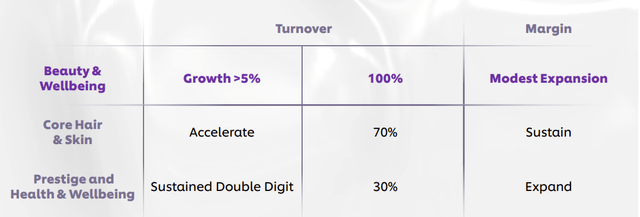

The corporate remains to be innovating. The most recent examples embody 1) Dove physique wash with a method that’s 98% bio-degradable, 2) Omo capsule to clean at low temperatures, 3) Clear, a premium product to deal with hair loss, and 4) Magnum ice cream premiumization. As soon as once more, we consider the market shouldn’t be appropriately pricing Unilever’s fast innovation enhancements. Well being and Status divisions have delivered 9 quarters of double-digit income development (Fig 5).

Unilever Q1 Outcomes Presentation – Fig 1

Unilever Q1 gross sales development

Deutsche Financial institution International Shopper Convention 2023 – Fig 2

Unilever portfolio optimisation

Fig 3

Unilever increased steerage

Fig 4

Unilever new construction

Fig 5

Unilever Status and Well being division evolution

Conclusion and Valuation

For the above factors, we’re estimating an working revenue margin of 16.4% for H2, and we arrive at a twelve-month ahead EPS estimate of three.05 from 2.99. Our EPS revision is principally supported by increased value assumptions for the present 12 months and virtually flat volumes. In our numbers, we continued to extend advertising funding (up by €500 million) and R&D bills. On a destructive notice, primarily based on the present spot charges, the corporate expects a destructive forex influence of -5% on its yearly gross sales and a minus 6/7% on the EPS. Contemplating these destructive developments and persevering with to worth Unilever with a 2023 P/E at 17x, we derive a valuation of €52 per share ($56.7 in ADR), implying an upside of 10% on the present inventory value. If we have a look at the MSCI Europe Shopper Staples Index, the sector is at the moment buying and selling at 18.15x; nonetheless, if we exclude the tobacco firms, we arrive at a P/E of 21x. Unilever is now buying and selling at 15x with a beta of 0.17, and we consider that the low cost shouldn’t be justified given its income development trajectory and enterprise safeness.

With activist involvement, higher development end-market estimates (supported by Unilever nation MIX – Rising Market gross sales signify 59% of the corporate’s whole gross sales – Fig 4), elasticities evolution higher than anticipated, and the latest deal with innovation make Unilever a transparent purchase. We should always see Unilever as a development story supported by draw back safety from a recurrent dividend per share. The corporate is now yielding 3.6%. Draw back dangers embody 1) value-destructive M&A exercise (GSK’s final 12 months bid was a transparent instance), 2) decrease margin evolution, 3) the next aggressive panorama, 4) failure of latest merchandise launches, and 5) shrinking accessible shelf area with personal label substitute merchandise.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.