JHVEPhoto

Funding Thesis

Dividend funds might be a wonderful supply of further revenue for buyers, significantly when the chosen corporations not solely present Dividend Revenue, but in addition Dividend Progress. My funding technique focuses on constructing funding portfolios which have the target of offering you with a sexy mixture of Dividend Revenue and Dividend Progress, thus serving to you develop your additional revenue at a sexy fee.

In at this time’s article that focuses on excessive dividend yield corporations, I’ll introduce you to these sorts of corporations that may make it easier to earn a major quantity of additional revenue within the type of Dividends. Every of those chosen corporations has robust aggressive benefits, is financially wholesome, and has a sexy Valuation (8 out of the ten chosen corporations have a P/E [FWD] Ratio beneath 10).

These picks may make it easier to elevate the Weighted Common Dividend Yield of your funding portfolio and make it easier to turn out to be more and more protected against inventory market worth fluctuations.

Beneath, I’ll describe the choice course of in additional element. Since I’ve already described this course of in a earlier article, in case you are already accustomed to it you’ll be able to skip the next part written in italics.

First step of the Choice Course of: Evaluation of the Monetary Ratios

To be able to establish corporations with a comparatively excessive Dividend Yield [FWD], I exploit a filter course of to make a pre-selection. From this pre-selection, I’ll later select my high 10 excessive Dividend Yield corporations of the month. To be a part of this pre-selection of excessive Dividend Yield shares, the businesses ought to fulfil the next necessities:

Market Capitalization > $10B Dividend Yield [FWD] > 2.5% P/E [FWD] Ratio < 30

Within the following, I wish to specify why I’ve chosen the metrics talked about above so as to choose my high 10 excessive Dividend Yield shares of the month.

A Market Capitalization of greater than $10B contributes to the truth that the dangers connected to your investments are decrease, since corporations with the next Market Capitalization are inclined to have a decrease volatility than corporations with a low Market Capitalization.

A P/E [FWD] Ratio of lower than 30 implies that the value you pay for the corporate will not be terribly excessive, thus filtering out people who have inventory costs through which excessive development expectations are priced in. Excessive development expectations indicate robust dangers for buyers, because the inventory worth may drop considerably. Once more, the filtering course of helps us to cut back the chance in order that we usually tend to make a wonderful funding choice.

Second step of the choice course of: Evaluation of the Aggressive Benefits

In a second step, the businesses’ aggressive benefits (for instance: model picture, innovation, expertise, economies of scale, and so forth.) are analyzed so as to make a good narrower choice. I take into account it to be significantly essential for corporations to have robust aggressive benefits so as to stand out in opposition to the competitors in the long run. Corporations with out robust aggressive benefits have the next likelihood of going bankrupt sooner or later, thus representing a powerful danger for buyers to lose their invested cash.

Third step of the choice course of: The Valuation of the businesses

Within the third step of the choice course of, I’ll dive deeper into the Valuation of the businesses.

To be able to conduct the Valuation course of, I exploit completely different strategies and standards, for instance, the businesses’ present Valuation as in keeping with my DCF Mannequin, the anticipated compound annual fee of return as in keeping with my DCF Mannequin and/or a deeper evaluation of the businesses’ P/E [FWD] Ratio. These metrics ought to function an extra filter to solely choose corporations that at the moment have a sexy Valuation, which lets you establish corporations which might be at the very least pretty valued.

The Fourth and remaining step of the choice course of: Diversification over Industries and Nations

Within the fourth and remaining step of the choice course of, I’ve established the next guidelines for selecting my high picks: so as to make it easier to diversify your funding portfolio, a most of two corporations ought to be from the identical business. Along with that, there ought to be at the very least one choose that’s from an organization that’s based mostly outdoors of america, serving as an extra geographical diversification.

New Corporations in comparison with the earlier month of June

BHP Group Restricted (OTCPK:BHPLF) Vitality Switch (NYSE:ET) Rio Tinto (NYSE:RIO) Société Générale Société anonyme (OTCPK:SCGLF, OTCPK:SCGLY) Swiss RE (OTCPK:SSREF)

My Prime 10 Excessive Dividend Yield Shares to Put money into for July 2023

Altria (NYSE:MO) AT&T (NYSE:T) BHP Group Restricted Vitality Switch Rio Tinto Société Générale Swiss RE The Financial institution of Nova Scotia (NYSE:BNS)(BNS:CA) United Parcel Service (NYSE:UPS) Verizon Communications Inc. (NYSE:VZ)

Overview of the chosen corporations for July 2023

Firm Identify

Sector

Business

Nation

Dividend Yield [TTM]

Dividend Yield [FWD]

Div Progress 5Y

P/E [FWD] Ratio

Altria Group

Client Staples

Tobacco

United States

8.48%

8.48%

6.69%

9.37

AT&T

Communication Companies

Built-in Telecommunication Companies

United States

7.01%

7.01%

-5.78%

6.85

BHP Group

Supplies

Diversified Metals and Mining

Australia

8.77%

5.96%

24.84%

13.86

Vitality Switch

Vitality

Oil and Gasoline Storage and Transportation

United States

8.76%

9.73%

-1.43%

8.95

Rio Tinto

Supplies

Diversified Metals and Mining

United Kingdom

7.58%

6.93%

10.99%

7.31

Société Générale

Financials

Diversified Banks

France

7.13%

7.13%

-6.65%

6.02

Swiss RE

Financials

Reinsurance

Switzerland

6.54%

6.54%

4.64%

3.48

The Financial institution of Nova Scotia

Financials

Diversified Banks

Canada

6.27%

6.37%

4.48%

9.53

United Parcel Service

Industrials

Air Freight and Logistics

United States

3.60%

3.71%

12.53%

16.33

Verizon Communications

Communication Companies

Built-in Telecommunication Companies

United States

7.11%

7.14%

2.04%

7.96

Click on to enlarge

Supply: The Creator

BHP Group Restricted

BHP Group is an organization from the Diversified Metals and Mining Business that was based in 1851 and operates by way of the next segments:

BHP Group pays a Dividend Yield [FWD] of 5.96% and it has proven wonderful outcomes when it comes to Dividend Progress: the corporate’s Dividend Progress Price [CAGR] over the previous 10 years is 10.05%, which lies 69.77% above the Sector Median.

This combine between a comparatively excessive Dividend Yield and a sexy Dividend Progress Price makes the corporate an interesting match for dividend revenue and dividend development buyers which might be on the lookout for methods to generate additional revenue within the type of Dividends.

I consider that the BHP Group is at the moment pretty valued, which relies on the corporate’s P/E [FWD] Ratio at the moment being 13.86. The corporate’s Common P/E [FWD] Ratio over the previous 5 years stands at 13.22, confirming my funding thesis that the corporate is at the moment pretty valued.

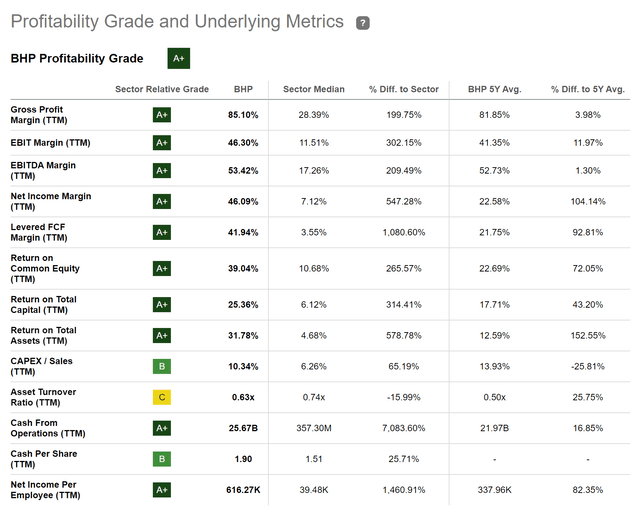

Along with that, I wish to spotlight that the corporate is a wonderful choose in terms of Profitability. This thesis is confirmed by taking a look on the firm’s EBIT Margin [TTM] of 46.30% (the EBIT Margin [TTM] of the Sector Median is 11.51%) and its Return on Fairness of 39.04% (the Return on Fairness of the Sector Median is 10.68%).

The Searching for Alpha Profitability Grade underlines the corporate’s energy when it comes to Profitability.

Supply: Searching for Alpha

Vitality Switch

On the firm’s present worth degree of $12.74, the corporate pays a Dividend Yield [FWD] of 9.73%. Along with that, it’s value mentioning that the corporate’s 10 Yr Dividend Progress Price [CAGR] stands at 5.76%, indicating that buyers mustn’t solely profit from a sexy Dividend Yield, but in addition from the truth that the corporate’s Dividend may proceed to develop throughout the upcoming years.

Nevertheless, it ought to be talked about that I don’t take into account the corporate’s Dividend to be solely protected. The explanation for that’s that its Payout Ratio lies at 82.65%. This comparatively excessive Payout Ratio contributes to the truth that I recommend underweighting the corporate in an funding portfolio, serving to you cut back the draw back danger of your portfolio.

However, I consider that Vitality Switch is at the moment a sexy match for buyers when contemplating danger and reward, which might be confirmed by the corporate’s Free Money Movement Yield [TTM] of 15.69%. This quantity can be utilized as a transparent indicator that buyers can profit from an funding with out counting on the corporate assembly excessive development expectations.

Along with the above, I wish to spotlight that I consider the corporate is at the moment pretty valued. This assumption relies on the truth that the corporate’s P/E Non-GAAP [FWD] Ratio lies at 9.07, which is 1.17% above the Sector Median and solely 9.31% above the corporate’s Common P/E [FWD] Ratio over the previous 5 years.

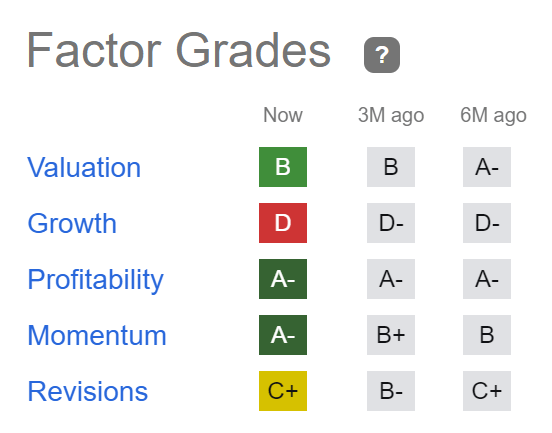

The Searching for Alpha Issue Grades additional strengthen my perception that the corporate is at the moment an awesome choose for buyers: it’s rated with an A- when it comes to Profitability and Momentum, with a B for Valuation, and with a C+ for Revisions.

Supply: Searching for Alpha

Rio Tinto

Rio Tinto was based in 1873 and at the moment has a Market Capitalization of $108.81B. The corporate gives buyers with a Dividend Yield [FWD] of 6.93%.

On the firm’s present worth degree, it has a Free Money Movement Yield [TTM] of 9.09%, which signifies that the corporate is a wonderful selection when it comes to danger and reward at this second of writing.

Over the previous years, the corporate has additionally proven wonderful outcomes in terms of Dividend Progress: the corporate’s Dividend Progress Price [CAGR] over the previous 10 years stands at 11.51%, which lies 94.30% above the Sector Median.

The corporate’s present P/E [FWD] Ratio of seven.31 additional signifies that the corporate is at the moment undervalued because it lies 45.54% beneath the Sector Median (13.43).

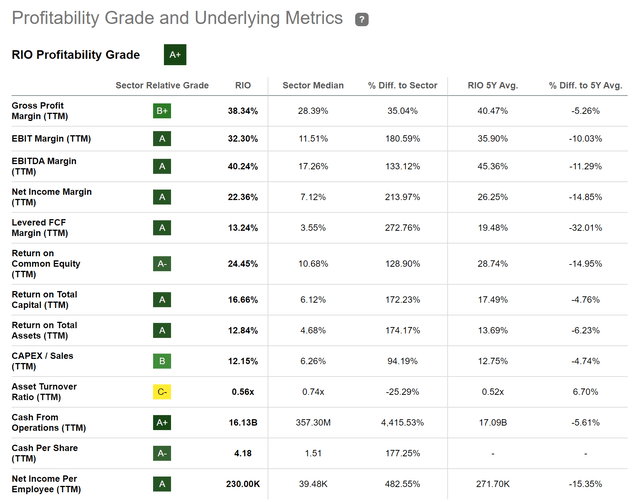

The Searching for Alpha Profitability Grade reveals us that Rio Tinto disposes of a powerful Profitability: the corporate’s EBITDA Margin [TTM] stands at 40.24% and its Return on Fairness is 24.45%, each underlying the corporate’s energy when it comes to Profitability.

Supply: Searching for Alpha

Société Générale

Société Générale gives banking and monetary providers and it operates by way of the next segments:

French Retail Banking Worldwide Retail Banking & Monetary Companies International Banking and Investor Options

The French financial institution was based again in 1864. It at the moment has 117,000 staff.

On the firm’s present inventory worth of $5.10, it pays shareholders a Dividend Yield [FWD] of seven.13%.

For my part, the French financial institution is at the moment undervalued. That is confirmed when taking a look on the firm’s present P/E [FWD] Ratio of 6.02, which lies 33.54% beneath the Sector Median of 9.06. These metrics strengthen my confidence to consider that the financial institution is undervalued at its present worth degree.

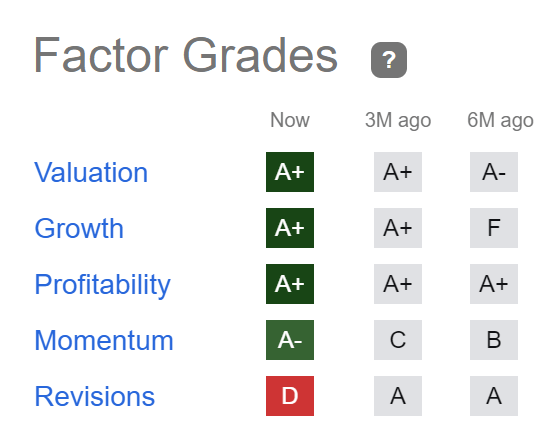

The Searching for Alpha Issue Grades additionally display that the corporate may end result to be a wonderful funding. The French financial institution is rated with an A+ when it comes to Valuation, Progress, and Profitability. For Momentum, it receives an A-, and for Revisions, a D.

Supply: Searching for Alpha

Nevertheless, I don’t take into account the French banks dividend to be protected (which is additional underlined by Searching for Alpha’s D Score when it comes to Dividend Security). Due to this fact, I recommend to solely underweight the French financial institution in an funding portfolio in case you resolve to incorporate it into your portfolio. I additional advocate giving the financial institution a most of two% of your total funding portfolio with the target of lowering the chance degree on your funding portfolio and herewith to extend the likelihood of acquiring wonderful returns over the long run.

Swiss RE

Swiss RE gives reinsurance and insurance coverage providers worldwide. The corporate operates by way of the next segments:

Property & Casualty Reinsurance Life & Well being Reinsurance Company Options

The corporate at the moment pays a Dividend Yield [FWD] of 6.54%. It has additional proven a Dividend Progress Price [CAGR] of 4.64% over the previous 5 years. These numbers have contributed to the truth that I consider it might be an awesome choose for these buyers that wish to mix a excessive Dividend Yield with Dividend Progress.

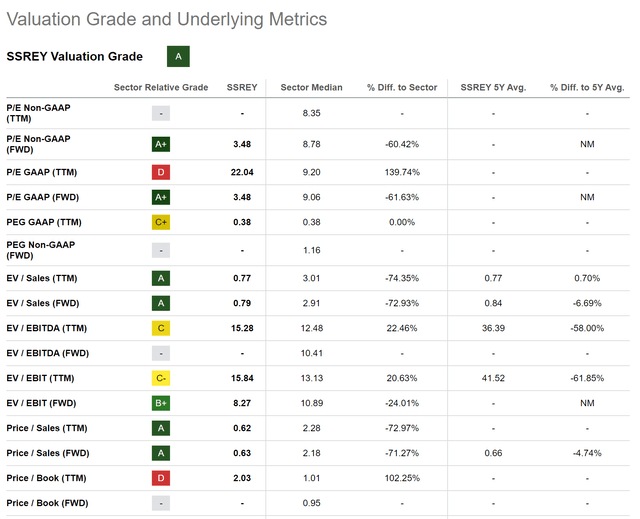

When it comes to Valuation, I wish to spotlight that Swiss RE at the moment has a P/E GAAP [FWD] Ratio of three.48, which lies clearly beneath the Sector Median of 9.06, indicating that the corporate is undervalued at its present worth degree.

Beneath you will discover the Searching for Alpha Valuation Grade, which highlights the corporate’s attractiveness in terms of Valuation and might be seen as further proof that Swiss RE is at the moment undervalued.

Supply: Searching for Alpha

The corporate additional appears to be a sexy match in terms of Progress, which is underlined by its EBIT Progress [YoY] of 43.04%, which is clearly above the Sector Median of 5.11%, and its EPS Diluted Progress [YoY] of 58.27%, that can be considerably above the Sector Median (-2.36%).

Altria

Throughout the previous 5 years, Altria has proven a efficiency of -22.33%. This destructive efficiency has contributed to the truth that the corporate has a sexy inventory worth at this time. On the firm’s present worth degree of $44.50, Altria has a P/E [FWD] Ratio of 9.41.

The corporate’s present Valuation lies 26.51% beneath its Common over the previous 5 years, clearly indicating that Altria is at the moment undervalued. That is additionally confirmed when taking a look on the firm’s Dividend Yield [TTM] of 8.45%, which lies 17.39% above its Common from over the previous 5 years.

Altria pays shareholders a Dividend Yield [FWD] of 8.45% and has a Payout Ratio of 75.92%. I interpret the corporate’s Payout Ratio of 75.92% in a means that its Dividend will not be solely protected. For that reason, I recommend that you simply restrict the proportion of the Altria place to a most of 5% of your whole funding portfolio when deciding to incorporate the corporate in your portfolio.

When in comparison with Philip Morris (NYSE:PM), I consider that Altria is barely superior in terms of Dividend Yield (Altria’s Dividend Yield [FWD] is 8.45% whereas Philip Morris’ is 5.28%), Dividend Progress (Altria’s 5 Yr Dividend Progress Price [CAGR] is 6.69% whereas Philip Morris’ is 3.15%) and when it comes to Profitability (whereas Altria’s Gross Revenue Margin is 68.82%, Philip Morris’ is 63.58%).

I additionally consider that Altria is extra enticing than Philip Morris when it comes to Valuation, which is confirmed by the corporate’s decrease P/E [FWD] Ratio of 9.41 when in comparison with Philip Morris’s (P/E [FWD] Ratio of 15.74).

AT&T

AT&T has a lot of aggressive benefits, offering the corporate with an financial moat over new corporations that would enter into its enterprise section: among the many firm’s aggressive benefits are its robust model picture (in keeping with Model Finance, AT&T is at the moment twenty second within the checklist of probably the most beneficial manufacturers on this planet), its broad buyer base, the corporate’s economies of scale and its community infrastructure.

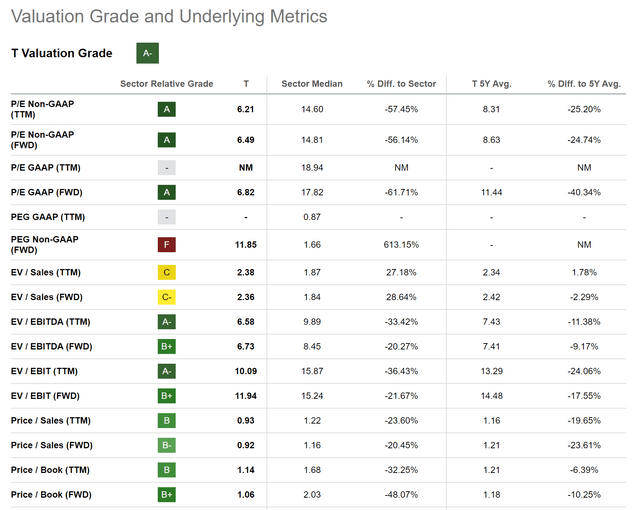

At this second of writing, I consider that the corporate has a sexy Valuation: AT&T at the moment has a P/E [FWD] Ratio of 6.82. This suggests that the corporate’s P/E [FWD] Ratio at the moment lies 40.34% beneath its Common over the previous 5 years. It additionally lies 61.71% beneath the Sector Median. Due to this fact, I consider that AT&T is at the moment undervalued.

Beneath you will discover the Searching for Alpha Valuation Grade which raises my confidence that the corporate is a sexy choose when it comes to Valuation at this second in time.

Supply: Searching for Alpha

AT&T at the moment pays a Dividend Yield [FWD] of seven.03%, which reveals that the corporate is especially enticing for dividend revenue buyers that purpose to construct additional revenue within the type of Dividends.

Nevertheless, it’s true that the corporate has restricted development views (the corporate’s Common Income Progress Price [YoY] over the previous 5 years stands at 0.22%), and for that reason I recommend underweighting AT&T in your funding portfolio. This helps you lower the chance degree of your portfolio whereas growing the likelihood of attaining wonderful funding outcomes over the long run.

The Financial institution of Nova Scotia

Over the previous 12-month-period, The Financial institution of Nova Scotia has proven a Complete Return of -18.02%, which has resulted within the financial institution at the moment having a P/E [FWD] Ratio of 9.53. Its present P/E [FWD] Ratio lies 5.89% beneath the financial institution’s Common over the previous 5 years, indicating that the financial institution is undervalued at this second of writing.

On the financial institution’s present inventory worth of $48.78, the Canadian financial institution pays its shareholders a Dividend Yield [FWD] of 6.37%. Along with this enticing Dividend Yield, it’s value mentioning that the financial institution has proven a Dividend Progress Price [CAGR] of 4.74% over the previous 3 years, making me consider that it’s certainly one of these corporations that may present buyers with a sexy combine between dividend revenue and dividend development.

Moreover, it’s noteworthy to focus on that the financial institution has already proven 17 Consecutive Years of Dividend Funds, which might be interpreted as an extra indicator that reveals that the financial institution is enticing for dividend revenue buyers.

When in comparison with U.S. banks similar to JPMorgan (NYSE:JPM) or Financial institution of America (NYSE:BAC), it may be said that The Financial institution of Nova Scotia pays a considerably larger Dividend Yield. Whereas the Canadian financial institution pays shareholders a Dividend Yield [FWD] of 6.37%, JPMorgan’s Dividend Yield [FWD] at the moment stands at 2.89%, and Financial institution of America’s at 3.14%.

Nevertheless, it ought to be highlighted that these U.S. banks have a considerably decrease Payout Ratio than their Canadian competitor: whereas JPMorgan’s Payout Ratio lies at 29.52%, Financial institution of America’s stands at 26.13%; The Financial institution of Nova Scotia’s Payout Ratio is 52.95%, indicating that its Dividend is much less protected than the Dividend from the U.S. banks and that these U.S. banks have extra room for future Dividend enhancements.

These U.S. banks have additionally proven larger Dividend Progress Charges in recent times: whereas The Financial institution of Nova Scotia’s Dividend Progress Price [CAGR] over the previous 5 years is 4.38%, JPMorgan’s is 12.91% and Financial institution of America’s is 12.89%, indicating that they might be the higher picks when it comes to Dividend Progress.

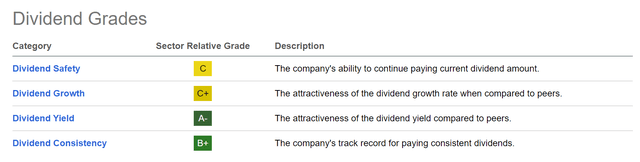

For my part, The Financial institution of Nova Scotia can be an awesome choose when contemplating Profitability: the financial institution has a Web Revenue Margin of 29.36%, which lies 13.61% above the Sector Median.

Beneath you will discover the outcomes of the Searching for Alpha Dividend Grades, which as soon as once more, verify the financial institution’s enticing Dividend: The Financial institution of Nova Scotia receives an A- for Dividend Yield, a B+ for Dividend Consistency, a C+ for Dividend Progress, and a C for Dividend Security.

Supply: Searching for Alpha

United Parcel Companies

United Parcel Companies can be amongst these kinds of corporations that mixes a comparatively excessive Dividend Yield with Dividend Progress, making it potential to earn a sexy Dividend Yield from at this time onwards, whereas with the ability to enhance this quantity at a sexy development fee from 12 months to 12 months.

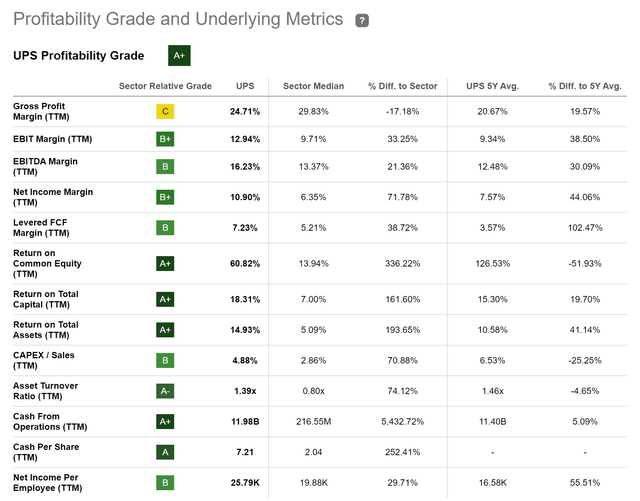

At this second of writing, UPS pays a Dividend Yield [FWD] of three.71%. The corporate’s Payout Ratio lies at 51.07%. Moreover, it’s value mentioning that the corporate’s Dividend Progress Price [CAGR] over the previous 3 years is 16.81%, which is considerably above the Sector Median of seven.62%. This serves as an extra indicator that buyers mustn’t solely profit from the corporate’s comparatively excessive Dividend Yield, but in addition from the truth that the corporate gives your portfolio with Dividend Progress.

I additional consider that UPS is at the very least pretty valued: it’s because its P/E [FWD] Ratio of 16.33 lies 14.01% beneath the Sector Median of 19.00. Along with that, it solely stands 1.53% above the corporate’s Common P/E [FWD] Ratio over the previous 5 years, confirming its truthful Valuation.

It’s value highlighting that UPS (P/E [FWD] Ratio of 16.33) has a barely larger Valuation when in comparison with FedEx (NYSE:FDX) (P/E [FWD] Ratio of 14.73), however its Valuation is considerably decrease than the Valuation of Amazon (NASDAQ:AMZN) (82.56) (as a result of the truth that Amazon expands an increasing number of its logistics capabilities, they are often thought of opponents in sure companies). Nevertheless, I see UPS as probably the most enticing choose for dividend revenue buyers, which relies on the truth that it pays a Dividend Yield [FWD] of three.71% whereas FedEx’s is 2.03% (Amazon doesn’t pay a Dividend). Nevertheless, I see FedEx barely forward of UPS in terms of Dividend Progress: FedEx’s Dividend Progress Price [CAGR] over the previous 5 years is 23.99%, whereas UPS’ is 12.53%.

The Searching for Alpha Profitability Grade additional strengthens my perception that the corporate possesses robust monetary well being: UPS has an EBIT Margin [TTM] of 12.94% and a Return on Fairness [TTM] of 60.82%.

Supply: Searching for Alpha

Verizon

Verizon was based in 1983 and I additionally consider it has robust aggressive benefits that forestall different corporations from coming into its enterprise section: to call only a few of them, Verizon has a powerful model status (it’s ranked eighth within the checklist of probably the most beneficial manufacturers on this planet in keeping with Model Finance), a powerful community (as a result of its wi-fi and fiber-optic networks) and a broad buyer base in addition to a concentrate on innovation (which can be expressed by its 5G networks).

At at this time’s inventory worth of $36.72, Verizon pays its shareholders a Dividend Yield [FWD] of seven.09%, serving as an indicator that the corporate is enticing for dividend revenue buyers. It’s additional value mentioning that Verizon has proven a Dividend Progress Price [CAGR] of two.42% over the previous 10 years, which demonstrates that buyers ought to be capable to enhance their further revenue within the type of dividends yearly when investing in Verizon.

I take into account this mixture of Dividend Revenue and Dividend Progress crucial for buyers, because it helps buyers turn out to be more and more protected against inventory market worth fluctuations.

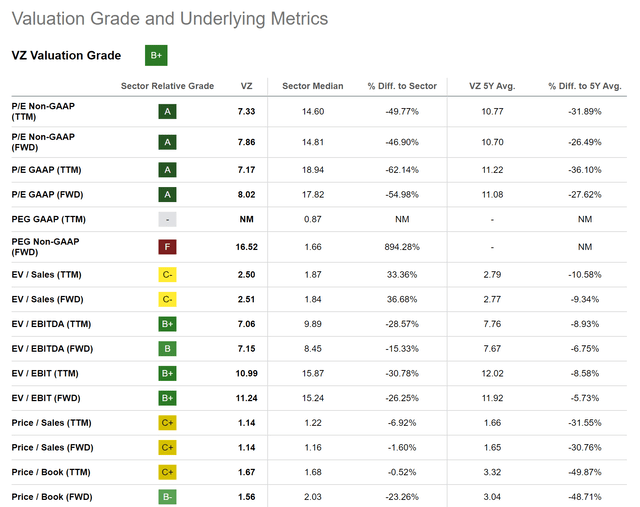

I additional consider that Verizon is undervalued. My opinion relies on the truth that Verizon’s P/E [FWD] Ratio of 8.02 stands 54.98% beneath the Sector Median. It will also be highlighted that it lies 27.62% beneath its Common over the previous 5 years.

Beneath you will discover the Searching for Alpha Valuation Grade, which underlines my idea that Verizon is at the moment undervalued.

Supply: Searching for Alpha

Conclusion

Implementing an funding technique that goals to mix Dividend Revenue with Dividend Progress helps you turn out to be much less affected by inventory market worth fluctuations.

The main focus of this text was on corporations that significantly present your funding portfolio with a sexy Dividend Yield, serving to you enhance the Weighted Common Dividend Yield of your portfolio.

I take into account these picks to at the moment be enticing when it comes to Valuation, which is demonstrated by the truth that 8 out of the ten chosen corporations at the moment have a P/E [FWD] Ratio beneath 10. Moreover, they’ve robust aggressive benefits and are financially wholesome, elevating my confidence that they are often enticing long-term investments.

With my funding analyses, I purpose that can assist you construct a diversified long-term funding portfolio with a diminished danger degree that helps you generate additional revenue within the type of Dividends (combining Dividend Revenue with Dividend Progress) whereas prioritizing the pursuit of Complete Return, encompassing each Capital Features and Dividends.

Creator’s Observe: I’d love to listen to your opinion on my number of excessive dividend yield corporations to purchase in July 2023. Do you already personal or plan to accumulate any of the picks? That are at the moment your favourite excessive dividend yield corporations? If you need to obtain a notification after I publish my subsequent evaluation, you’ll be able to click on the ‘Observe’ button.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.