Senco Gold IPO Overview: Senco Gold Restricted is developing with its Preliminary Public Providing (IPO). The IPO will likely be open for subscription on July 4, 2023, and closes on July 6, 2023. The corporate is trying to elevate Rs 405 Crores by way of IPO out of which Rs 270 Crores will likely be a recent concern and the remaining will likely be a proposal on the market of Rs 135 Crores.

On this article, allow us to look deeper into the Senco Gold IPO Overview and its future prospects, financials, alternatives, threats, and plenty of extra. Preserve studying to know extra!

Senco Gold IPO Overview – Concerning the Firm

Senco Gold Restricted is a pan-India jewelry retailer which was integrated in 1994 in West Bengal, India. Later, with the intention to develop its actions within the subject of the jewelry enterprise, the Firm was transformed to a public restricted firm in August 2007 with the title Senco Gold Restricted.

It primarily sells gold and diamond jewelry together with jewelry manufactured from silver, platinum, and different valuable stones below the model title “Senco Gold & Diamonds”. The corporate additionally sells costume jewelry, gold and silver cash and silver utensils throughout its shops.

With over 5 a long time of expertise, Senco Gold Restricted is the most important organized jewelry retail participant within the japanese area of India based mostly on the variety of shops. As on March 31, 2023, the corporate has 136 showrooms, which have a complete space of roughly 409,882 sq. ft., in 96 cities and cities over 13 states throughout India. Senco Gold has each on-line and offline shops.

With a listing of 120,000 designs for gold jewelry and greater than 69,000 designs for diamond jewelry, it presents a big number of designs of handcrafted jewelry, most of that are designed and manufactured in-house in shut collaboration with over 170 expert native craftsmen (typically termed Karigars) in Kolkata and throughout the nation.

With a workforce of 20 devoted designers, the corporate additionally manufactures machine-made light-weight jewelry in gold and diamonds and supply jewelry from third-party distributors.

Merchandise of the Firm

Senco Gold Restricted primarily sells gold, diamonds, studded gold jewelry, jewelry manufactured from silver, and platinum, gold and silver cash. It additionally sells different merchandise like costume jewelry and utensils manufactured from silver. In these classes, it presents jewelry like

Marriage ceremony Jewelry

Pageant Jewelry

Each day put on Jewelry

Males’s Jewelry

Youngsters Jewelry

Now allow us to look into their model collections of Senco Gold Restricted

Everlite is a set of light-weighted jewelry crafted for contemporary Indian Girls. The light-weight gold and diamond assortment begins from roughly ₹ 5,000 and goes as much as ₹ 60,000.

‘Gossip’ model is manufactured from sterling silver or base metallic with valuable and semi-precious stones, together with zirconia, to cater to the silver jewelry wants of our prospects, we’ve launched our ‘Gossip’ model for fast-moving, trendy and easy-to-wear jewelry.

Aham assortment has been designed particularly for the cosmopolitan man and can be utilized as a part of each day put on in addition to on social events. It features a assortment of rings, bracelets, cufflinks, ear-studs, chains and pendants in diamond, platinum, gold and silver.

The Vivaha Assortment (marketed below the Senco-Di-wedding marketing campaign) has a variety of jewelry for weddings within the household, together with the bride, the groom and their respective households. This assortment presents an unique vary of Filigree, Temple, Vintage, Polki, Kundan and a novel diamond assortment. The product choices embody waistbands, rings, Jhoomar, Nath, Haathphol, Maangtika, Necklace Units, Armbands, Nostril Pin, Hair Accent, Bangles, Toe rings, Anklets, Nath, Sankha & Pola (Bangle), Kharu, Cheek and Lengthy Chain.

Excellent Love Diamond Solitaire

This assortment presents an beautiful vary of solitaire earrings, rings, pendants, nostril pins and single diamond studs.

Senco Gold IPO – Business Overview

If we have a look at the worldwide gems and jewelry business, the worldwide gold demand was at an 11-year excessive in 2022, adopted by strong funding demand. Moreover, the demand for bars and cash grew by 2% to 1,217 tonnes, whereas holdings in ETFs fell by a smaller quantity when in comparison with CY 2021. Funding demand (excluding OTC) reached 1,107 tonnes – recording a development of 10%.

Coming to the Indian gems and jewelry business, we are able to see that the gems and jewelry market was roughly valued round Rs 4,700 billion in fiscal 2023 with gold jewelry dominating the general market with a 66% share as per the CRISIL reviews. As a feather within the cap, India surpassed China by way of gold consumption and emerged as the most important client of gold jewelry within the yr 2022.

Senco Gold IPO – Monetary Highlights

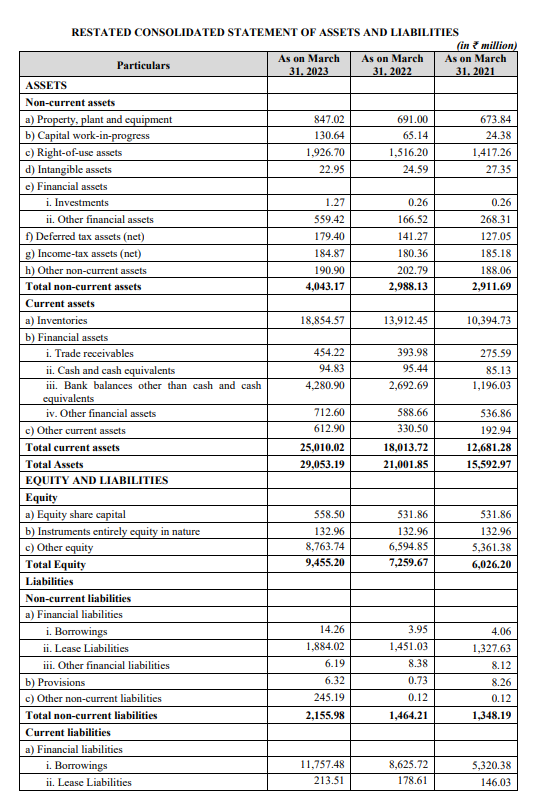

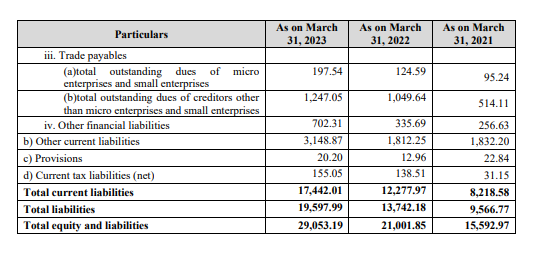

If we have a look at the financials of Senco Gold Restricted we are able to see that their belongings have elevated from Rs 1559.30 Crores to Rs 2905.32 Crores from FY21 to FY23. Equally, the income of the corporate has elevated from Rs 2,674.92 Crores to Rs 4,108.54 Crores from FY21 to FY23 respectively.

Transferring ahead if we see the online income of the corporate, it has elevated from Rs 61.48 Crores to Rs 158.48 Crores from FY21 to FY23. Moreover, the income CAGR of the corporate elevated at a CAGR of 15.36% and the revenue for the yr has elevated at a CAGR of twenty-two.75percentfrom Fiscal 2022 to Fiscal 2023

One other key metric to contemplate right here is that the borrowings of the corporate have significantly elevated from Rs 532.44 Crores in FY21 to Rs 1,177.17 Crores in FY23.

Abstract of Monetary Data

The Stability Sheet Of The Firm

Rivals of the corporate

Strengths of the Firm

The fundamental standards that each purchaser of gold and diamonds appears to be like at is the authenticity of the model. With a powerful model title and legacy of over 5 a long time, Senco Gold Restricted has gained the boldness of many shoppers.

The corporate has been doing BIS Hallmarking to all its gold jewelry since 2012, a lot previous to the obligatory use of BIS Hallmark which began in 2021. The act of the corporate to make sure transparency in its operations has elevated the belief within the firm which is a serious energy of the corporate.

The corporate has centered extra on the light-weight inexpensive jewelry and the designs favored by the youthful technology. That is seen as a core competency of the corporate, because the working-age inhabitants (15-64 years) as part of the general inhabitants has risen from 65% in 2013 to 67% in 2021 and immediately impacts the income of the corporate.

Senco Gold Restricted has an skilled administration workforce and institutional investor assist which is a key contributor to the sustainable development of the corporate

The corporate presents all kinds starting from festive collections to each day put on. This optimum product combine helps in growing the general revenue margins of the corporate

Weaknesses of the Firm

The corporate operates in a extremely aggressive market the place there are a number of gold and jewelry corporations which can be effectively established, for instance, Tanishq by TATA, Malabar Gold, and many others. If these corporations provide merchandise at aggressive costs, it might be an indication of menace to the corporate

The corporate requires an enormous quantity of working capital for continued development. Therefore the shortage of working capital sooner or later would trigger an adversarial influence on the monetary place of the enterprise

The corporate was subjected to a “search and seizure” operation by the Earnings tax division previously, which has resulted in taxation and legal proceedings being initiated in opposition to our Firm and our Particular person Promoter. Any adversarial end result of such proceedings might need a destructive influence on the enterprise

As the costs of gold and diamond are unstable and depending on many nationwide and worldwide components, this may have an effect on the income and profitability of the corporate.

Senco Gold IPO Overview – Key IPO Data

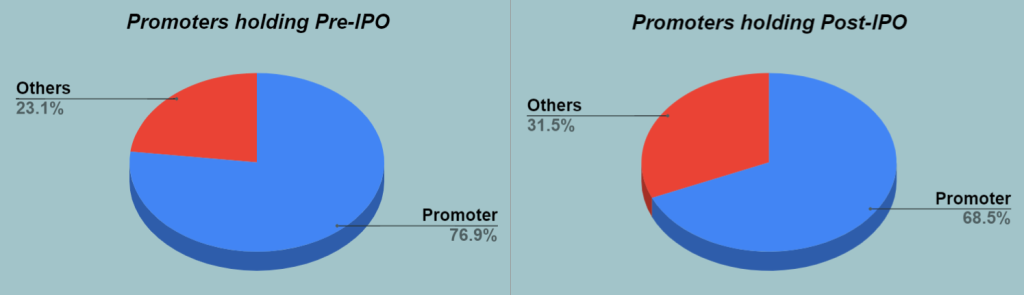

Promoters: Suvankar Sen, Jai Hanuman Shri Siddhivinayak Belief And Om Gaan Ganpataye Bajrangbali Belief

E-book Operating Lead Managers: IIFL Securities, Ambit Personal Restricted and SBI Capital Market Restricted

Registrar to the Provide: KFIN Applied sciences Restricted

Targets of the Difficulty

Funding working capital necessities of the Firm

Basic company functions

Senco Gold IPO – GMP

The shares of Senco Gold Restricted traded at a premium of 18.93% within the gray market on June thirtieth, 2023. The shares are estimated to commerce at Rs 377. This offers it a premium of Rs 60 per share over the cap value of Rs 317.

Closing Ideas

On this article on Senco Gold Restricted IPO Overview, we appeared intimately on the key data of the corporate together with its overview and financials. Market analysts stay divided on the IPO and its potential positive factors because of the authorized proceedings on the corporate. That’s it for this put up. Comfortable Studying!

Written by Bhagyalakshmi Patil

By using the inventory screener, inventory heatmap, portfolio backtesting, and inventory evaluate device on the Commerce Brains portal, buyers achieve entry to complete instruments that allow them to determine the perfect shares additionally get up to date with inventory market information, and make well-informed funding choices.

Begin Your Inventory Market Journey Immediately!

Need to be taught Inventory Market buying and selling and Investing? Be certain to take a look at unique Inventory Market programs by FinGrad, the educational initiative by Commerce Brains. You’ll be able to enroll in FREE programs and webinars out there on FinGrad at this time and get forward in your buying and selling profession. Be a part of now!!