rarrarorro/iStock by way of Getty Pictures

Introduction

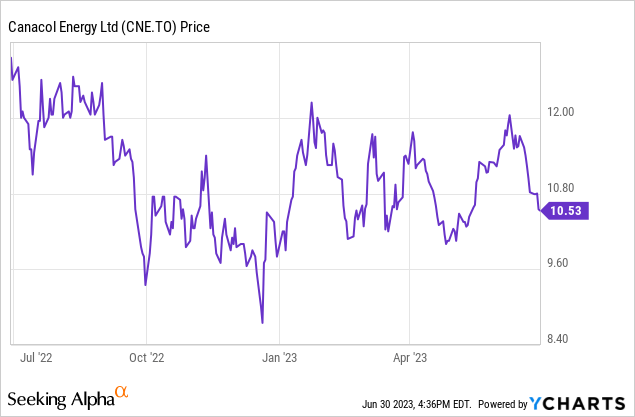

I’ve been following Canacol Power (TSX:CNE:CA) (OTCQX:CNNEF) for some time right here at Searching for Alpha and though I am seeking to generate capital features on the again of an growing pure fuel manufacturing and growing reserves, the share worth has gone nowhere prior to now three years because the inventory is now buying and selling about 50% decrease than three years in the past. Because the pure fuel worth in Colombia could be very flat, Canacol didn’t partake within the pure fuel hype in 2022 in North America and Europe. And whereas the predictability of the pure fuel worth has its benefits, the shortage of volatility means there are only a few punters and Canacol shouldn’t be purchased as an possibility on the pure fuel worth. Fortuitously the dividend yield of round 10% retains me glad, whereas the firm invests its incoming working money circulation on its belongings in an try and additional improve the reserves.

The money flows stay sturdy, however the capex stays excessive

The typical manufacturing price within the first quarter of the 12 months was roughly 185,500 Mcf per day leading to an oil-equivalent manufacturing of round 33,000 barrels per day. The corporate additionally produced slightly below 600 barrels per day of oil, leading to a complete manufacturing of 33,600 barrels of oil-equivalent and a internet manufacturing of 33,133 boe/day (after deducting the pure fuel used in the course of the manufacturing course of).

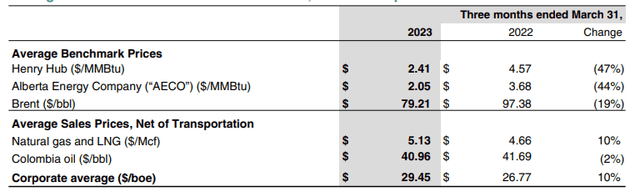

Canacol Power Investor Relations

As you’ll be able to see above, the typical realized pure fuel worth was US$5.13, a rise of 10% in comparison with the primary quarter of 2022, and considerably larger than the North American pure fuel costs. So whereas Canacol didn’t see a spike in its realized worth in 2022, it is also not seeing the pure fuel worth drop to the identical extent as in North America.

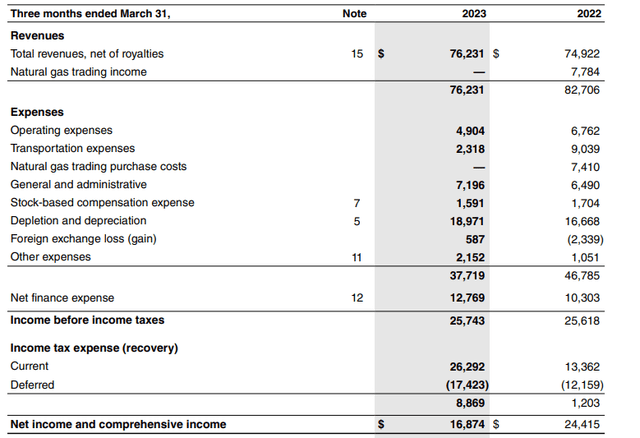

Canacol Power studies its monetary ends in US {dollars} and the full income within the first quarter got here in at US$76.2M. That’s decrease than within the first quarter of final 12 months, however the easy rationalization is that the corporate didn’t do any pure fuel buying and selling. That boosted the full income in Q1 final 12 months, however the margins have been comparatively skinny (about 4%). So whereas the income decreased, so did the working bills as there clearly additionally have been no bills associated to the pure fuel buying and selling.

Canacol Power Investor Relations

The overall working bills have been lower than $38M and about half of that was associated to depreciation and depletion bills. And whereas the web finance bills elevated, the pre-tax earnings of $25.7M and the web earnings of $16.9M have been nonetheless very robust. On a per share foundation, the EPS was $0.49, and that’s roughly C$0.65 per share.

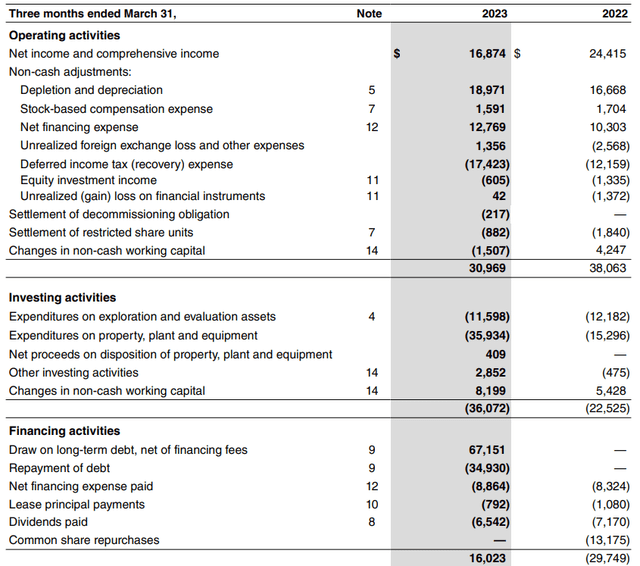

The money circulation result’s much more necessary than the reported internet earnings, as Canacol Power will probably be spending fairly a bit of money this 12 months on its properties.

As you’ll be able to see beneath, the working money circulation was $31M however this included a $1.5M funding within the working capital place and excluded the roughly $9.5M in curiosity and lease funds. On an adjusted foundation, the working money circulation was $23M. This is able to have been round $40M after normalizing the money tax funds.

Canacol Power Investor Relations

This nonetheless wasn’t sufficient to be money circulation constructive as Canacol spent about $47.5M on capital expenditures. This isn’t a shock as Canacol at present is investing closely in its belongings to spice up the reserves forward of the completion of a brand new pipeline to serve the Medellin market.

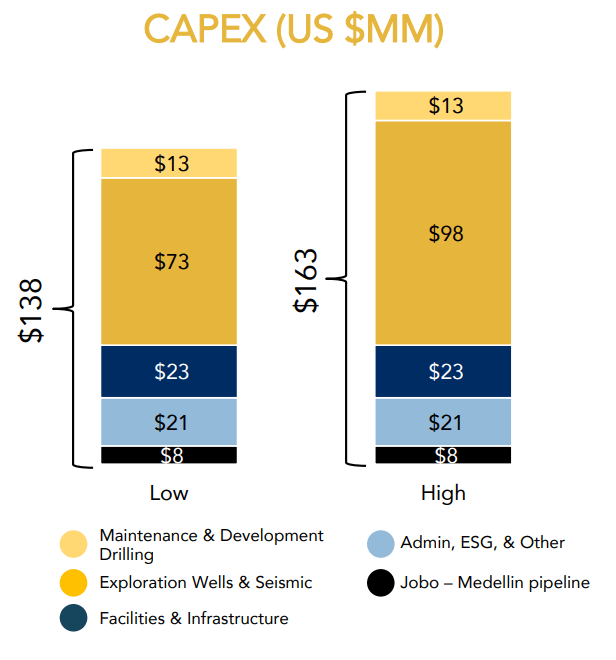

The complete-year capex steering stays unchanged at $138-163M, which represents a mean of $35-40M per quarter. This implies Canacol’s Q1 capex was trending above the typical for this 12 months and the capital expenditures will probably be decrease within the subsequent few quarters.

Canacol Power Investor Relations

The exploration actions are beginning to repay and in the newest replace, Canacol disclosed a brand new effectively (Lulo 2) encountered 230 ft of internet fuel pay. The effectively will now be cased and accomplished and tied into the fuel remedy facility. This can assist to organize the corporate for an anticipated improve within the demand for pure fuel in Colombia within the second half of the 12 months as Canacol expects a constructive impression from the El Nino season.

Whereas the corporate continues to aggressively drill and put together wells, it continues to pay a slightly beneficiant dividend. The subsequent quarterly dividend of C$0.26 per share will probably be payable on July 17 and on an annualized foundation, the dividend yield is now nearly 10%. As Canacol is a Canadian firm, Canadian dividend withholding taxes will probably be withheld the place relevant.

Funding thesis

Whereas I used to be initially pursuing capital features with my funding in Canacol Power, I now must be proud of the beneficiant 10% dividend yield. Fortuitously the corporate’s money circulation outcomes are very robust and the present adverse free money circulation result’s solely brought on by the very excessive funding within the fuel challenge to spice up the reserves and get the output capability prepared for when the brand new Medellin pipeline will probably be accomplished.

So I’ll simply must be affected person. Canacol Power is doing all the correct issues and I am nonetheless getting a ten% dividend yield whereas I await the share worth to maneuver. With in extra of $70M in money on the stability sheet and no debt maturities earlier than 2027, Canacol can simply proceed to spend money on its properties.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.