Each investor needs a portfolio that may generate returns, however discovering the correct shares for that’s at all times a problem. The analysts at Goldman Sachs have developed a data-based rule to kind by the mass of shares and discover the shares which can be going to usher in stable returns.

The important thing to Goldman’s ‘Rule of 10’ lies in every firm’s projected gross sales progress – the agency appears for shares with potential to indicate a multi-year CAGR of 10% or greater. In line with David Kostin, the financial institution’s Chief Funding Officer and Head of Funding Technique, fast and constant gross sales progress is a prevalent attribute amongst right now’s main shares as they ascend the ranks.

“We refresh our ‘Rule of 10’ display, which identifies shares with realized and anticipated annual gross sales progress larger than 10% through the 5 years from 2021 by 2025,” Kostin famous.

A few of the high analysts at Goldman Sachs have been recommending shares that align with the “Rule of 10” standards. We’ll check out two of them, utilizing the information drawn from the TipRanks platform. Each are S&P-listed corporations, and each have proven excessive sustained gross sales progress over time – with excessive potential to keep up that efficiency. It additionally doesn’t harm that every inventory is admired by the remainder of the analyst neighborhood, sufficient so to earn a “Robust Purchase” consensus score. Let’s take a more in-depth look.

SolarEdge Applied sciences (SEDG)

The primary Goldman decide on our record is SolarEdge Applied sciences, a designer and producer of microinverters, that are important expertise in solar energy installations. Microinverters convert DC present, the sort produced by photovoltaic panels, into AC present that can be utilized on the grid and in family methods. SolarEdge is likely one of the main firms within the US microinverter section, with roughly 40% market share.

The corporate doesn’t relaxation solely on the microinverter enterprise; it produces a variety of photo voltaic expertise merchandise. The product line consists of monitoring methods for photovoltaic technology methods, energy optimizers, and even solar-powered EV chargers for residence use. SolarEdge markets on to the residential market, in addition to to industrial shoppers, together with constructing homeowners, small companies, development shoppers, and set up professionals.

Story continues

When examined by the lens of Goldman’s ‘Rule of 10,’ SolarEdge displays a projected gross sales CAGR of 24% from 2022 by the tip of 2025. Few firms can match this exceptional degree of sustained progress.

SolarEdge’s present efficiency offers good cause to imagine it can match the projections. The corporate confirmed a number of report metrics in its 1Q23 monetary outcomes, the final quarterly outcomes reported. These included report quarterly income of $943.89 million, a end result that was up 44% year-over-year and got here in additional than $12.05 million forward of the estimates. The information additionally included the non-GAAP EPS outcomes of $2.90, a major enchancment in comparison with the $1.20 worth in 1Q22 and surpassing the forecast by 95 cents.

In his protection of SolarEdge for Goldman Sachs, 5-star analyst Brian Lee sees the corporate’s diversification as a key help for its success. Lee acknowledges that SolarEdge has established itself within the US residential photo voltaic market, however he additionally factors out that the corporate’s enterprise is increasing on the quickest tempo in Europe and within the industrial and industrial markets.

“For 2023, we anticipate Europe to be one of many quickest rising areas, with whole photo voltaic installations up >25% yoy (we anticipate the expansion of resi to be inline-to-above the general market) vs. US residential finish market up <10% yoy and up to date datapoints suggesting it may find yourself being worse than that. Notably, SEDG’s shipments to Europe accounted for ~60% of the whole in 1Q23… When it comes to finish market, 50%-60% of SEDG’s whole volumes had been shipped to the C&I finish market — which seems to have remained stable and resilient regardless of macro uncertainties vs. resi, based mostly on our channel checks. With the aforementioned dynamics, we’re tactically extra constructive on SEDG,” Lee opined.

To this finish, Lee charges SEDG shares a Purchase, unsurprisingly in gentle of his feedback, and units a $445 worth goal that means ~65% one-year upside for the inventory. (To observe Lee’s monitor report, click on right here)

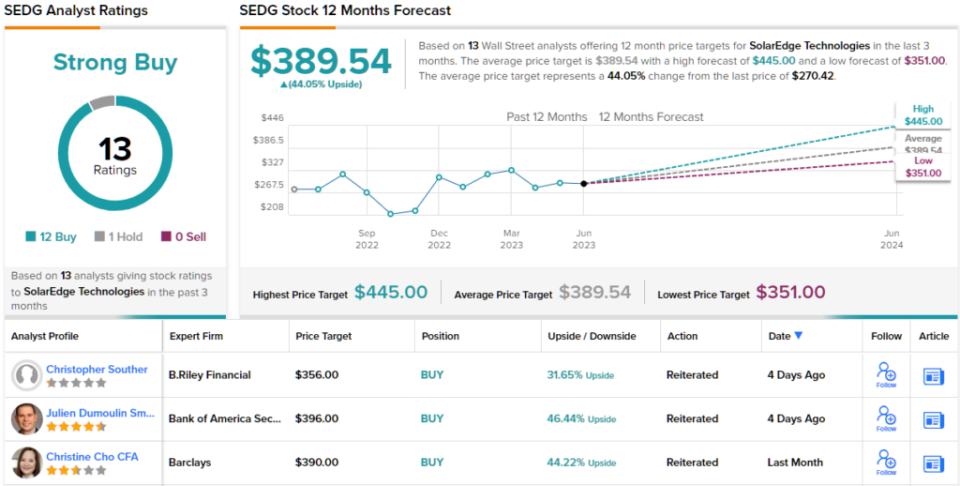

Total, SolarEdge has attracted 13 analyst evaluations not too long ago, with a breakdown of 12 to 1 in favor of Buys over Holds. The shares are buying and selling for $270.42, and the typical worth goal of $389.54 suggests a acquire of 44% within the subsequent 12 months. (See SEDG inventory forecast)

Intuit, Inc. (INTU)

The second inventory we’re taking a look at has not too long ago accomplished its strongest season of the yr. Intuit is a software program firm greatest identified for its two flagship merchandise: TurboTax and QuickBooks. These software program merchandise present tax calculation and submitting companies, bookkeeping capabilities, and different accounting duties optimized for in-home or small enterprise use. The corporate’s different merchandise embrace the Credit score Karma private software program bundle and the favored advertising automation system, Mailchimp.

Intuit’s product line is geared toward facilitating monetary and advertising record-keeping and automation for non-professionals, and the corporate boasts over 100 million prospects worldwide. The corporate operates out of 20 places of work in 9 totally different international locations, and final yr introduced in $12.7 billion in whole income.

Making use of the Goldman Rule of 10, we discover that Intuit’s 2022 to 2025E CAGR runs at 13%, a stable determine that places the corporate effectively above the ten% threshold Goldman makes use of to foretell future success. The corporate has loads of room for future progress, as its largest section is tax prep – and the US tax preparation market alone exceeds $11.2 billion. Globally, the tax prep market is estimated at greater than $28 billion this yr.

The corporate completed its fiscal Q3 on April 30, reporting high line income of $6.02 billion, up 7% from the prior yr interval. The revenues simply missed expectations, coming in $73.9 million, or 1.22%, beneath the forecast. On the backside line, Intuit’s non-GAAP earnings per share hit $8.92, for a 17% y/y enhance, and beat the analyst forecasts by 42 cents.

Kash Rangan, one other of Goldman’s 5-star analysts, lays out a number of the explanation why Intuit is poised to money in on its progress potential. Because the analyst writes, “We see a number of long-term structural progress drivers: 1) Generative AI may solidify INTU’s market management as it’s uniquely positioned to leverage an unlimited quantity of tax-related information with the usage of LLMs. 2) The broader ~$30bn tax-prep market creates vital alternatives for TurboTax Dwell (which holds 3-5% of the market) to seize share. 3) With Intuit solely capturing ~10% of the ~$2 trillion in quantity occurring on its platform, and contemplating 70% of B2B funds are nonetheless not digitized, we anticipate its funds providing to scale to $4-5bn in income. Intuit’s potential to tug value levers to drive effectivity regardless of decrease top-line visibility must also be rewarded.”

Quantifying his constructive stance, Rangan offers Intuit shares a Purchase score, together with a $565 worth goal that signifies his confidence in a one-year upside of 25%. (To observe Rangan’s monitor report, click on right here)

That is one other inventory with a Robust Purchase consensus score from the Avenue. The score relies on 16 latest analyst evaluations, which embrace 15 Buys in opposition to a single Maintain. Intuit shares are at present priced at $451.57, whereas the $508.67 common worth goal implies ~13% upside going ahead into subsequent yr. (See INTU inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.