da-kuk/E+ through Getty Photos

Introduction

Nearly two years in the past I wrote an article on SA about satellite tv for pc imagery supplier Satellogic (NASDAQ:SATL) wherein I stated that I preferred the know-how however that I used to be involved concerning the financials in addition to operational dangers.

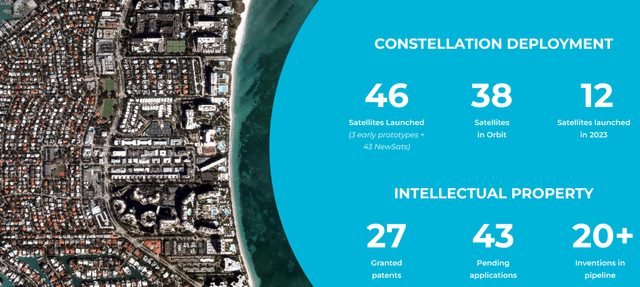

Properly, Satellogic at present has simply 38 satellites in orbit and plans to launch one other 10 by the tip of 2023. Again in 2021, the corporate was anticipating to have a complete of 111 satellites by the tip of this 12 months. As well as, plainly demand is nowhere close to Satellogic’s expectations as 2022 revenues got here in at solely $6.01 million. For my part, the corporate might run out of money within the coming months which is more likely to result in important inventory dilution and my ranking on the inventory is a powerful promote. Let’s assessment.

Overview of the enterprise and financials

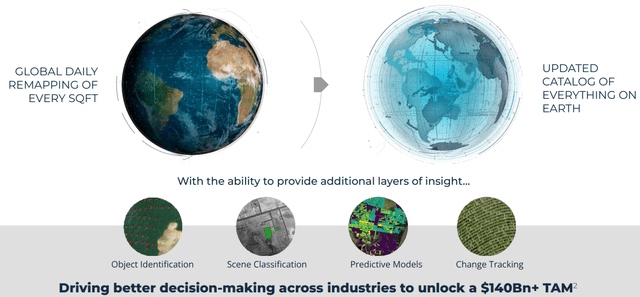

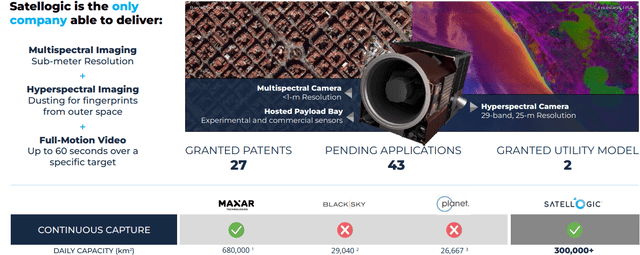

In case you are not conversant in Satellogic or my earlier protection, here is a brief description of the enterprise. The corporate was established in 2010 with the concept of taking on the satellite tv for pc imagery sector by utilizing small satellites costing lower than $1 million every and a patented digital camera design to seize round 10 instances extra knowledge than another small Earth Remark satellite tv for pc. Its aim is to construct the primary scalable, absolutely automated Earth Remark platform on this planet and remap the whole floor of the planet every day in sub-meter decision. So as to obtain this, the corporate would want a full constellation of about 200 satellites. In accordance with Satellogic, the full addressable market (TAM) is price over $140 billion.

Satellogic Satellogic

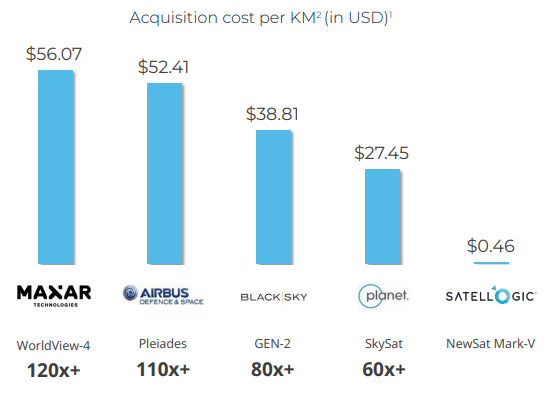

In accordance with the corporate’s newest company presentation, its acquisition price per sq. kilometer is simply $0.46, which is much beneath its opponents. As well as, the decision of its pictures seems superior in comparison with a lot of its friends.

Satellogic Satellogic Satellogic

That being stated, I’m involved that the acquisition price per sq. kilometer within the company presentation is totally the identical as two years in the past. Not only for Satellogic, however for its opponents as effectively. As well as, whereas the corporate at present has the biggest industrial fleet of sub-meter decision satellites on this planet, progress on launches has been gradual and the Satellogic is nowhere close to reaching 200 satellites in orbit. It completed 2022 with simply 26, with plans to launch one other 22 in 2023. In accordance with the newest company presentation, the corporate has a complete of 38 satellites in orbit.

Satellogic

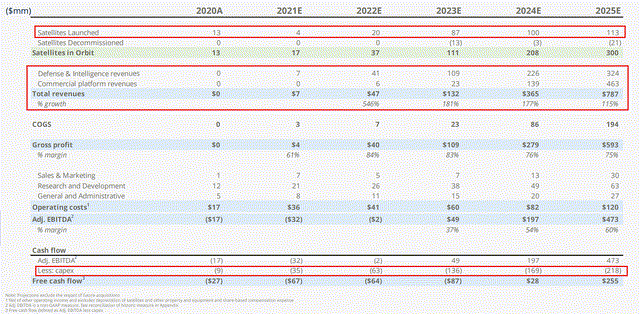

Again in 2021 when Satellogic was getting listed on NASDAQ by means of a SPAC named CF Acquisition Corp, the forecasts had been for 37 satellites in orbit by 2022 and 111 by 2023. One other regarding piece of knowledge right here is that Satellogic’s satellites have a design lifetime of 3-4 years and a complete of 13 of them had been anticipated to be decommissioned in 2023 alone. In view of this, the variety of satellites in orbit might drop to simply 35 by the tip of the 12 months (if 10 satellites are launched and 13 are decommissioned). Trying on the monetary forecasts for the enterprise, Satellogic was anticipating to develop quickly again in 2021, with revenues of $787 million and EBITDA of $473 million by 2025.

Satellogic

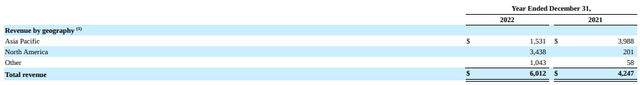

Properly, plainly demand for Satellogic’s companies is considerably decrease than anticipated as revenues got here in at simply $4.25 million in 2022 and $6.01 million in 2023. As well as, a complete of $3.4 million of the 2022 income got here from a single buyer (see web page 48 right here). The corporate at present will get its revenues primarily from promoting imagery by means of its asset monitoring and constellation-as-a-service ((CaaS)) traces of enterprise.

Satellogic

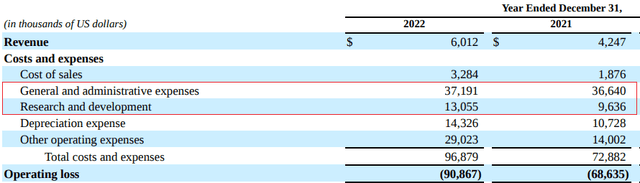

Whereas revenues for 2023 are anticipated to come back in at between $30 million and $50 million, that is nonetheless far beneath the forecasts from two years in the past and EBITDA breakeven is forecast for 2024. Contemplating that analysis and growth, and basic and administrative bills alone had been above $50 million in 2022, I count on Satellogic to be deep within the pink this 12 months.

Satellogic

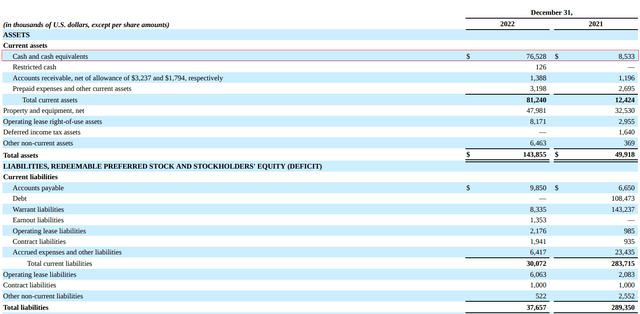

Turning our consideration to the steadiness sheet, I’m involved that the corporate might run out of money quickly, which might result in important inventory dilution. You see, money and money equivalents stood at $76.5 million as of December 2022, reducing by about $47.5 million within the second a part of the 12 months alone. The web money flows utilized in working actions in 2022 stood at $68.5 million and I count on them to extend considerably in 2023 as a result of launch of over 20 satellites in addition to the decommissioning of a number of extra.

Satellogic

So, how do you play this? Properly, I believe that the most effective plan of action might be to keep away from this inventory as short-selling appears harmful. In accordance with knowledge from Fintel, the brief borrow charge charge stands at 83.9% as of the time of writing. As well as, it takes over 2.5 days to cowl and the bottom out there strike value out there for name choices is $2.50.

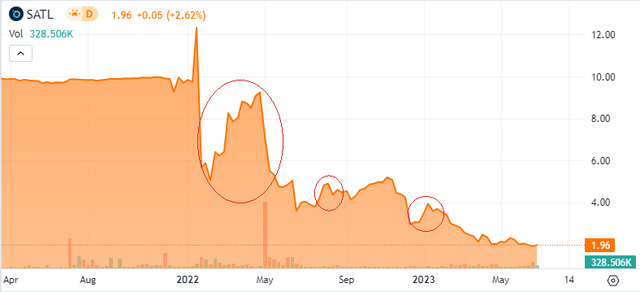

Trying on the dangers for the bear case, I believe that the main one is that the share costs of microcaps can soar with none information or catalysts, which might result in important losses for brief sellers. Satellogic itself is an effective instance of this, as its share value elevated considerably throughout February-April 2022, July-August 2022, and December-January 2023. It is a comparatively thinly traded inventory, with a every day buying and selling quantity hardly ever exceeding 30,000 shares.

In search of Alpha

Investor takeaway

Satellogic is among the many main suppliers of high-resolution satellite tv for pc imagery options on this planet at present, however its satellite tv for pc launches have been gradual which limits the capabilities of its community and revenues are far beneath expectations. With a number of of the corporate’s satellites nearing the tip of their design life, I’m involved that the variety of satellites in orbit might lower by the tip of 2023. As well as, Satellogic could be deep within the pink even when revenues for the 12 months reached $50 million and I count on money to expire within the coming months. That being stated, short-selling appears harmful because the brief borrow charge charge is over 80% and the inventory has a historical past of great share value volatility. For my part, it might be finest for risk-averse buyers to keep away from this inventory.