HJBC

Amazon.com, Inc. (NASDAQ:AMZN) is ready to report outcomes for its Q2 that ended June thirtieth, 2023 after hours on Thursday, July twenty seventh. Whereas it might appear just a little early to preview greater than three weeks out, I do not anticipate most of these things on this article to vary materially with earnings on faucet. As well as, an early evaluation might assist the readers put together their sport plan early, because the earnings deluge will quickly take us all by storm.

Earlier than we get into Q2 preview, a fast recap on my most up-to-date Amazon protection. After Amazon’s Q1 earnings report, I wrote that the report was pretty good and the inventory was probably punished attributable to administration’s tone on the convention name than for precise outcomes. Since then, the inventory has gone up almost 25%, outperforming the S&P 500 by an element of 4. I imagine the inventory continues to be a purchase regardless of this run up, as I imagine Amazon continues to be adjusting to its pandemic excesses and can come out a lot stronger than earlier than.

Now, let’s preview Q2 with none additional ado.

Steadily Growing Expectations

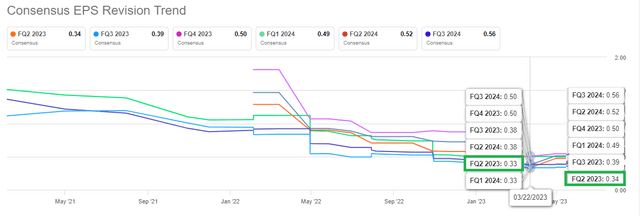

Amazon is predicted to report earnings per share of 34 cents when it experiences its Q2, which might characterize a powerful turnaround from the -20 cents the corporate reported in the identical quarter in 2022. Income is predicted to come back in at $131 billion, ~8% greater in comparison with the $121.23 billion in the identical quarter in 2022.

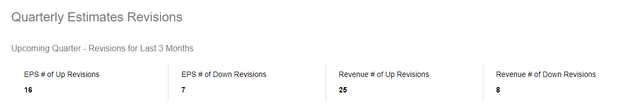

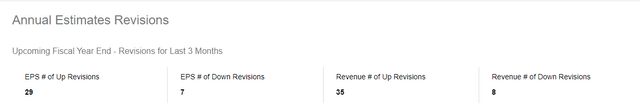

One other option to verify growing expectations is by estimates revision during the last 3 months. Each the upcoming quarter’s estimates and the present fiscal yr’s estimates have gone up. Amazon has all the time been a income story and it’s not stunning that upward revisions on income outnumber EPS revisions (each as proportion and uncooked numbers), each on quarterly and annual foundation.

In brief, expectations are on the rise as we await Q2 outcomes.

AMZN Qtly Revisions (Seekingalpha.com)

AMZN Annual Revisions (Seekingalpha.com)

EPS Development (Seekingalpha.com)

Beat or Miss? It is a Coin Toss

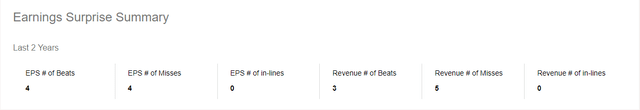

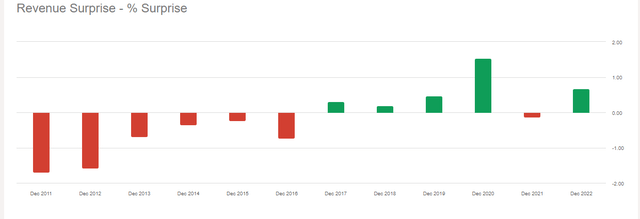

Will Amazon beat or miss? It is a coin toss, virtually actually primarily based on current historical past. EPS missed by enormous margins twice whereas the beats have been spectacular as properly. Income has all the time been the extra constant story with Amazon and I anticipate extra of the identical when the corporate experiences its Q2. The market is prone to be paying extra consideration to income steerage than revenue, given the corporate’s inclination to make use of proceeds from worthwhile segments to search out the following progress avenue.

Going again just a little additional, within the final 8 quarters, Amazon has a 50% file on EPS beat and only a 37.50% on income beat. In brief, it’s a idiot’s errand to foretell what Amazon’s EPS goes to be, given their inclination to take a position as they please. I anticipate income to come back in between $131 billion (assembly expectations) and $132.5 billion (1.50% beat).

AMZN EPS Historical past (Seekingalpha.com)

Income Shock (Seekingalpha.com)

AWS with an AI Twist and Promoting

A slowdown in Cloud computing was anticipated in 2023 however I do not imagine Amazon buyers have been ready to see AWS changing into the trade laggard, as was the case in Q1 2023. Q2 AWS income and extra importantly, Q3’s AWS income steerage might be key components that decide the inventory’s value motion post-earnings. With AWS income rumored to cross $100 billion in 2023, a robust Q2 from AWS (say $25 billion) will go a good distance in organising the remainder of the yr. Nevertheless, that may characterize a progress of almost 27% from the $19.7 billion that AWS recorded in Q2 2022. I do not imagine Amazon will be capable of report one thing that spectacular and undertaking a low to mid teen progress proportion. In different phrases, I anticipate AWS income to come back in between $22.30 billion and $23 billion.

Given the expansion issues in AWS by and of itself, Amazon already has its technique in place for income era. As CEO Andy Jassy defined, there are three layers of help to reinforce income by offering (1) compute assets, (2) coaching capabilities, and (3) purposes for generative AI and enormous language fashions (“LLM”). In my evaluation of Q1 outcomes, I famous that Amazon’s tone within the convention name didn’t encourage a lot confidence and was one of many causes I believed the inventory bought hammered regardless of respectable numbers. This time round, I will not be stunned to see Amazon discuss additional concerning the hottest matter on the town, AI, and its plans on leveraging its present ecosystem to help AI purposes.

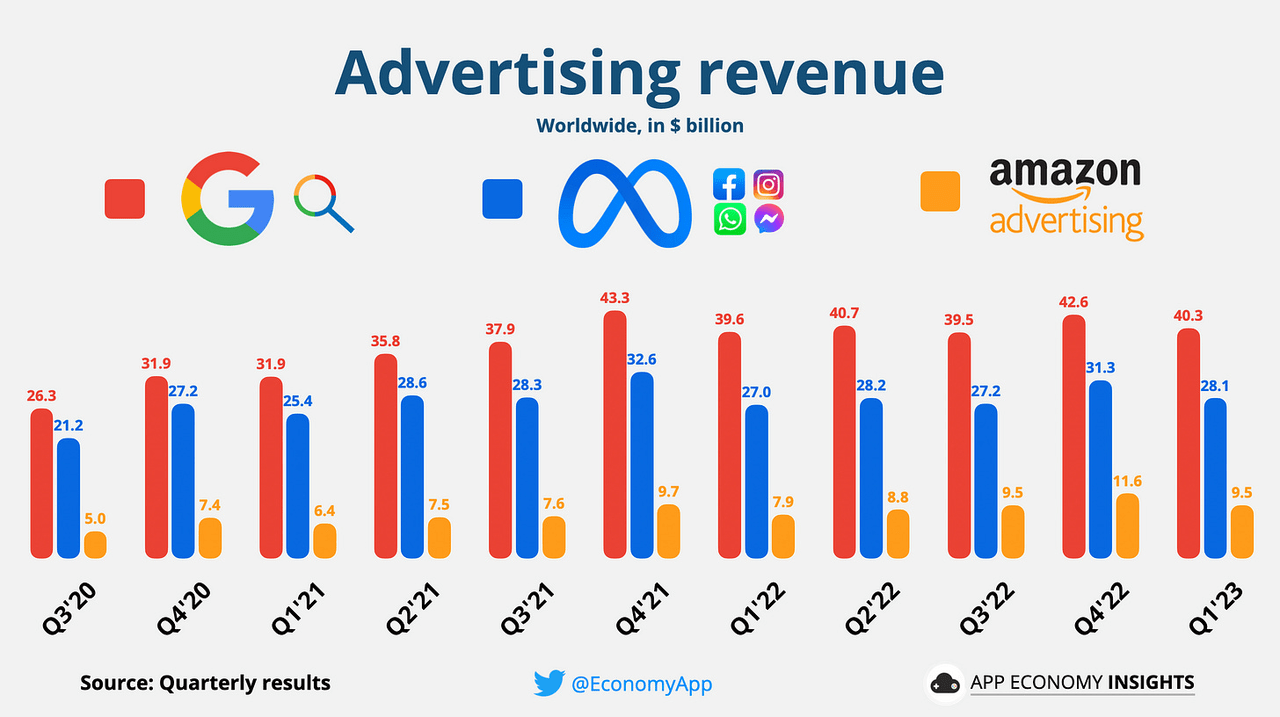

Promoting’s significance to Amazon has been steadily growing over the previous couple of years with the section contributing almost 7.50% to the general combine in 2022 at $38 billion. To place this into context, Amazon’s promoting income of $9.5 billion in Q1 2023 already represents 25% of Google’s and greater than a 3rd of Meta Platforms, Inc.’s (META). Relationship again to Q3 2020, the bottom progress fee this section has proven on a YoY foundation was 17% with the common being almost 27%. This section is rising on the proper time for Amazon given the slowdown in AWS and I predict Amazon’s promoting income to cross $10 billion just for the second time ever (on quarterly foundation) when the corporate experiences its Q2 outcomes.

AMZN Advert Income (appeconomyinsights.com)

Low-cost and Expensive

I recall authors and readers alike quarrelling within the feedback part on In search of Alpha over 10 years in the past as as to if Amazon’s inventory was low cost or expensive. Greater than a decade later, this debate continues to be not settled, though bulls are the extra comfortable campers. Even now, the inventory is each low cost and expensive on the similar time. Let’s have a look.

At about 2.50 occasions 2022’s income, Amazon is way cheaper than different mega-caps on price-to-sales ratio. Apple, Inc. (AAPL), for instance, is buying and selling at almost 8 occasions 2022’s income. Alphabet Inc. (GOOG) is buying and selling at 5.40 occasions 2022’s income and so forth. Clearly, the catch right here is that Amazon’s low-margin retail enterprise makes up almost 50% of its income, denting its revenue margin. Talking of revenue, Amazon continues to be working with the mindset of an organization in progress spurt because it funnels income from one section to fund the following income driver. Because of this, Amazon’s EPS has all the time been and can probably be beneath strain (in comparison with its income). Regardless of that, a ahead a number of 83 is just too expensive for a trillion-dollar behemoth. However investing is all concerning the future. So, Amazon’s anticipated earnings progress fee of 72%/yr offers it a Worth-Earnings/Progress (“PEG”) of 1.15 even with the ridiculous sounding ahead a number of of 83. Again to the expensive aspect, the inventory is already up 50% YTD and has reached one other 52-week excessive. How a lot room does it have up right here even when it delivers on the growing expectations? Okay, you get the gist. Amazon’s inventory stays a valuation conundrum as we gear up for Q2’s outcomes.

Technical Energy

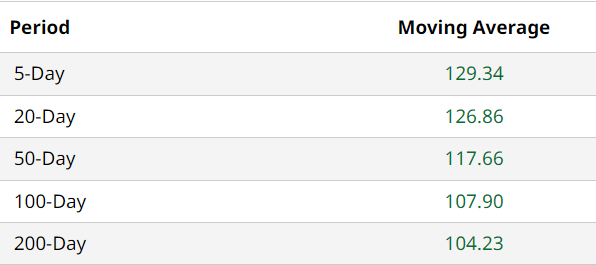

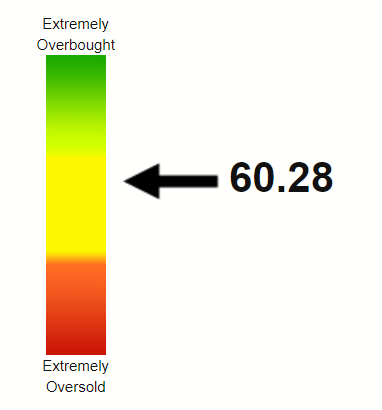

Amazon’s inventory is displaying some strong technical energy heading into the earnings. The inventory’s shifting averages are progressively higher as proven beneath, indicating rising accumulation and energy. Regardless of this energy, the inventory’s Relative Energy Index (“RSI”) is at 60, which supplies the inventory loads of room to maintain ticking greater earlier than it will get overextended technically.

AMZN Shifting Avgs (Barchart.com)

AMZN RSI (Stockrsi.com)

Conclusion

With inflation cooling down and the Federal Reserve displaying indicators of relenting as properly, the market has been on a tear with progress names main the race. As soon as once more, for example, Amazon’s inventory is up almost 25% since I reviewed its Q1 earnings and has outperformed the market by an element of 4. I do not anticipate Q2 to herald such outperformance given the inventory’s run up already however a robust income steerage, particularly on AWS entrance is probably going all that’s wanted from the corporate to offer the inventory one other ahead jolt. I can even be eager on the promoting income to see if its significance to the general combine retains growing. My robust perception in Amazon’s robust ecosystem makes me snug sufficient to carry the inventory by robust occasions and add on weaknesses.

What do you consider Amazon’s upcoming outcomes? Please go away your feedback beneath.