Ralf Hahn

Gladstone Capital (NASDAQ:GLAD) not too long ago raised its month-to-month dividend by 6.7%, from $0.075 to a brand new 10-year excessive of $0.08. In consequence, the inventory is now providing a ahead dividend yield of 9.8% with a payout ratio of 94%. When such a excessive yield is mixed with such a excessive payout ratio, it often indicators {that a} dividend minimize is simply across the nook. Nevertheless, this isn’t the case for Gladstone Capital, which is prospering within the present surroundings of multi-year excessive rates of interest. Even when enterprise situations deteriorate within the upcoming years, the corporate could minimize its dividend however it would in all probability nonetheless offer an above common dividend yield.

Enterprise overview

Gladstone Capital is a enterprise improvement firm [BDC] that invests primarily in small and medium companies, which can not borrow funds by way of the standard banking channels. The corporate has a historical past of about 20 years and invests both in fairness securities or debt securities. The previous comprise roughly 9% of the funding portfolio of Gladstone Capital whereas the latter comprise the remaining 91%.

As a enterprise improvement firm, Gladstone Capital distributes a minimum of 90% of its earnings to its shareholders within the type of dividends. In consequence, the corporate is left with a minimal amount of money to put money into the expansion of its funding portfolio and therefore it has to both borrow funds or challenge new shares to fund its new investments.

It’s thus not stunning that the corporate has exhibited an uninspiring efficiency file over the past 9 years. Throughout this era, Gladstone Capital has grown its internet funding revenue per share by solely 0.8% per yr on common, from $0.88 in 2013 to $0.94 in 2022.

One other drawback of most BDCs is their vulnerability to recessions. A lot of the firms during which BDCs make investments are susceptible to financial downturns and therefore they might be unable to maintain servicing their debt throughout tough financial durations. They’ll thus have an adversarial impact on the money flows of Gladstone Capital.

Nonetheless, Gladstone Capital proved remarkably resilient to the recession brought on by the Coronavirus disaster in 2020. The corporate posted only a 4% lower in its internet funding revenue per share and slashed its annualized dividend by solely 7%, from $0.84 to $0.78. That is a powerful efficiency for a corporation that invests in high-yield debt securities associated to firms that can’t borrow funds by way of the traditional banking channels. The resilience of Gladstone Capital to the pandemic is a testomony to the disciplined strategy of its administration, which invests in growth-oriented companies with promising fundamentals. Administration applies a extremely selective screening course of, beneath which fewer than 5% of the offers reviewed materialize.

Alternatively, traders shouldn’t conclude that Gladstone Capital is proof against recessions. Within the Nice Recession, which was the worst monetary disaster of the final 90 years, the corporate minimize its month-to-month dividend by 50%, from $0.14 in 2007 to $0.07 in 2008, and its inventory value quickly plunged 80%, from $25 to $5. Whereas the inventory has doubled off its backside in 2009, it’s nonetheless 60% decrease than its all-time excessive, which was posted simply earlier than the onset of the Nice Recession. Subsequently, the inventory is appropriate just for the traders who’re assured {that a} brutal recession, just like the one in 2009, is not going to present up within the upcoming years.

On the brilliant aspect, Gladstone Capital is having fun with optimistic enterprise momentum due to the 15-year excessive rates of interest prevailing proper now, as 91% of the funding portfolio of the corporate advantages from floating charges. This can be a key attribute of the funding portfolio of the corporate. Within the second quarter of its fiscal yr, Gladstone Capital posted an enchancment within the common yield of its funding portfolio, from 12.3% within the prior yr’s quarter to 13.1%. In consequence, the rise in internet funding revenue outpaced the rise in borrowing prices and thus internet funding revenue per share grew 10%, from $0.24 to $0.263.

Even higher, within the newest convention name, administration said that it has recognized many new investing alternatives amongst decrease center market firms and thus it expects to broaden the funding portfolio of the corporate additional within the upcoming quarters. Analysts agree on the sustained enterprise momentum of Gladstone Capital, as they count on the BDC to develop its internet funding revenue per share 13% this yr, from $0.94 to $1.06.

Dividend

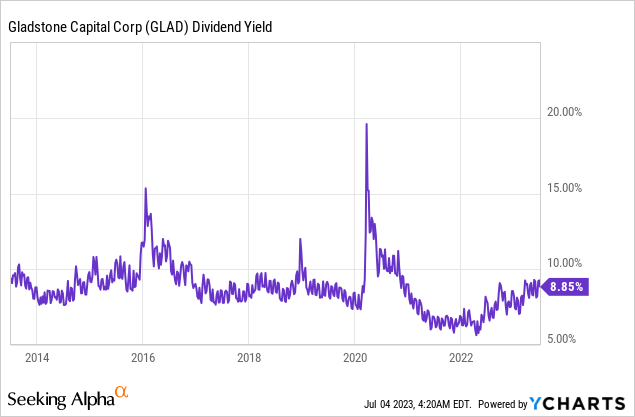

Because of its optimistic enterprise momentum, Gladstone Capital not too long ago raised its month-to-month dividend by 6.7%, from $0.075 to $0.08. The brand new dividend corresponds to a ahead annualized yield of 9.8%. Whereas this yield is typical for this BDC, it’s enticing for income-oriented traders.

On the one hand, the corporate has a payout ratio of 94% and therefore its dividend is just not protected. Alternatively, Gladstone Capital has a stable curiosity protection ratio of two.8 and a wholesome leverage ratio (Web Debt to EBITDA) of barely lower than 3.5. It additionally proved resilient all through the coronavirus disaster, which bodes effectively for the protection of the dividend.

It is usually necessary to notice that Gladstone Capital has maintained an annual dividend of a minimum of $0.78 each single yr all through its 21-year historical past. As this era contains the Nice Recession and the pandemic, it’s protected to imagine that the corporate is just not more likely to cut back its dividend under its historic low of $0.78. This quantity corresponds to a dividend yield of seven.9%. In different phrases, even within the adversarial state of affairs of a dividend minimize, the inventory will in all probability offer a dividend yield of a minimum of 7.9%. Subsequently, the inventory is enticing for income-oriented traders.

Threat

Similar to all BDCs, the first danger issue of Gladstone Capital is the monetary form of the businesses it invests in. Within the occasion of a protracted recession, some firms could show unable to maintain servicing their debt and thus Gladstone Capital could incur a big lower in its money flows. That is what occurred within the Nice Recession, although the corporate proved resilient to the coronavirus disaster. Total, Gladstone Capital is more likely to show resilient to a typical recession however it might incur irreversible losses throughout a dramatic recession. Solely the traders who’re assured {that a} extreme recession is not going to present up within the upcoming years ought to think about buying this inventory.

Closing ideas

Most traders dismiss BDCs as a consequence of their elevated inherent danger. Nevertheless, Gladstone Capital has disciplined administration and a considerably conservative enterprise mannequin, which depends on a strict screening course of. Even when Gladstone Capital reduces its dividend to a historic low stage, it would nonetheless offer a 7.9% dividend yield. It’s thus appropriate for many income-oriented traders.