Nilang Kachare/iStock through Getty Photos

The one true knowledge is in realizing you understand nothing

– Socrates

On the fiftieth anniversary of the 1929 market crash, funding supervisor Robert Kirby printed an essay describing how every technology fails to be taught the teachings of the previous.[1] Evaluating the late Twenties with the institutionally dominated funding markets of his day in 1979, Kirby found that there have been extra similarities than variations between the 2 intervals. He famous that the 1920’s was characterised primarily by reckless hypothesis, and fifty years later, Kirby argued that establishments merely gave the impression to be “investing” via their intensive use of pricy analysis and computer systems. Within the late Twenties, most funding managers would have overtly laughed if somebody recommended they go to with firm administration earlier than shopping for or promoting its inventory. Kirby claimed the candid response would have been, “What does the corporate should do with whether or not or not the inventory goes up?”

Kirby noticed that the majority 1979 funding establishments possessed spectacular options, together with an in depth employees of analysts backed by economists, demographers, and different specialists. This was sometimes a sham, as though these establishments had the horsepower and experience wanted to operate as true “traders,” their habits resembled the manic dealer who shunned basic analysis. Kirby believed that lots of the day’s selections have been primarily based extra on a technician’s secret interpretation of a worth chart than on a cautious analysis of an organization’s future working efficiency.

Monetary markets should not proof against fads and developments. The inventory market of the early Nineteen Seventies was no exception, regardless of the hazard indicators seen to any prudent investor. In November 1967, Warren Buffett started to mood the expectations of his funding companions within the Buffett Partnership Ltd. He highlighted that the partnership of $20 million invested in “managed firms” (i.e., unlisted subsidiaries) and $16 million in short-term authorities debt wouldn’t profit from any potential inventory market rally. This determination was primarily a mirrored image of Buffett’s incapability to “discover any clearly worthwhile and protected locations to place the cash.” By Could 1969, Buffett referred to as it quits and wrote to advise his companions that he was closing the partnership: “I simply don’t see something accessible that provides any affordable hope of delivering 12 months, and I’ve no need to grope round, hoping to “get fortunate” with different individuals’s cash. I’m not attuned to this market surroundings, and I don’t wish to spoil an honest file by attempting to play a recreation I don’t perceive so I can exit a hero.”

Whereas Warren Buffett was within the technique of exiting the inventory market, different market individuals pursued a bunch of shares that will later be generally known as the ‘Nifty Fifty’. These glamour shares included IBM, Gillette, Coca-Cola (KO), and Xerox (XRX). This subset of shares promised stability; none of those firms had lower their dividends since World Warfare II. Coupled with their distinctive development prospects, together with worldwide enlargement, traders justified paying any valuation a number of for these shares. The ‘Nifty Fifty’ gained a repute as ‘one determination’ shares: the one determination revolved round how a lot to purchase, assured that these shares would defy any weak point within the world financial system. By 1972, the S&P 500 index (SP500) was buying and selling at a wealthy a number of of 19 instances annual earnings. In distinction, the ‘Nifty Fifty’ traded at a mean a number of of forty-two instances annual earnings. A number of firms with the ‘Nifty Fifty’ reached absurdly optimistic ranges. Avon Merchandise traded at sixty-five instances earnings, Walt Disney (DIS) at eighty-two instances earnings, McDonald’s (MCD) reached a a number of of eighty-six instances earnings, whereas Polaroid ultimately achieved a price-earnings a number of of ninety-one.

The music abruptly stopped on January 11, 1973. Within the phrases of a Forbes columnist, firms throughout the Nifty Fifty “have been taken out and shot, one after the other.” Following their respective inventory worth peaks, Xerox inventory fell by 71%, Avon Merchandise fell by 86%, and Polaroid’s worth collapsed by 91%. A autopsy evaluation by Forbes summarized the devastation: “What held the Nifty Fifty up? The identical factor that held up tulip-bulb costs in long-ago Holland – in style delusions and the insanity of crowds. The delusion was that these firms have been so good it didn’t matter what you paid for them; their inexorable development would bail you out. Clearly, the issue was not with the businesses however with the short-term madness of institutional cash managers – proving once more that stupidity well-packaged can sound like knowledge. It was really easy to neglect that no sizable firm may probably be value over fifty instances regular earnings.”

If one participates lengthy sufficient within the funding markets, they understand human nature by no means modifications. Just like the ‘Nifty Fifty,’ a couple of immensely in style world know-how mega-cap shares have captivated the eye of at this time’s market individuals. Final decade’s monetary repression drove rates of interest to zero, successfully destroying the enchantment of money and bonds as related asset courses for a lot of traders. Of their seek for constructive actual returns, traders have been enticed by the attract of the fairness markets. Each establishments and particular person traders view this restricted group of huge know-how shares because the most secure, most dominant, and rational option to personal in at this time’s unsure surroundings. Whereas these companies might show enduring, the security of an funding is finally a operate of worth and worth. A inventory represents a declare to a future money circulate that an investor expects to obtain. The long-term returns an investor expects from these money flows are inseparable from the value paid.

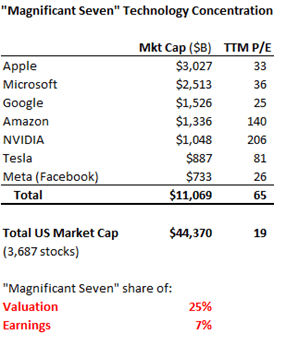

Final 12 months’s delicate inventory market pullback reversed in October, as market individuals corresponding to retail traders, exchange-traded funds, establishments, and hedge funds piled again into the shares of Apple (AAPL), Microsoft (MSFT), Google (GOOG,GOOGL) , Amazon (AMZN), Nvidia (NVDA), [[Meta]], and Tesla (TSLA). These shares have been deemed essentially the most liquid and thought of “low cost” sufficient to personal in dimension. This 12 months, Synthetic Intelligence (AI) is the brand new pixie mud, additional engaging individuals deeper into market darlings. Presently, each Wall Road analyst makes the case that these know-how giants will disproportionately profit from the AI increase. The extreme hype surrounding AI to justify ahead earnings estimates and present valuations could seem absurd however is just not surprising—it follows the identical sample each cycle. Or, as Kurt Vonnegut as soon as wrote, “Historical past is merely a listing of surprises. It may solely put together us to be stunned but once more.”

Bloomberg Knowledge; July 3, 2023

Apple and Microsoft collectively possess a market worth exceeding $5.5 trillion. If one contains Nvidia, with a market worth of simply over $1 trillion, the cumulative value of those three firms practically matches all the economies of France ($2.8 trillion) and Germany ($4.1 trillion). This comparability highlights the extraordinary valuation, rivaling two of the world’s largest industrial economies. Additional, this sum ignores Google ($1.5 trillion) and Amazon ($1.3 trillion). Apple, Amazon, Microsoft, Google, and Nvidia have largely pushed the proportion beneficial properties within the US inventory market this 12 months. Actually, Apple and Microsoft now account for nearly 15% of the market capitalization of the S&P 500 index, the biggest share complete for any two firms since 1980 (IBM and AT&T).

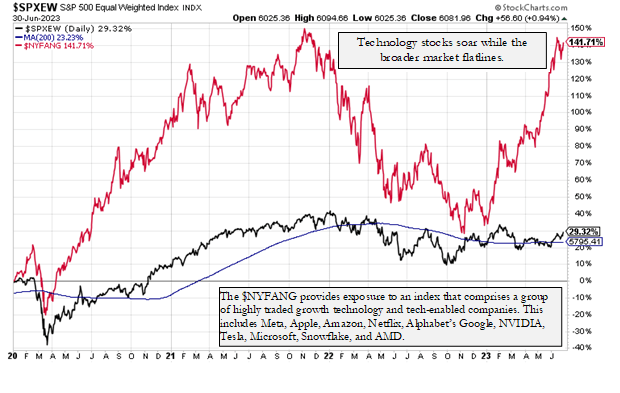

If the S&P 500 was weighted equally, moderately than by market capitalization, its efficiency over the past three years seems anemic. The equal weight index supplies a greater understanding of the breadth of the market and the financial system. After all, not all shares are equal, as some maintain higher significance than others. Some companies are poised to learn and develop extra because of the ongoing AI revolution. One may argue that the aforementioned 5 firms present substantial publicity to AI, doubtlessly unleashing a wave of artistic destruction. Nonetheless, warning is warranted when 25% of all the U.S. inventory market capitalization is concentrated in simply seven know-how firms, buying and selling at materially totally different earnings a number of of the remaining 3,687 companies

The AI ‘bell cow’ main the brand new funding narrative is Nvidia, at present priced at a stage the place its free money circulate yields solely 0.45% for its shareowners; by comparability, riskless U.S. Treasury Payments now yield 5.3%. Sadly, 70% of Nvidia’s meager money yield of 0.45% is additional eroded by stock-based compensation (SBC) for its staff and administration. The corporate’s inventory compensation plan consumes $2.8 billion of the corporate’s $28 billion annual income however shares excellent haven’t decreased. Nvidia’s market capitalization is 37% higher than Berkshire Hathaway (BRK.A, BRK.B). Nonetheless, when evaluating fundamentals, Berkshire Hathaway generated $23 billion in free money circulate over the previous 4 quarters whereas Nvidia generated solely $2.6 billion (SBC adjusted). Moreover, Berkshire Hathaway doesn’t dilute shareholders with stock-based compensation. Regardless of a big selection of accessible funding choices, market individuals have overwhelmingly favored a choose few dominant know-how firms.

At its present worth of $423, Nvidia is valued at forty instances its annual income. If one heroically assumes that the corporate manages to compound income by 50% per 12 months for 3 years, it’s going to “solely” commerce at a a number of of twelve instances hypothetical gross sales in 2026…hardly a screaming cut price. After all, market historical past has an fascinating manner of repeating itself. Essentially the most exaggerated know-how bubble occurred in 1928-29 when the Radio Company of America (RCA) captured the creativeness of each speculator on Wall Road. RCA’s buying and selling quantity typically accounted for 20% of the overall quantity on the New York Inventory Trade. On the inventory worth peak in September 1929, the corporate was “valued” at $665 million. Gross sales elevated from $65 million in 1927 to $102 million in 1928 to $182 million in 1929. Subsequently, on the peak of the RCA inventory shopping for frenzy, the corporate was “valued” at a a number of of “solely” 3.6 income. Forty-five years later, in 1974, RCA’s annual gross sales have been $4.6 billion, but the inventory worth bottomed that 12 months at $38, about one-third of its 1929 inventory worth excessive.[2]

Whereas most rational traders contemplate Nvidia ‘barely’ overvalued, market momentum may push fantasy valuations larger. Evaluating the 1929 interval of RCA and the present state of affairs with Nvidia in 2023, one observes the same sample the place most shares expertise decline whereas a handful of huge firms powered the most important indices larger. In each cases, unsuspecting traders maintained the phantasm that the “market” was wholesome.

In 1929, the monetary press reported that the “huge trusts” have been primarily shopping for “blue chips,” liquid and “protected” elements of the Dow Jones Industrial Common. These institutional trusts understood that the financial system stood on shaky floor, however the music performed, and so they had no selection however to proceed dancing. An analogous phenomenon is happening at this time, with establishments concentrating on a choose group of know-how firms that supply each liquidity and dimension appropriate to accommodate their buying and selling methods. Because of this, the inventory market indices push larger whereas the broader market stagnates. Notably, throughout each intervals, the U.S. Federal Reserve Financial institution was elevating rates of interest because the financial system slid into some type of contraction. The one factor extra painful than studying from expertise is failing to be taught from expertise.

Many traders maintain the assumption that final 12 months’s market expertise was a “worst-case situation”. Nonetheless, it’s doable that 2022 is merely the start of a a lot bigger course of geared toward addressing essentially the most vital bubble in historical past. The character of the inventory market lately has been characterised by a speculative fervor as excessive as earlier asset bubbles. Such a manic inventory market surroundings, which gave beginning to meme shares and over 23,000 totally different cryptocurrencies, doesn’t fade away with out leaving echoes. As bubbles deflate, one can count on the resurgence of speculative habits.

Within the second quarter, the rekindling of animal spirits amongst lively merchants attracts in a large number of passive traders. This contains people commonly buying index funds for his or her retirement accounts, which additional channels extra funds to essentially the most overvalued shares pushed by speculative actions. Moreover, volatility-targeting funds like threat parity methods are compelled to place large quantities of cash to work within the inventory market because of the success of individuals in pushing costs larger. By using excessive leverage via short-dated choices, systematic fund flows create highly effective types of market misdirection that don’t have anything to do with firm fundamentals.

From a price investor’s perspective, the misbehavior of the inventory market might merely be that markets have behaved irrationally for thus lengthy, with the total endorsement of U.S. Federal Reserve coverage, that the majority are reluctant to simply accept rational expectations. As regarding as which may be, one can take some consolation in Warren Buffett’s assertation that one ought to by no means wager towards America. America stays the world’s richest, most efficient, and most revolutionary financial system. America enjoys a number of advantages over different main economies: outstanding ranges of training, higher demographics, the rule of regulation, a extra versatile financial system than Europe, and a more healthy and fairer financial and political system than China. If one invested $100 within the S&P 500 in 1990, it might be value $2,000 at this time, 4 instances what would have been earned elsewhere within the developed world.

Nonetheless, this statistic fails to account for the large development of debt and the regular fall within the greenback worth, by which the S&P 500 is denominated, over the previous three a long time. These components have vastly inflated valuations, elevating doubts concerning the chance of comparable future beneficial properties. If the S&P 500 have been to repeat this efficiency, it might commerce at 80,000 in 2052. Reaching such a milestone would necessitate additional vital inflation and forex debasement. During the last three a long time, America’s development got here not from superior financial administration or coverage however from an explosion of private and non-private sector debt and authorities spending. This isn’t success, however moderately an phantasm of prosperity loved by a shrinking share of the American inhabitants.

The final century has been sort to America, and maybe the following hundred years will observe go well with. Nonetheless, present-day America now confronts the problem of inflation. To generate inflation-adjusted actual charges of return, rates of interest should transfer larger. Financially, it’s practically unattainable attributable to extreme quantities of debt in our nation’s financial system, making it troublesome to refinance at larger rates of interest. Economically, too many firms rely on low-interest charges to help their present enterprise mannequin. Moreover, the U.S. authorities’s curiosity expense is now $929 billion yearly, quickly to exceed one trillion {dollars} or equal to the nation’s complete protection price range. Over the previous decade, U.S. authorities debt grew from $15 trillion to $32.4 trillion, a stage solely akin to that after WWII.[3]

In opposition to this incongruous backdrop it’s exceptional to contemplate the year-to-date performances of among the magnificent seven know-how shares: Apple is up 50%, Amazon is up 55%, Fb is up 138%, and Nvidia is up 190%. One can not assist however sense the distant echoes of March 2000, when the Nasdaq Composite peaked at over 5,000. After plunging by 80% over the following two years, the Nasdaq Composite took fifteen years to regain that 5,000 stage. It is a typical market sample when one grossly overpays for an asset, even a high-quality firm like Apple—overpaying at this time pulls ahead future funding returns. The online result’s that first, one loses cash, after which one loses time.

When Warren Buffett wrote to companions of the Buffett Partnership in 1967, he warned “The market surroundings has modified progressively, leading to a pointy diminution within the variety of apparent quantitatively primarily based funding bargains accessible. We is not going to observe the continuously prevalent method of investing in securities the place an try to anticipate market motion overrides enterprise valuations. Such so-called ‘vogue’ investing has continuously produced substantial and fast income lately. It doesn’t fully fulfill my mind and most positively doesn’t match my temperament. I cannot make investments my very own cash primarily based upon such an method – therefore, I’ll most definitely not accomplish that along with your cash.” Fifty-five years later, one wonders how this message is perhaps obtained at this time.

Investor and historian Jeremy Grantham famous that the central reality of the funding enterprise is habits is pushed by profession threat.[4] Grantham cited English economist John Maynard Keynes, who emphasised the prime directive is first and final to maintain your job. Keynes defined that one must not ever, ever be incorrect on their very own. To stop this calamity, skilled traders pay ruthless consideration to what different traders are doing and “glide.” The result’s herding, or momentum, which drives costs far above or far beneath truthful worth. Value momentum explains the discrepancy between a remarkably unstable inventory market and relative steady financial development. Lacking a big transfer within the inventory market, nevertheless unjustified it could be by fundamentals, is to take an infinite profession threat. Skilled herding will all the time dominate investing, and short-term worth actions will all the time be exaggerated.

Though a company’s future worth stretches a long time, or as GMO’s Ben Inker has written, two-thirds of all company worth lies past twenty years; markets typically focus solely on the following 4 quarters. Keynes wrote in Common Concept that the investor can be perceived as “eccentric, unconventional and rash within the eyes of common opinion … and if within the quick run, he’s unsuccessful, which could be very doubtless, he is not going to obtain a lot mercy.” Worth-oriented corporations which have the accountability of investing their shoppers’ long-term financial savings via basic evaluation can relate to Keynes’ remarks. Preserving funding capital from exterior components corresponding to inflation and taxation is already a difficult process, and it turns into extra advanced if recklessness and profession threat is concerned within the funding choice course of. When entrusted with the capital of others, it is important to not have interaction in an surroundings the place actions are pushed by expectations moderately than by what is actually proper.

At this time, the very best clarification for the surge in market costs is the widespread perception amongst traders that the U.S. Federal Reserve will start decreasing rates of interest later this 12 months. Whether or not this perception holds true or not is just not vital. What issues is the market firmly believes and has consequently acted, herding into the property perceived as essentially the most attentive to decrease rates of interest. Whereas market individuals are entitled to their opinions, anybody believing the general market in all fairness valued and can present enticing risk-adjusted returns over the long run should disregard a plethora of sobering details. Based mostly on any traditionally dependable valuation metric, the S&P 500 index is costlier than any stage in historical past earlier than October 2020, together with 1929 and 2000. Greater rates of interest will ultimately weigh on shares by suppressing financial exercise and subsequently pressuring firm income. The present technology-led rally can solely masks an underlying financial weak point for a restricted interval.

Returning to Robert Kirby’s perspective in 1979, he expressed a perception {that a} portfolio of marketable securities must be managed like an actual property portfolio. The everyday actual property dedication is made in anticipation of projected money flows versus bills; the investor develops an estimated future inner fee of return primarily based on the property’s predicted web money flows. To satisfy an anticipated funding return, the investor doesn’t should assume that he can promote the property at the next worth to another person later; moderately she or he adopts the mindset of a non-public proprietor of property. Kirby advocated {that a} portfolio of frequent shares must be constructed, and their future returns measured, by the identical set of standards. In instances of obvious prosperity, it’s essential to look at and scrutinize the underlying causes to determine whether or not present prosperity is real or merely an phantasm. Kirby’s recommendation supplies a priceless information within the present funding panorama saturated with the phantasm of prosperity.

With sort regards,

St. James Funding Firm

Footnotes

[1] Robert Kirby, “Classes Discovered and By no means Discovered,” The Journal of Portfolio Administration, June 1979, 52-55.

[2] Fleckenstein Capital, Could 31, 2022, www.fleckensteincapital.com.

[3] U.S. Nationwide Debt Clock : Actual Time

[4] Jeremy Grantham, “My Sister’s Pension Property and Company Issues,” GMO Quarterly Letter, April 2012.

© 2023 St. James Funding Firm

Click on to enlarge

Authentic Put up

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.