alberto clemares expósito

The Dry Bulker Funding Thesis Proves Compelling After The Deep Pullback

We beforehand lined Golden Ocean Group (NASDAQ:GOGL) in March 2023, highlighting the early hints of the dry bulker restoration, attributed to its promising FQ2’23 TCE charges.

Within the current earnings name, GOGL reiterated its glorious FQ2’23 Capesize TCE charges of $20.01K (+46.9% QoQ/ -19.3% YoY) and Panamax TCE charges of $14.6K (-12.2% QoQ/ -38.3% YoY).

FQ3’23 seems to be much more promising at $22.3K (+11.4% QoQ/ -27.2% YoY) and $19.6K (+34.2% QoQ/ -28.9% YoY), respectively. These numbers look stellar certainly, in comparison with the most recent spot charges of $15K and $12.5K by July 05, 2023, respectively.

Primarily based on the contracted charges, we may even see GOGL generate a mean TCE of $17.08K in FQ2’23 (+14.4% QoQ/ -41.9% YoY) and $20.68K in FQ3’23 (+21% QoQ/ -10.1% YoY), suggesting an enormous enchancment from pre-pandemic averages of $16.53K in 2019 and $12.37K in H1’19.

Whereas these numbers stay a distance away from 2021 averages of $27.58K and 2022 averages of $24.26K, we aren’t overly involved, as a result of potential enchancment within the dry bulker’s money circulation transferring ahead.

For instance, because of GOGL’s environment friendly money breakeven of $14.3K for Capesize, $10.5K for Panamax, and youthful common fleet age of 6.5 years, the dry bulker has guided an annualized $229M of Free Money Circulate era primarily based on a mean TCE fee of $20K.

Most notably, the dry bulker’s extra gasoline environment friendly fleets have been capable of command increased TCE charges of $14.92K in FQ1’23, compared to Eagle Bulk Delivery Inc. (NYSE:EGLE) at $12.91K and Genco Delivery (GNK) at $13.94K on the identical time.

GOGL’s quantity is sort of in keeping with Star Bulk Carriers’ (SBLK) TCE charges of $14.19K as properly, as a result of latter’s absolutely scrubber-fitted vessels and decrease gasoline pricing.

In the meantime, GOGL’s steadiness sheet stays greater than respectable, with money/ equivalents of $118.42M (-13.5% QoQ/ +10.3% YoY). Whereas it might report elevated debt and finance lease liabilities of $1.3B (+8.3% QoQ/ -7.1% YoY), these are largely attributed to its fleet renewal by new Castlemaxes and Kamsarmaxes, scheduled for deliveries by the following few quarters.

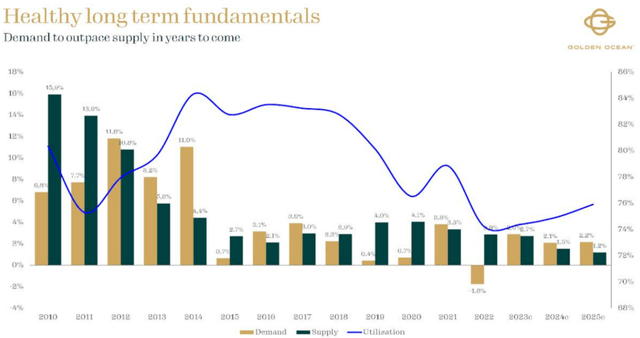

Dry Bulker Provide & Demand Imbalance

GOGL

Because of the prudent ship-building technique at a time of peak recessionary fears, we consider that GOGL is properly positioned to make the most of the worldwide financial system reopening as soon as the height recessionary fears are moderated by 2024.

Moreover, the worldwide dry bulk fleet provide could stay tight by 2025, probably boosting its fleet utilization to 75% then, nearer to pre-pandemic ranges of 80%. These optimistic developments could enhance the dry bulker’s high and backside line, supporting its variable shareholder returns as properly.

Then once more, GOGL traders should additionally rein of their expectations for FQ2’23, because the administration expects 6 ships to dry dock, naturally growing its off-hire days. As well as, its curiosity bills could proceed to rise within the intermediate time period, with an annualized sum of $82M already reported by the most recent quarter (+16.4% QoQ/ +103.9% YoY).

These components could pose additional headwinds to its profitability, since it’s unknown when the Fed could pivot with the struggle towards a 2% inflation fee nonetheless ongoing. Lastly, the hyper-pandemic TCE charges and dividend payouts are unlikely to happen once more, with issues more likely to decelerate to a brand new regular.

Because of this, GOGL traders could wish to reset their expectations accordingly.

So, Is GOGL Inventory A Purchase, Promote, or Maintain?

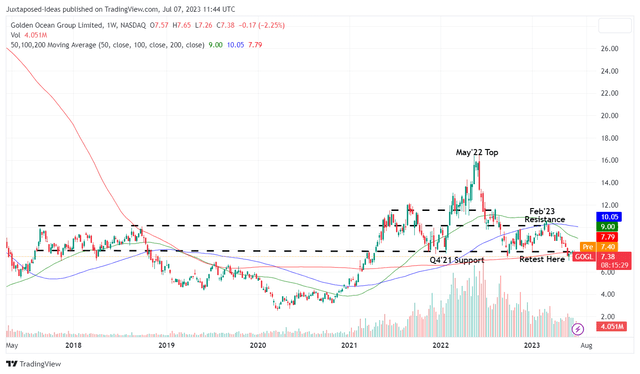

Dry Bulker’s 1Y Inventory Value

Buying and selling View

For now, because of the baked-in pessimism from the rising inflationary pressures and Powell’s commentary of two extra fee hikes in 2023, it’s unsurprising that many dry bulkers’ inventory costs, together with GOGL, have underperformed for the previous yr.

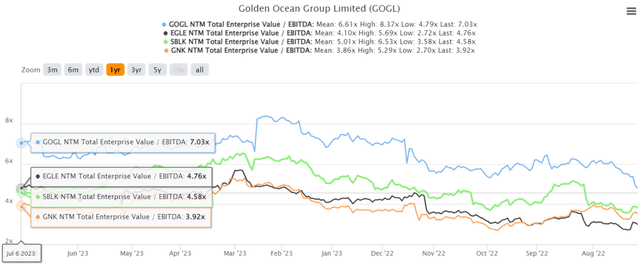

GOGL NTM EV/ EBITDA Valuation

S&P Capital IQ

Then once more, we suppose the pessimism has been overly finished, because the GOGL inventory now trades at NTM EV/ EBITDA of seven.03x, in comparison with its pre-pandemic ranges of 8.75x. The identical has been noticed with its dry bulker friends as properly.

That is regardless of the market analysts’ optimistic projection for the previous, with FY2023 adj EBITDA of $389.77M (-31.8% YoY) and FY2024 of $405.95M (+4.2% YoY), in comparison with FY2019 ranges of $212.5M.

GOGL 6Y Inventory Value

Buying and selling View

Mixed with the sturdy help ranges at $7s, we’re cautiously ranking GOGL as a Purchase right here. Naturally, the inventory is simply appropriate for earnings traders who’re snug with variable dividends, as a result of extremely cyclical (and unstable) nature of the dry bulk trade.

These depressed ranges additionally supply glorious ahead dividend yields of 5.34% in opposition to the sector median of 1.65%, EGLE at 0.85%, and GNK at 4.27%, although decrease than SBLK’s at 8.07%.