jozzeppe

Funding Thesis: Marriott Worldwide might see additional development going ahead, on the premise of robust earnings development, a gorgeous P/E ratio, and continued RevPAR development throughout its luxurious manufacturers.

In a earlier article again in April, I made the argument that Marriott Worldwide (NASDAQ:MAR) might see important development going ahead, on the premise of serious growth of its Ritz-Carlton and W Inns manufacturers in China this yr, in addition to wanting attractively priced from an earnings standpoint.

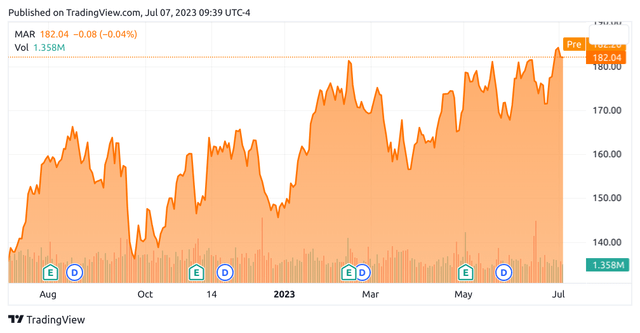

Since then, the inventory has ascended to a value of $182.04 on the time of writing:

TradingView.com

The aim of this text is to evaluate whether or not Marriott Worldwide has the power to see continued development from right here taking latest efficiency into consideration.

Efficiency

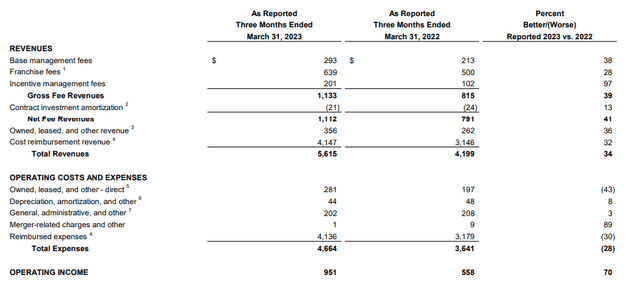

When first quarter 2023 outcomes for Marriott Worldwide, we will see that working earnings noticed substantial development of 70% as in comparison with the identical quarter in 2022, on the premise of robust development in whole revenues and working earnings:

Marriott Worldwide: First Quarter 2023 Outcomes

Over the identical interval, earnings per share (diluted) was up by 113% from $1.14 in Q1 2022 to $2.43 in Q1 2023.

For my part, this robust development in earnings demonstrates that Marriott Worldwide has proven resilience within the face of inflationary pressures – revenues have continued to rise despite greater costs and this has been greater than adequate to soak up the impact of upper working prices. The luxurious finish of the market has continued to carry out strongly, and I’m optimistic that this pattern can proceed as we head into Q2.

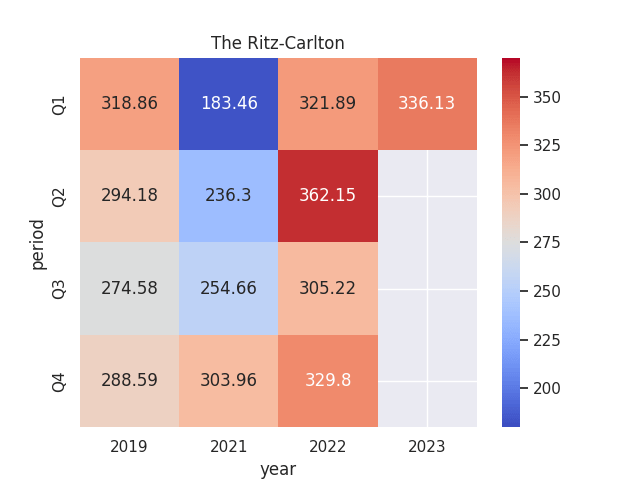

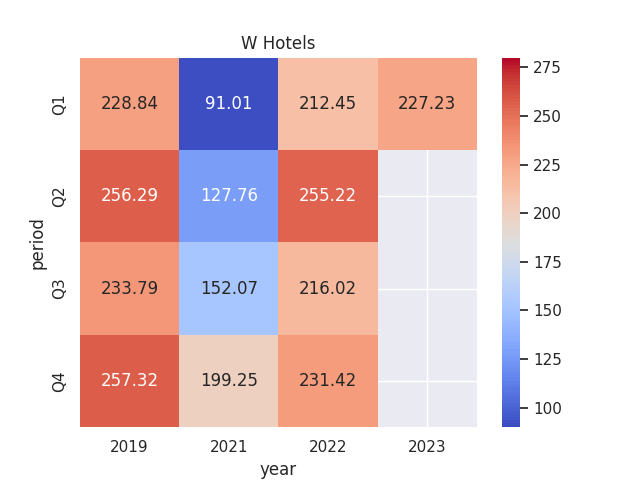

Given my earlier argument that the growth of The Ritz-Carlton and W Inns manufacturers in China might assist to propel total development for Marriott Worldwide – I wish to analyse efficiency throughout these manufacturers in additional element.

We will see that RevPAR for Q1 2023 is up for each The Ritz-Carlton and W Inns on that of Q1 2022 (for comparable company-operated US & Canada properties):

The Ritz-Carlton

Heatmap generated by creator utilizing Python’s seaborn library. RevPAR figures sourced from historic Marriott Worldwide Quarterly Reviews (Q1 2019 to Q1 2023).

W Inns

Heatmap generated by creator utilizing Python’s seaborn library. RevPAR figures sourced from historic Marriott Worldwide Quarterly Reviews (Q1 2019 to Q1 2023).

We’ve seen that Q2 was the strongest performing quarter for these manufacturers final yr.

In consequence, explicit consideration can be paid to RevPAR efficiency in Q2 2023 – as underperformance on this regard might give buyers concern that development is slowing.

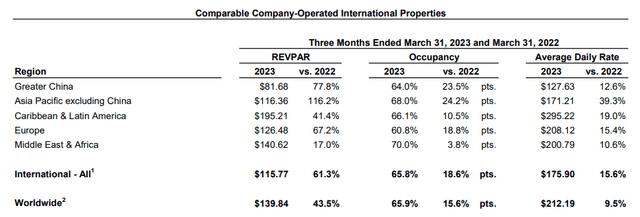

RevPAR efficiency holistically, we will see that whereas RevPAR for Higher China nonetheless stays considerably under that of different areas – despite development of 77.8% in Q1 2023 as in comparison with Q1 2022.

Marriott Worldwide: First Quarter 2023 Outcomes

As well as, it’s notable that development within the common day by day charge for this area was 12.6% over the identical interval (which is considerably under that of Asia Pacific excluding China, and under that of Europe and Caribbean & Latin America). As well as, ADR itself was additionally decrease than different areas.

This would possibly counsel that clients are extra price-sensitive within the Higher China area than others – whereby a rise in value might result in a larger drop in reserving demand as in comparison with different areas.

With Marriott Worldwide having celebrated the opening of its five hundredth lodge throughout Higher China in June, the lodge chain might be in a superb place to bolster total income via quantity development. Nevertheless, this may must be accompanied by RevPAR development over time to justify the elevated value of working within the area. As such, the upcoming quarter can be a big telling level as as to if total RevPAR throughout Higher China can recuperate after the lifting of COVID restrictions.

Dangers and Trying Ahead

Going ahead, I take the view that Marriott Worldwide is in a superb place total to proceed seeing development from right here.

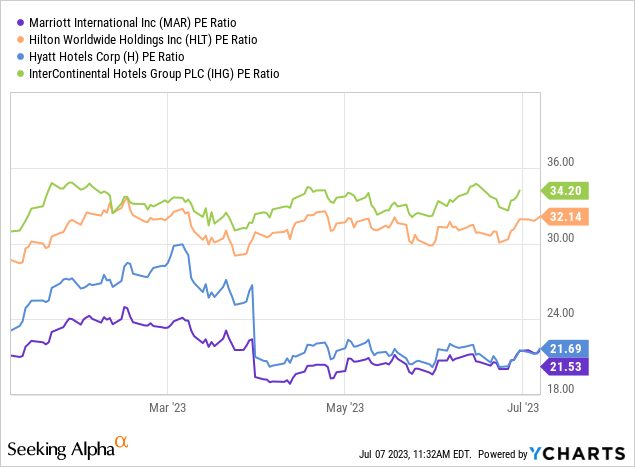

As we’ve got seen, earnings per share is up considerably on that of the identical quarter for the earlier yr. As well as, we will see that amongst rivals Hilton Worldwide Holdings (HLT), Hyatt Inns (H), InterContinental Inns Group (IHG) – Marriott Worldwide at the moment exhibits the bottom P/E ratio amongst its rivals under despite robust earnings development. This might point out that the inventory is attractively valued relative to others within the business:

ycharts.com

To research this additional, allow us to evaluate Value/RevPAR as a ratio throughout these 4 lodge chains. On condition that income per accessible room is a key measure of profitability for the lodge business – an organization that’s buying and selling at a low value relative to the RevPAR that the lodge generates in a selected interval may be argued to be extra attractively valued on this foundation.

Marriott Worldwide Hilton Worldwide Holdings Hyatt Inns InterContinental Inns Group Value on thirty first March 2023 166.04 140.87 111.79 66.6 Worldwide (system-wide) RevPAR 139.84 103.72 130.54 74.77 Value to RevPAR ratio 1.19 1.36 0.86 0.89 Click on to enlarge

Supply: Closing inventory value on thirty first March 2023 sourced from nasdaq.com. Worldwide (system-wide) RevPAR figures sourced from Q1 2023 studies for Marriott Worldwide, Hilton Worldwide Holdings, Hyatt Inns, and InterContinental Inns Group.

We will see that Marriott Worldwide trades decrease than Hilton Worldwide Holdings on this foundation – however greater than that of Hyatt Inns and InterContinental Inns Group. With that being stated, the truth that the corporate confirmed the best worldwide RevPAR for Q1 2023 provides me extra confidence that buyers can be ready to pay a premium for the inventory because of this.

By way of the potential dangers to Marriott Worldwide at the moment, I see the principle one as being that RevPAR within the subsequent quarter is available in decrease than that seen for Q2 2022. Ought to this occur, then buyers would possibly take this as a sign that development in reserving demand is stalling as a result of macroeconomic components, and we might see the inventory consolidate because of this. As well as, if RevPAR throughout Higher China additionally stays considerably under that of different areas, then this is also seen as an indication that the post-COVID restoration is stalling.

With that being stated, RevPAR for the Ritz-Carlton and W Inns continues to see development throughout the US & Canada – which is an even bigger marketplace for Marriott Worldwide as in comparison with Higher China. Ought to we proceed to see RevPAR development within the subsequent quarter throughout these manufacturers – then I take the view that the inventory might proceed to see additional upside.

Moreover, with COVID-19 now within the rear-view mirror – we might be in a superb place to see a robust rebound of worldwide journey by Chinese language clients to america – which is predicted to raise total revenues throughout the corporate’s luxurious manufacturers additional.

Conclusion

To conclude, Marriott Worldwide has continued to see robust earnings development, and RevPAR throughout its luxurious manufacturers has continued to rise.

Whereas dangers to development stay, I take the view that the corporate’s robust earnings development, engaging P/E ratio, and continued development in RevPAR throughout its luxurious manufacturers might nonetheless permit the corporate to see additional upside going ahead.