CPI inflation knowledge, begin of Q2 earnings season in focus.

Delta Air Traces shares are a purchase with upbeat earnings on deck.

Citigroup’s inventory will wrestle amid weak revenue and income outlook.

Searching for extra actionable commerce concepts to navigate the present market volatility? InvestingPro Summer season Sale is on: Take a look at our large reductions on subscription plans!

Wall Road’s most important indices ended decrease on Friday, capping off a dropping week as traders digested a U.S. that didn’t shake off fears that the Federal Reserve could begin mountaineering rates of interest once more later this month.

The U.S. added the fewest jobs in additional than two years in June, though persistently excessive wage development pointed to still-tight labor market situations, U.S. authorities knowledge confirmed.

For the week, the blue-chip fell roughly 2%, whereas the benchmark and technology-heavy declined round 1.2% and 0.9% respectively. The small-cap slumped 1.4%.

The week forward is anticipated to be one other eventful one as traders proceed to gauge the outlook for inflation, rates of interest, and the economic system.

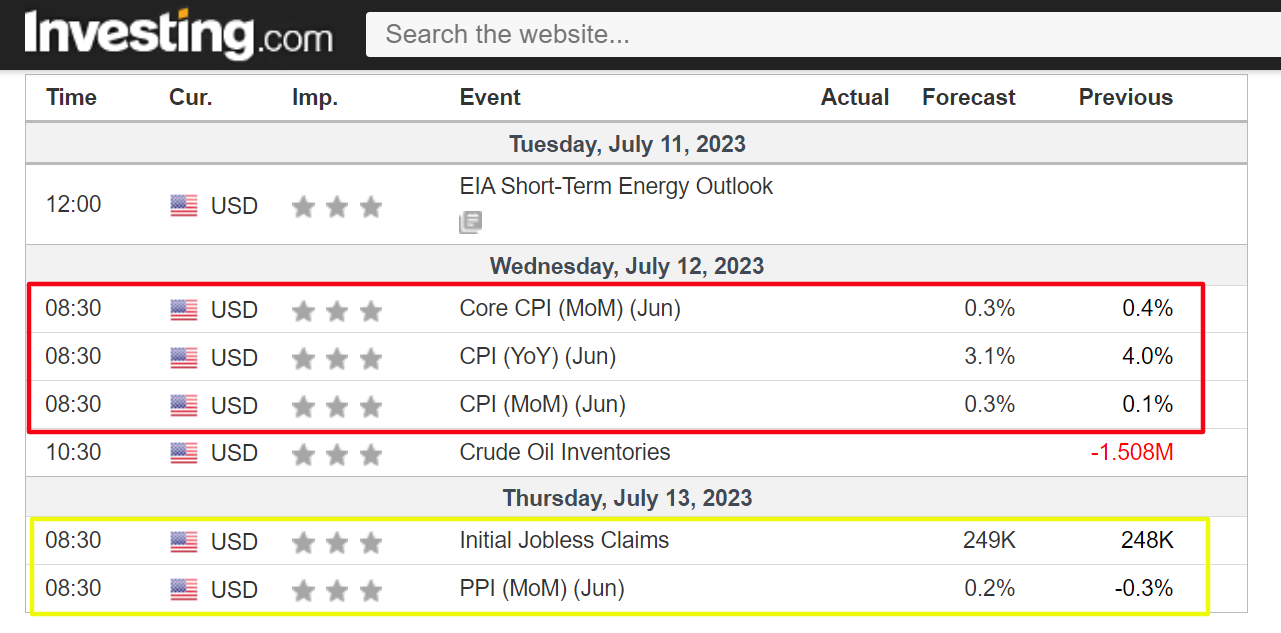

On the financial calendar, most vital will likely be Wednesday’s U.S. report for June, which is forecast to indicate headline annual CPI cooling to three.1% from the 4.0% enhance seen in Might.

The CPI knowledge will likely be accompanied by a heavy slate of Federal Reserve audio system, which is able to absolutely add to the talk on the U.S. central financial institution’s subsequent transfer.

At present, monetary markets are pricing in a 93% likelihood of a 25 foundation level charge hike on the subsequent coverage assembly on July 26, in keeping with Investing.com’s

In the meantime, the earnings season formally kicks off on Friday with JPMorgan Chase (NYSE:), Wells Fargo (NYSE:), and UnitedHealth Group (NYSE:) all scheduled to launch quarterly outcomes.

No matter which route the market goes, under I spotlight one inventory prone to be in demand and one other which may see additional draw back.

Keep in mind although, my timeframe is only for the week forward, July 10-14.

Inventory To Purchase: Delta Air Traces

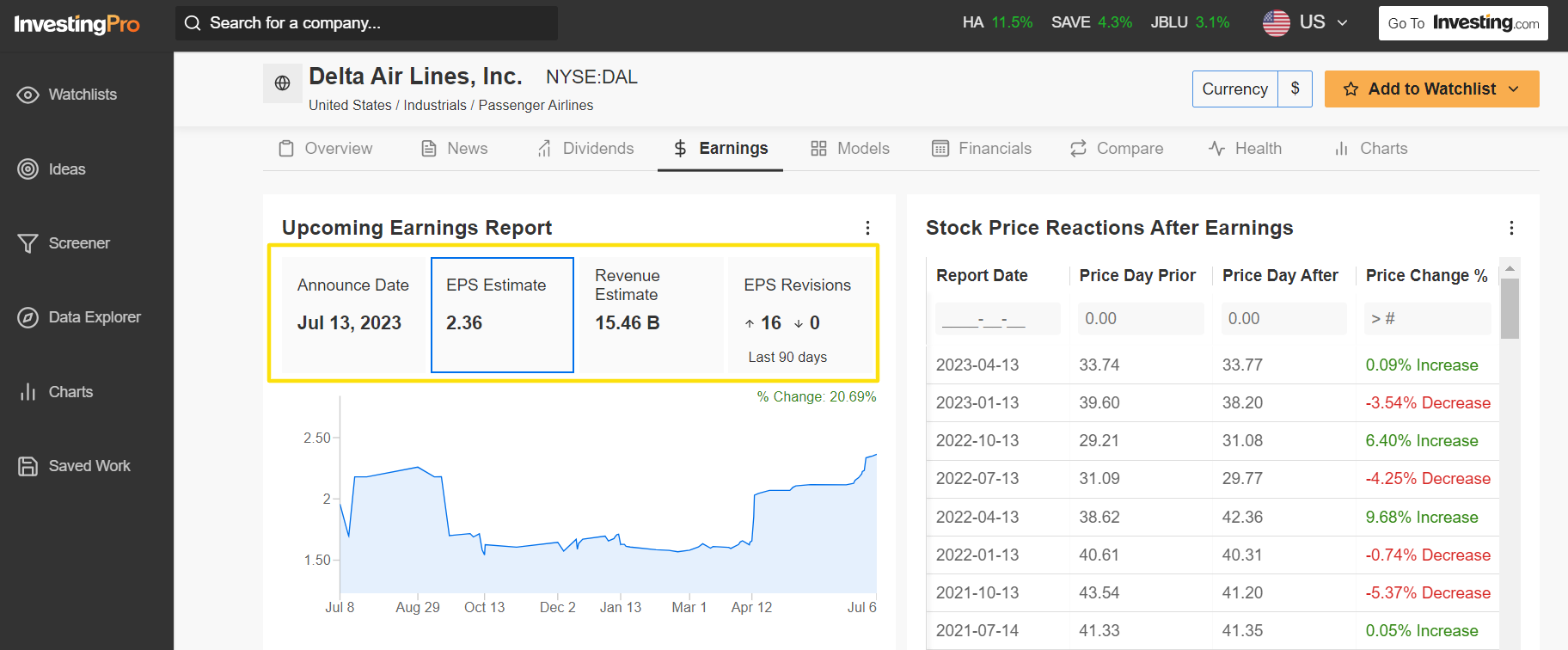

I anticipate Delta Air Traces (NYSE:) inventory to march increased within the week forward, with a possible breakout to a brand new 52-week excessive on the horizon, because the legacy air provider’s second quarter earnings will shock to the upside for my part because of favorable client demand developments and an enhancing elementary outlook.

Delta is scheduled to ship its Q2 report earlier than the U.S. market opens on Thursday, July 13, at 6:30AM ET. In accordance with the choices market, merchants are pricing in a swing of about 6% in both route for DAL inventory following the replace.

Regardless of a difficult working surroundings, I consider Delta is poised to ship a better-than-expected print because it capitalizes on the continuing restoration within the journey business regardless of recession fears which have sparked issues about client spending.

In accordance with an InvestingPro survey, Delta’s earnings estimates have been revised upward 16 occasions up to now 90 days, in comparison with zero downward revisions, as Wall Road analysts develop more and more bullish on the airliner.

Wall Road sees the Atlanta, Georgia-based firm incomes $2.36 a share within the June quarter, hovering 63.9% from EPS of $1.44 within the year-ago interval, whereas income is forecast to extend 25.6% yearly to $15.46 billion.

If these figures are confirmed, it will mark the most effective quarter in Delta’s 98-year historical past as profitability developments proceed to get well from the COVID-19 pandemic amid the continuing enchancment in air journey demand.

As such, I consider Delta’s administration will present robust gross sales steerage for the remainder of the 12 months because the provider stays well-placed to thrive because of sturdy home demand for each leisure and company journey whereas additionally benefitting from rising worldwide site visitors.

DAL inventory ended at $47.88 on Friday. Shares – which have gained 45.7% to this point this 12 months – climbed to $48.81 on Wednesday, a stage not seen since April 15, 2021.

At present valuations, Delta has a market cap of about $31 billion, incomes it the standing of the world’s most precious airline firm, forward of business friends comparable to Southwest Airways (NYSE:), Ryanair Holdings (NASDAQ:), United Airways (NASDAQ:), and American Airways (NASDAQ:).

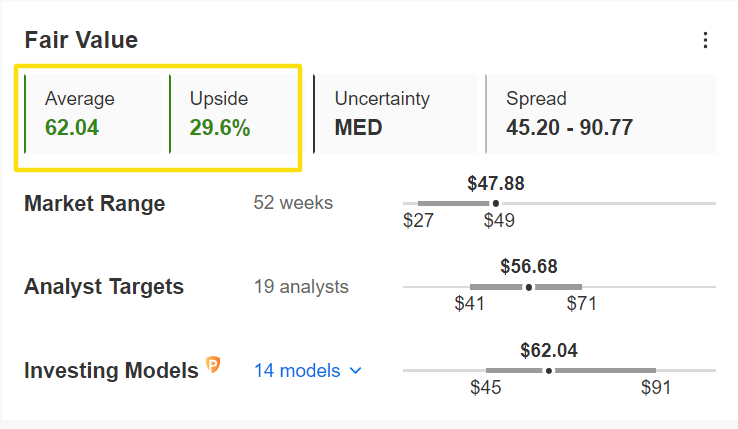

Regardless of robust year-to-date good points, it must be famous that Delta’s inventory seems to be considerably undervalued heading into the earnings print, in keeping with a number of valuation fashions on InvestingPro.

The common ‘Truthful Worth’ worth goal for DAL stands at $62.04, a possible upside of 29.6% from the present market worth.

With InvestingPro, you’ll be able to conveniently entry a single-page view of full and complete details about totally different corporations multi function place, eliminating the necessity to collect knowledge from a number of sources and saving you effort and time.

Inventory To Promote: Citigroup

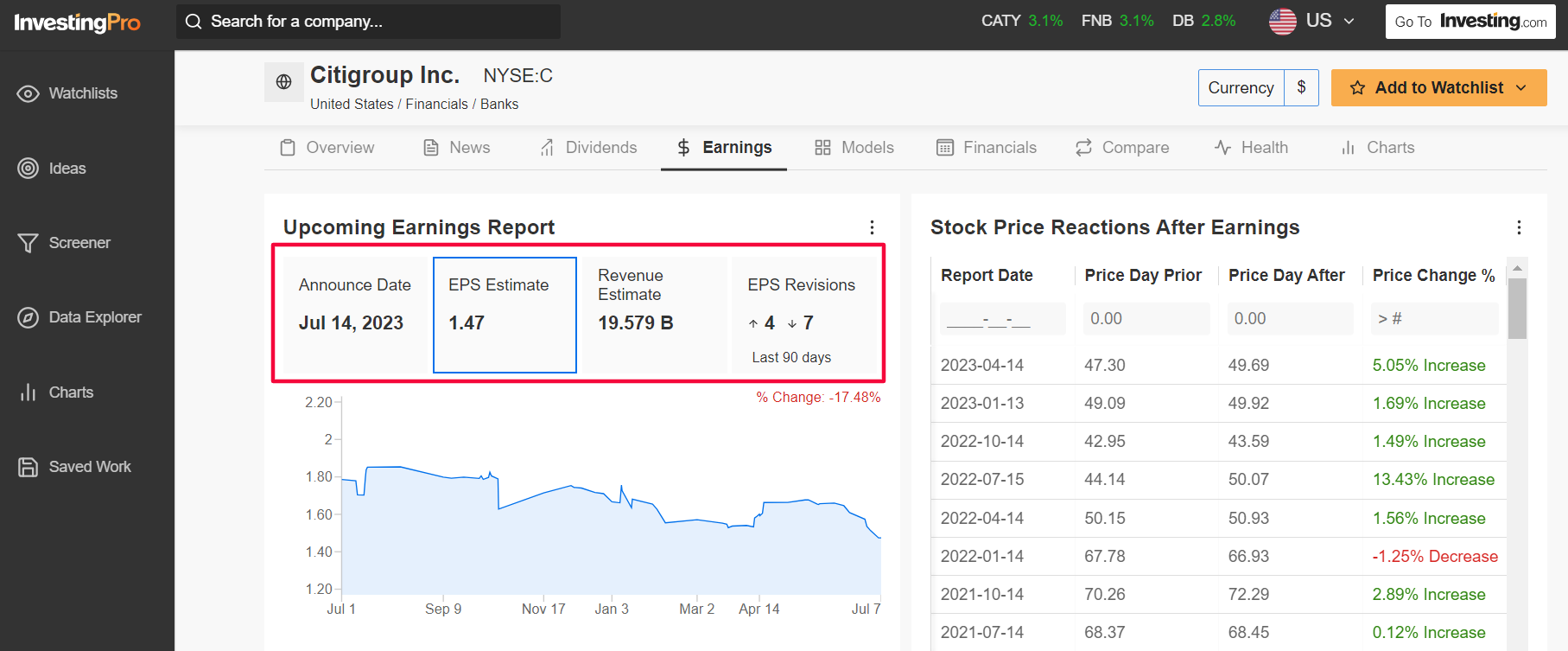

I consider shares of Citigroup (NYSE:) will underperform within the week forward because the megabank’s newest earnings report will possible reveal one other sharp slowdown in each revenue and income development because of the troublesome financial local weather.

Citi’s monetary outcomes for the second quarter are due forward of the opening bell on Friday, July 14 at 8:00AM ET and are as soon as once more prone to take successful from a slowdown in its client banking enterprise.

Choices buying and selling implies a roughly 5% swing for C shares after the replace drops.

Underscoring a number of headwinds Citigroup faces amid the present backdrop, an InvestingPro survey of analyst earnings revisions factors to mounting pessimism forward of the report, with analysts chopping their EPS estimates seven occasions within the final 90 days, in comparison with 4 upward revisions.

Consensus requires the New York-based lender to ship earnings per share of $1.47, declining 32.8% from EPS of $2.19 within the year-ago interval.

Income expectations are equally regarding, with gross sales development predicted to slide about 1% year-over-year to $19.57 billion attributable to a pointy slowdown in its client banking unit.

Past the top-and-bottom line figures, feedback from CEO Jane Fraser ought to supply additional steerage on how she expects the financial institution to carry out all through the remainder of the 12 months amid lingering macroeconomic headwinds and worries over deposit stability.

C inventory ended Friday’s session at $45.74, incomes the monetary companies firm a market cap of $89 billion. At its present valuation, Citigroup is the fourth-largest banking establishment in the US, behind JPMorgan Chase, Financial institution of America (NYSE:), and Wells Fargo.

Citigroup shares have underperformed these of the opposite huge banks this 12 months, gaining simply 1.1% in 2023, amid lingering worries over the well being of the monetary sector within the aftermath of the regional banking disaster.

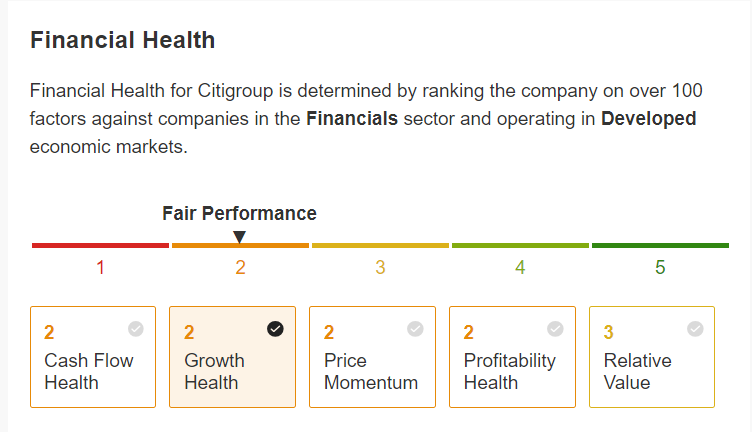

Not surprisingly, Citi at the moment has a under common InvestingPro ‘Monetary Well being’ rating of two.2 out of 5.0 attributable to issues on profitability, development, and free money circulation. The Professional well being metric is set by rating the corporate on over 100 elements towards different corporations within the Financials sector.

Regardless of mountaineering its dividend following the Fed’s stress take a look at final month, Citi mentioned its stress capital buffer (SCB) requirement will enhance this 12 months, contrasting with business rivals whose SCB dropped.

The scale of the SCB, which refers to an extra layer of capital launched in 2020 that sits on high of banks’ minimal capital necessities, displays how properly a financial institution performs on the take a look at.

Searching for extra actionable commerce concepts to navigate the present market volatility? InvestingPro helps you simply determine successful shares at any given time.

As a part of the InvestingPro Summer season Sale, now you can get pleasure from unimaginable reductions on our subscription plans for a restricted time:

Month-to-month: Save 20% and achieve the pliability to take a position on a month-to-month foundation.

Yearly: Save a jaw-dropping 50% and safe your monetary future with a full 12 months of InvestingPro at an unbeatable worth.

Bi-Yearly (Internet Particular): Save an astonishing 52% and maximize your returns with our unique net supply.

Do not miss out on this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and professional insights. Be part of InvestingPro at this time and unlock your investing potential. Hurry, Summer season Sale will not final eternally!

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials. The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)